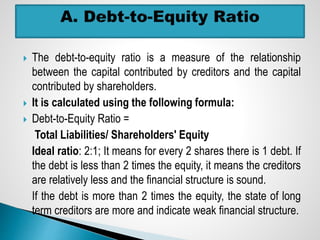

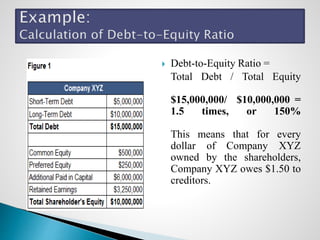

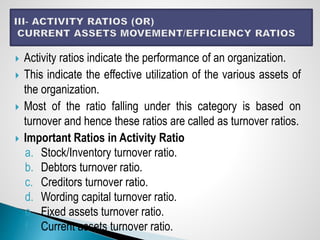

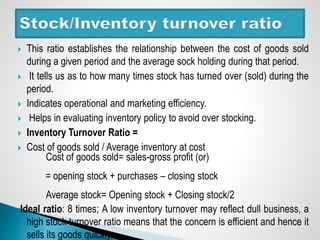

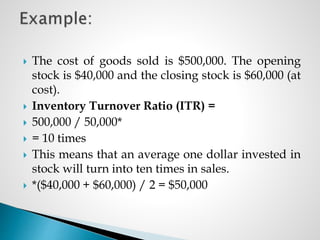

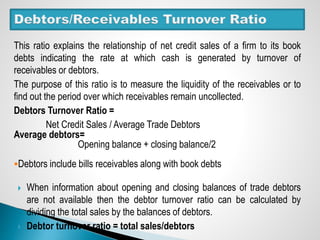

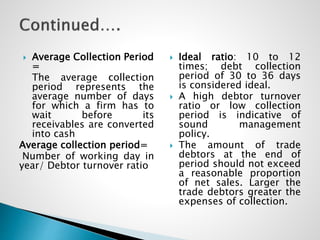

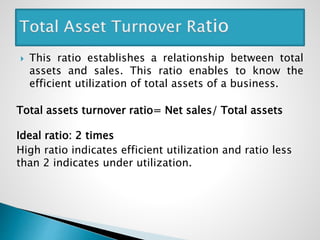

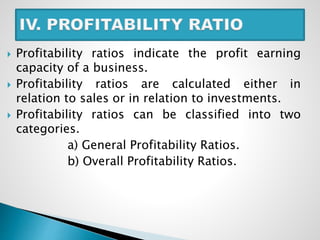

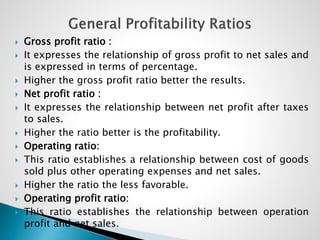

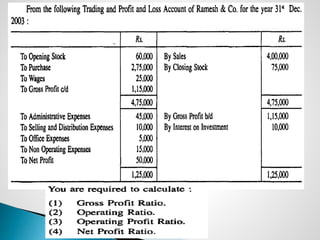

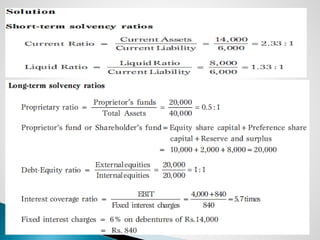

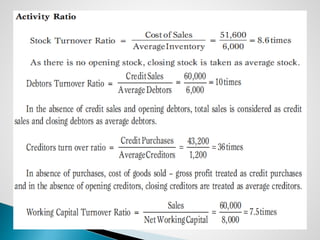

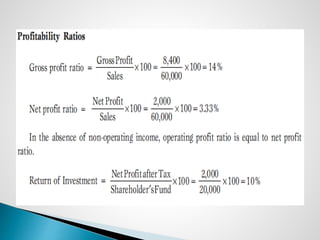

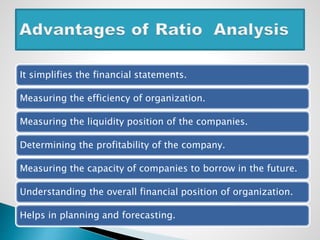

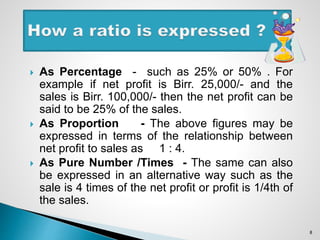

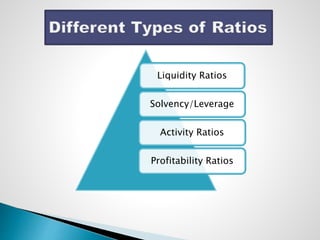

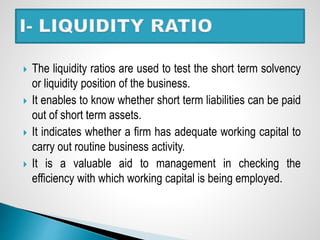

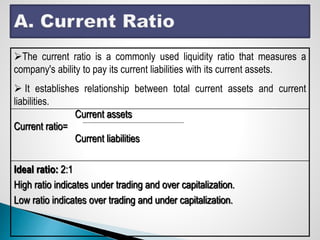

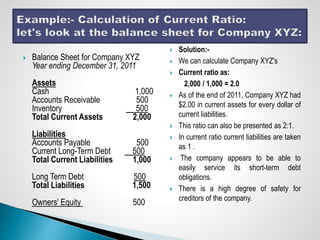

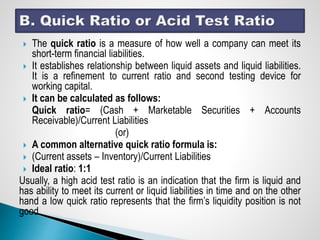

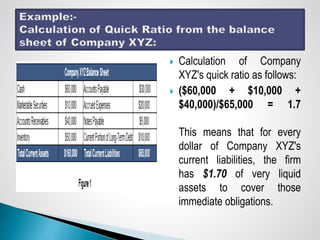

