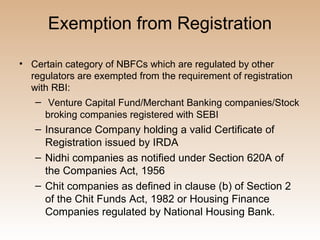

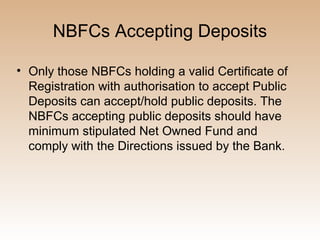

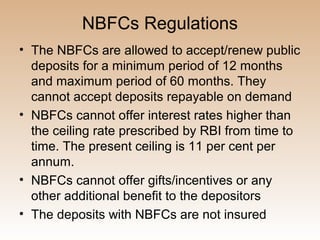

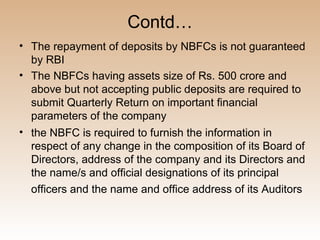

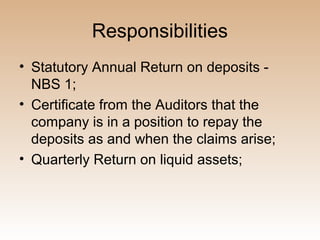

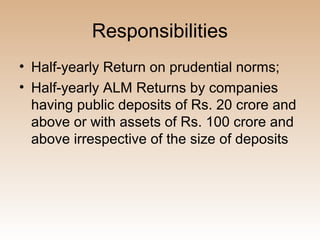

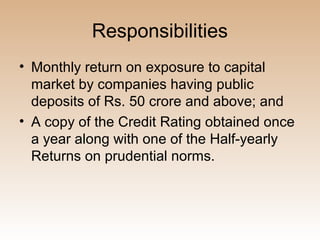

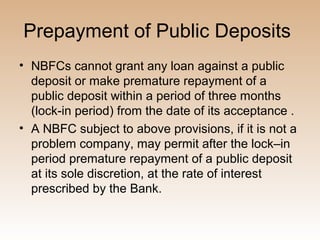

Non-Banking Financial Companies (NBFCs) are financial institutions that are registered under the Companies Act and provide banking services like loans and advances but cannot accept demand deposits. [1] NBFCs must be registered with the Reserve Bank of India (RBI) and are regulated by RBI guidelines regarding public deposits, capital adequacy ratios, liquidity requirements, and other operational conditions. [2] Major types of NBFCs include equipment leasing companies, loan companies, investment companies, and residuary non-banking companies. [3]