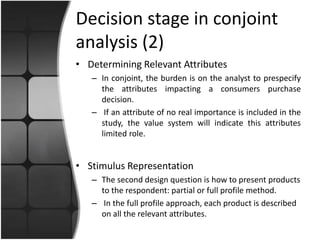

The document discusses various methods for conducting market analysis for new product development. It focuses on four main areas: idea generation, product optimization, marketing mix optimization, and market prediction. For idea generation, methods like brainstorming, focus groups, and morphological analysis are presented. Product optimization discusses approaches like Quality Function Deployment (QFD) and conjoint analysis to design the product based on customer needs. Test marketing and concept testing are described as ways to introduce the new product to the market and predict its anticipated success. Case studies on pharmaceutical companies and automakers are provided as examples.

![Diffusion models (2)

• The probability that an initial purchase will

be made at T given that no purchase has

yet been made is a linear function of the

number of previous buyers.

P(T) p (q /m)Y(T)

2 S(T) pm (q p)Y(T) q /m[Y(T)]

• If the coefficient of imitation is greater

than the coefficient of innovation the

solution rises to a peak and then declines.

• Figure growth of new product](https://image.slidesharecdn.com/npd-141015193113-conversion-gate01/85/Npd-31-320.jpg)