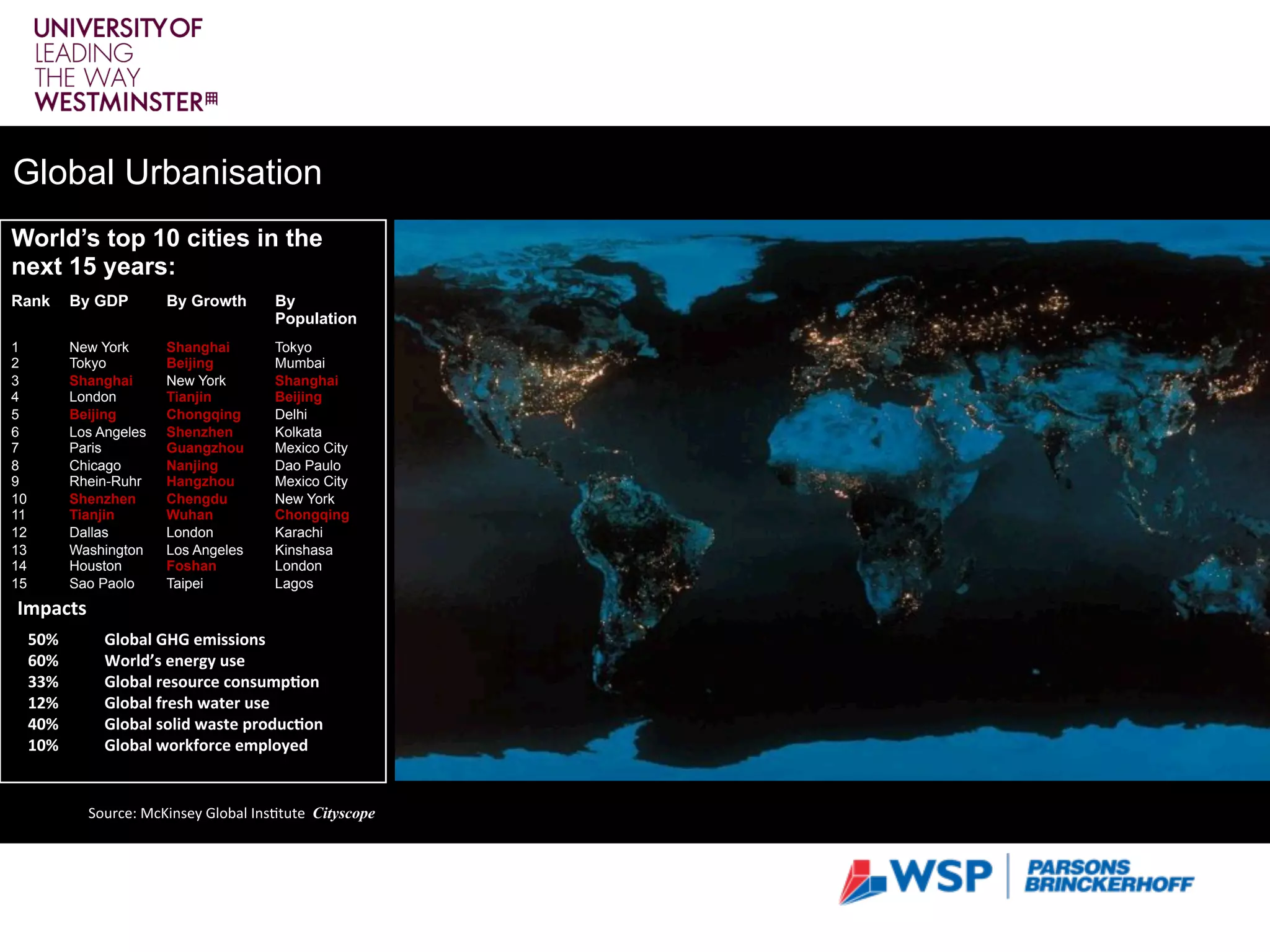

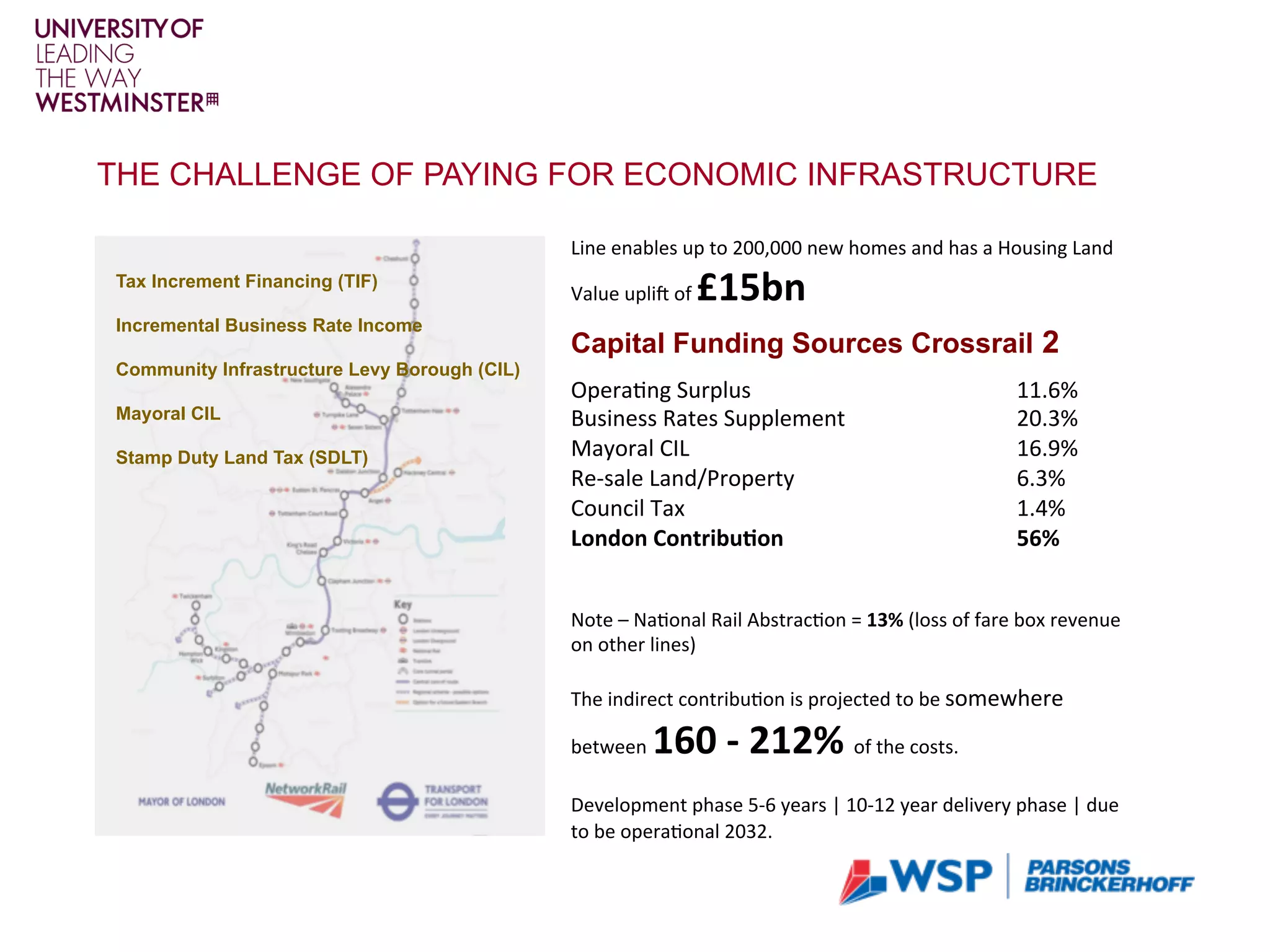

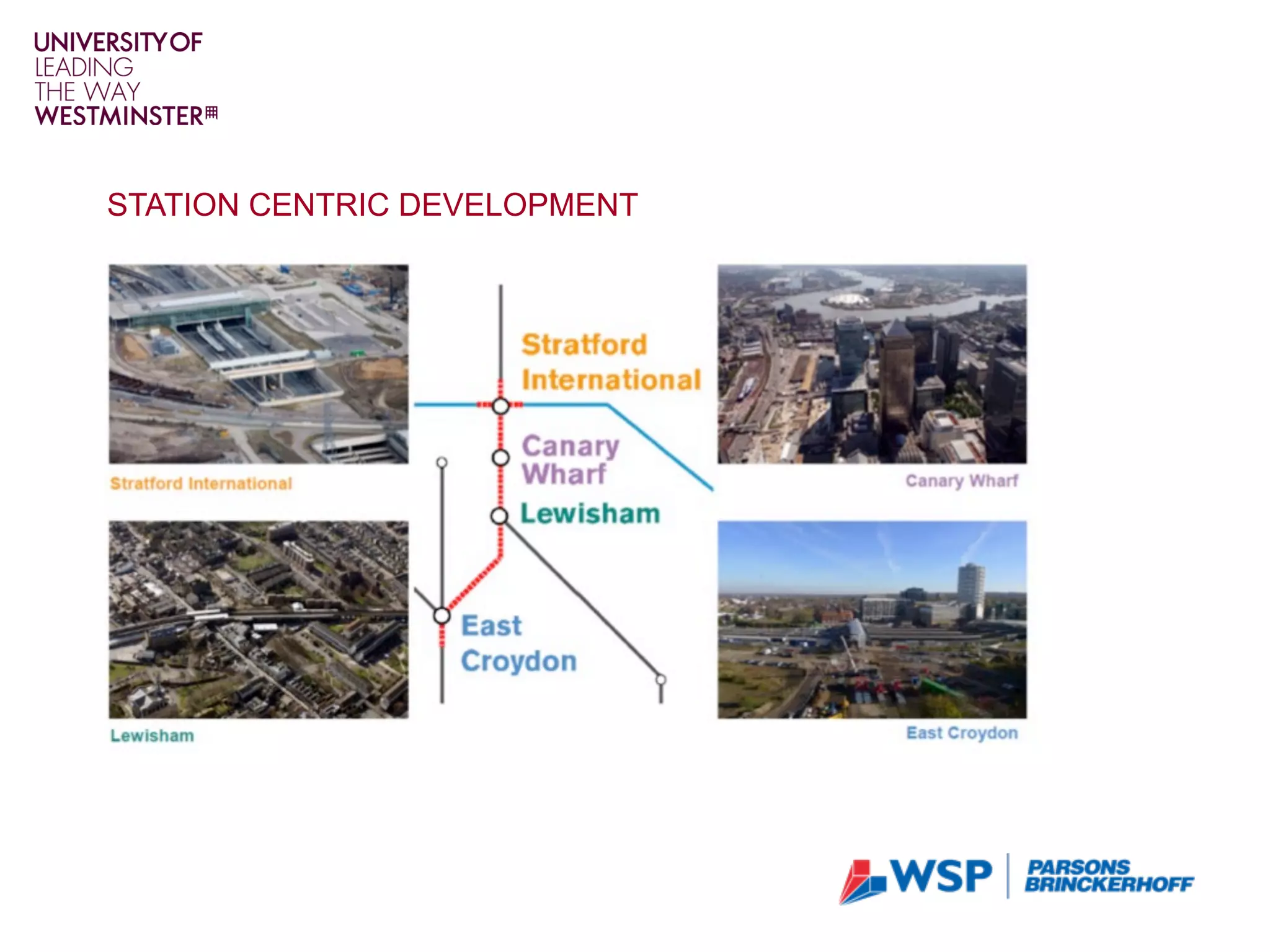

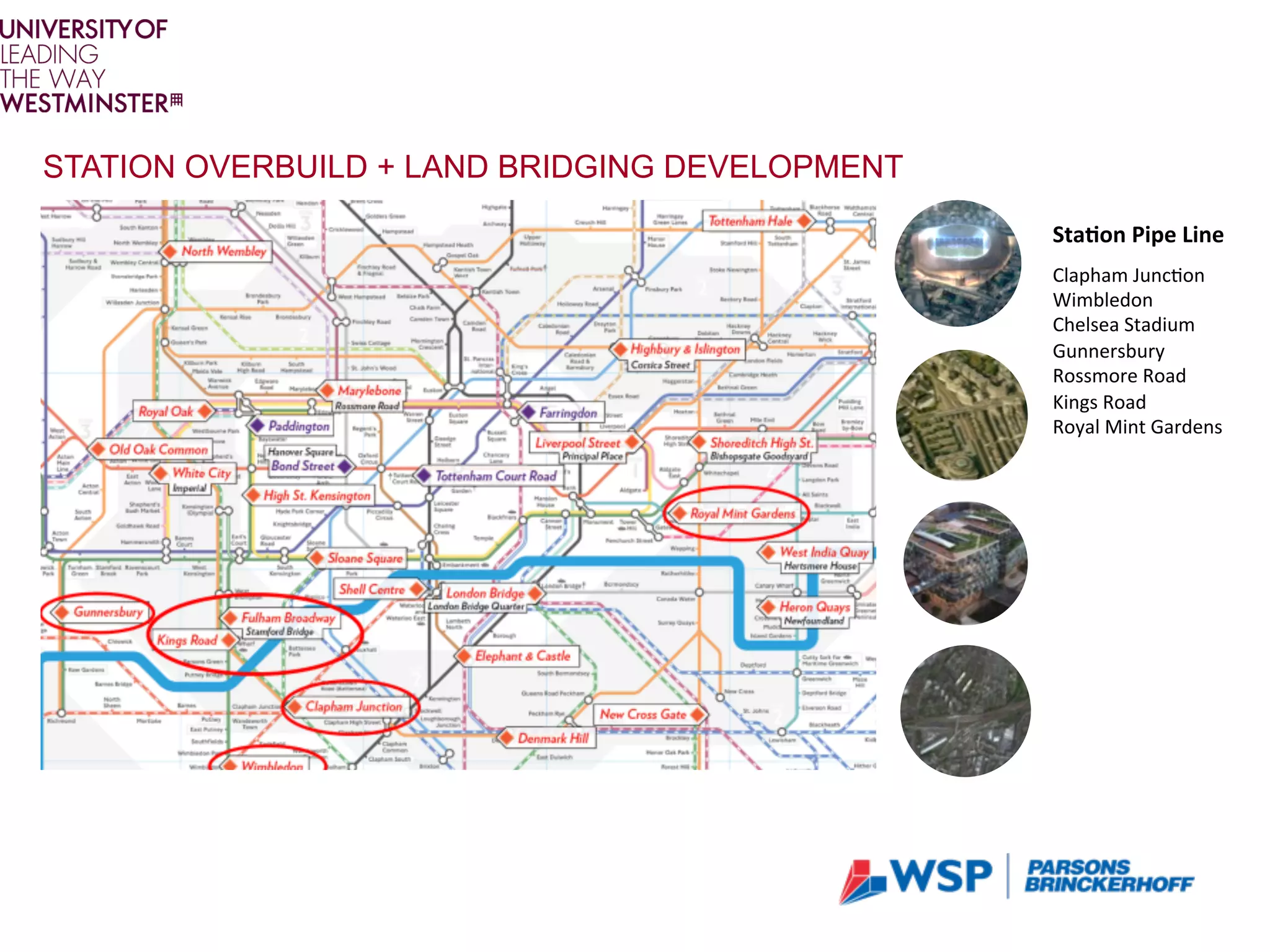

