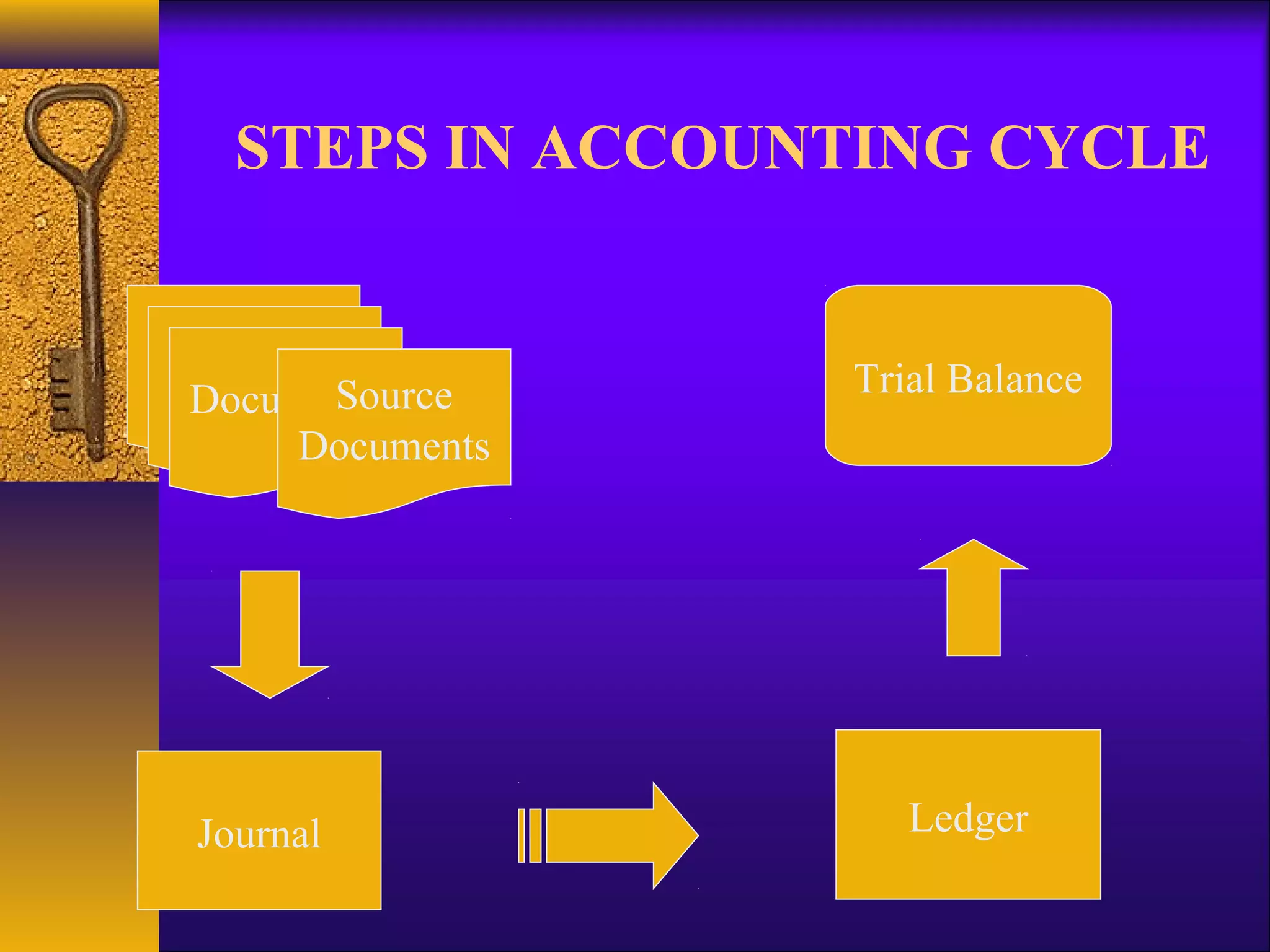

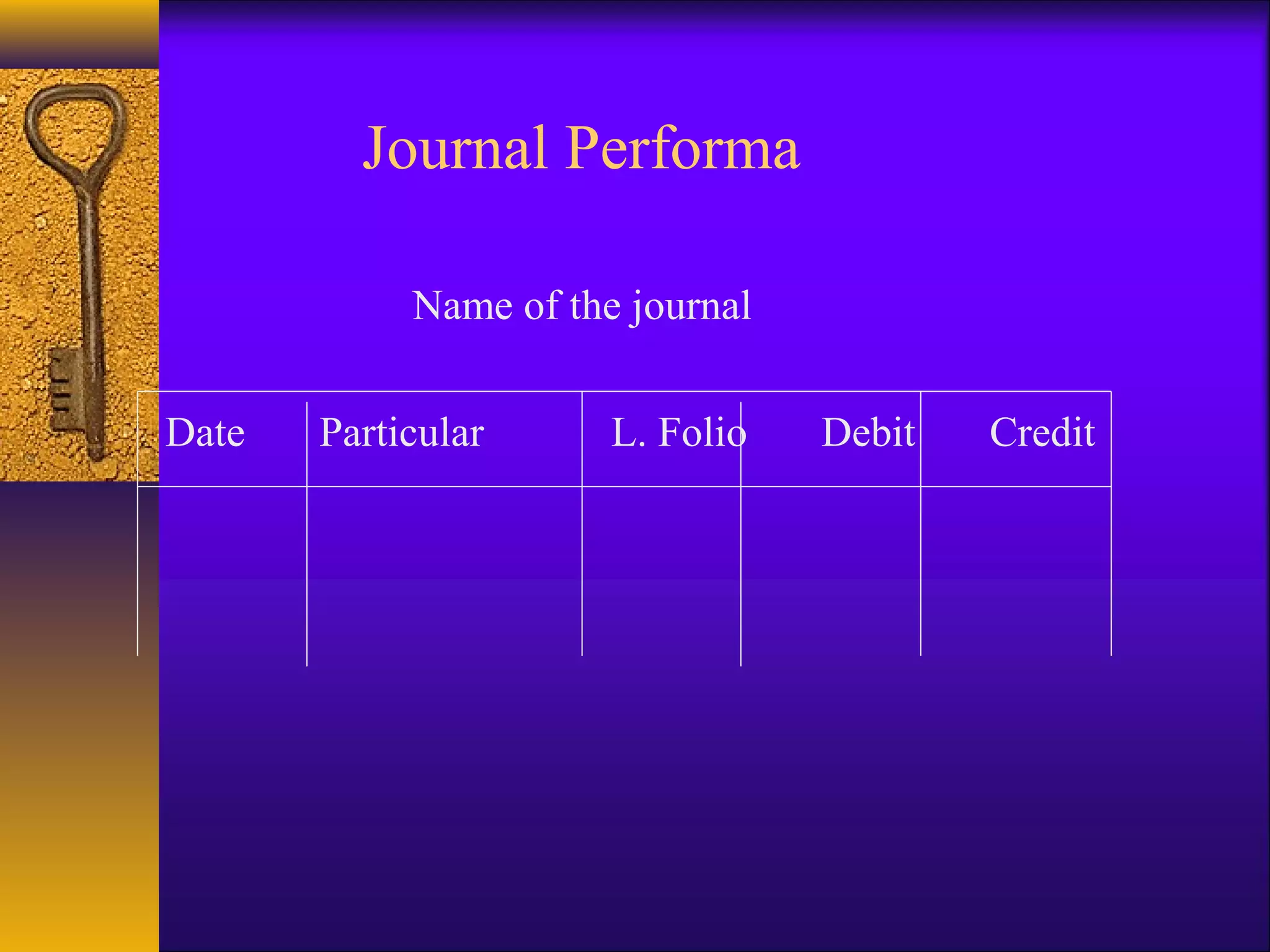

