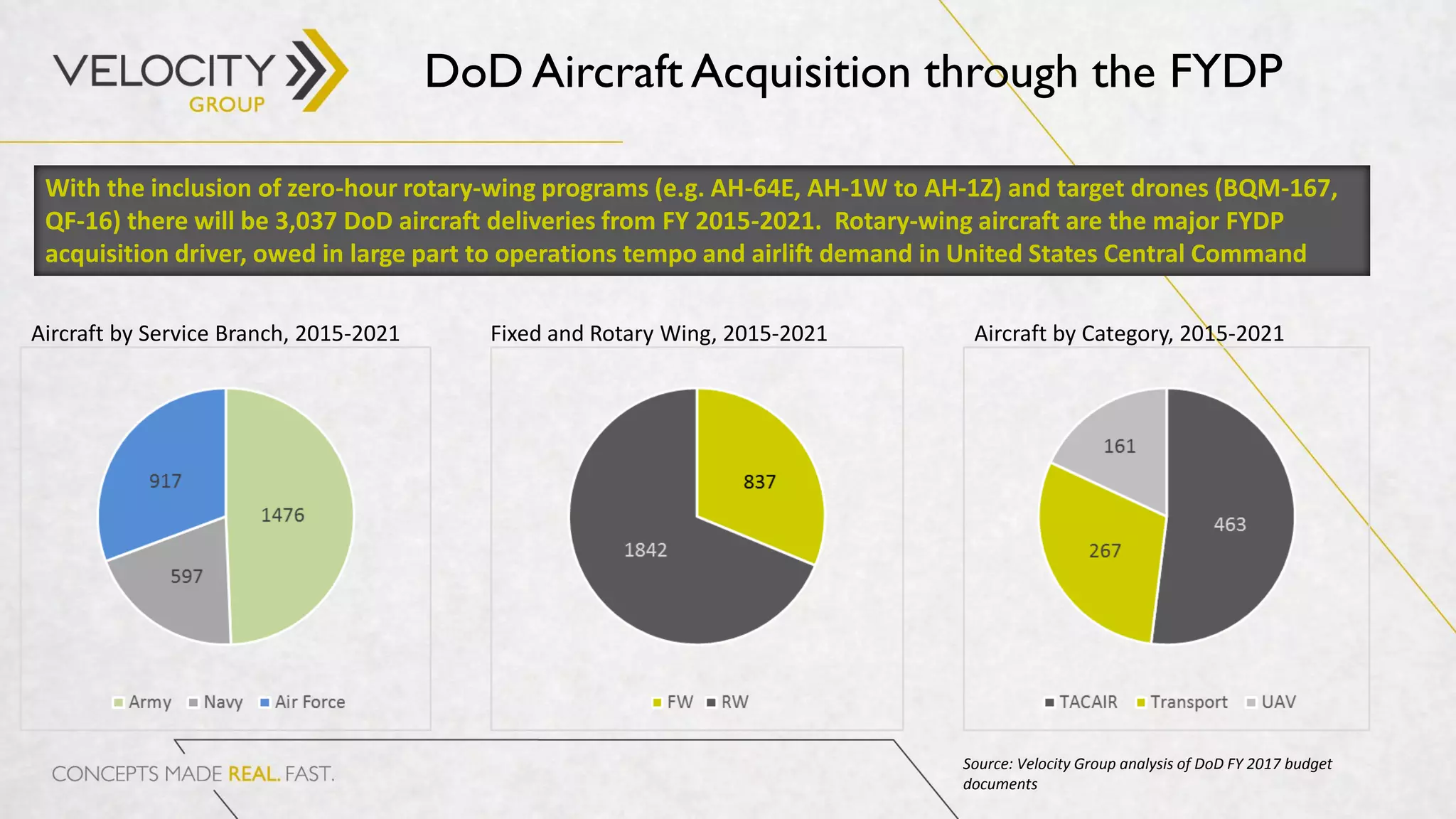

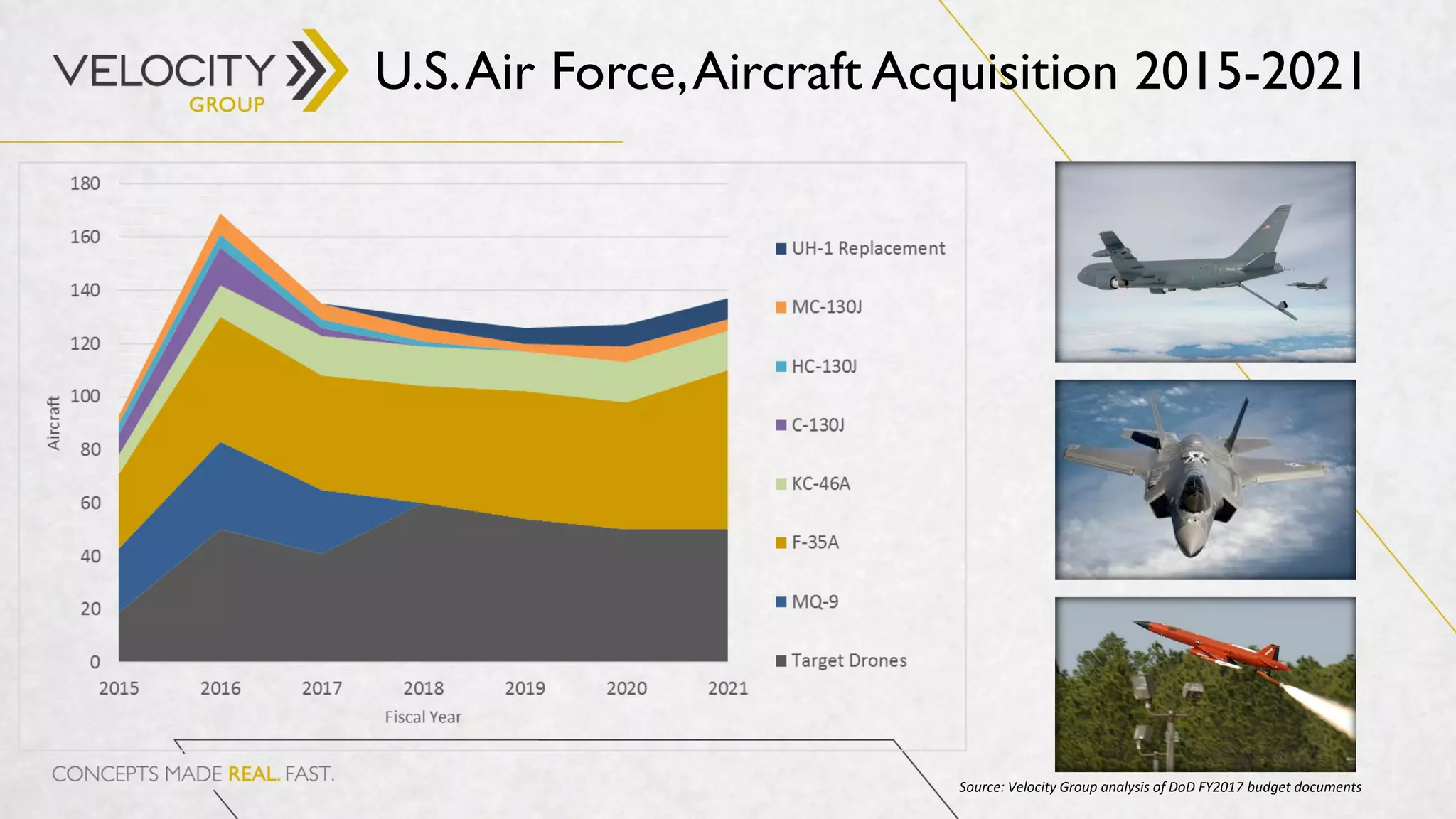

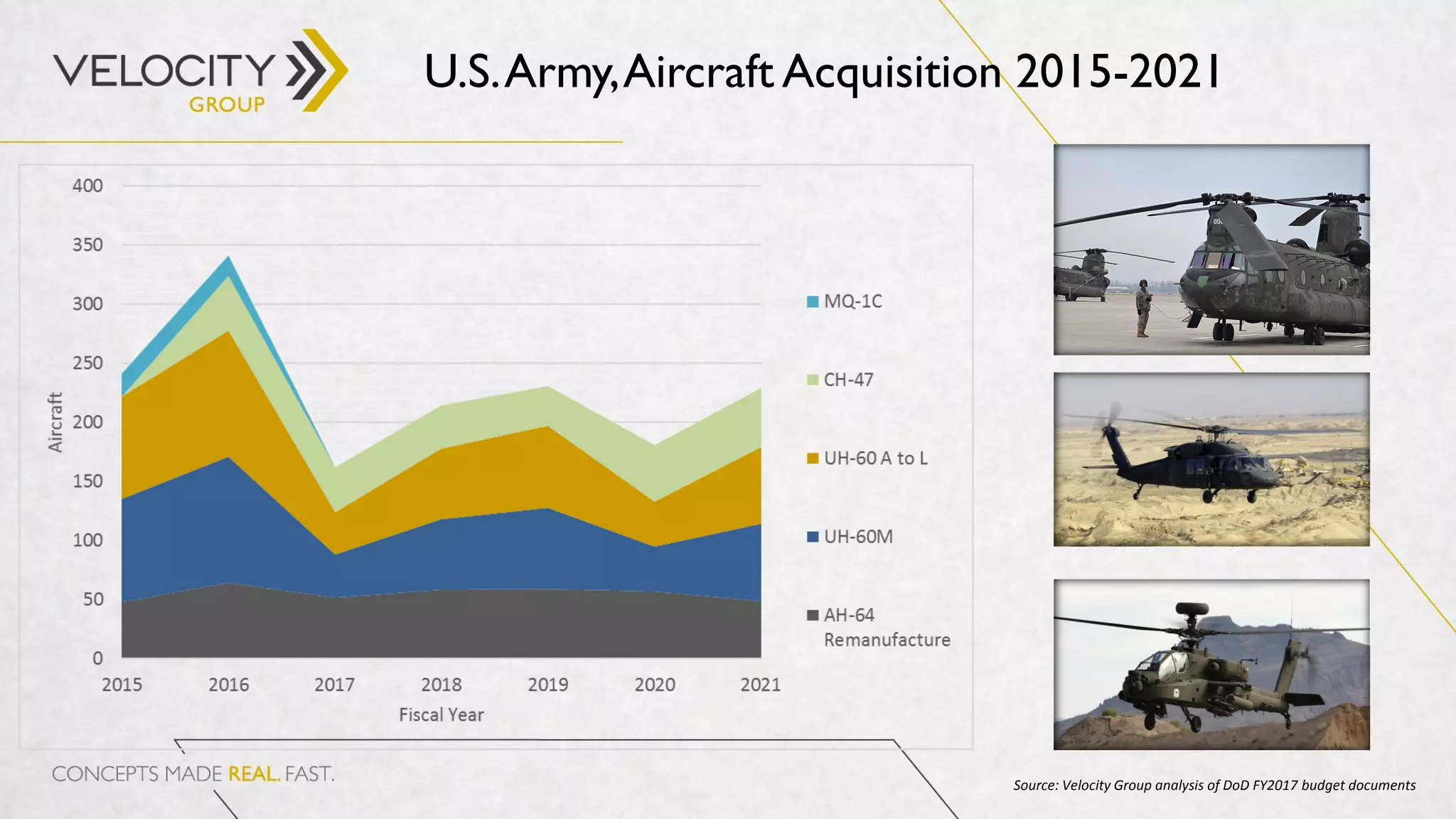

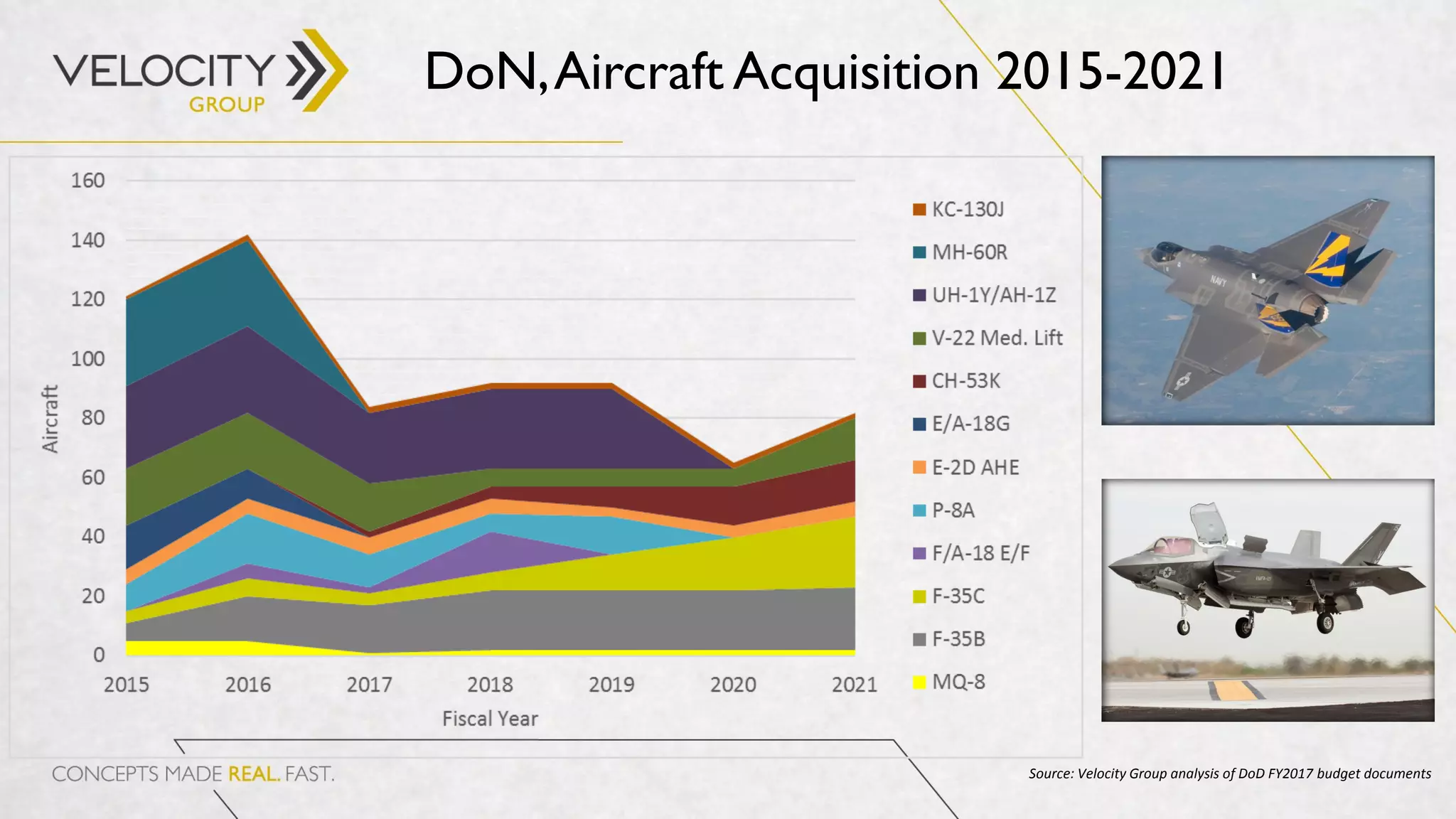