Financial statement analysis involves various techniques to evaluate a company's financial health and performance, including ratio analysis. Ratio analysis calculates statistical relationships between financial data points to gain insights. Key ratios discussed in the document include liquidity ratios like the current ratio and quick ratio, leverage ratios like the debt-to-equity ratio, activity ratios like inventory turnover ratio, and profitability ratios. Calculating and analyzing ratios helps understand a company's liquidity, creditworthiness, operational efficiency, and profit generating ability.

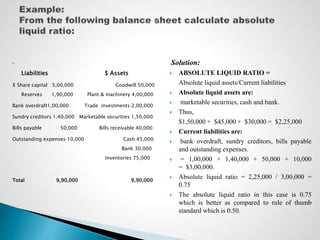

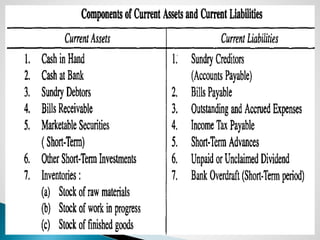

![ This ratio establishes a relationship between absolute

liquid assets and current liabilities.

Formula:

Absolute liquid ratio =

Absolute liquid assets / Current liabilities

Where absolute liquid assets are =

[ Cash + Bank + marketable securities.]

Current Liabilities = [Bank overdraft, sundry creditors, bills

payable and outstanding expenses.]

Ideal ratio: 0.5:1](https://image.slidesharecdn.com/ratioanalysisbydr-150402080617-conversion-gate01/85/Ratio-Analysis-by-Dr-Suresh-vadde-17-320.jpg)