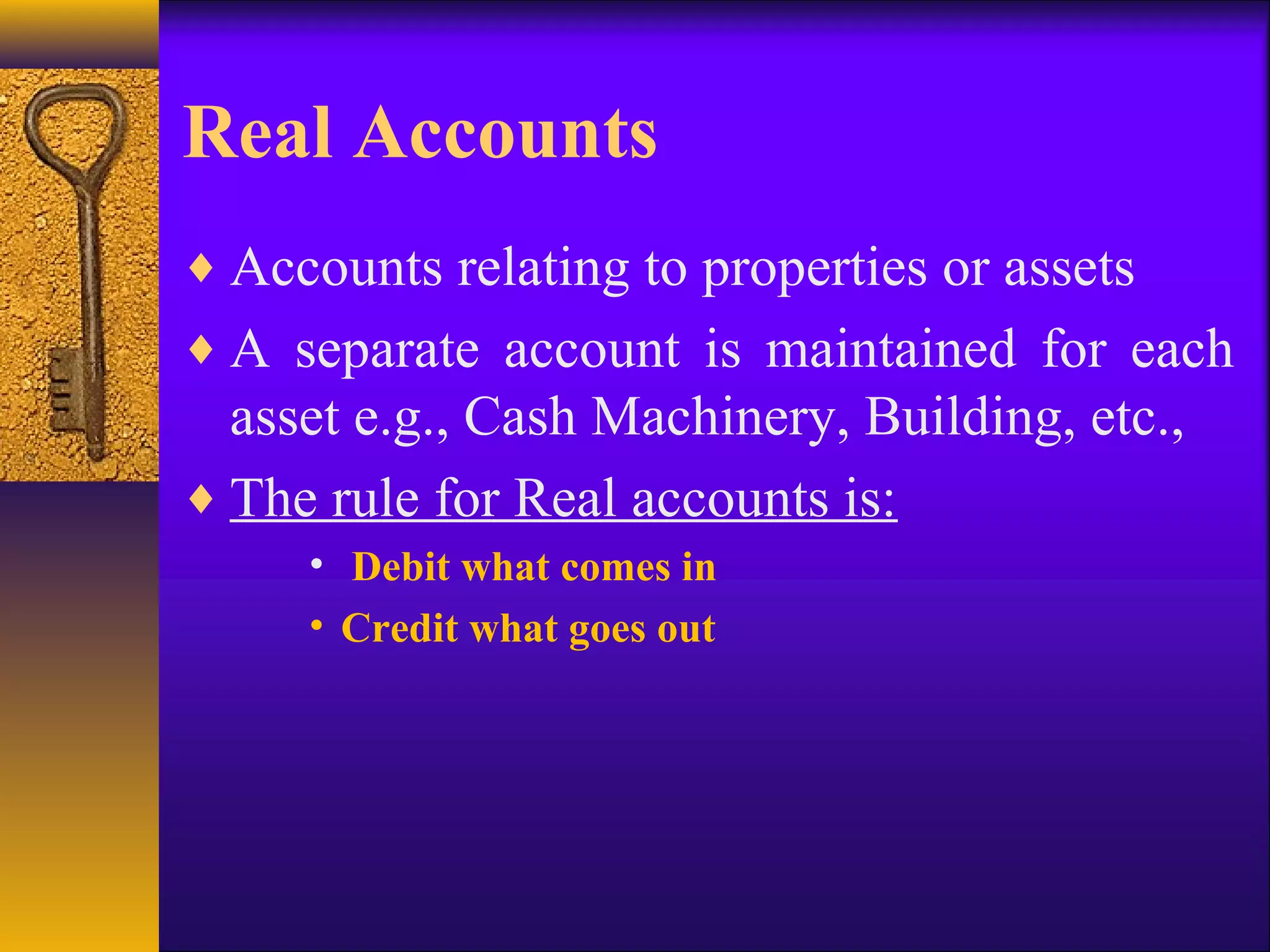

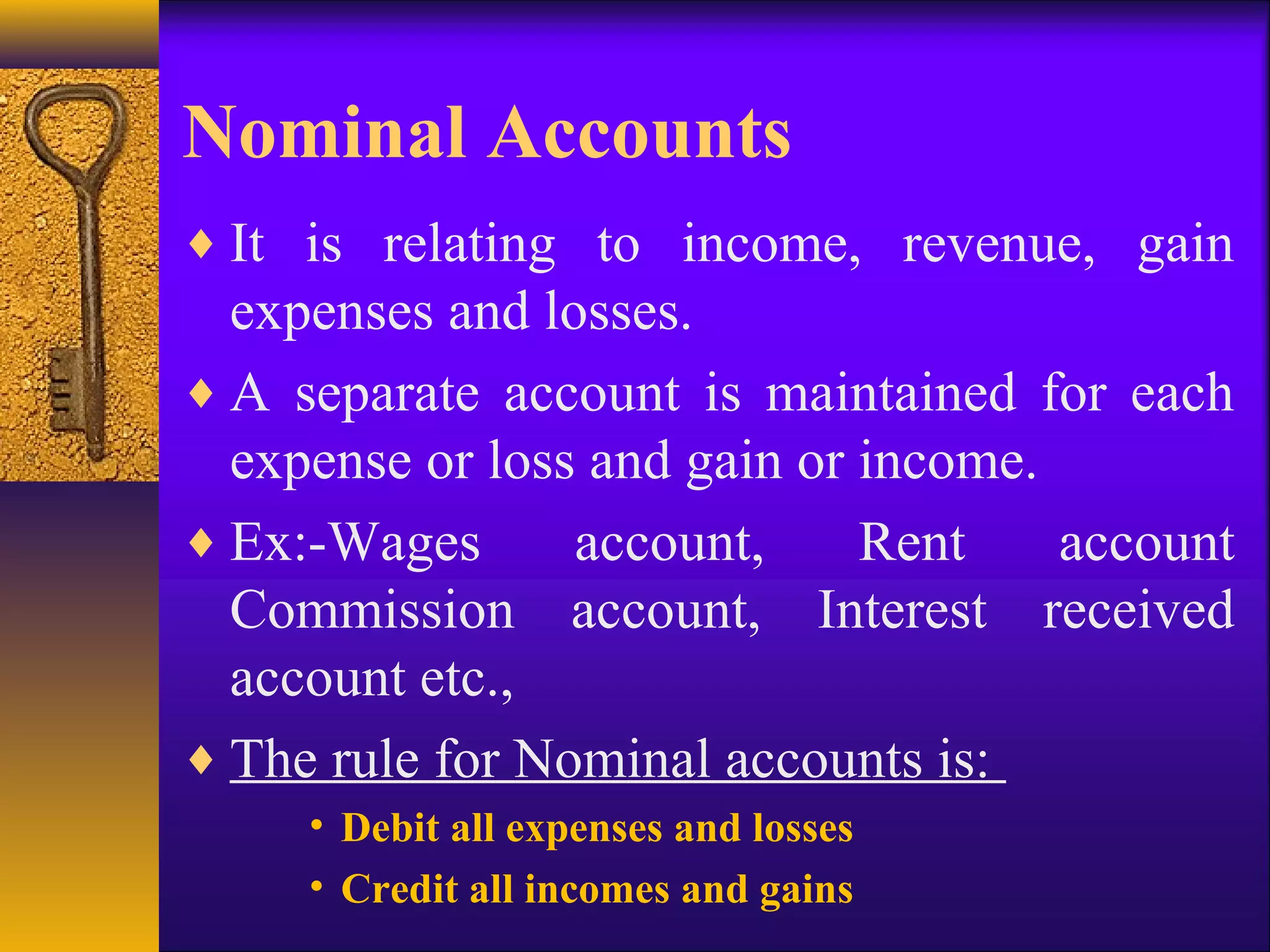

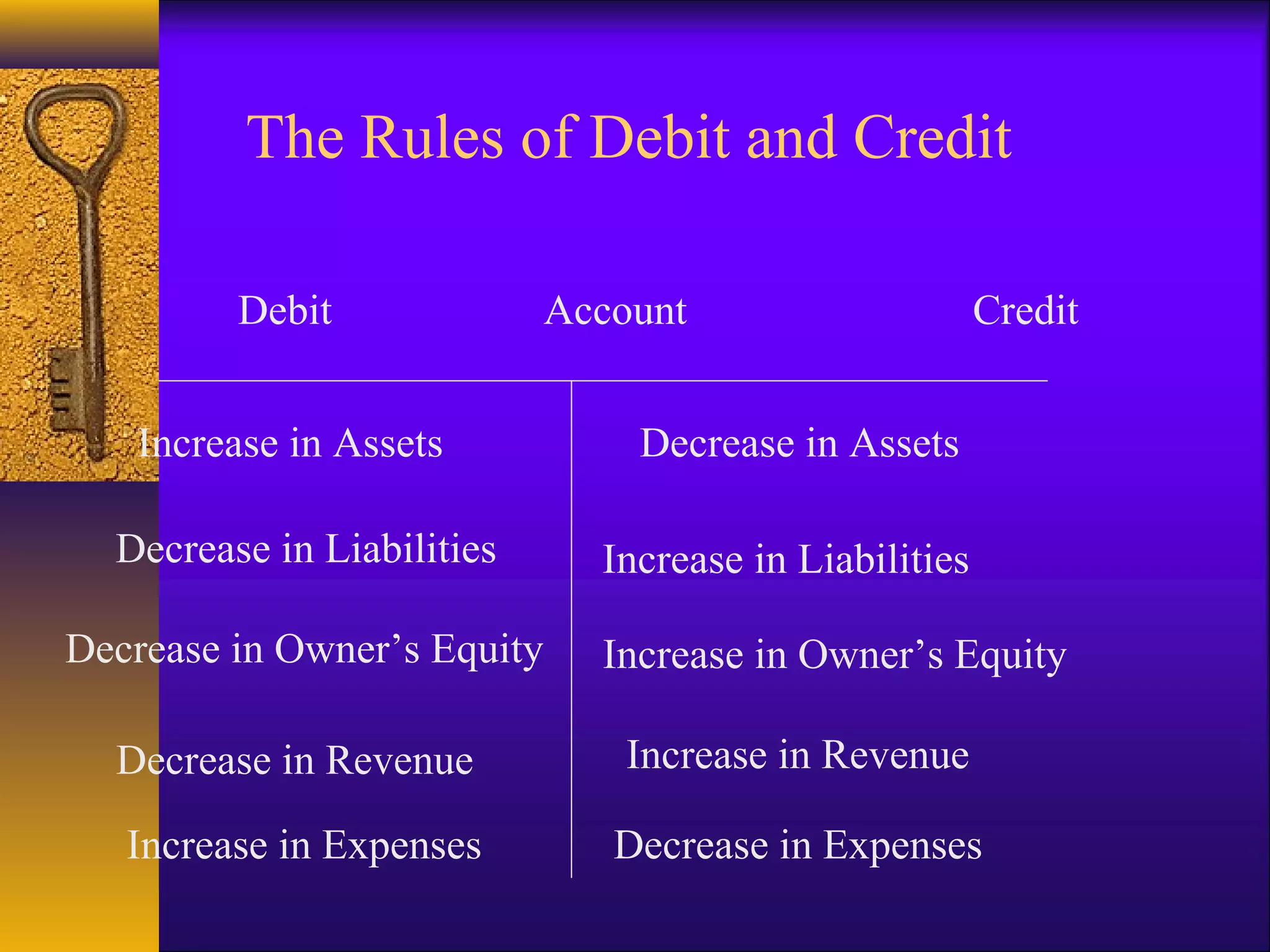

