The document discusses different types of audit reports that can be issued by an auditor:

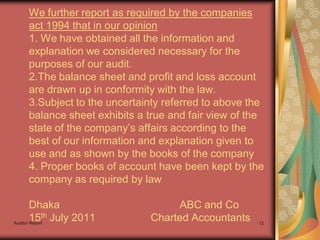

- Unqualified or clean report is issued when no issues are found during the audit.

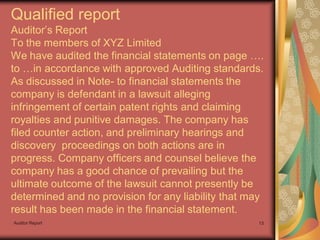

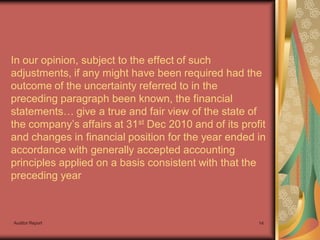

- A qualified report is issued when the auditor has reservations but the financial statements are still fairly presented subject to the auditor's qualifications.

- A disclaimer is issued when the auditor is unable to express an opinion due to limitations or uncertainties.

- An adverse opinion is issued when the financial statements are materially misstated.

- A compartmental report is issued when the auditor can express an opinion on some but not all aspects of the financial statements.