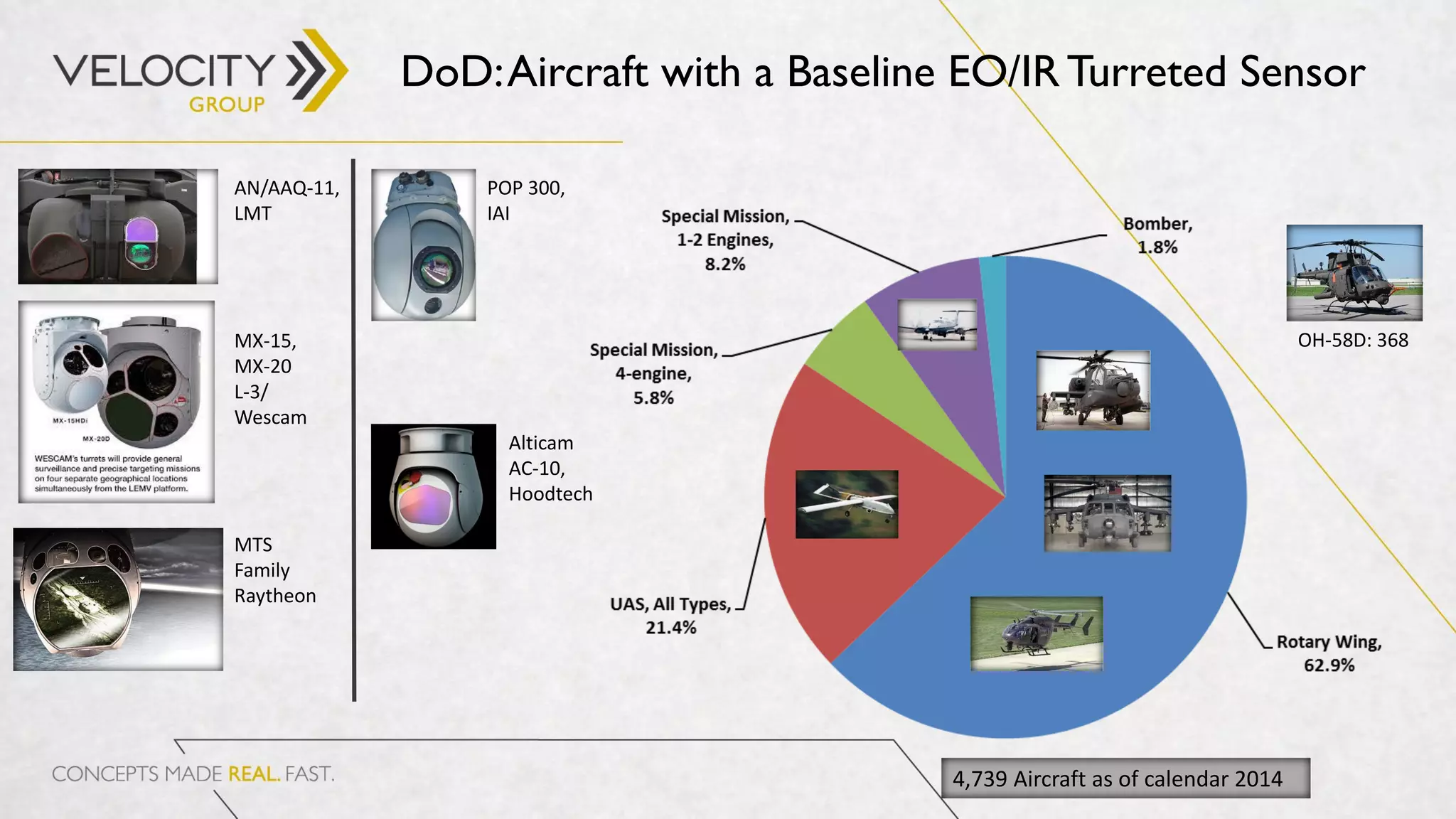

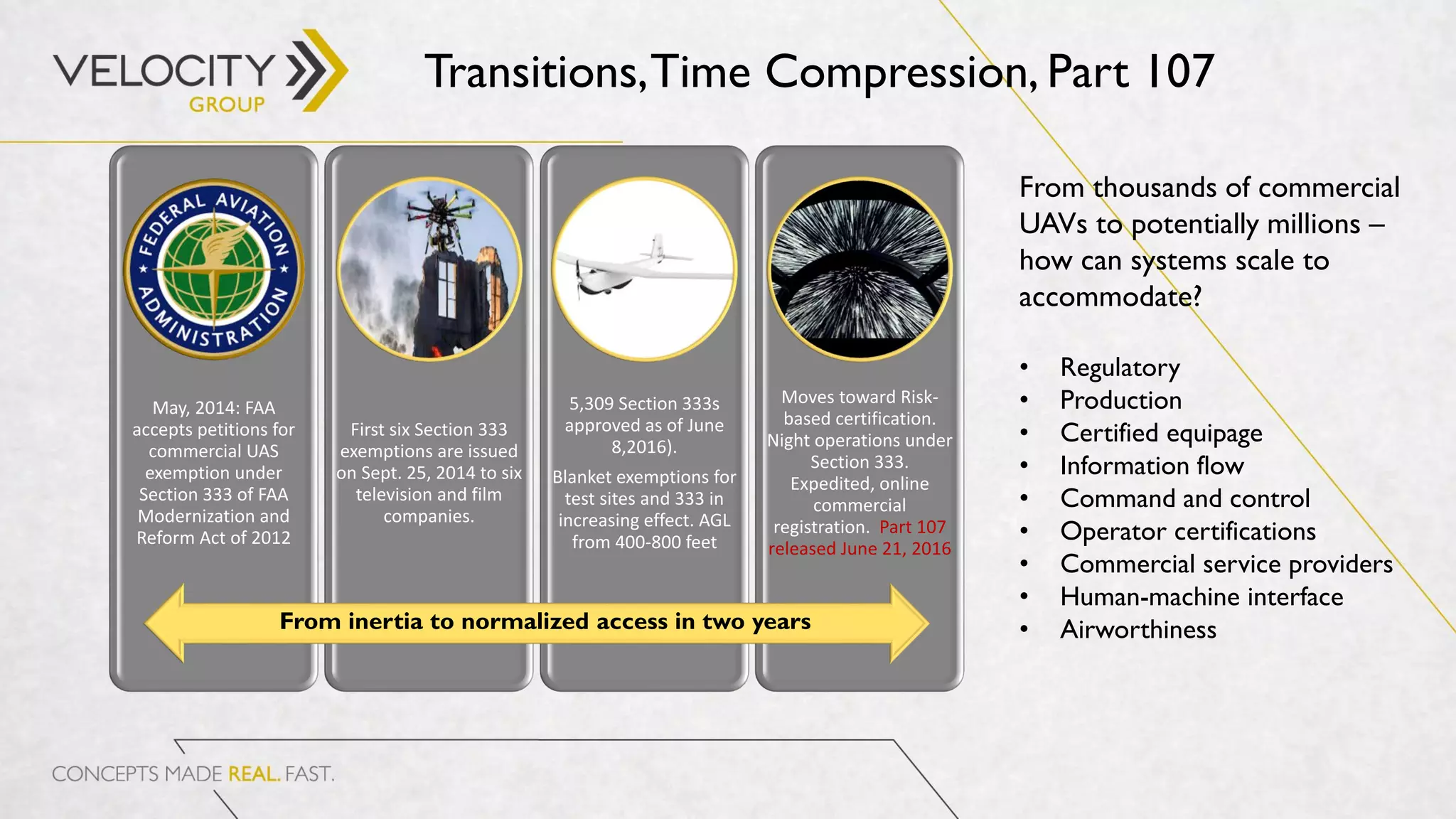

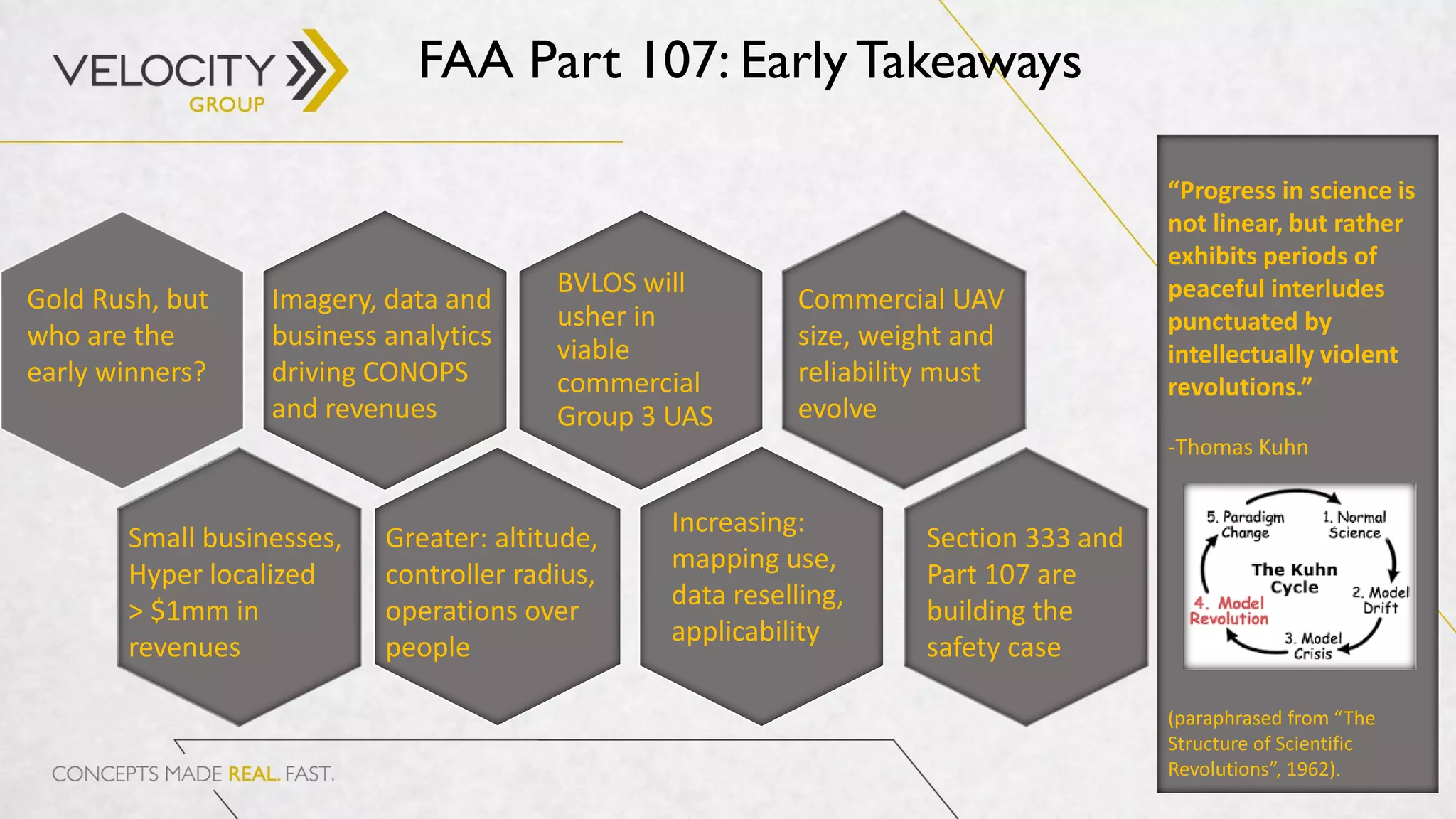

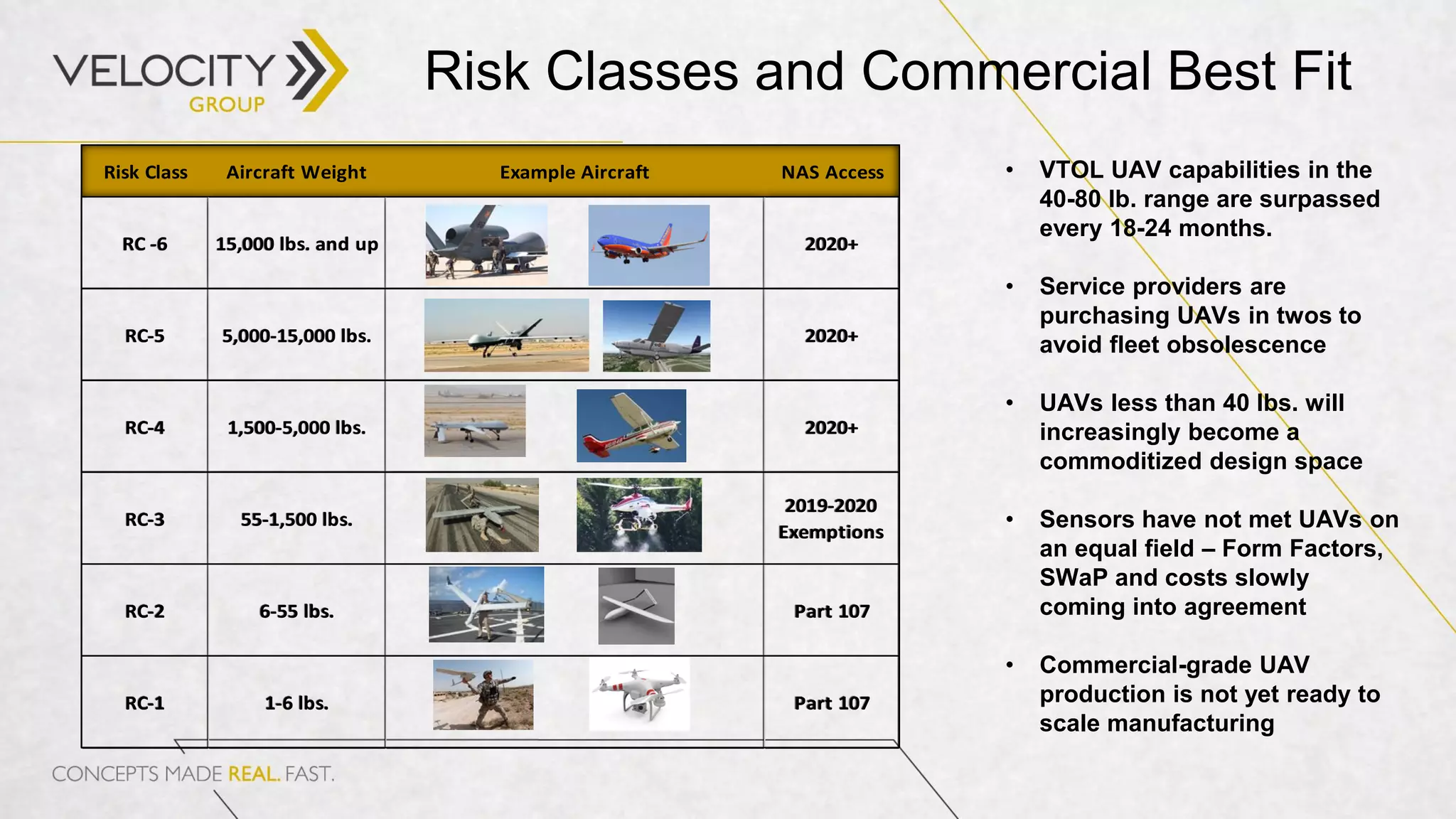