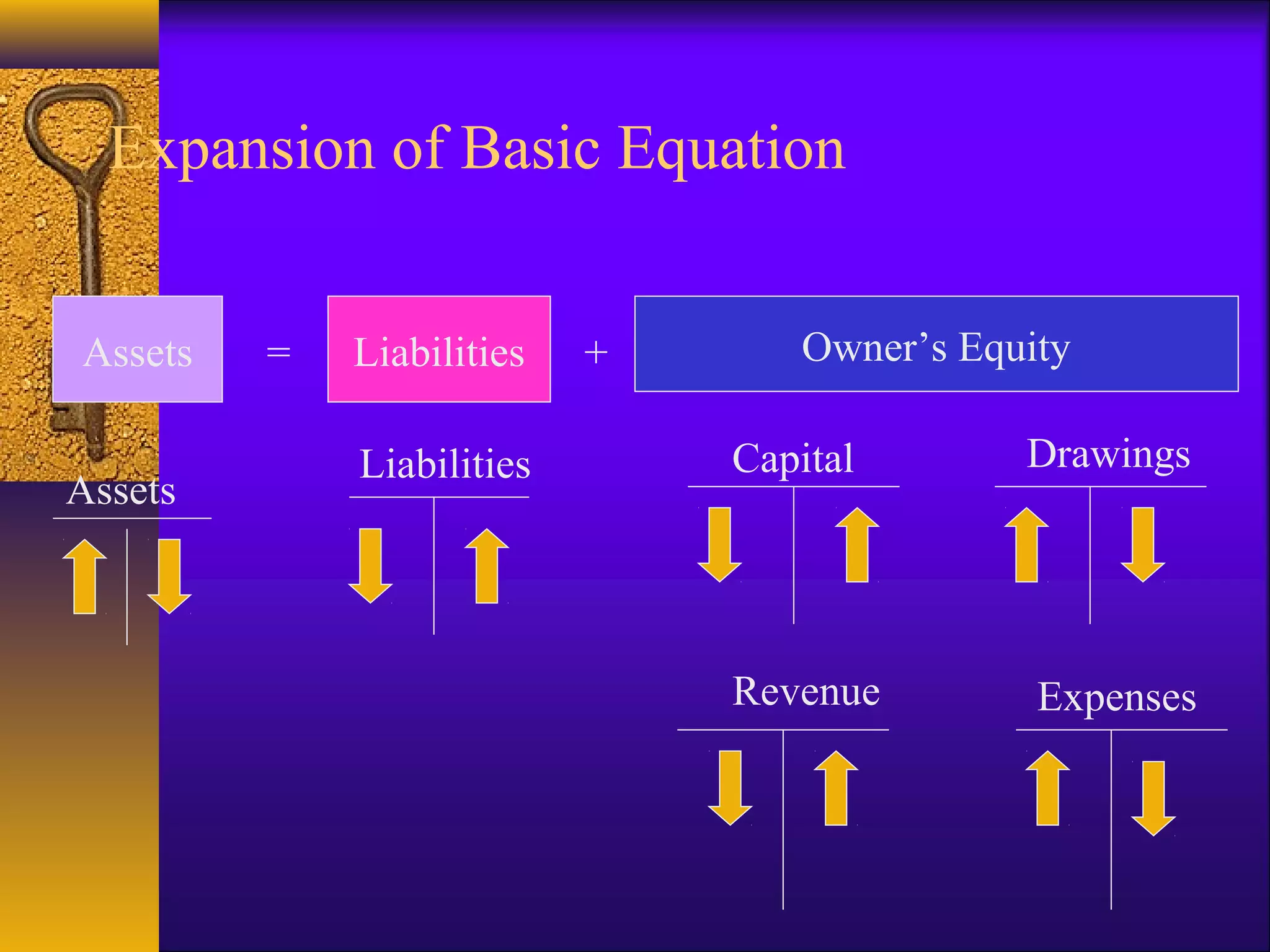

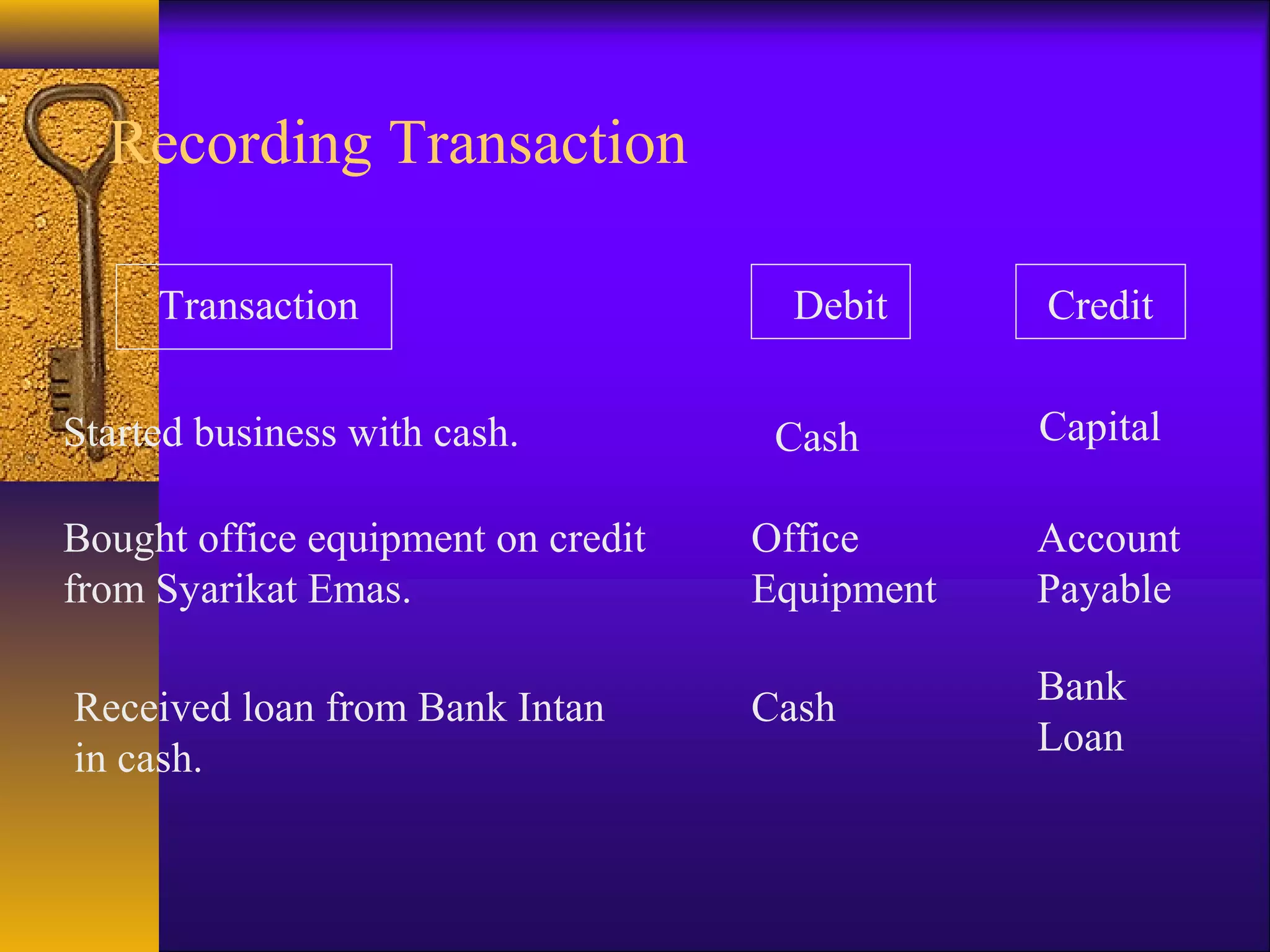

