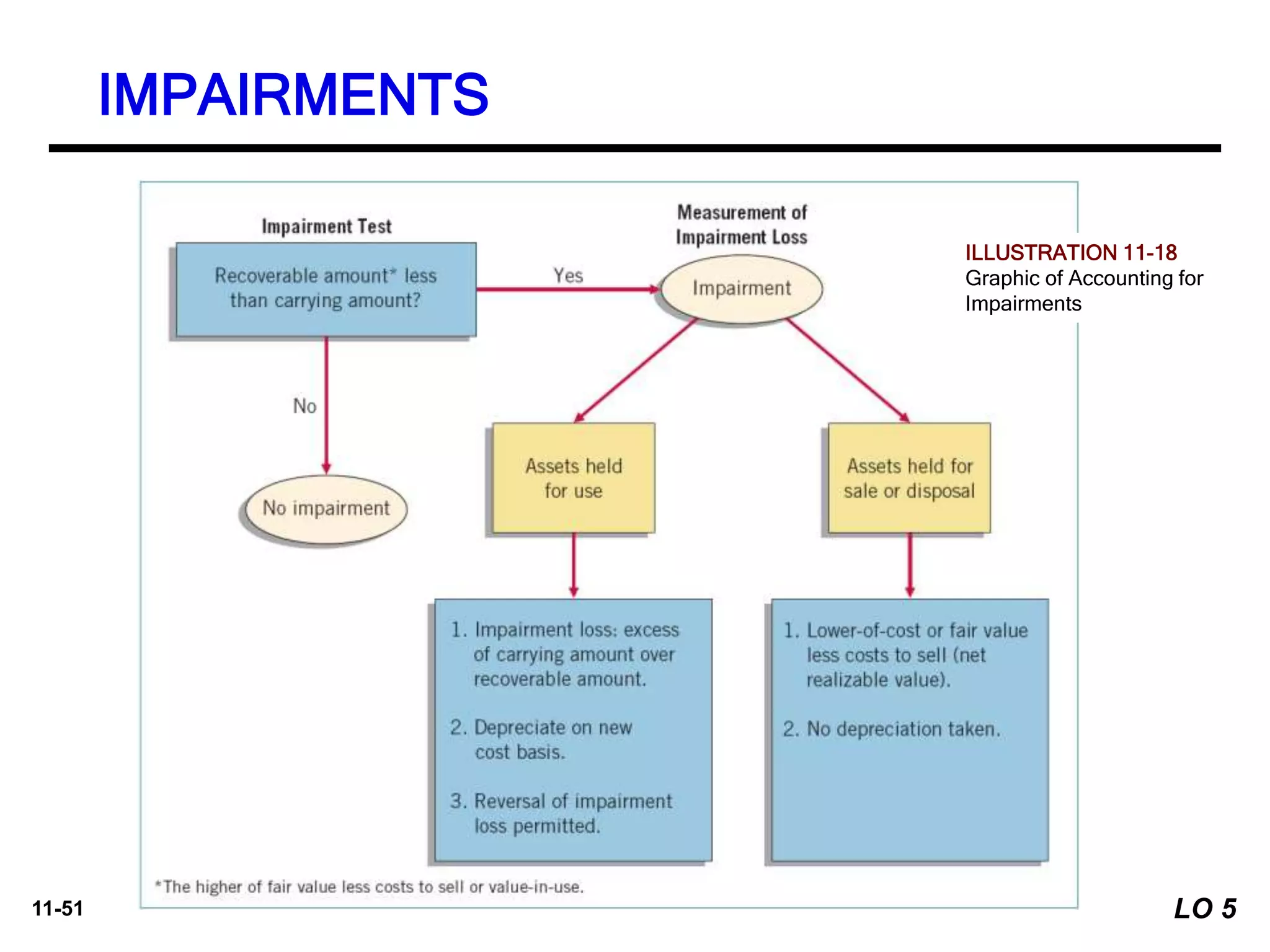

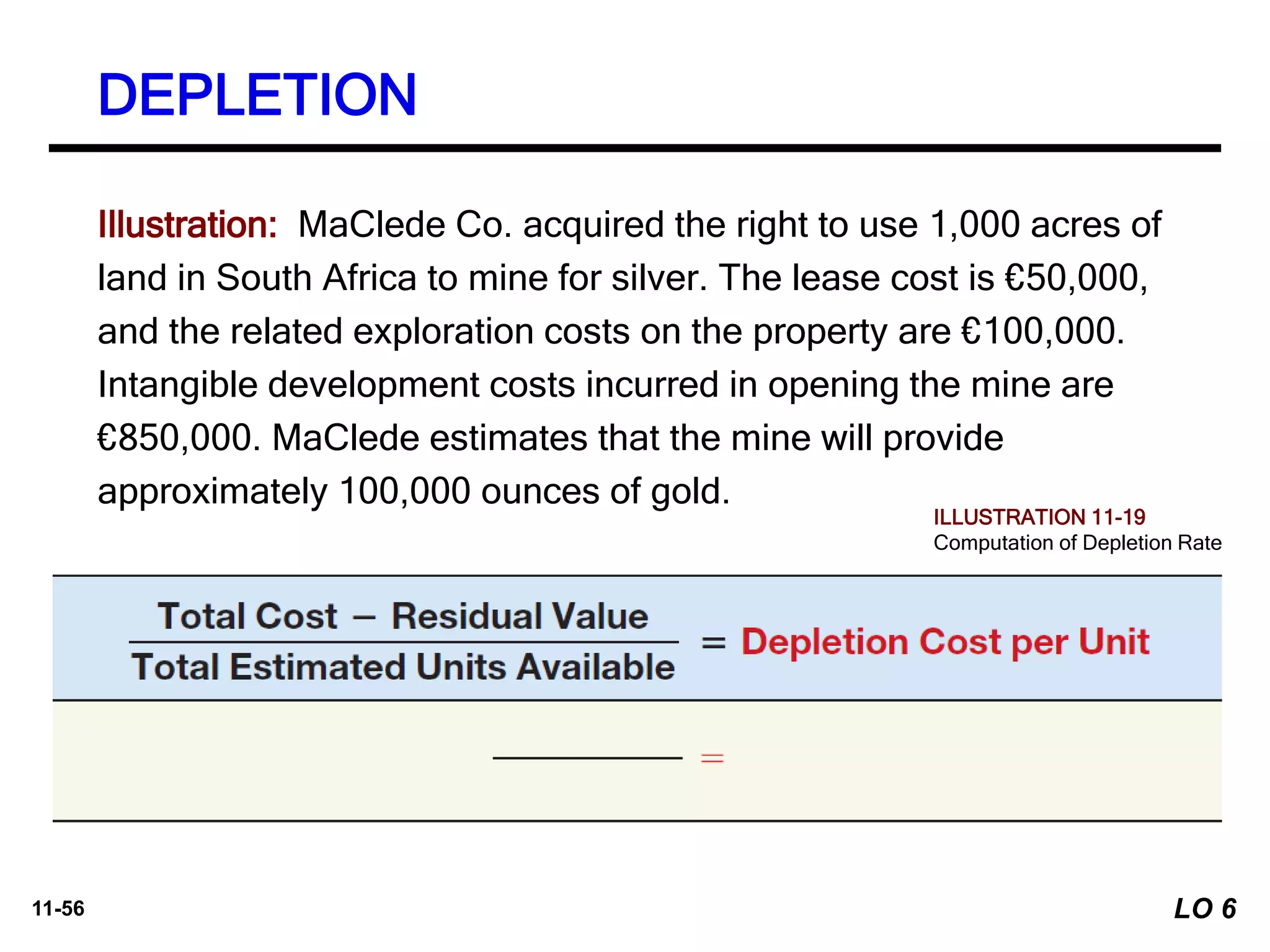

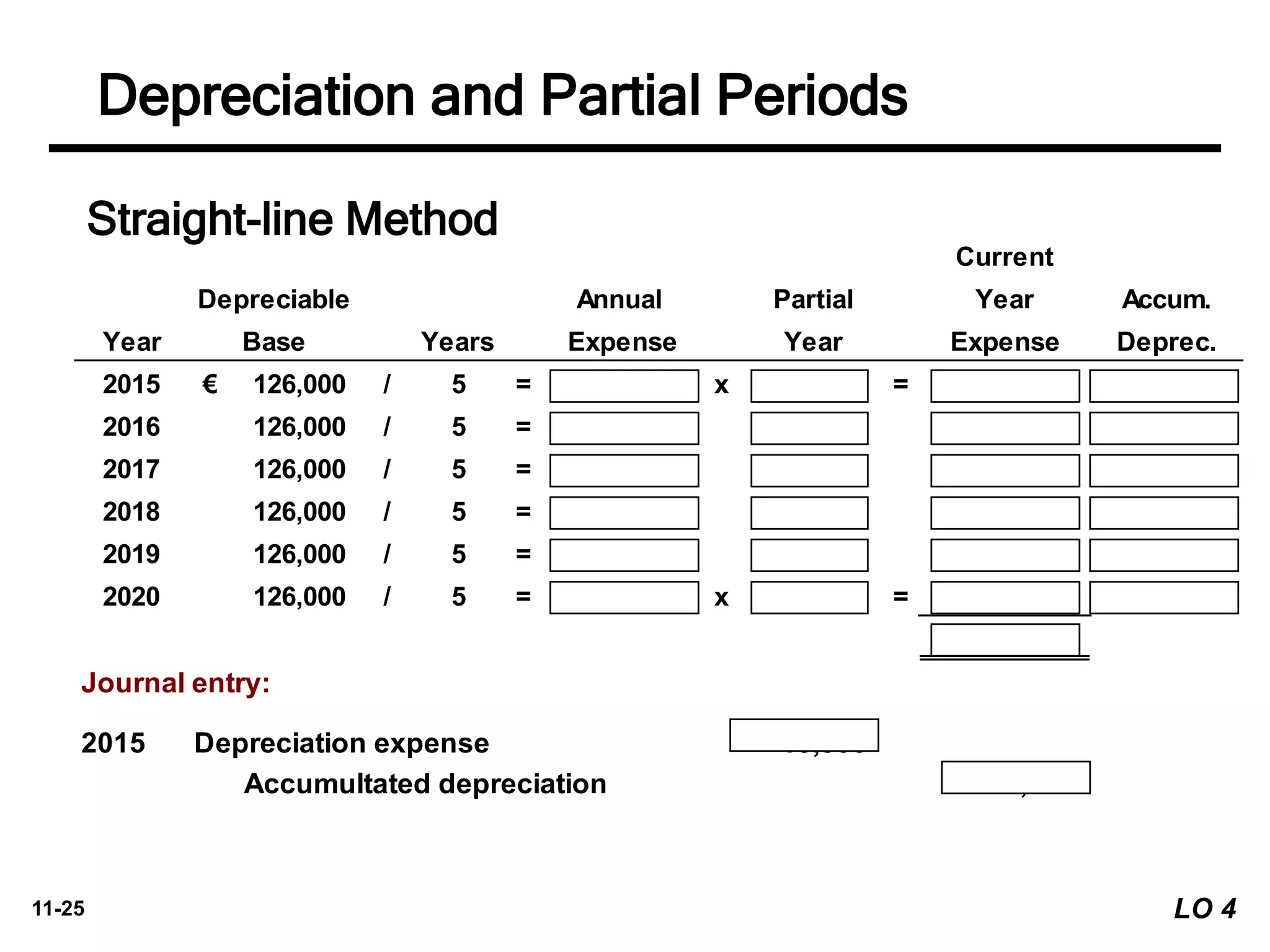

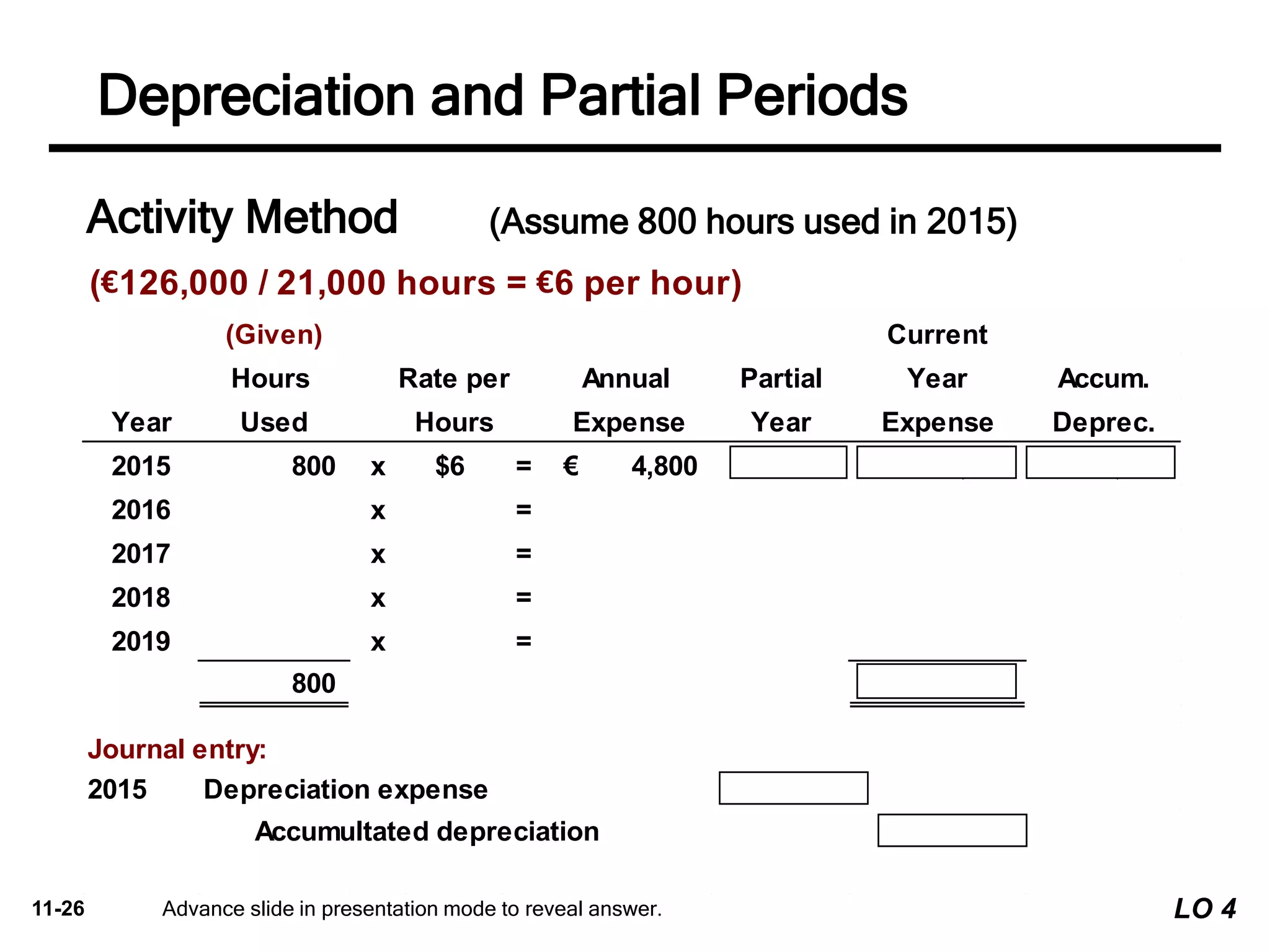

This chapter discusses accounting for long-lived assets such as property, plant, and equipment. It covers depreciation methods which allocate the cost of tangible assets over their estimated useful lives. Specific methods discussed include straight-line, activity, and diminishing-charge methods. The chapter also addresses component depreciation and accounting for partial periods. Asset impairment and depletion of mineral resources are additional topics covered.

