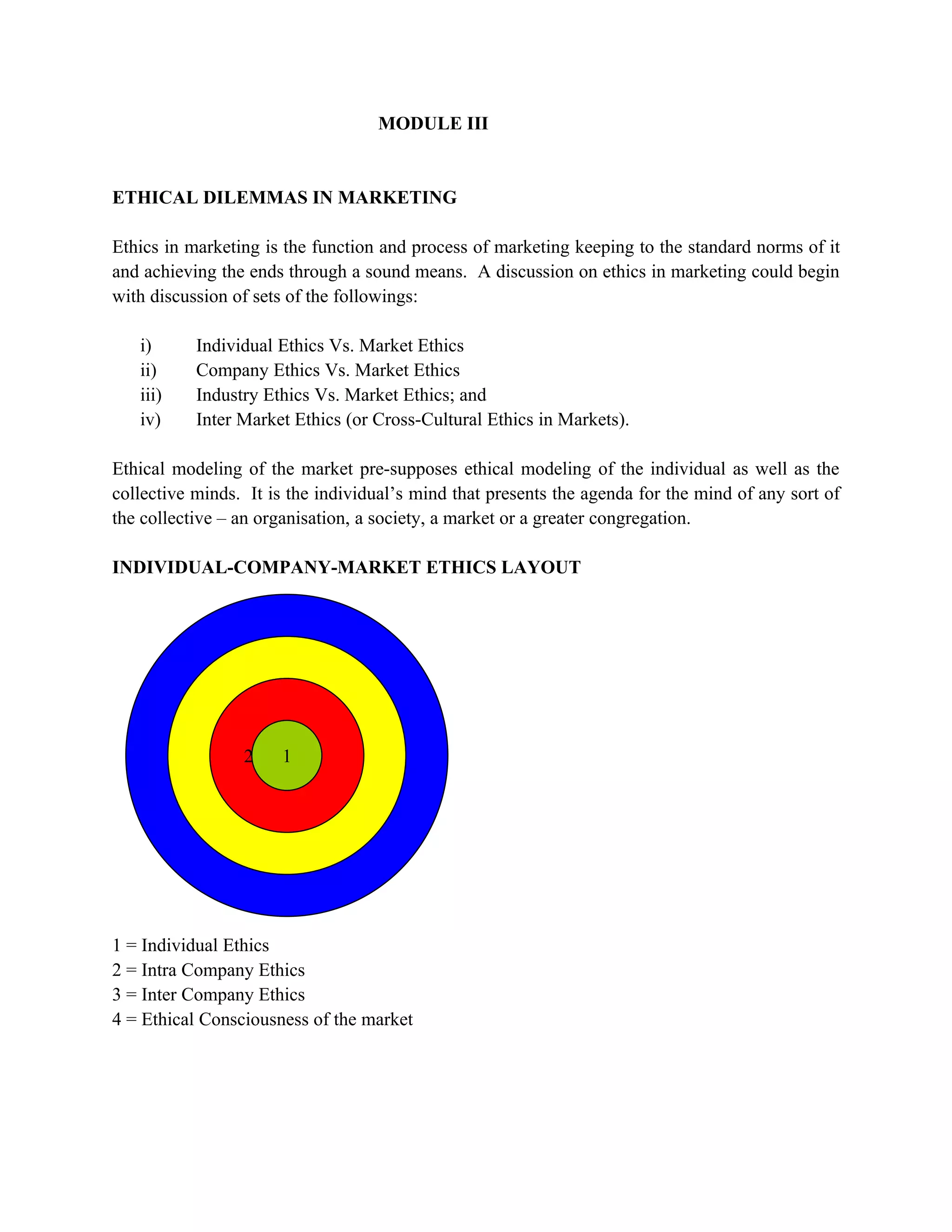

This document discusses various ethical dilemmas that can arise in marketing. It begins by defining ethics in marketing and examining individual, company, industry, and cross-cultural ethics. It then analyzes the relationship between individual, intra-company, inter-company, and market ethics. The document proceeds to identify several potentially unethical marketing practices, including deceptive advertising, bribery, price fixing, and targeting vulnerable groups. It emphasizes that marketers have a responsibility to provide accurate information to customers and not engage in manipulation. Overall, the document examines the need for high ethical standards in marketing to ensure customers benefit and a company can succeed in competitive business environments.

![1. Unsuitable types of securities, that is, recommending stocks, for example, when bonds

would better fit the investor’s objectives.

2. Unsuitable grades of securities, such as selecting lower-rated bonds when higher-rated

ones are more appropriate;

3. Unsuitable diversification, which leaves the portfolio vulnerable to changes in the

markets;

4. Unsuitable trading techniques, including the use of margin or options, which can

leverage an account and create greater volatility and risk; and

5. Unsuitable liquidity. Limited partnerships, for example, are not very marketable and

are thus unsuitable for customers who may need to liquidate the investment.

HIGH FINANCE

Most people agree that high finance, has had many undesirable consequences on society.

But like the gun lobbyists of the USA, they would place the blame on the wickedness of man and

not on the instrument. (Guns do not kill people. People do.) We need to work on this wickedness

rather than question the instrument. In India, the left and ultra traditionalists are against high

finance just as they are for more extensive laws. But the new right conservatives are for it just as

they are for minimal laws.

[Four major types of High Finance are: 1. Stock market operations primary or secondary, 2.

Bank operations, 3. Stock market operations through derivatives and international swapping

transactions, and speculative dealing in money markets in debentures and government securities,

and 4. Mergers and acquisitions]

The most glaring breakdowns of ethical norms in the world today are undoubtedly in the

area often described as high finance. Why is there such an ethical vulnerability in this area and

what can we do about it?

The special ethical features of high finance are:

• The basic rewards in this field are not from improving real productivity but in speculative

forecasting.

• The focus in the management at organisations is not on effective governance, but as

sources of income to fulfill “naked greed”. There is no incentive to develop permanent

and long standing trust relationships. There is only an unquenchable thirst for profits.

• Decisions are always highly risky and tantamount to gambling.

• The transactions are easily hidden from the public eye and there is no transparency.

• The systems are such that the rewards for risk-taking go to one set of persons whereas the

costs are likely to be foisted on other groups.](https://image.slidesharecdn.com/newmodule3-100410144640-phpapp01/85/Ethics-8-320.jpg)