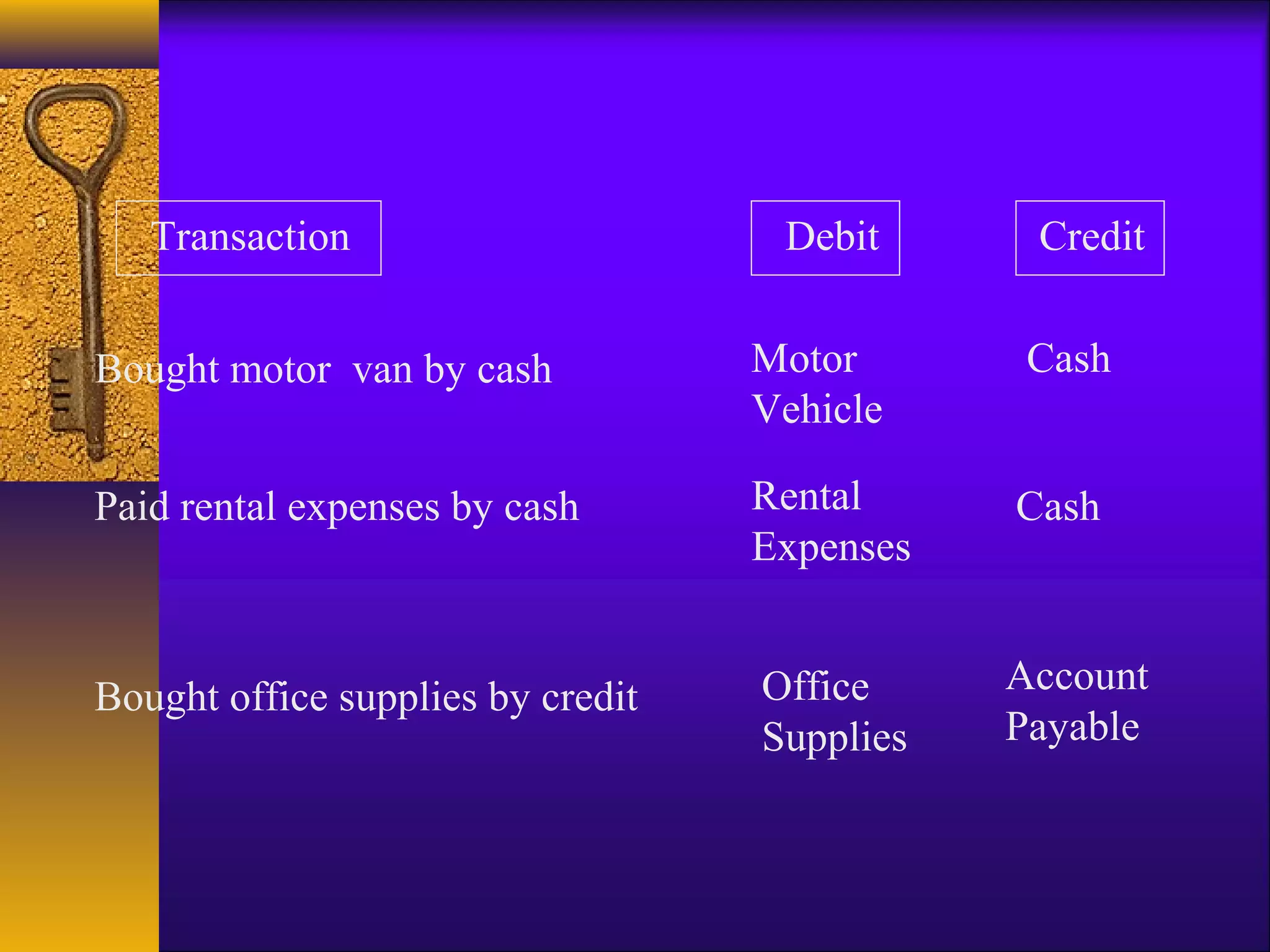

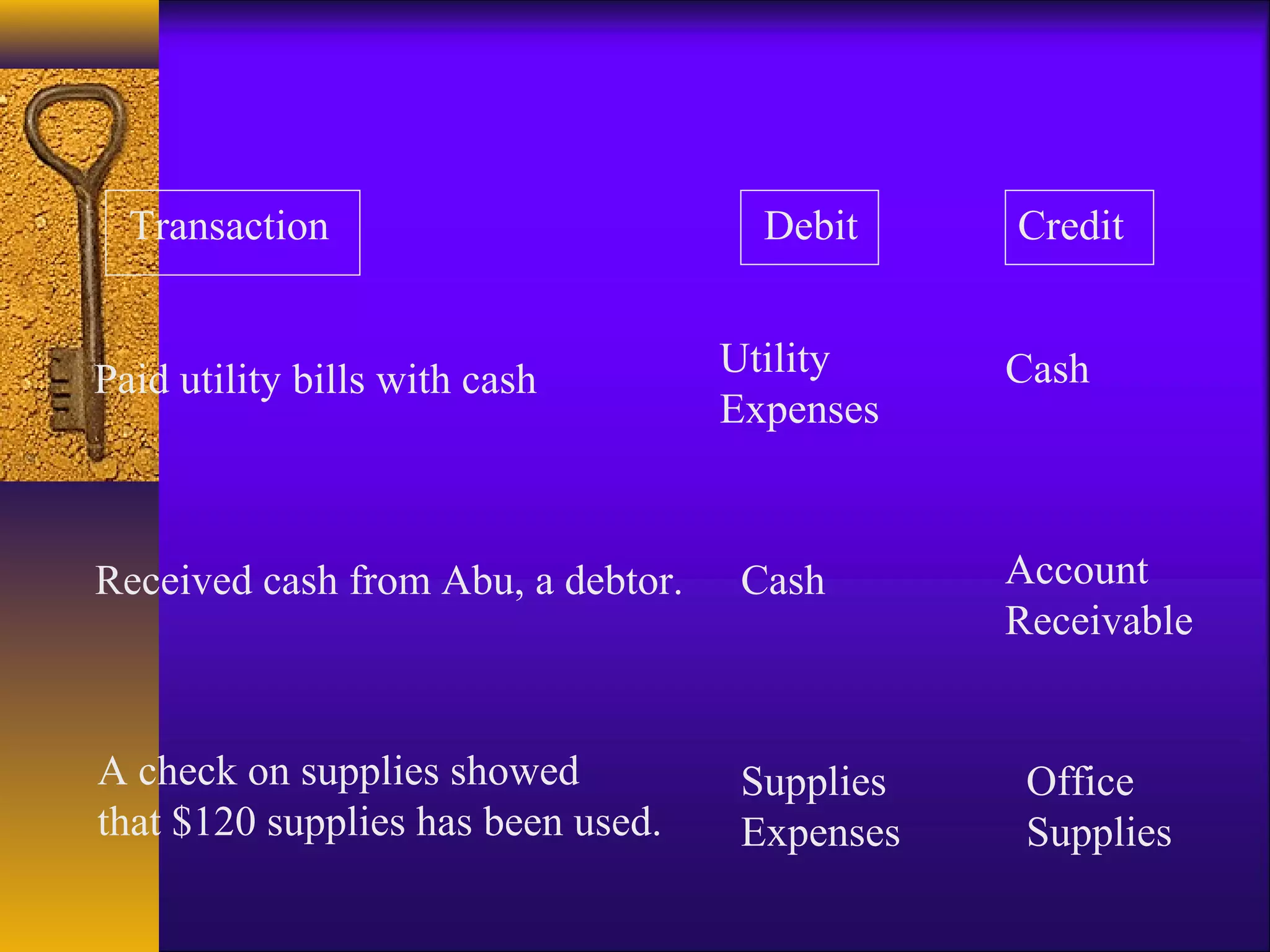

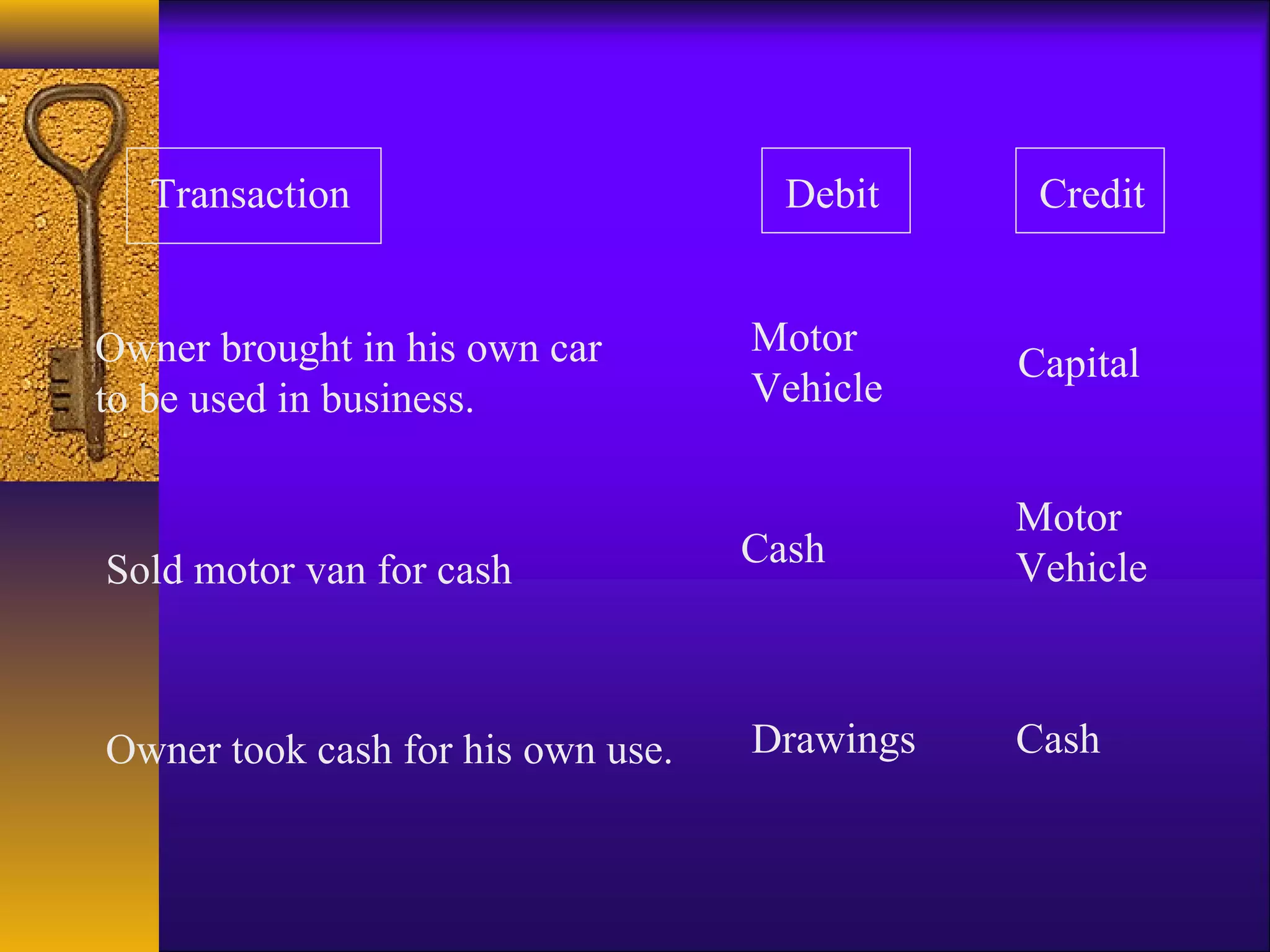