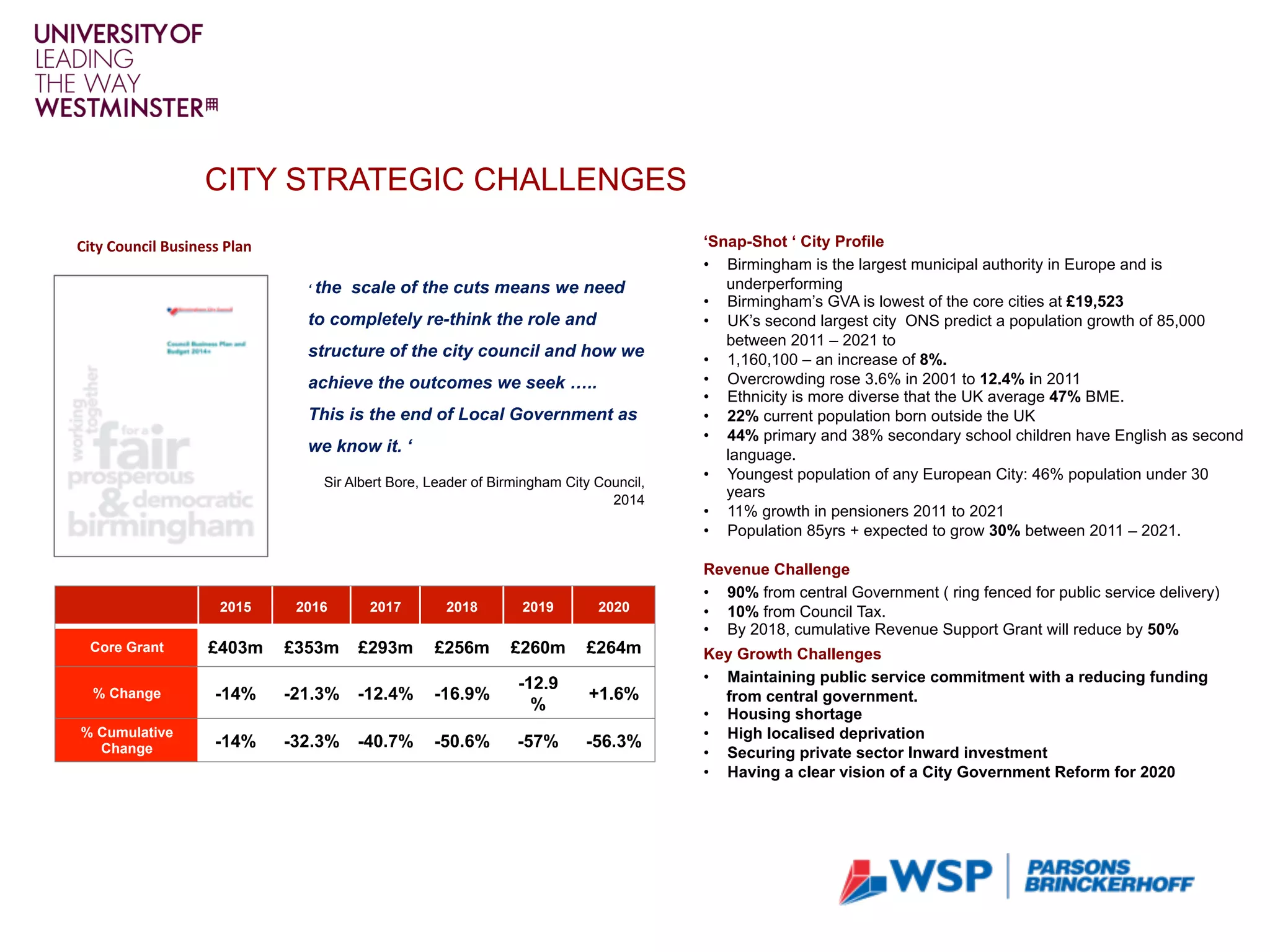

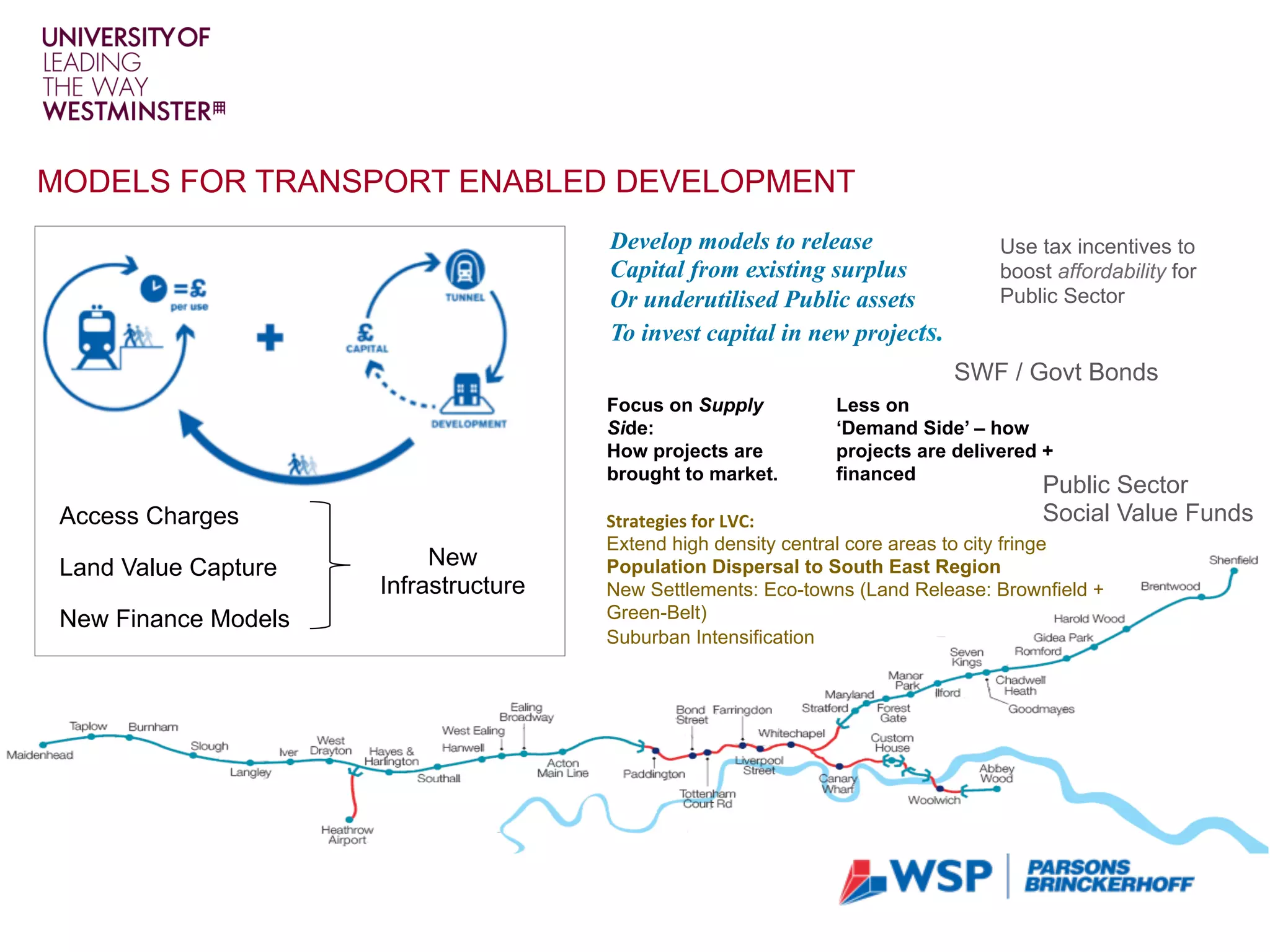

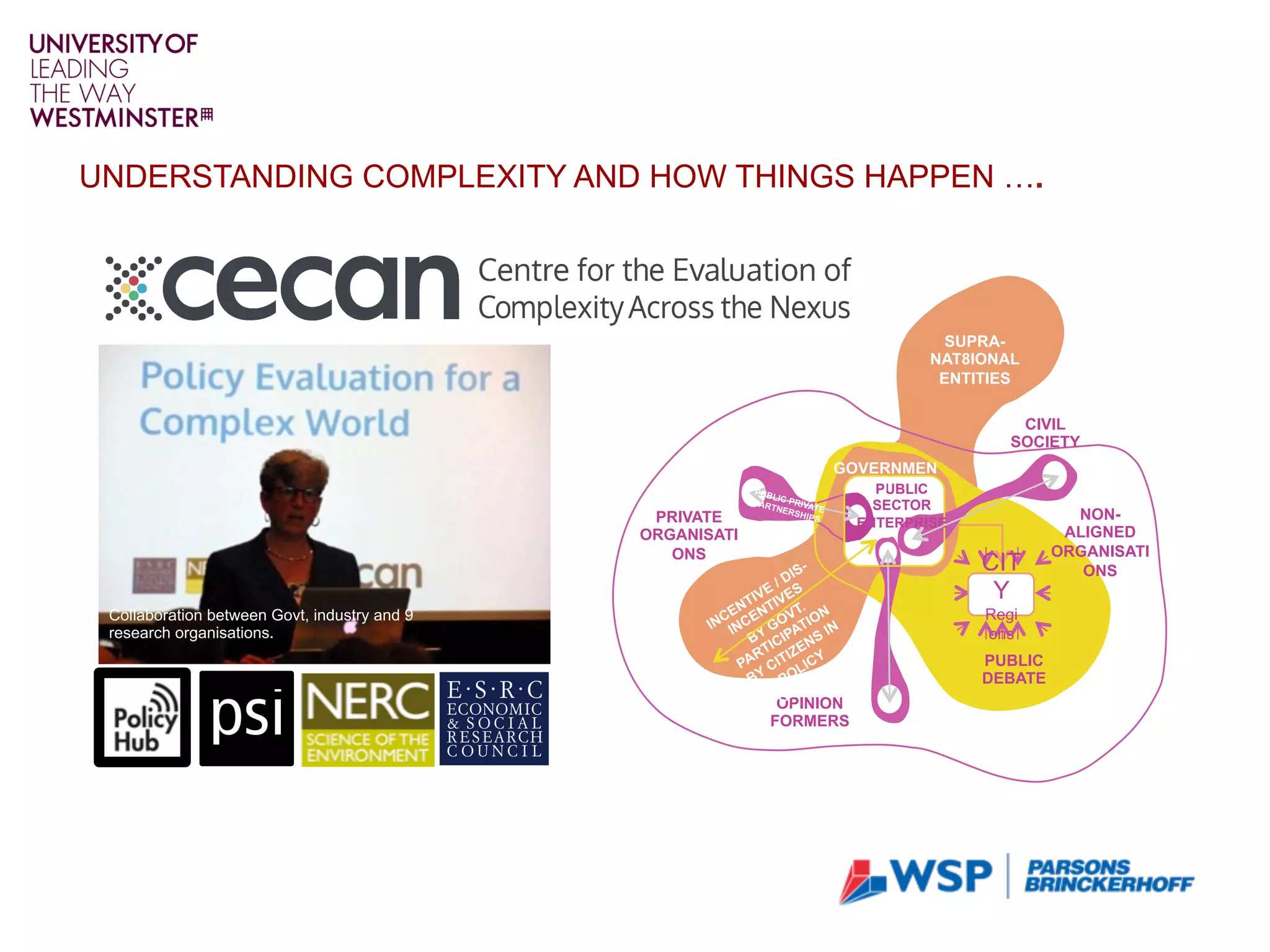

The document discusses the critical role of city regions in the global economy, emphasizing their contribution to GDP and projected infrastructure spending of over $40 trillion to support urban growth. It outlines the challenges faced by cities, including resource constraints and social equity issues, while highlighting the importance of innovative financing models for infrastructure projects. Additionally, it calls for increased engagement with decision-makers regarding infrastructure's role in economic competitiveness and the need to attract new talent to the industry.

![A

(14%)

B

(14%)

D

(14%)

I

([PERCENTAGE]) E

([PERCENTAGE])

L

([PERCENTAGE])

E

(8%)

K

([PERCENTAGE])

J

([PERCENTAGE])

E

([PERCENTAGE])

E

([PERCENTAGE])

C

([PERCENTAGE])