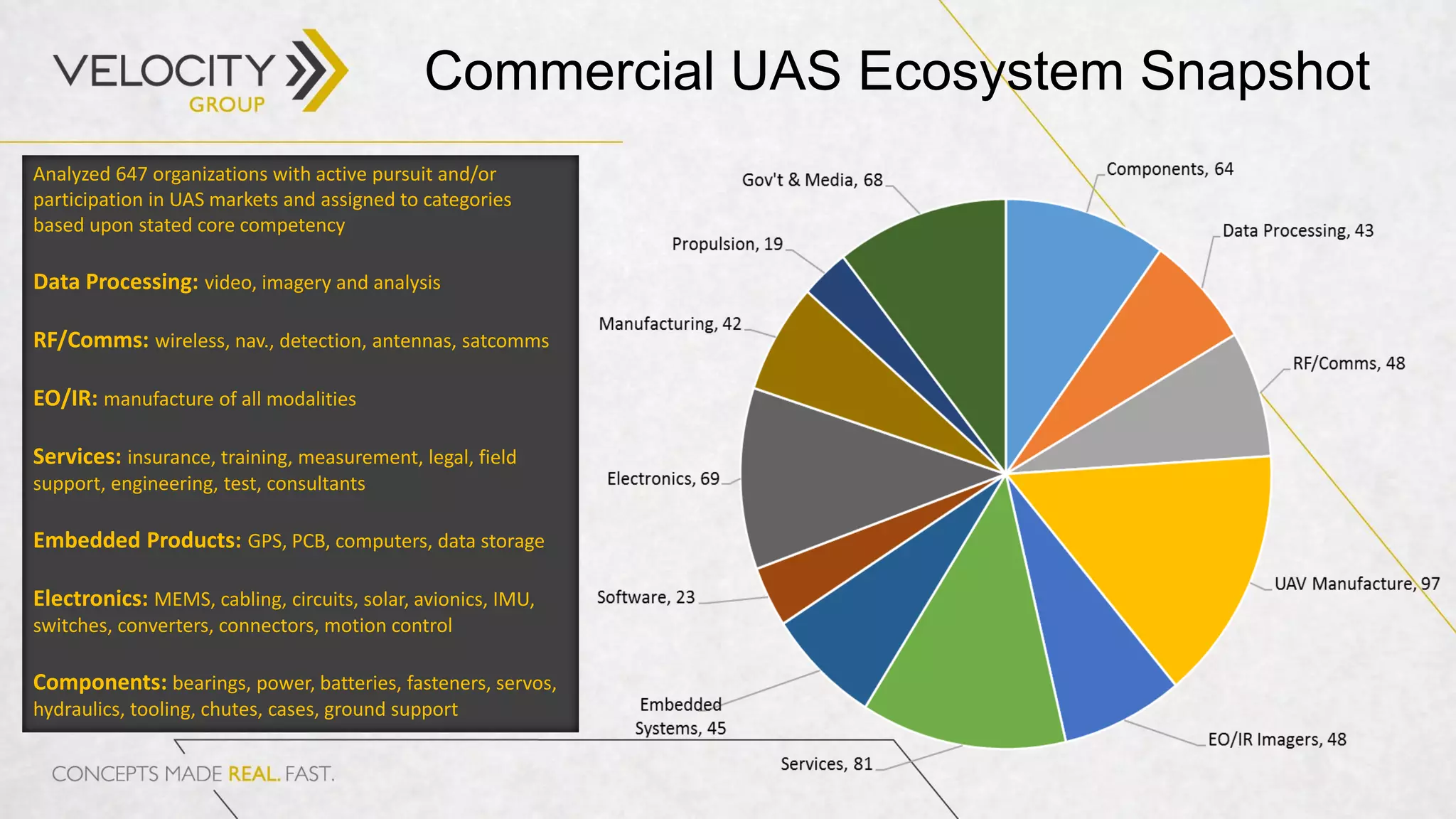

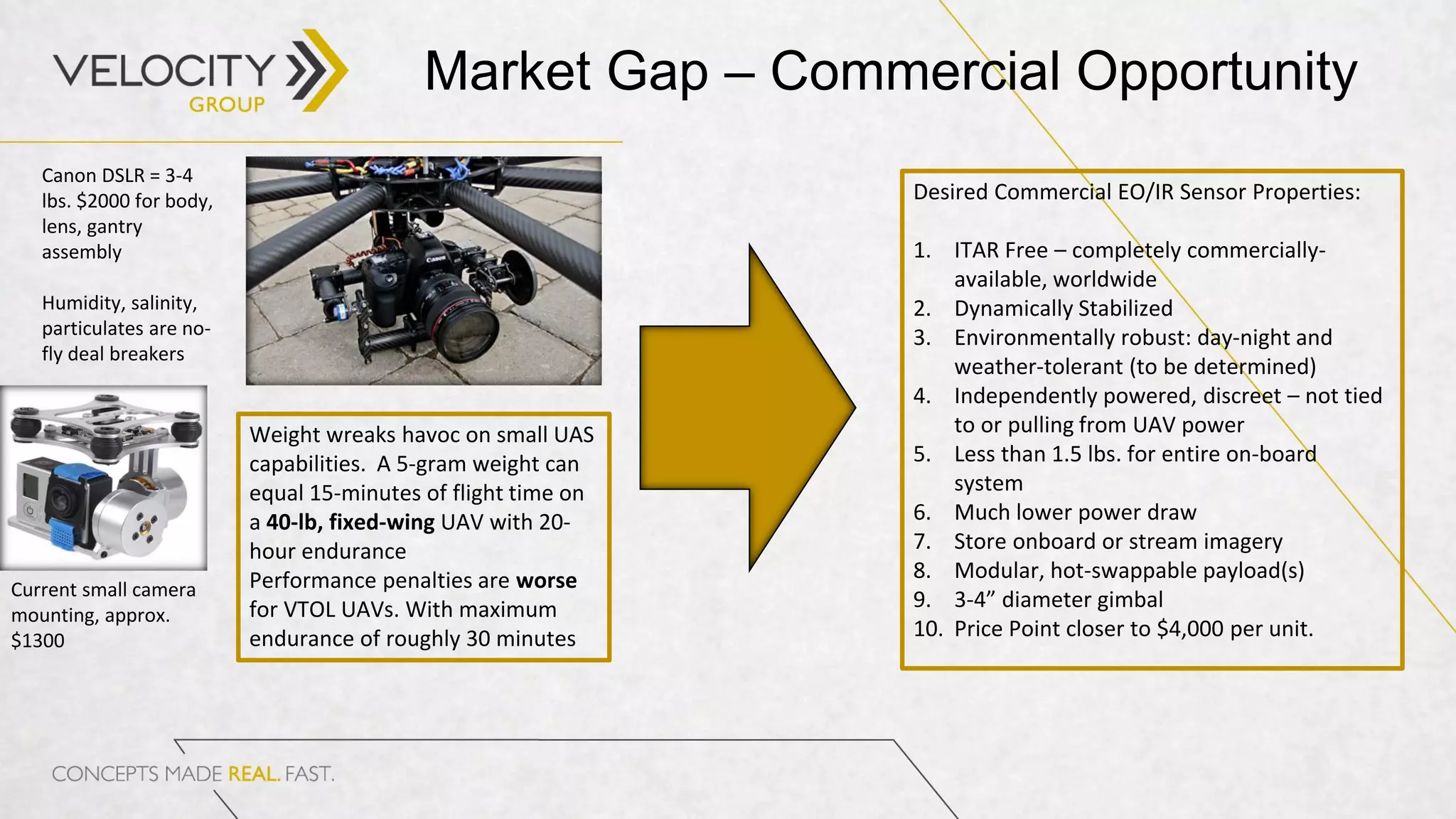

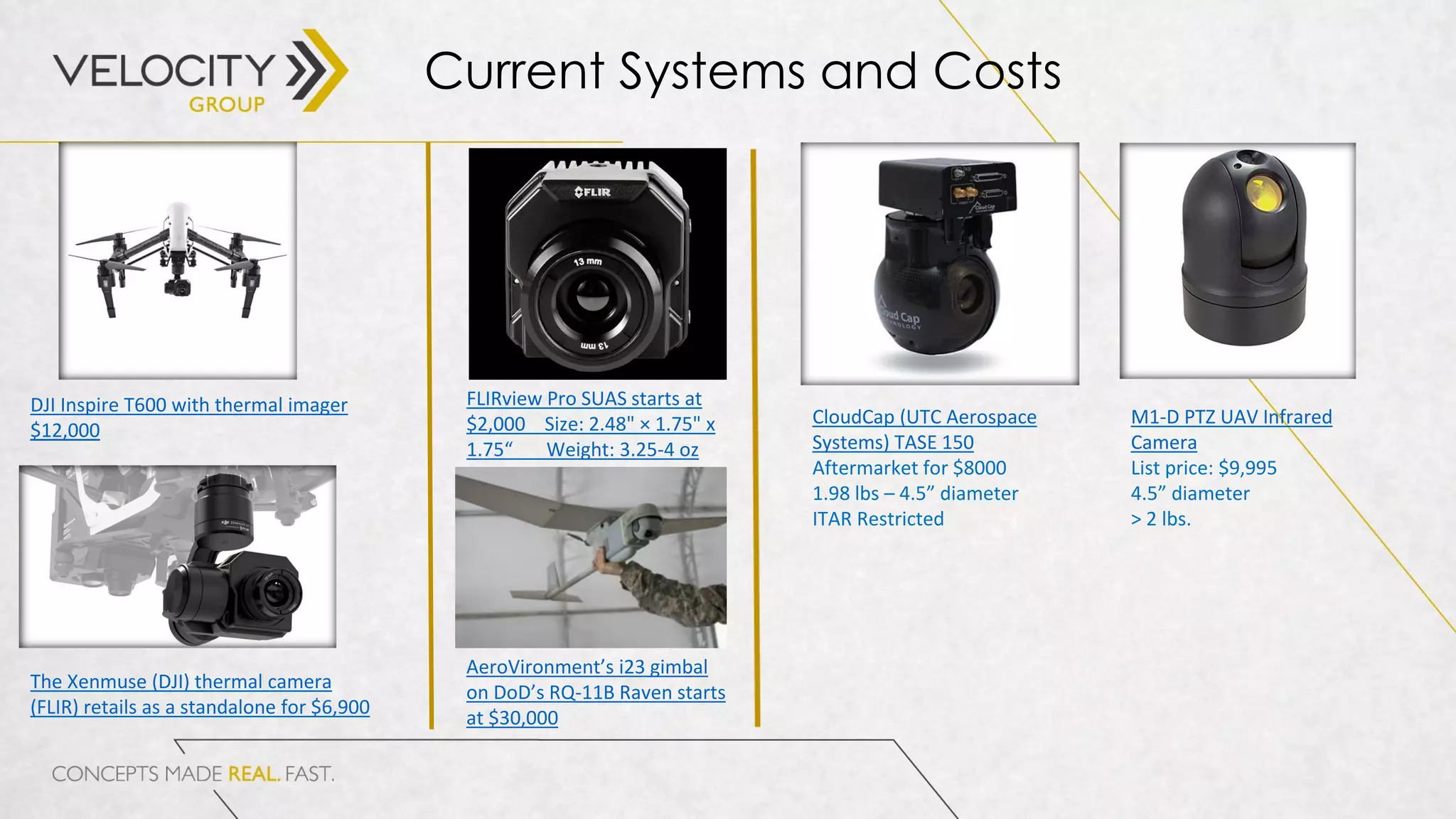

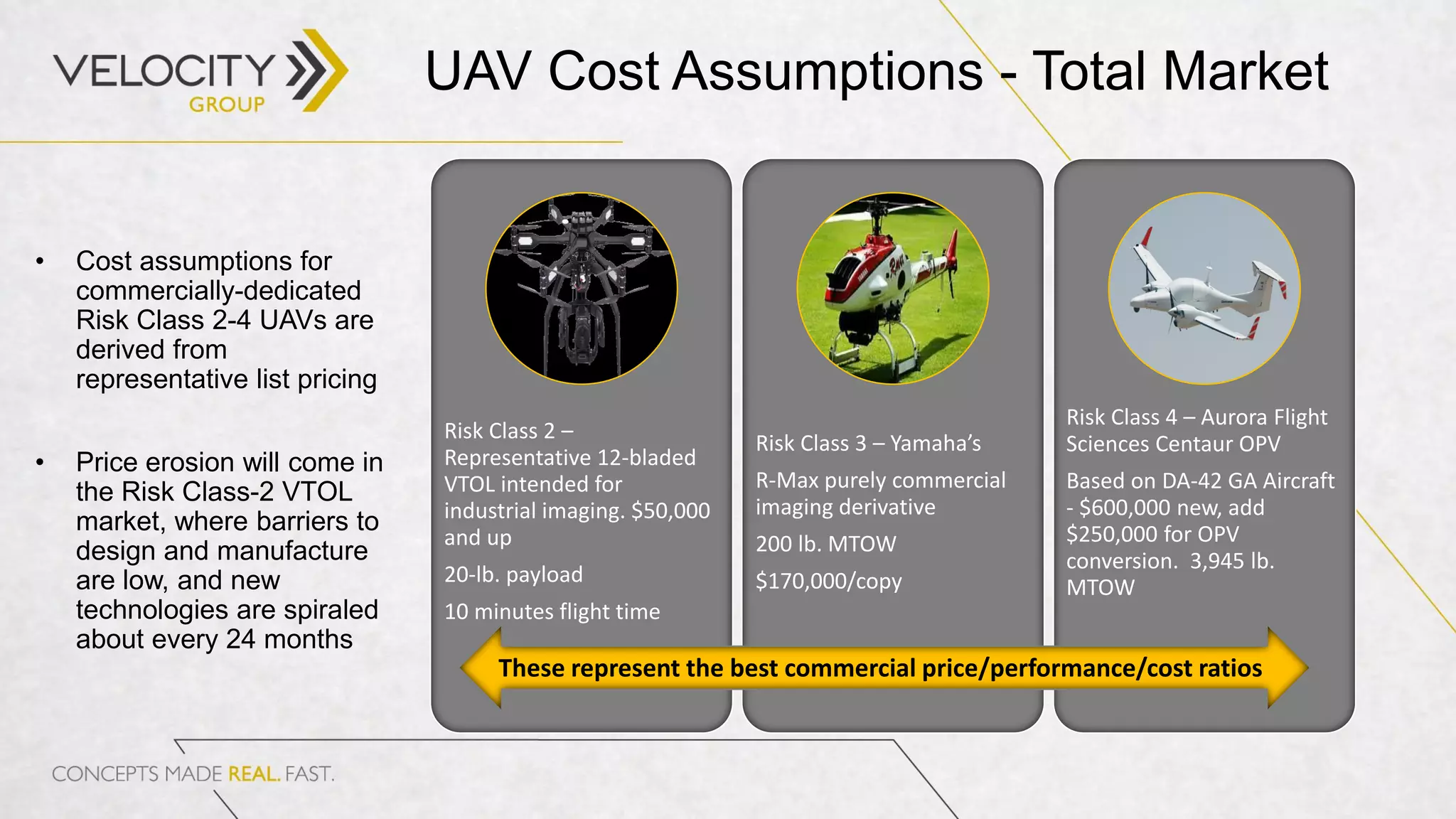