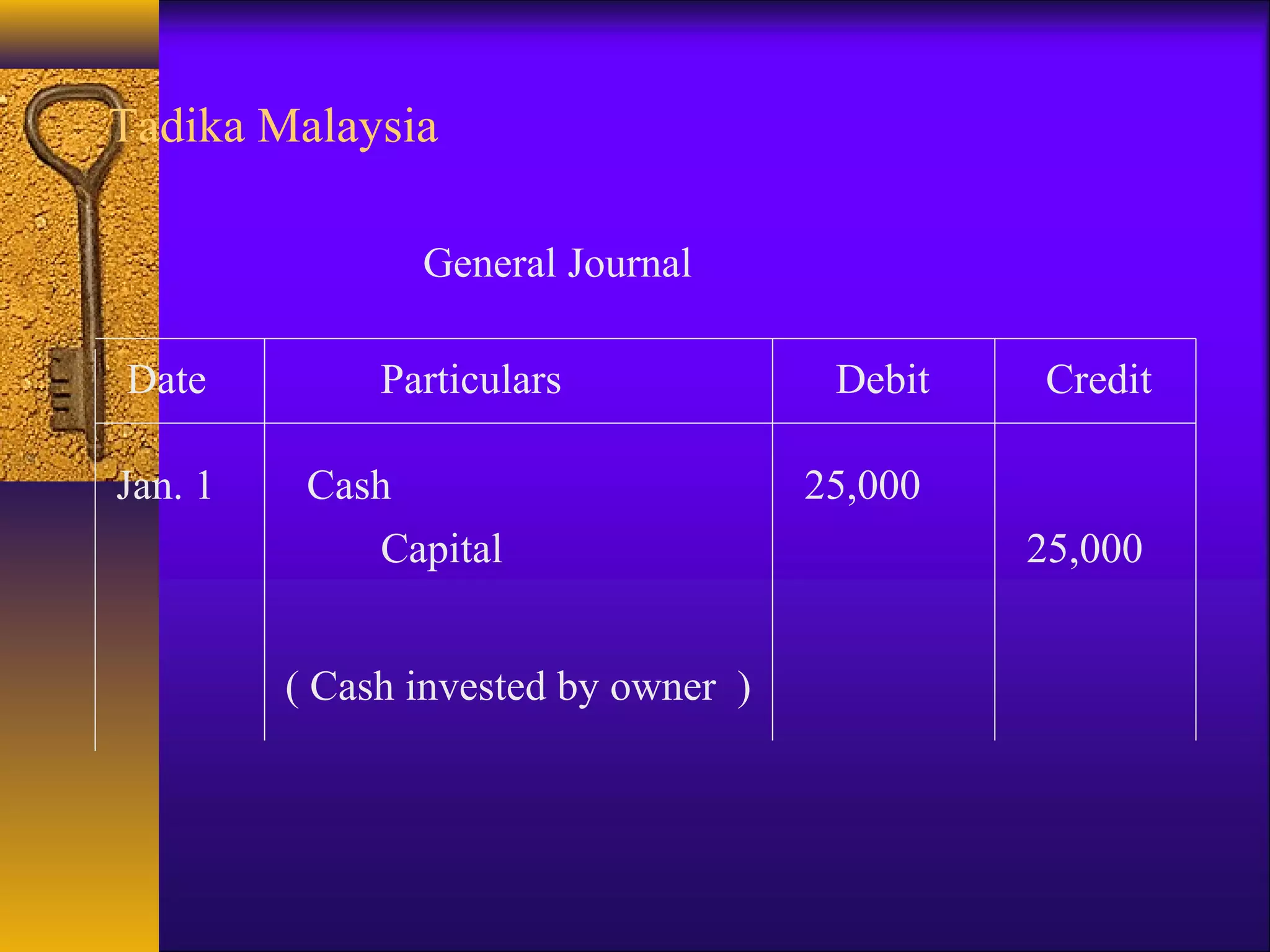

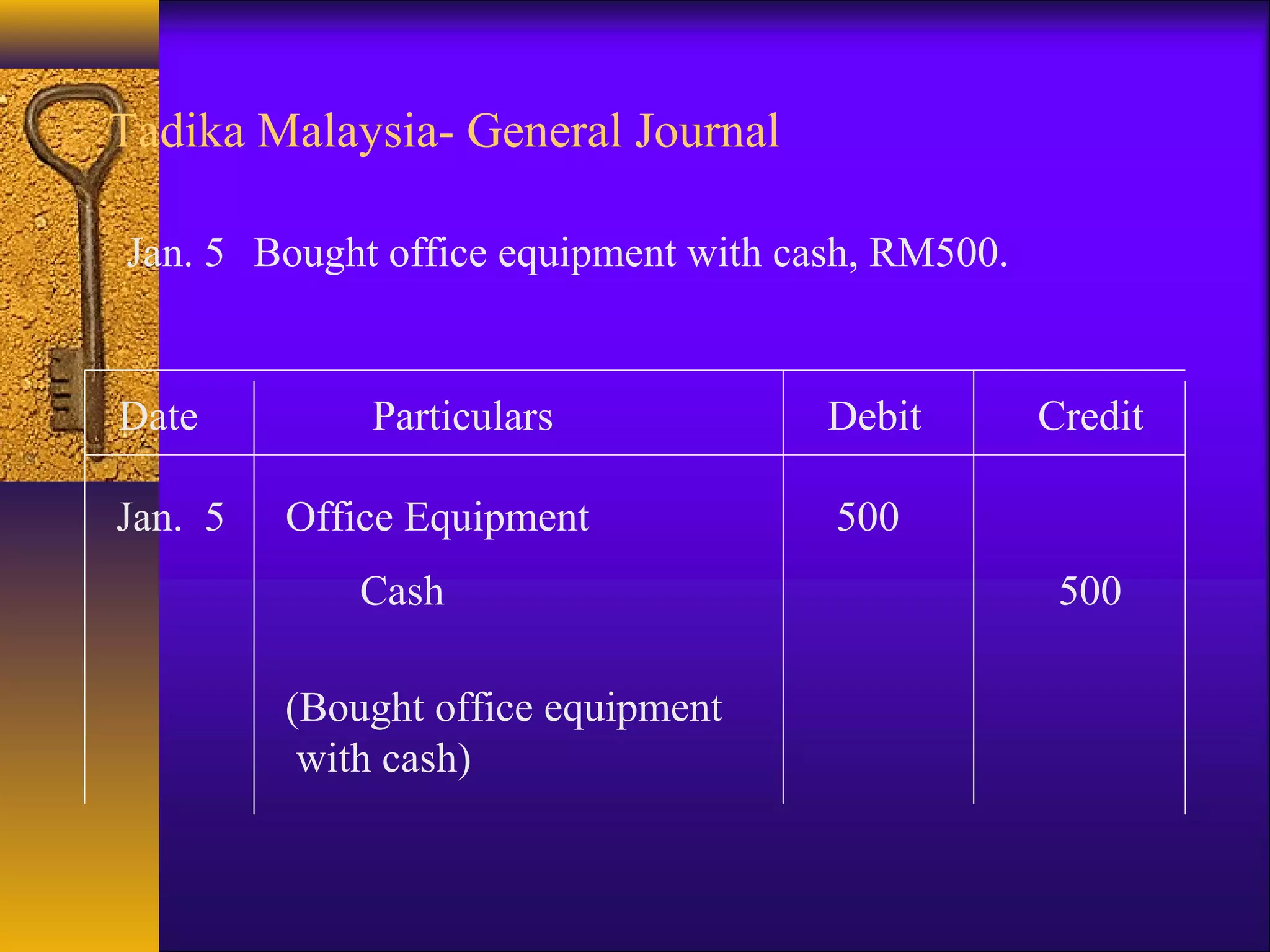

