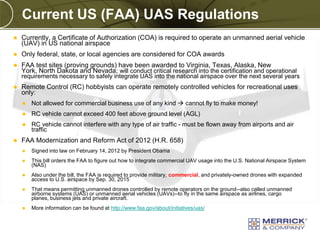

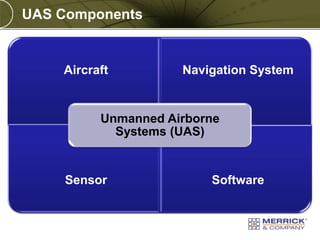

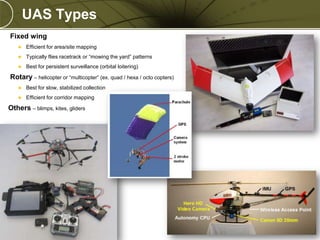

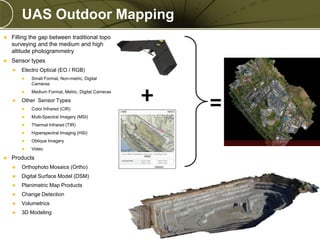

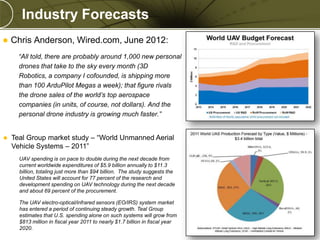

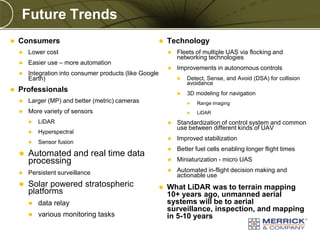

The document provides an overview of unmanned airborne systems (UAS) and their regulatory framework, focusing on current capabilities, sensor types, and mapping technologies. It discusses FAA regulations governing UAS operations, including certificates of authorization and integration into U.S. airspace. Future trends indicate significant growth in UAS technology and applications, driven by advancements in automation, sensor variety, and consumer integration.