![11-41

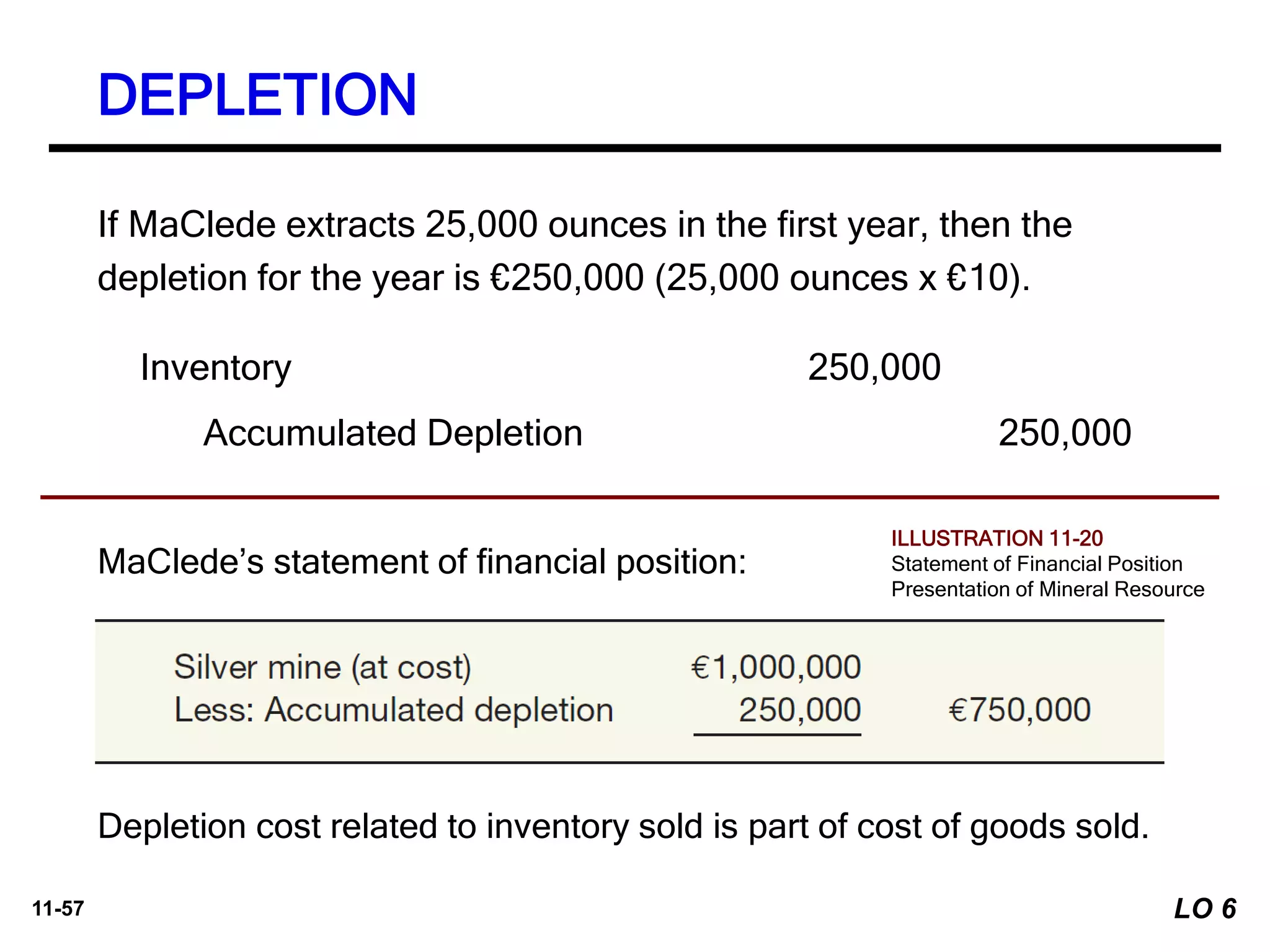

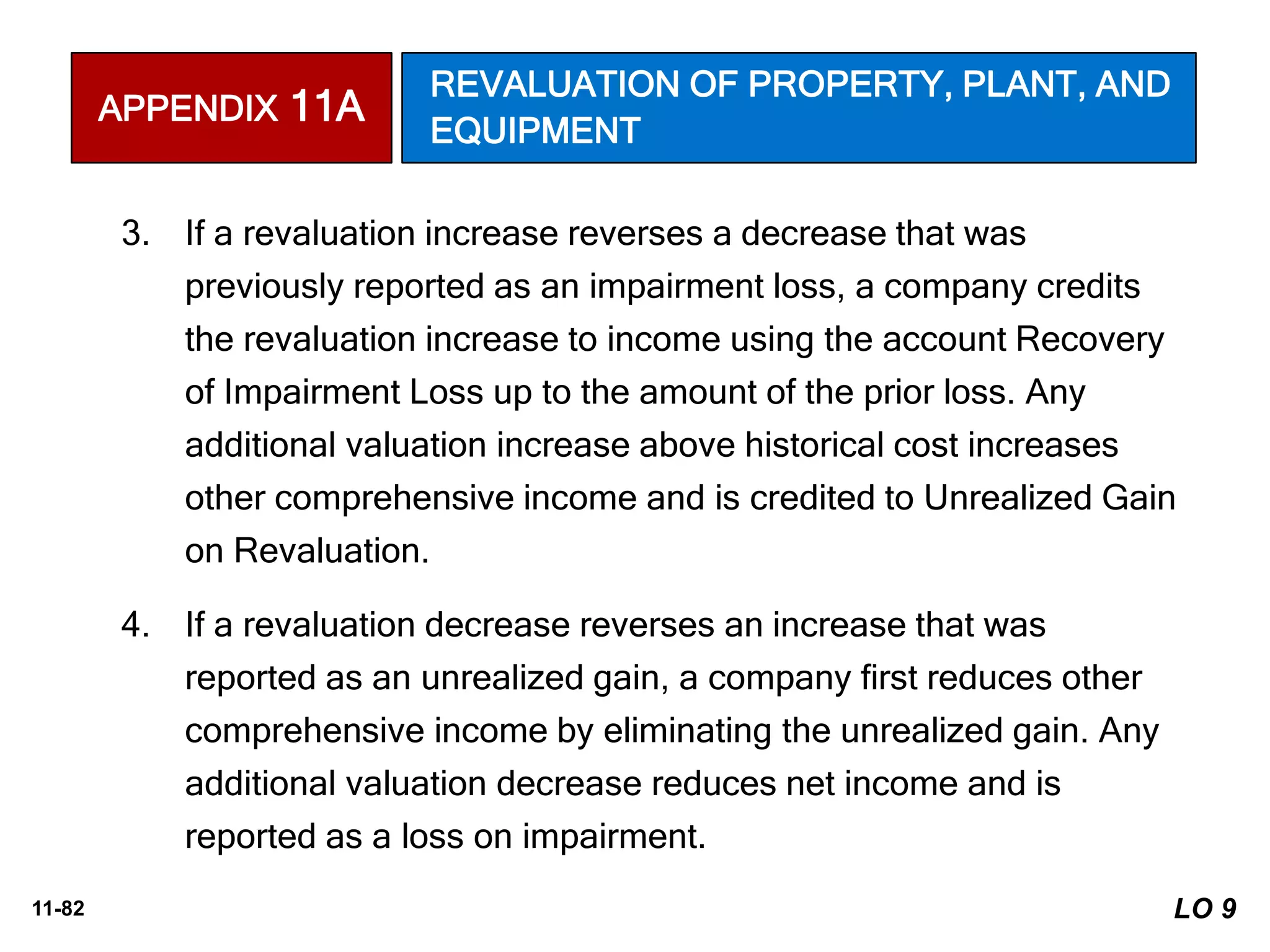

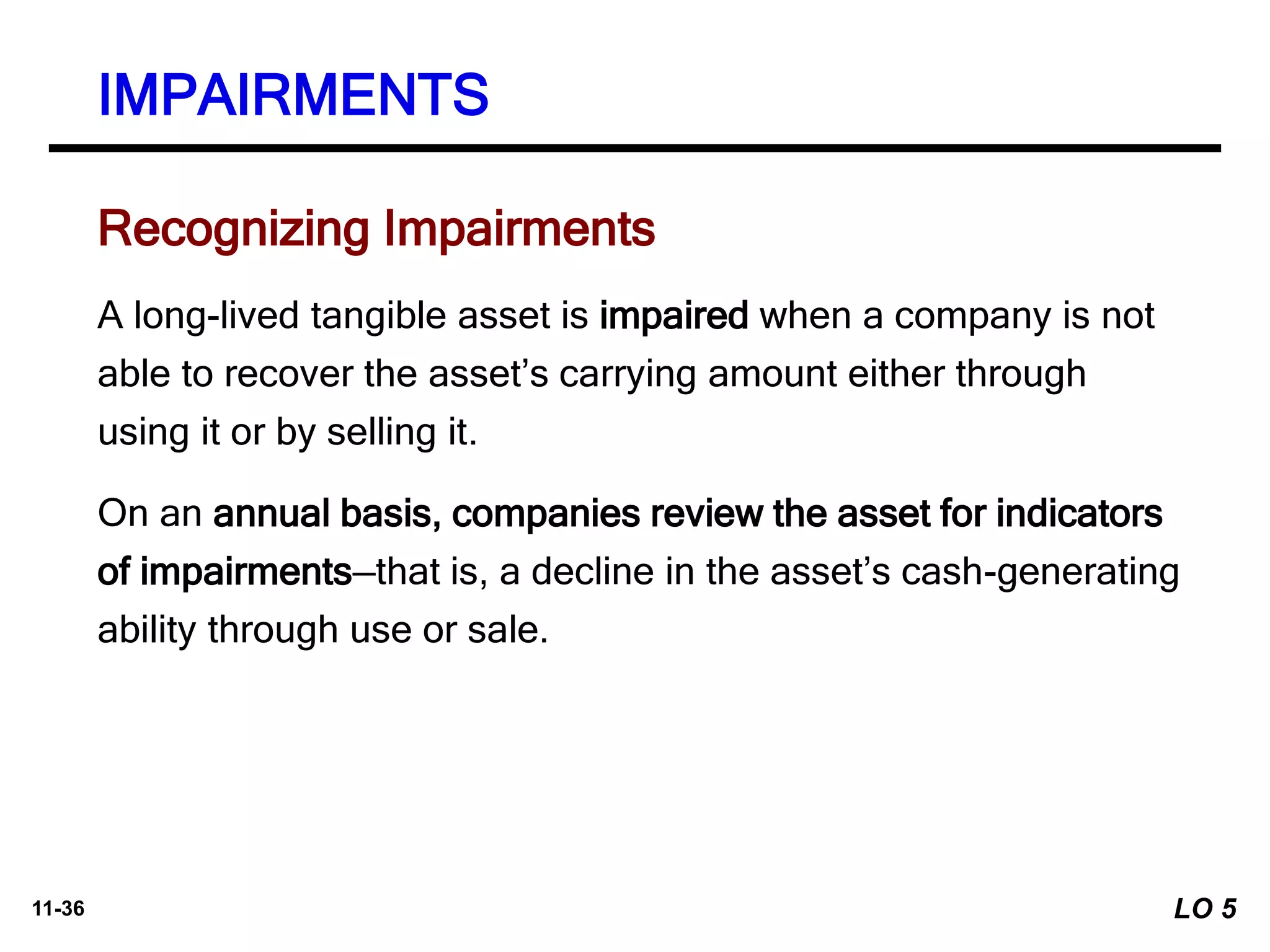

Case 1

At December 31, 2016, Hanoi Company has equipment with a cost of

VND26,000,000, and accumulated depreciation of VND12,000,000. The

equipment has a total useful life of four years with a residual value of

VND2,000,000. The following information relates to this equipment.

1. The equipment’s carrying amount at December 31, 2016, is

VND14,000,000 (VND26,000,000 - VND12,000,000).

2. Hanoi uses straight-line depreciation. Hanoi’s depreciation was

VND6,000,000 [(VND26,000,000 - VND2,000,000) ÷ 4] for 2016

and is recorded.

3. Hanoi has determined that the recoverable amount for this asset at

December 31, 2016, is VND11,000,000.

4. The remaining useful life of the equipment after December 31,

2016, is two years.

Impairment Illustrations

LO 5](https://image.slidesharecdn.com/ch11-180306120327/75/Ch11-41-2048.jpg)