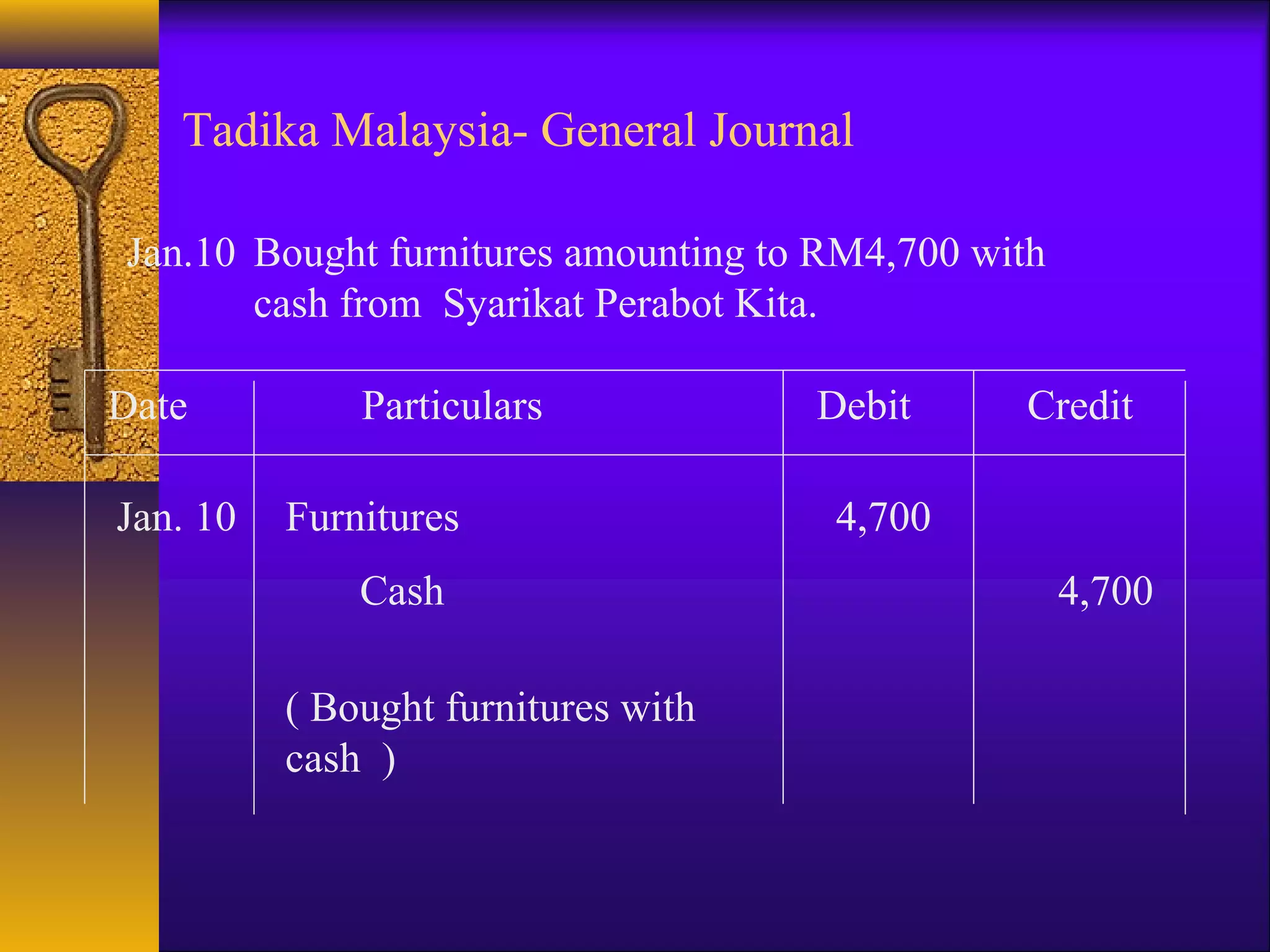

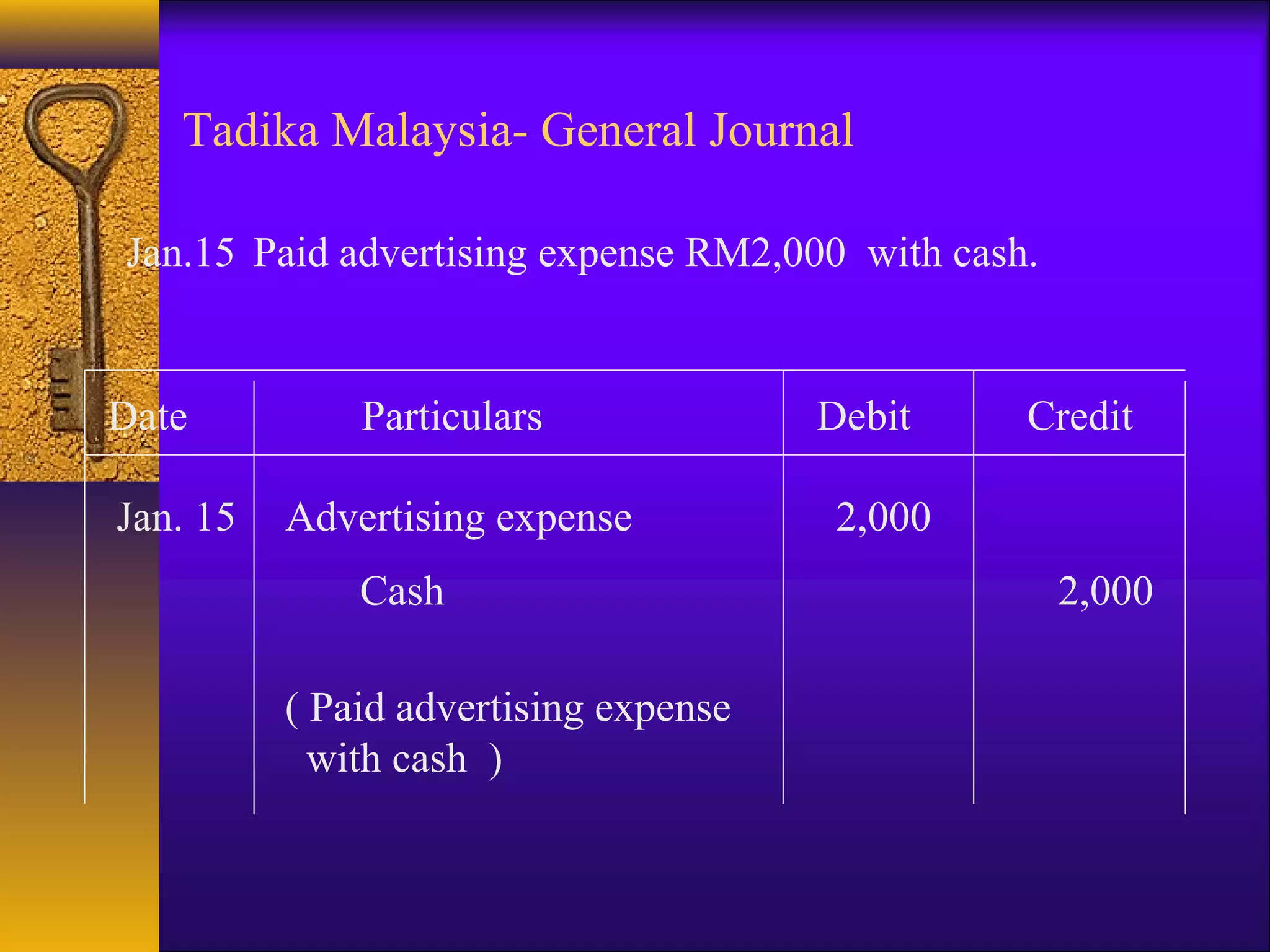