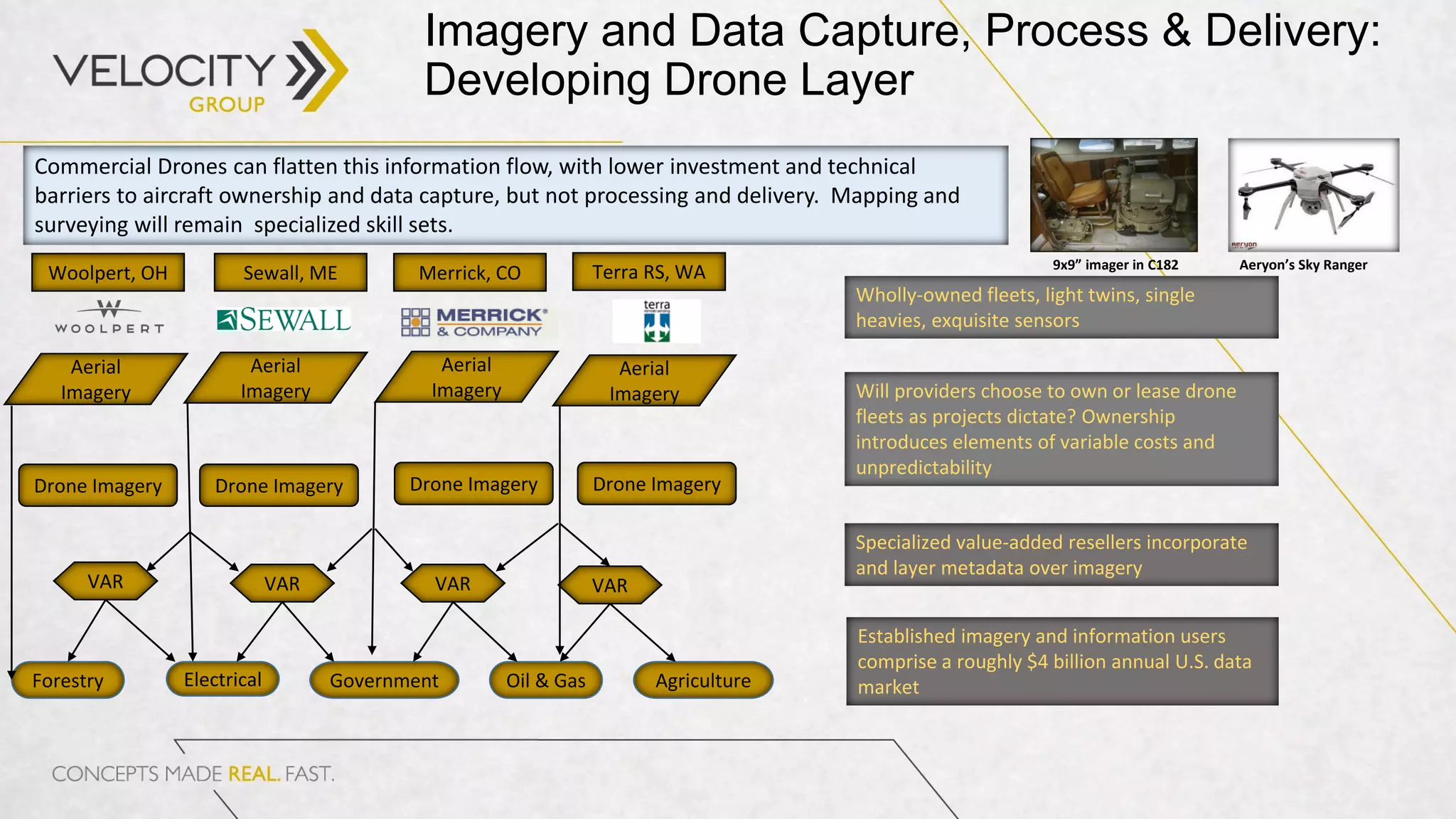

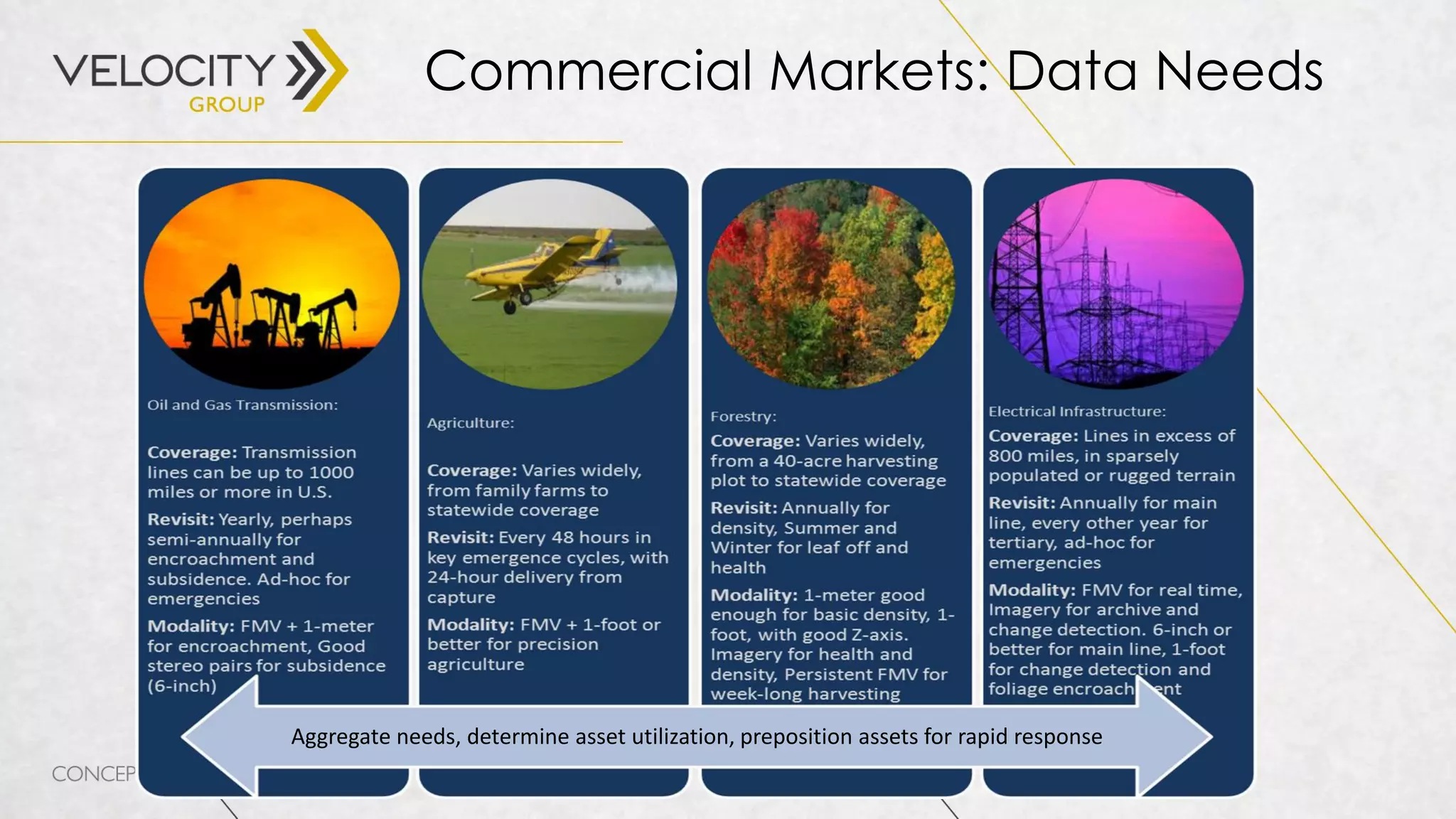

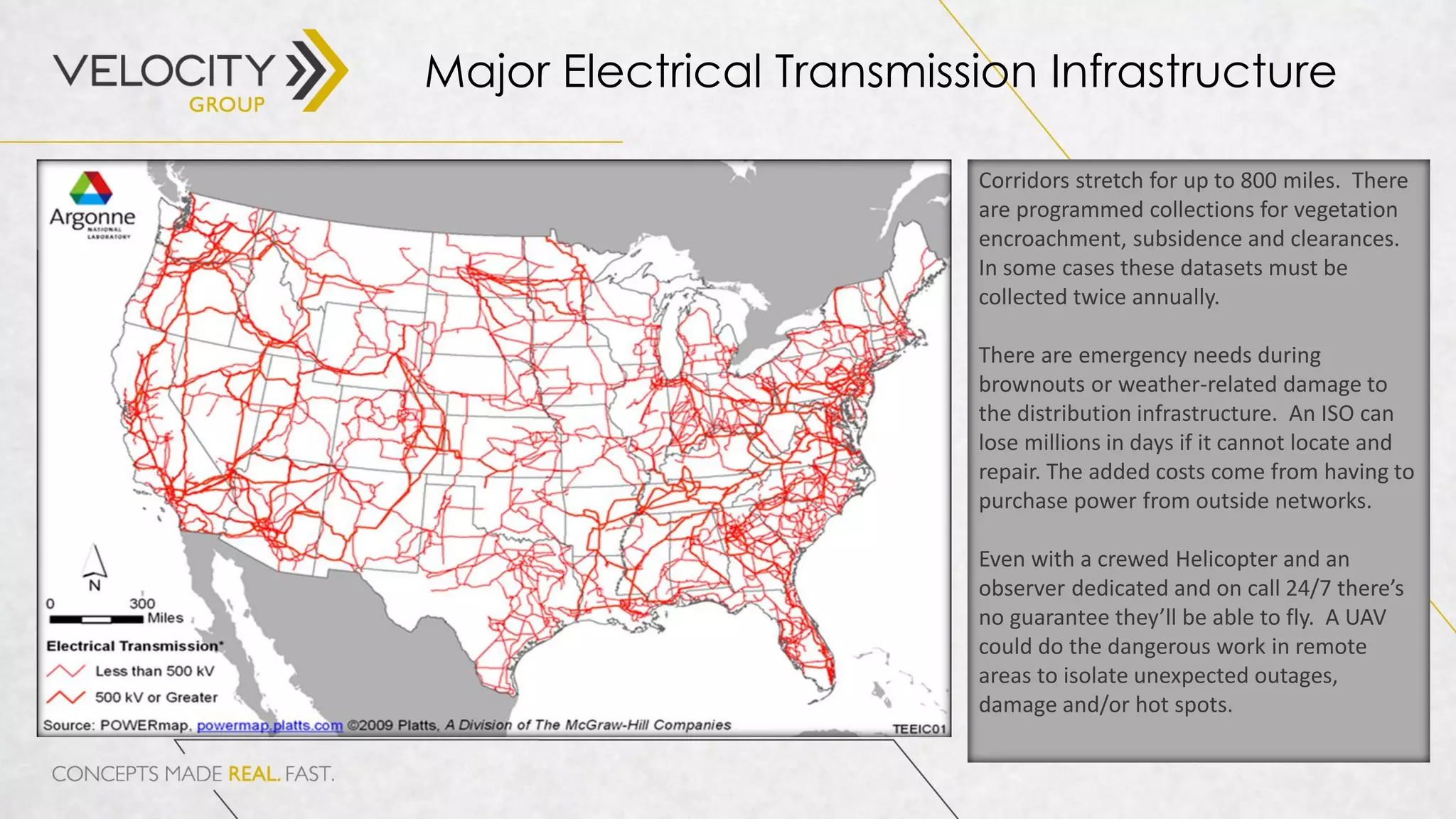

