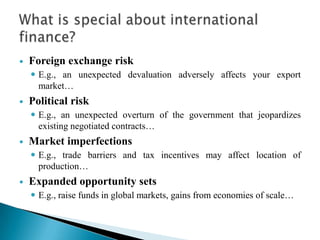

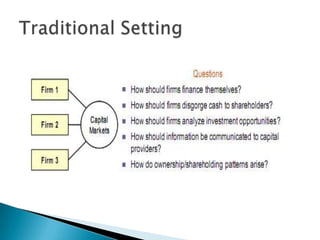

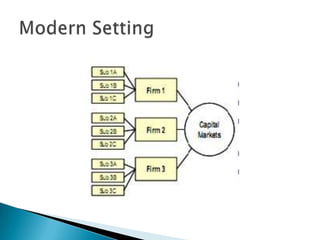

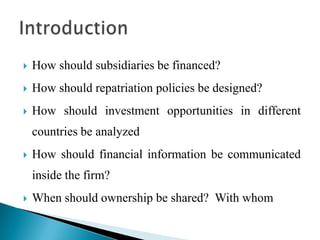

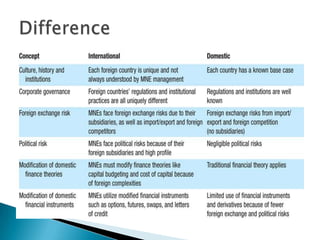

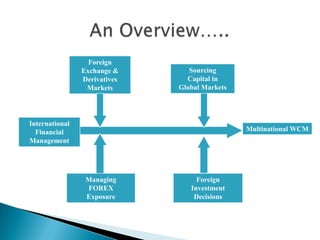

This document provides an introduction to international finance. It discusses how companies and individuals can now raise funds, invest money, produce goods and sell products globally. This increased internationalization brings both opportunities in larger markets but also additional risks that must be managed. It gives examples of how trade and consumption have become highly globalized with people routinely purchasing goods from all around the world. Production has also become global as companies source inputs and locate production wherever costs are lowest. Financial markets too have integrated as investors diversify portfolios across borders. The document outlines some of the key questions international finance practitioners must address such as how to analyze investments across countries while accounting for currency and political risks.