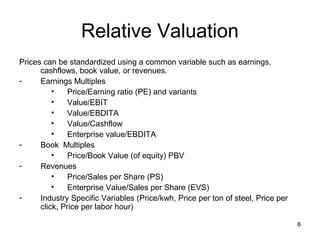

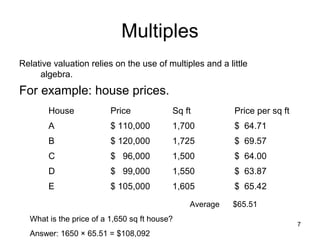

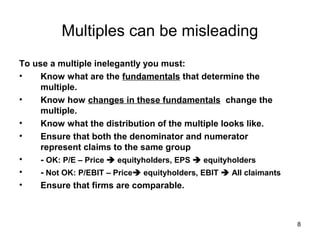

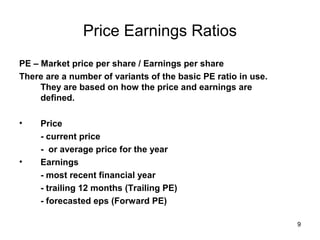

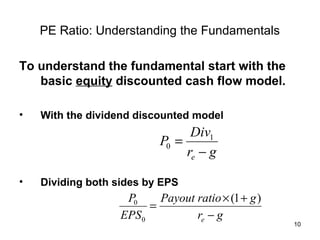

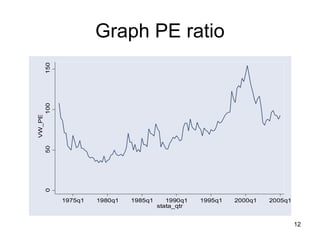

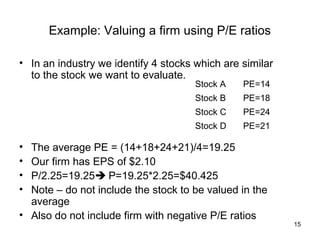

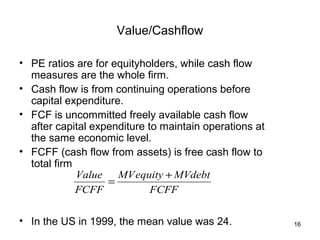

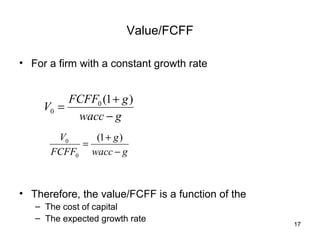

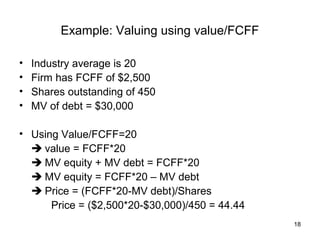

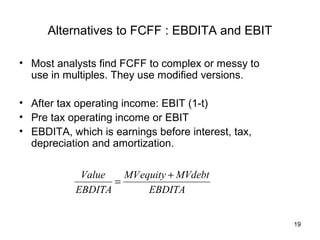

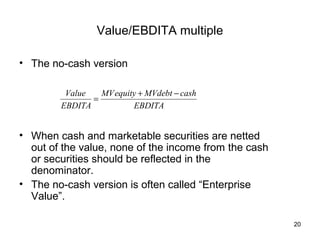

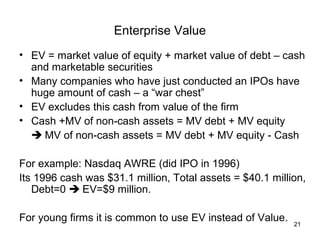

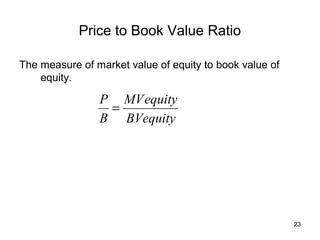

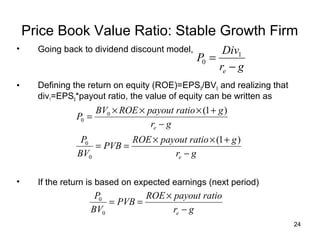

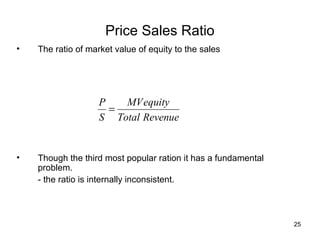

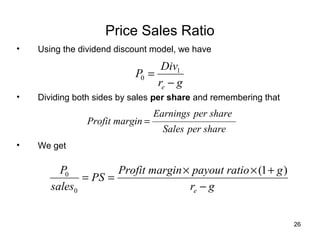

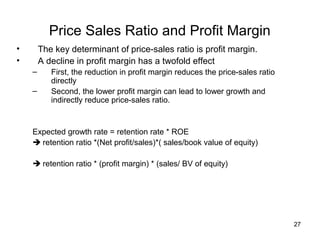

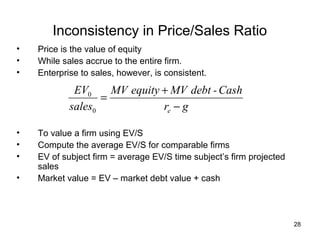

The document discusses two main approaches to company valuation: relative valuation and fundamental valuation. Relative valuation uses multiples like P/E ratios to value companies relative to competitors, while fundamental valuation uses discounted cash flow models. It then focuses on relative valuation, explaining various multiples used like P/E, EV/EBITDA, P/B, and P/S. It discusses how to interpret these multiples based on factors like growth and risk. Overall, the document provides an overview of relative versus fundamental valuation and describes several commonly used relative valuation multiples.