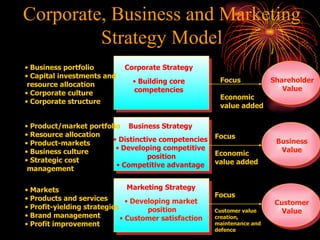

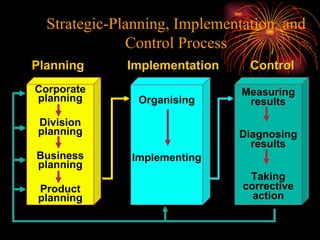

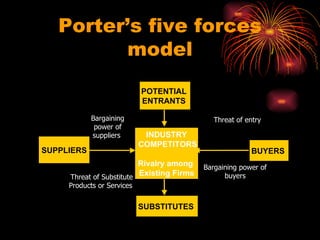

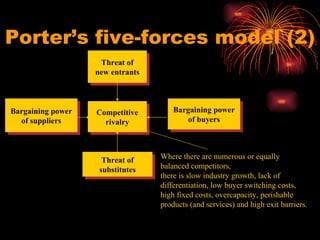

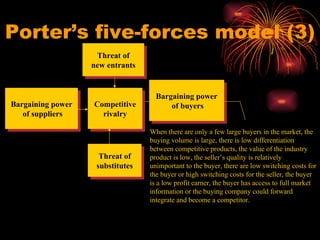

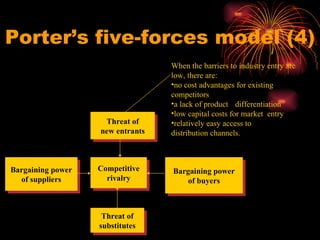

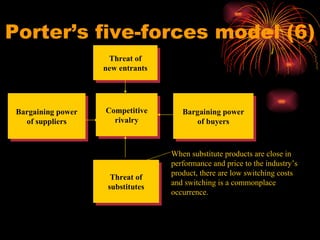

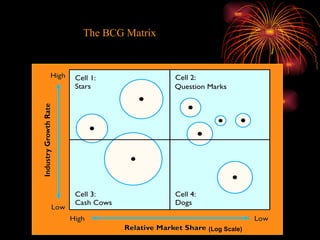

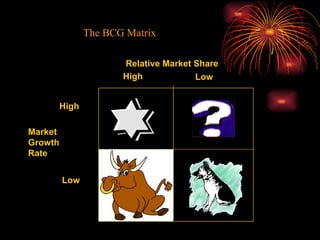

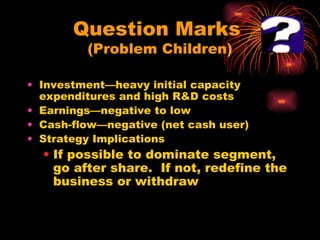

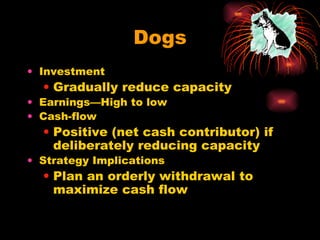

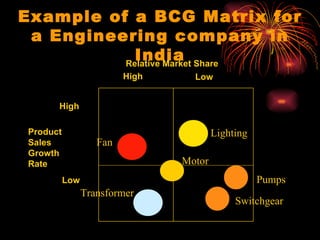

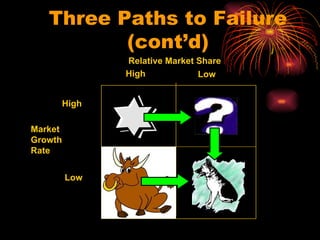

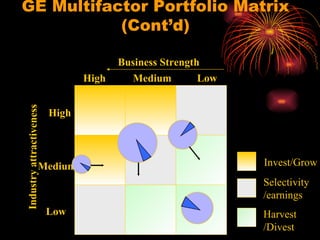

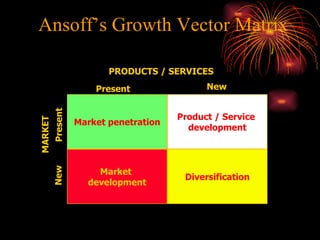

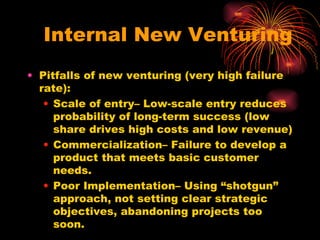

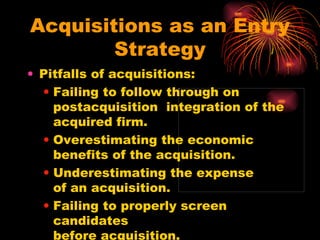

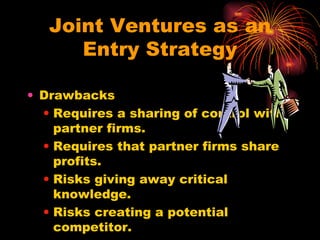

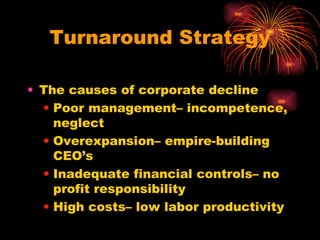

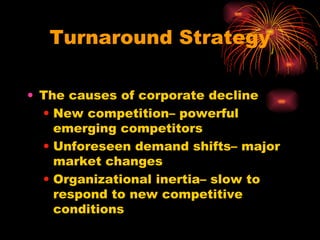

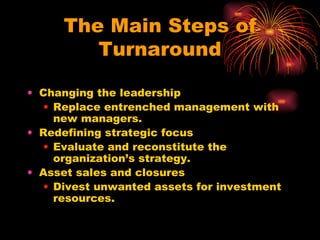

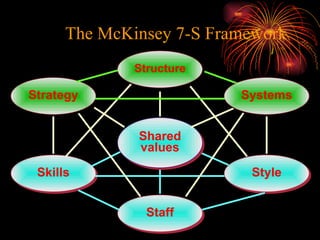

This document provides an overview of strategic planning and marketing concepts. It discusses various strategic planning frameworks including the BCG matrix, GE/McKinsey multifactor matrix, and Ansoff's growth vector matrix. It also covers topics like corporate, business, and marketing strategy, strategic-planning processes, Porter's five forces model, and approaches to turnaround strategies, restructuring, and entry strategies like acquisitions and joint ventures.