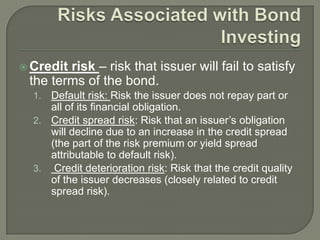

A bond is a loan in the form of a security where the issuer borrows money from investors. Bonds are used by firms and governments to finance long-term investments and are traded on primary and secondary markets. The bond market is large, with over $65 trillion in bonds outstanding worldwide in 2007. Bonds have features like maturity date, coupon rate, and call provisions that are defined in the indenture contract between the issuer and investors. The main risks to bond investors include interest rate risk, credit risk, inflation risk, and liquidity risk.