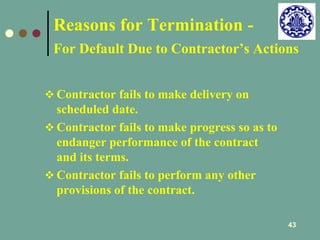

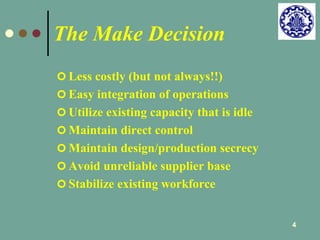

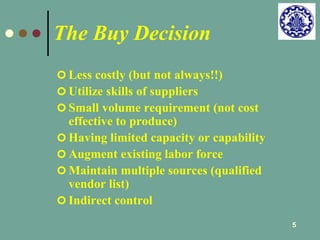

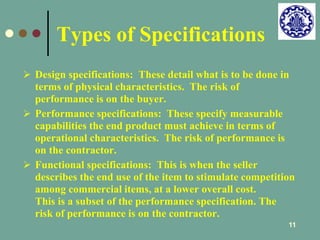

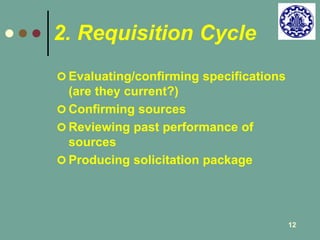

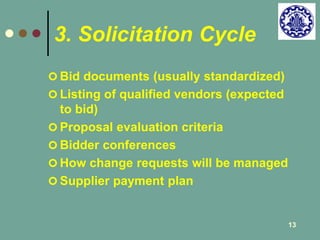

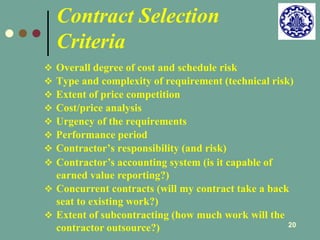

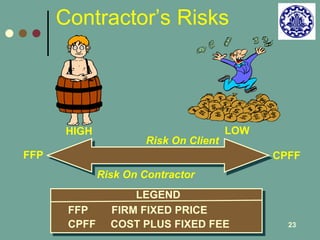

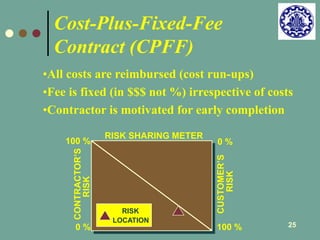

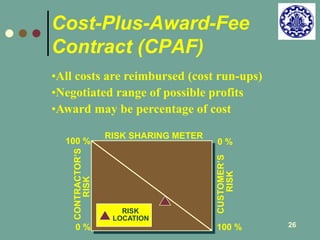

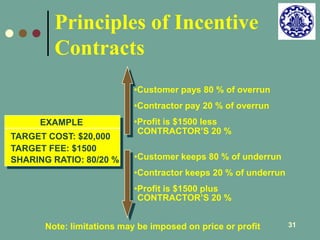

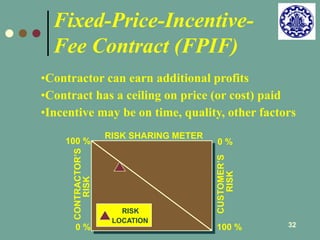

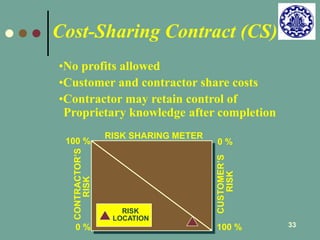

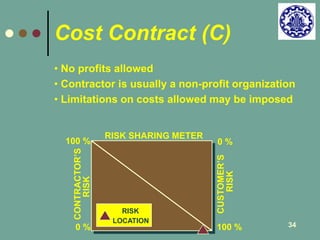

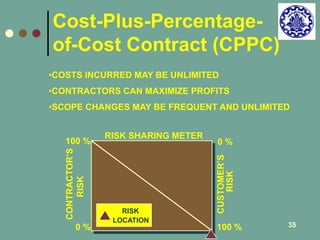

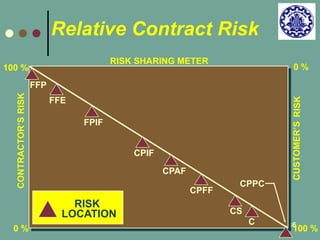

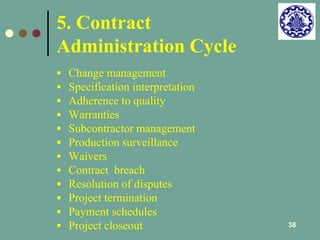

The document discusses procurement management and the various cycles and strategies involved. It describes the requirement, requisition, solicitation, award, and contract administration cycles. It also covers make-or-buy analysis, contract types, risk allocation, and contract changes and termination. The goal of procurement management is to purchase necessary goods and services while managing relationships and contracts.

![39

Order of Precedence

A. Specifications (first priority)

B. Other instructions (second priority)

C. Other documents, such as exhibits,

attachments, appendices, SOW, contract

date requirements list [CDRL], etc.

(third priority)

D. Contract clauses (fourth priority)

E. The schedule (fifth priority)](https://image.slidesharecdn.com/pmsession11-141015193215-conversion-gate01/85/Pm-session11-39-320.jpg)