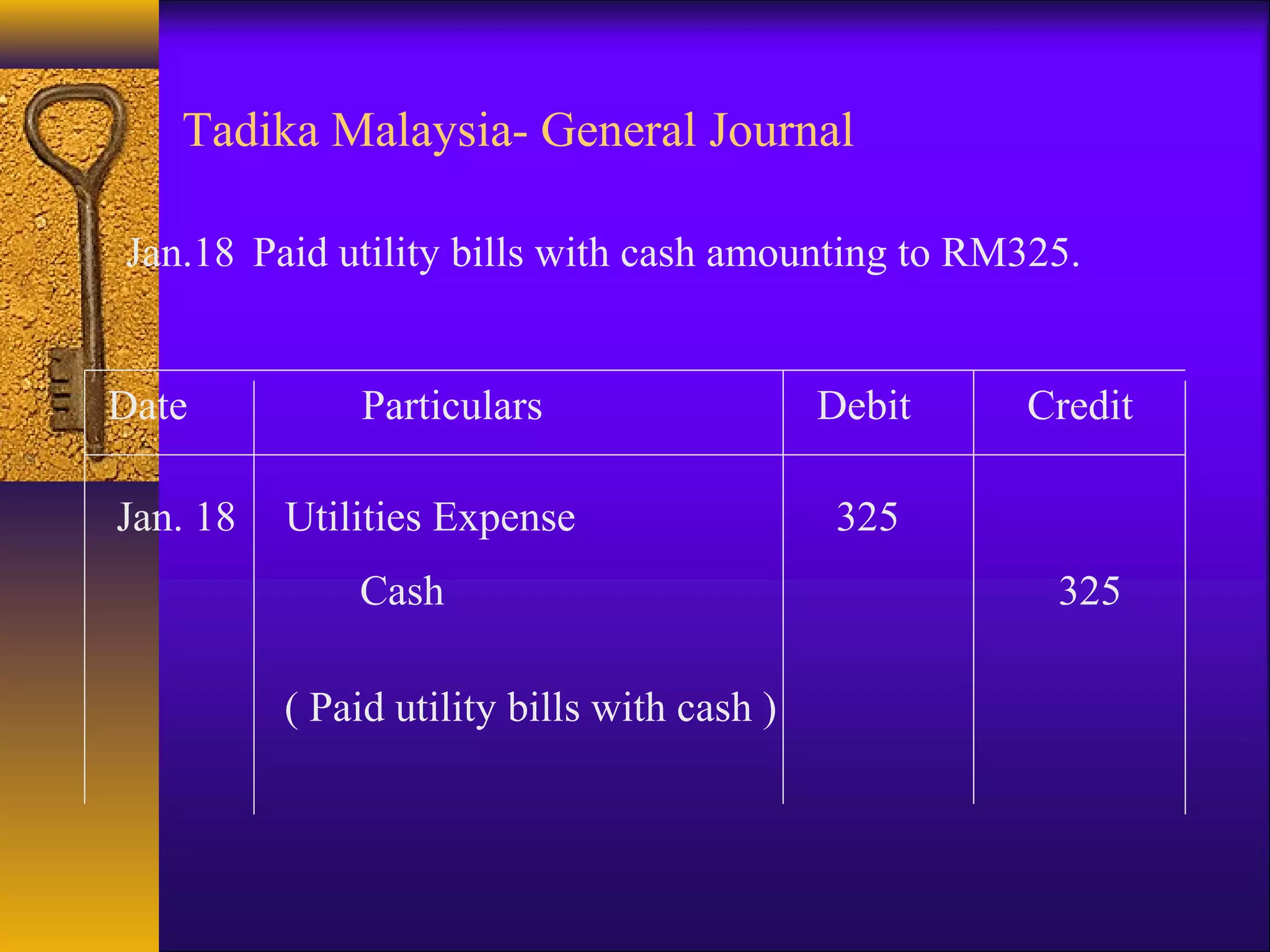

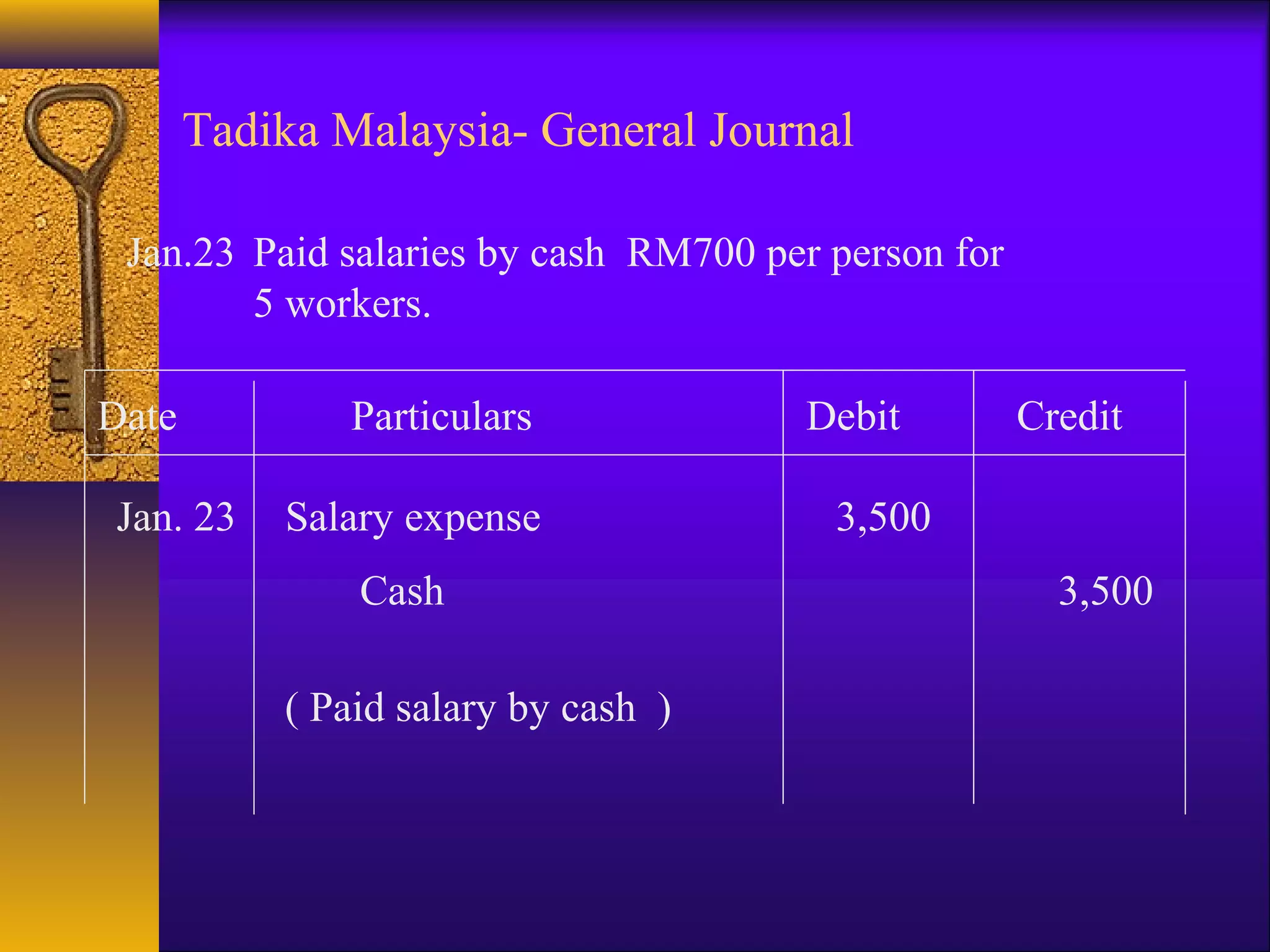

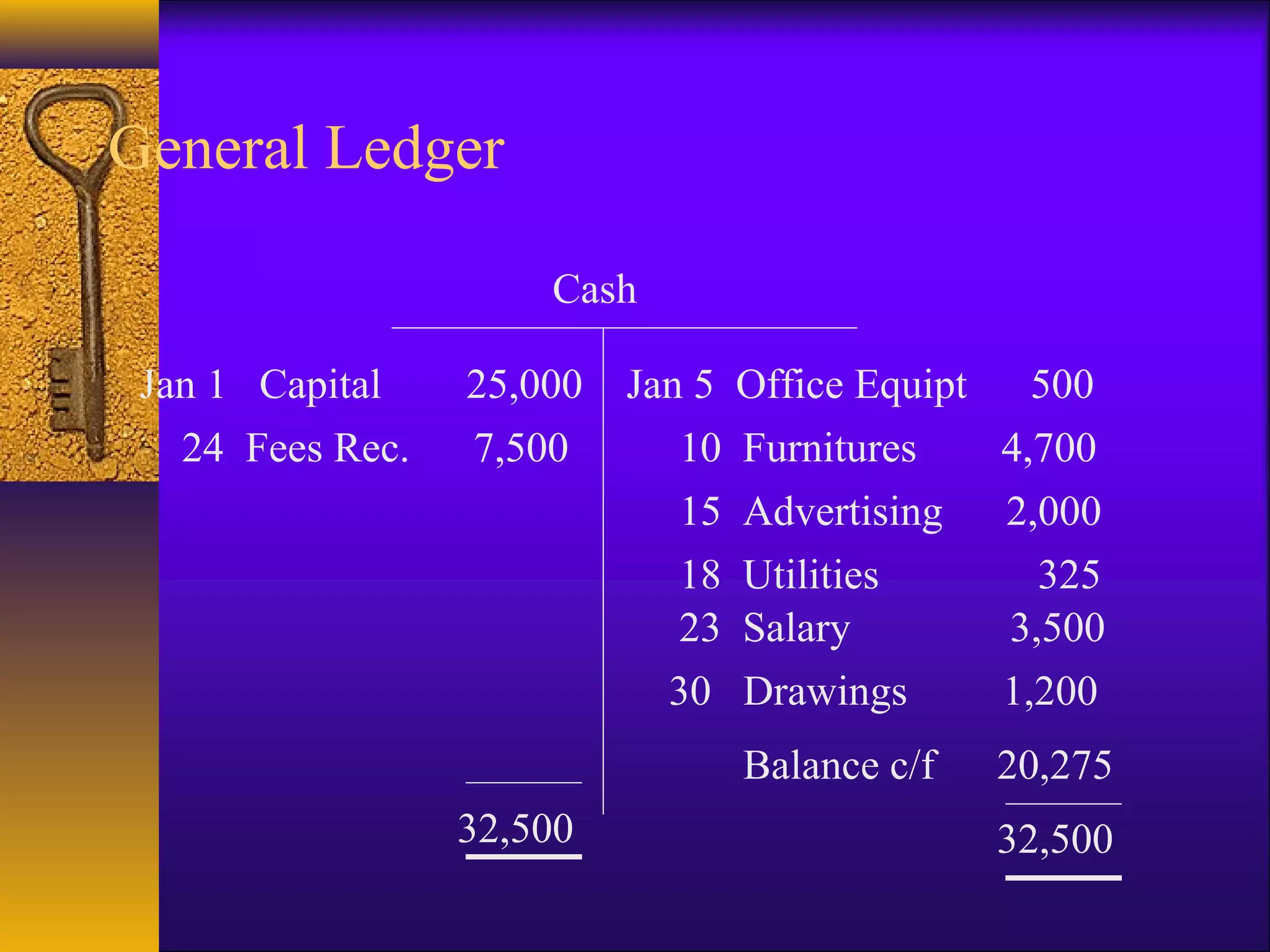

