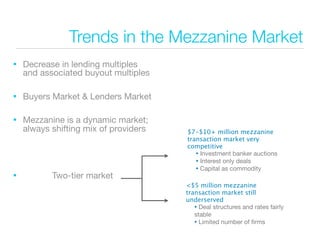

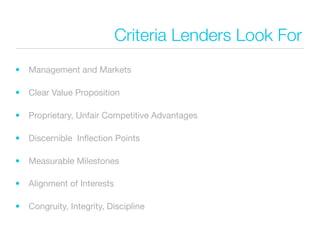

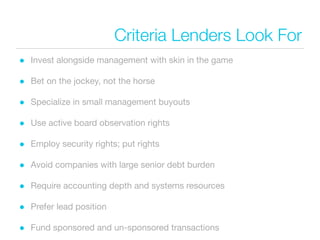

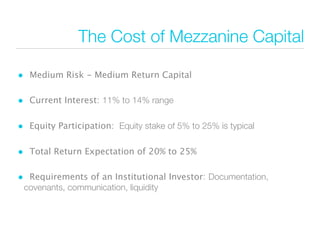

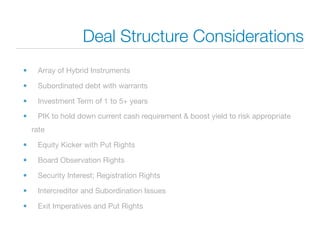

Mezzanine finance is medium risk, medium return debt capital that is typically used to finance ownership successions, management buyouts, and growth capital. It has flexible structures like subordinated debt combined with equity warrants. Mezzanine lenders seek management teams with experience and clear business strategies, and look for proprietary advantages, measurable milestones, and alignment of interests between investors and management. Total returns for mezzanine investors typically target 20-25% through both interest payments and equity participation.