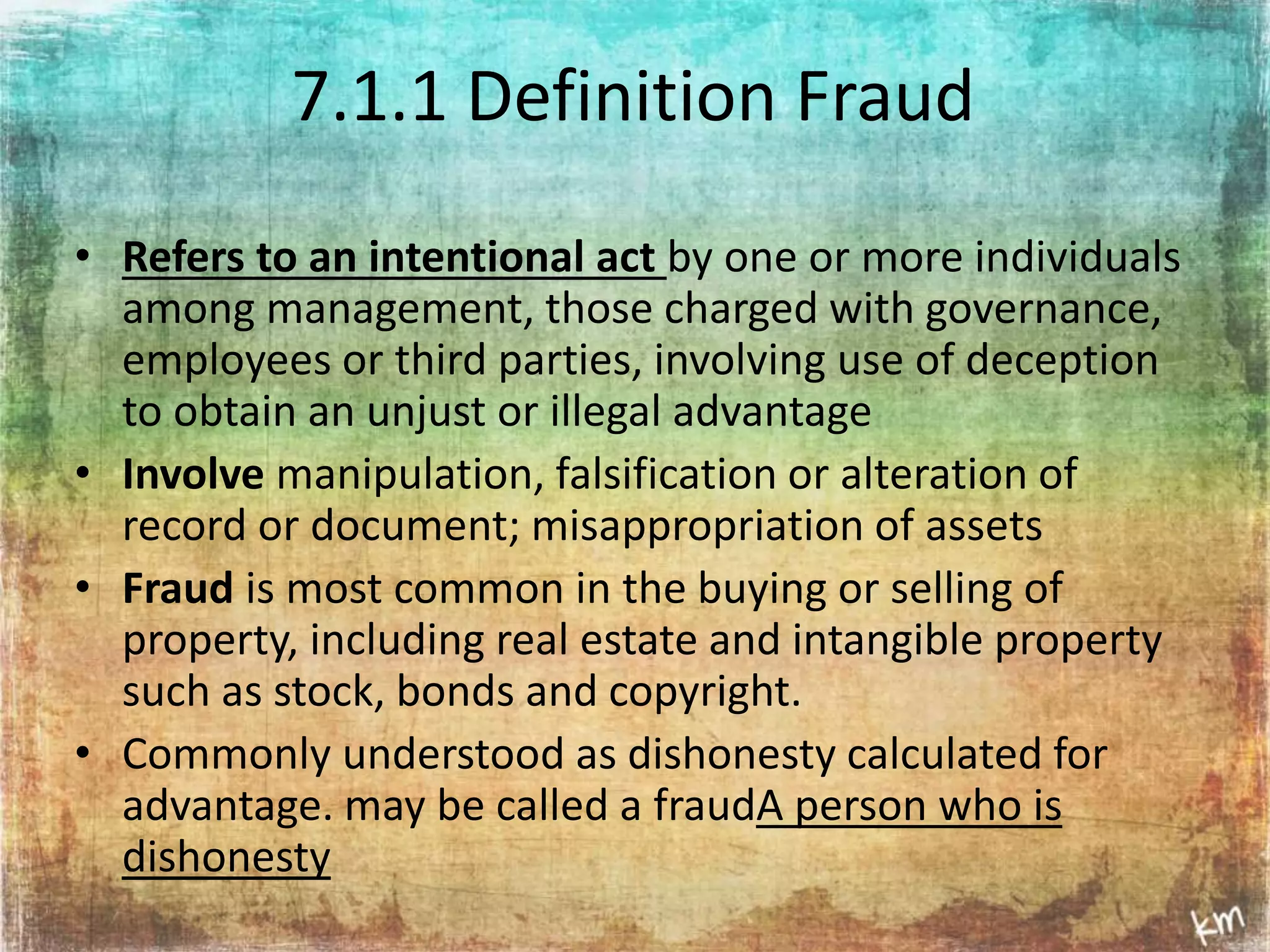

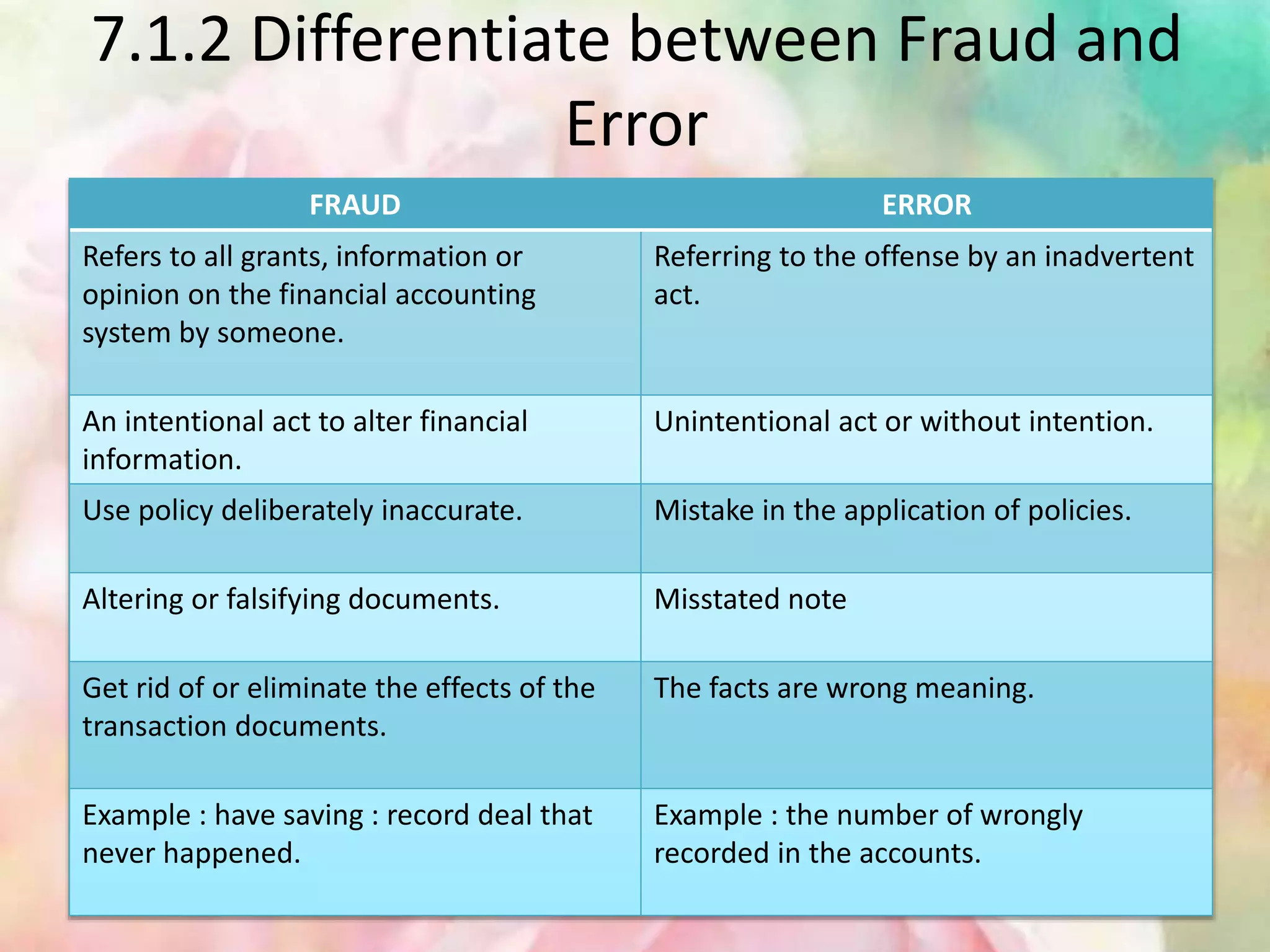

This document provides information about auditing and assurance including defining fraud and differentiating it from error, understanding audit legal liabilities, and identifying factors that help minimize auditor liabilities. It defines fraud as an intentional act involving deception, discusses how fraud differs from unintentional errors, and provides examples of each. It also outlines three types of legal liabilities for auditors: to clients, to third parties, and for fraud cases. Key cases related to each type of liability are summarized. Finally, it discusses factors that can help minimize an auditor's legal liabilities such as setting standards, opposing unwarranted lawsuits, educating users, and tailoring engagements.