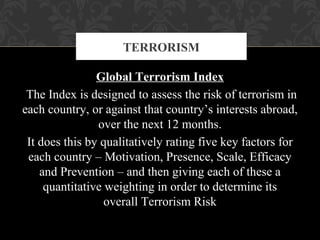

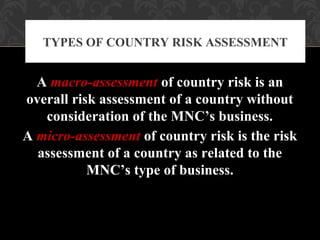

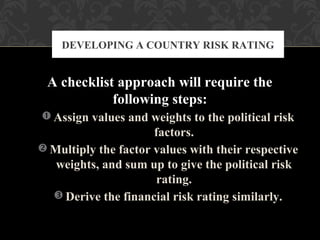

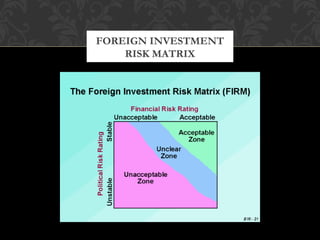

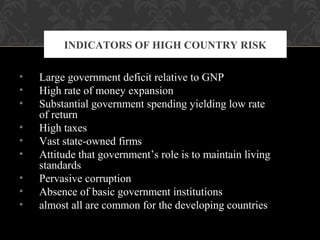

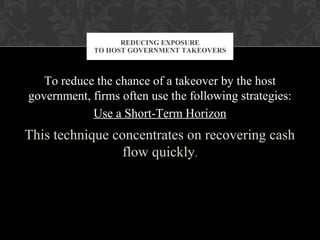

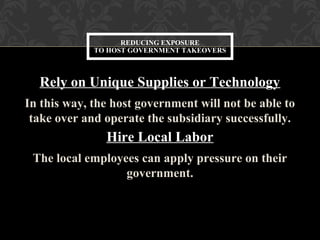

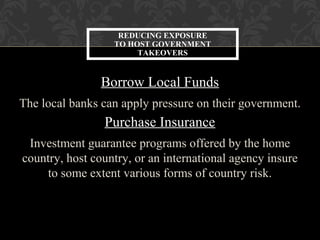

The document discusses country risk analysis. It defines country risk as risks arising from changes in a country's business environment that may negatively impact profits or asset values. It identifies several political, economic, financial, and subjective factors that contribute to country risk, such as currency controls, civil unrest, economic growth rates, corruption, and consumer attitudes. The document also discusses methods for assessing country risk like checklists, the Delphi technique, and quantitative analysis. It provides examples of how country risk ratings can inform investment decisions and be incorporated into capital budgeting.