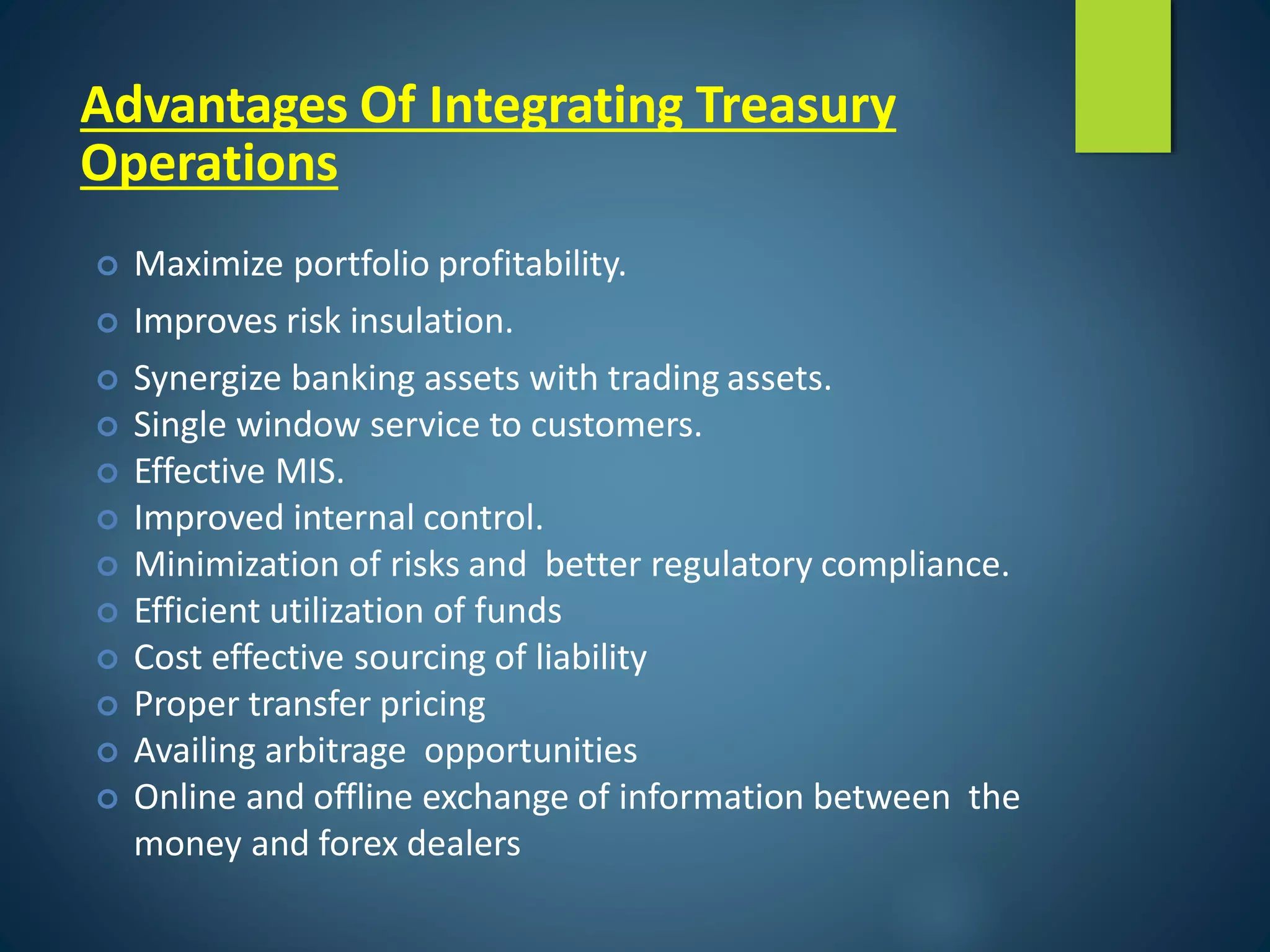

The document discusses the critical role of treasury management within an organization, emphasizing its responsibilities for managing liquidity, capital structures, and risk mitigation. It outlines the structure and functions of an integrated treasury department, detailing the roles of front office, mid office, and back office in executing treasury operations. The conclusion highlights the treasury department's significance in the banking industry, requiring specialized skills to navigate its complex dynamics.