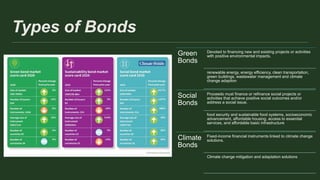

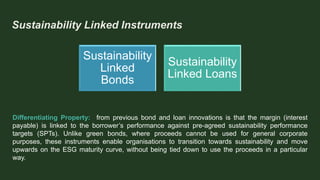

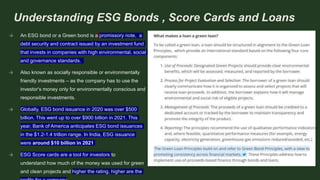

Green finance refers to financial products and services that promote environmentally sustainable investments and stimulate low-carbon technologies. It includes loans, debt mechanisms, and investments used to encourage green projects or minimize climate impacts. Government policies can significantly influence green finance markets by shaping them around sustainability agendas. Investors see opportunities in national green recovery efforts but also risks of a market bubble without sufficient investment opportunities. Various bond types like green bonds, social bonds, and sustainability-linked bonds are emerging to direct funding to green and social projects. Blockchain and cryptocurrencies also show potential to enable more sustainable financing models if technical and environmental issues can be addressed. Significant investment is still needed to achieve countries' renewables and decarbonization goals.