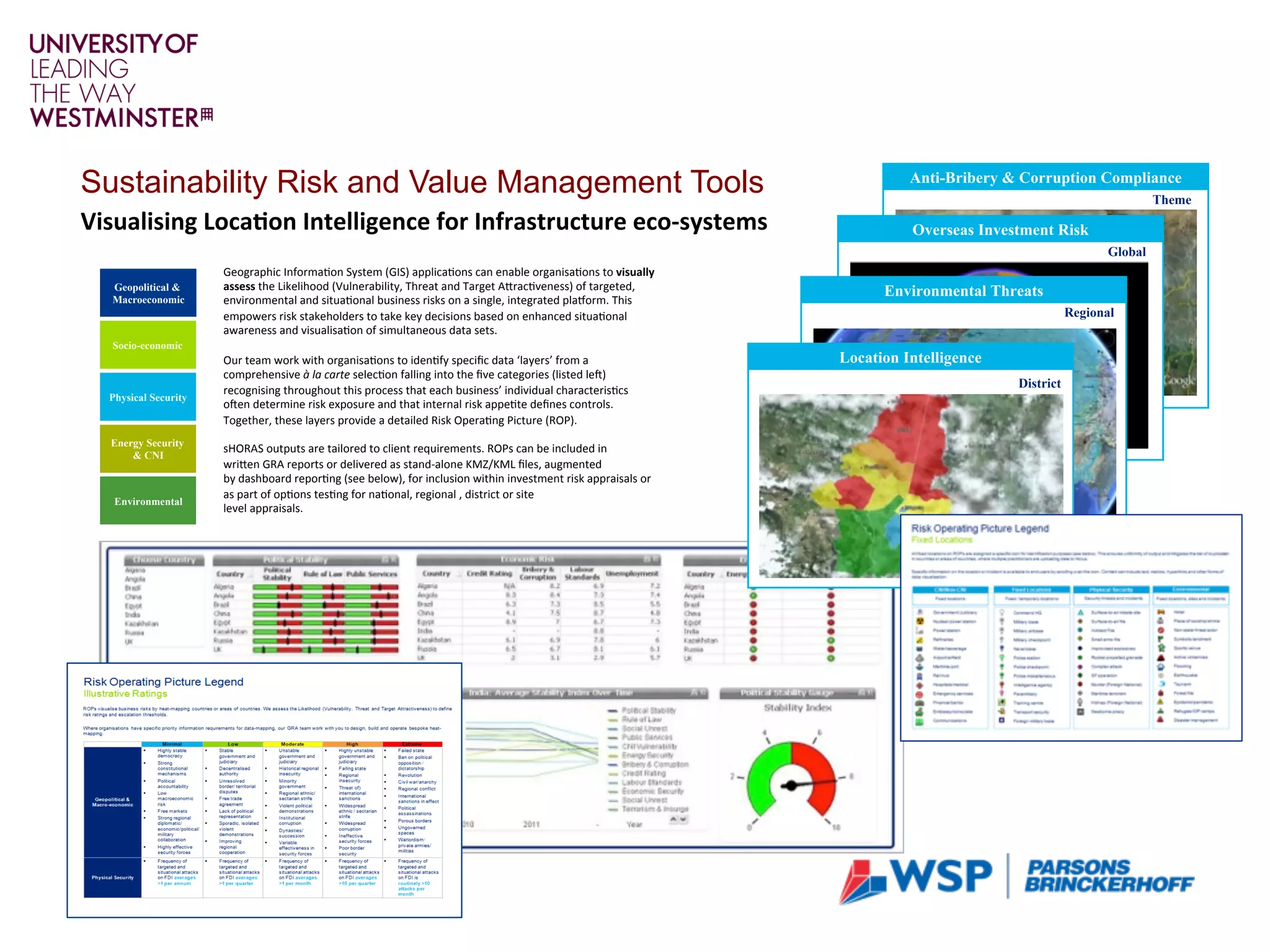

TOP 5 investment priori4es to help ensure our long term compe44veness

Improved transport links between ci1es e.g.

HS2, HS3 Northern Powerhouse

Improved transport linkages within ci1es and

city regions e.g. Cross Rail 2

Increased airport capacity in the South East

Conven1onal Power Genera1on,

Transmission, Distribu1on

Increase Renewable Energy

Systems Improvement e.g. electrifica1on

Improving UK's main Trunk Roads and

Motorways

Improving Local Road Transport

Flood Defense / Climate Resilience

Ranking Priority

1st

A

B

Improved Transport between ci1es

Improved transport within ci1es

3rd C Digital & IT Infrastructure

4th D Airport Expansion in SE

5th

E

F

G

H

Trunk Road & Motorway Improvement

Increased Renewable Energy

Urban Housing

Social Infrastructure

9th

10th

11th

12th

I

J

K

L

Conven1onal Power

Flood Defence / Climate resilience

Local Road Transport

Systems Improvements, Electrifica1on

Cities & Infrastructure: Pulse Survey

Single most important areas for Government and policy makers to ensure growth and compe44veness

Na4onal Infrastructure 28%

23%

20%

Beker, integrated inter- urban transport systems

Long term na1onal infrastructure plan with cross party support

Na1onal clean power strategy + support systems

City & City Regions 22%

20%

17%

Beker public transport systems

Beker, integrated mul1-modal transport systems

Devolu1on

Rural 52%

10%

7%

Broad-Band

Community Investment

Planning policies that support economic development](https://image.slidesharecdn.com/c4ir1sharratt-170313123823/75/Global-C4IR-1-Masterclass-Cambridge-Sharratt-WSP-2017-19-2048.jpg)