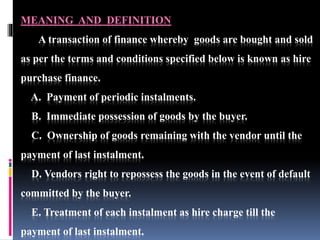

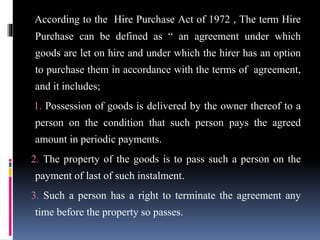

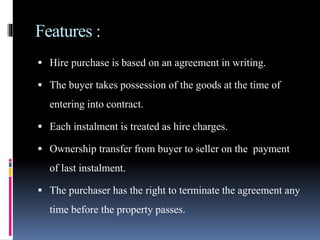

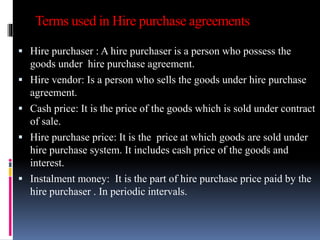

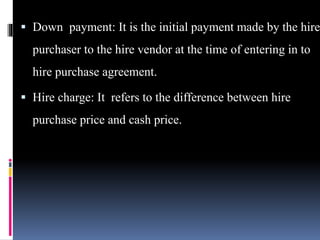

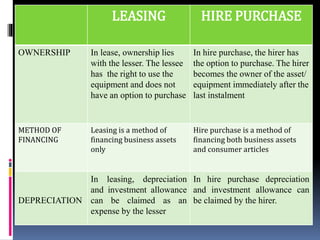

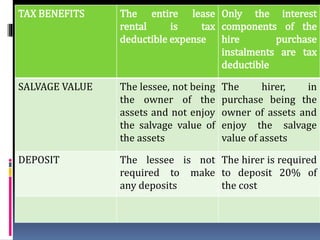

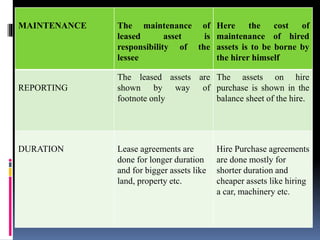

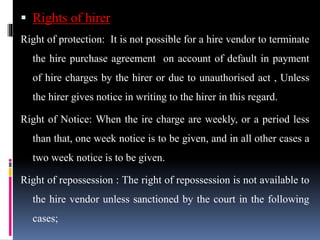

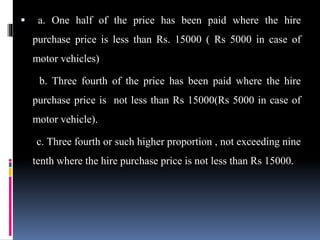

The document discusses the concept of hire purchase, which is a mode of financing where goods are leased on hire with the option for the lessee to purchase them by paying installments. Key points include: hire purchase involves periodic installment payments, immediate possession of goods by the buyer but ownership remaining with the seller until final payment; features like being based on a written agreement and ownership transferring after final payment; and rights and obligations of both the hirer and hire vendor. Differences between leasing and hire purchase are also outlined.