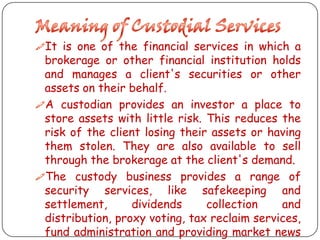

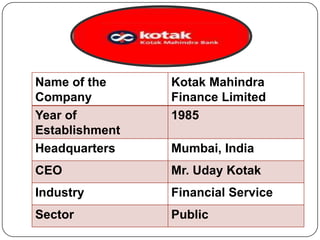

Kotak Mahindra Bank provides custodial services including safekeeping of securities, processing of corporate actions like dividends and bonuses, foreign exchange services, proxy voting, compliance monitoring, transaction settlement, and customized reporting. As one of India's leading private banks, it has over 30 years of experience in financial services and capital markets. Its custody services are aimed at both domestic and foreign institutional investors investing in Indian debt and equity markets.