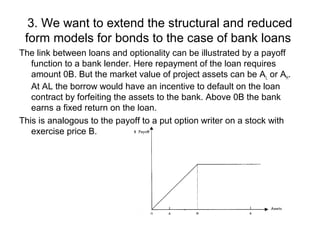

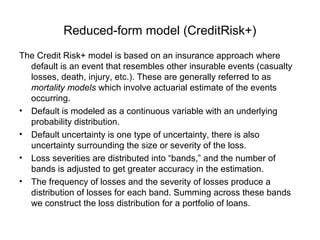

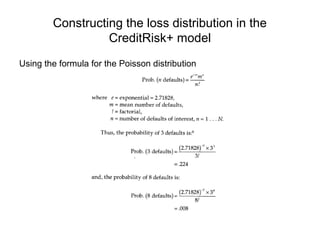

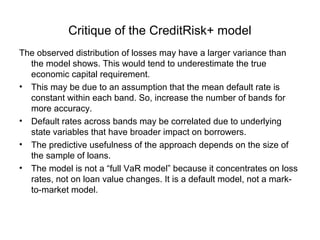

This document discusses three main approaches to modeling credit risk: structural, reduced form, and incomplete information. It provides details on the structural approach using the Merton and first passage models and the reduced form approach using a Poisson process for default. It also discusses extending these models to value bank loans, specifically comparing the structural KMV model and reduced form CreditRisk+ model. The critiques note limitations like non-observability of variables, lack of dynamics, and potential underestimation of risk.

![Market value of firm equity, E(t)

Shareholder equity is similar to a call option on the firm’s assets, since

at maturity the payoff to equity holders is max [A(t) – B, 0].

However, shareholder equity is different from a European option if the

firm pay dividends to shareholders prior to maturity as reflected in

the first term of the last line in (18.4) where δ denotes the dividend

rate.](https://image.slidesharecdn.com/creditriskmodels-131203051614-phpapp01/85/Credit-risk-models-7-320.jpg)