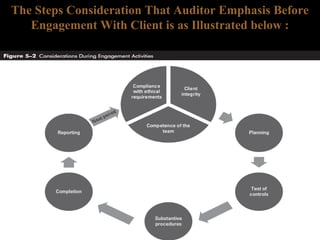

The document outlines the four types of audit reports issued by independent auditors, detailing the importance of 'true and fair view' in financial statements. It describes the necessary steps auditors must take before engaging with clients and highlights the differences between unqualified, qualified, adverse, and disclaimer audit reports, including their conditions. Additionally, it emphasizes the importance of proper planning and compliance with ethical standards to maintain auditor-client relationships.