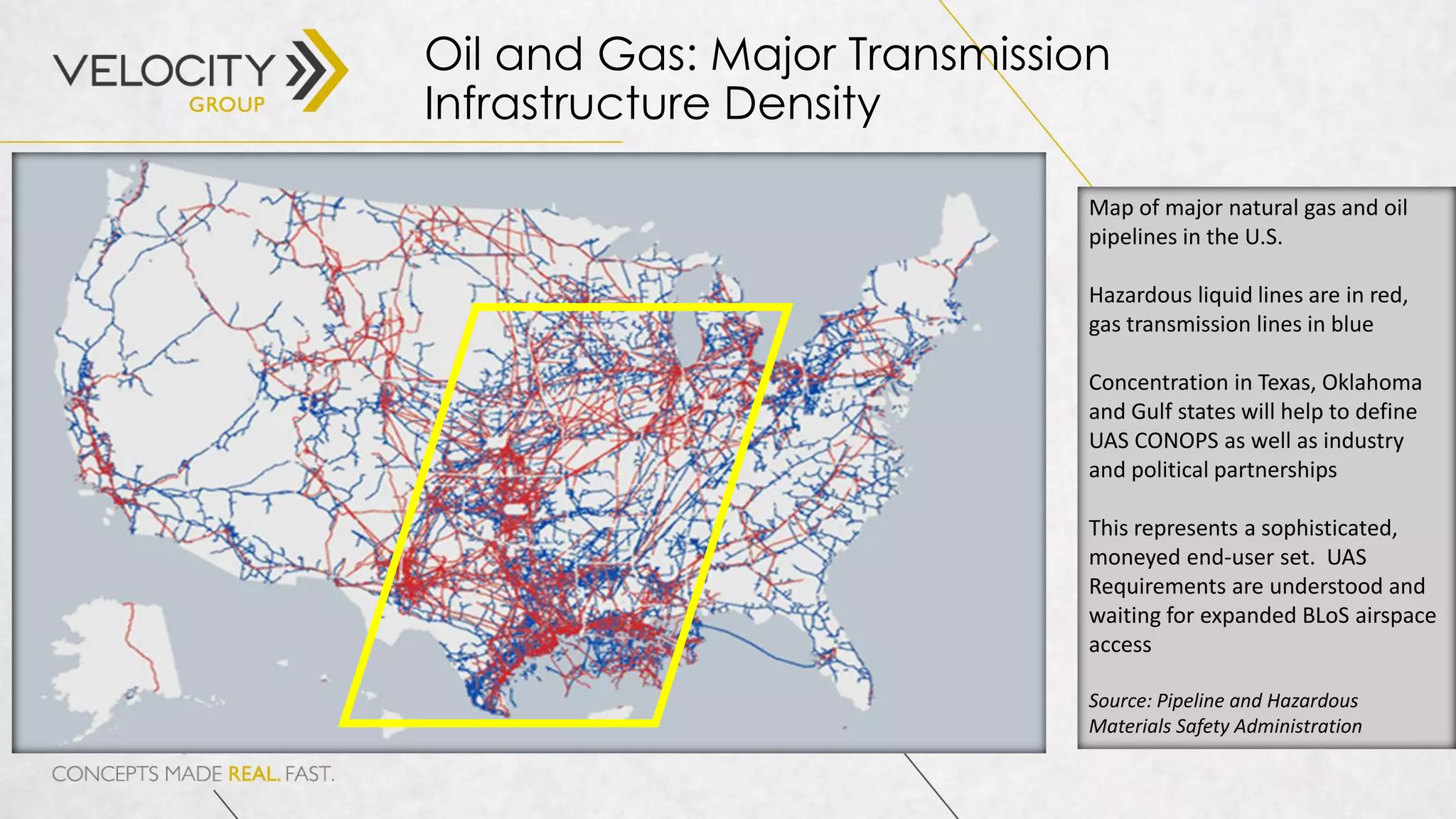

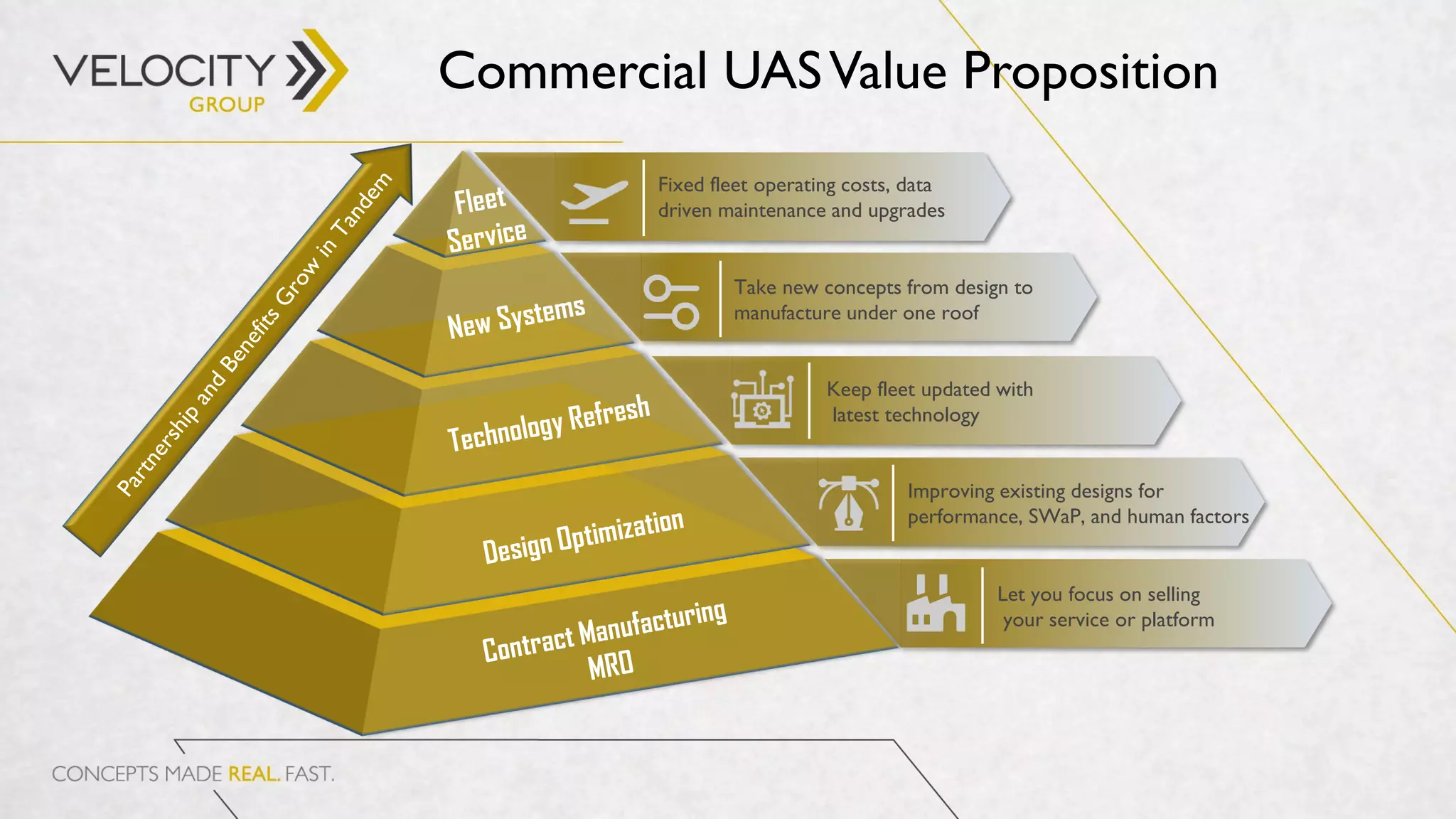

The document discusses the evolving landscape of commercial unmanned aerial systems (UAS) in relation to military and government needs, focusing on aircraft acquisition trends, regulatory developments, and technological advancements. It highlights the importance of end-user requirements, the challenges of scaling commercial UAS, and the potential for integrating advanced imaging and data processing capabilities. The analysis covers various aspects, including cost assumptions, market opportunities, and the implications for different sectors such as agriculture, oil, and gas.