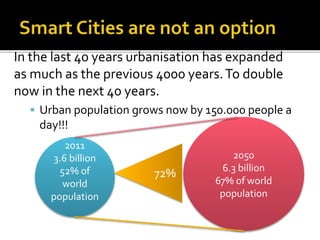

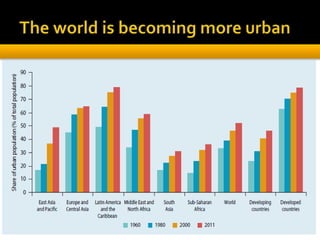

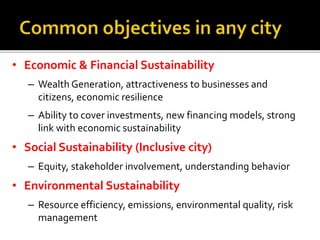

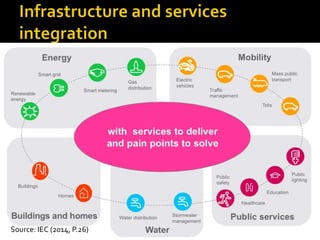

This document discusses the development of smart cities. It notes that urban populations are growing rapidly and will account for over two-thirds of the world's population by 2050. Smart cities aim to address this growth through greater efficiency, sustainability, and inclusion. Key points discussed include the need for collaboration between different stakeholders, the role of standards in ensuring interoperability, challenges around financing smart city projects, and ensuring citizens are involved as both users and producers within smart cities. The document examines different approaches to planning, governance, and financing that can help facilitate the transition to smarter urban environments.