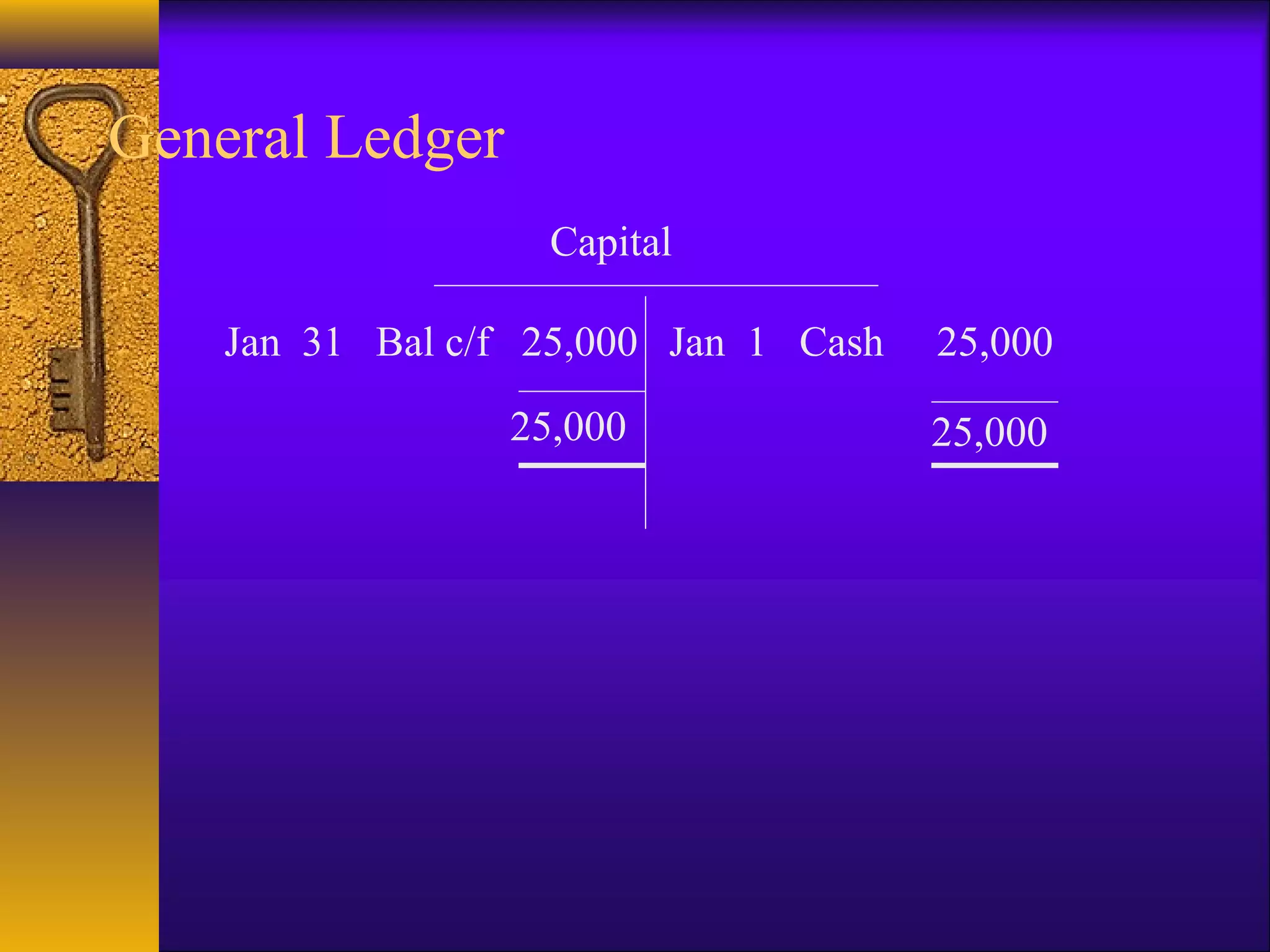

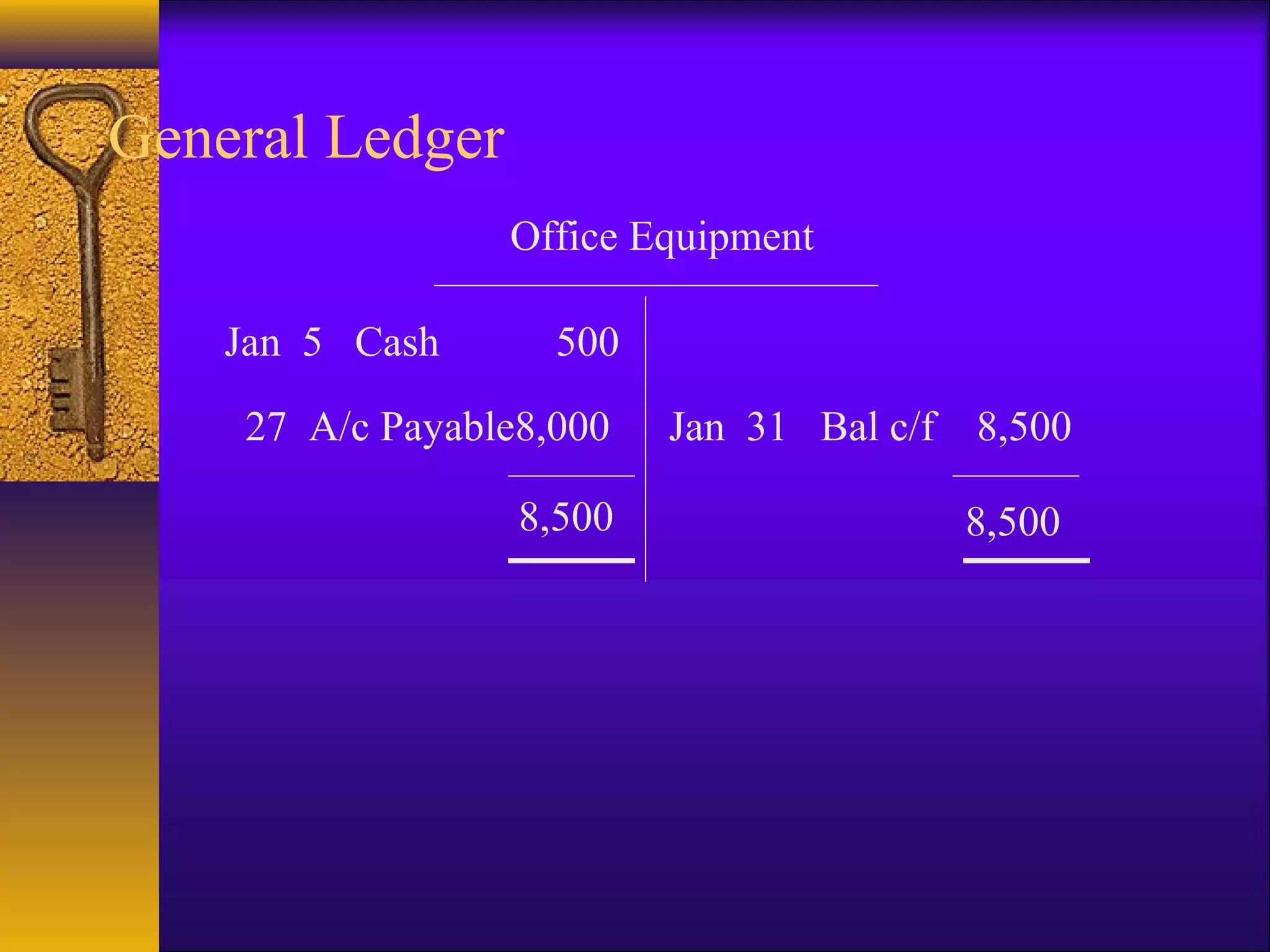

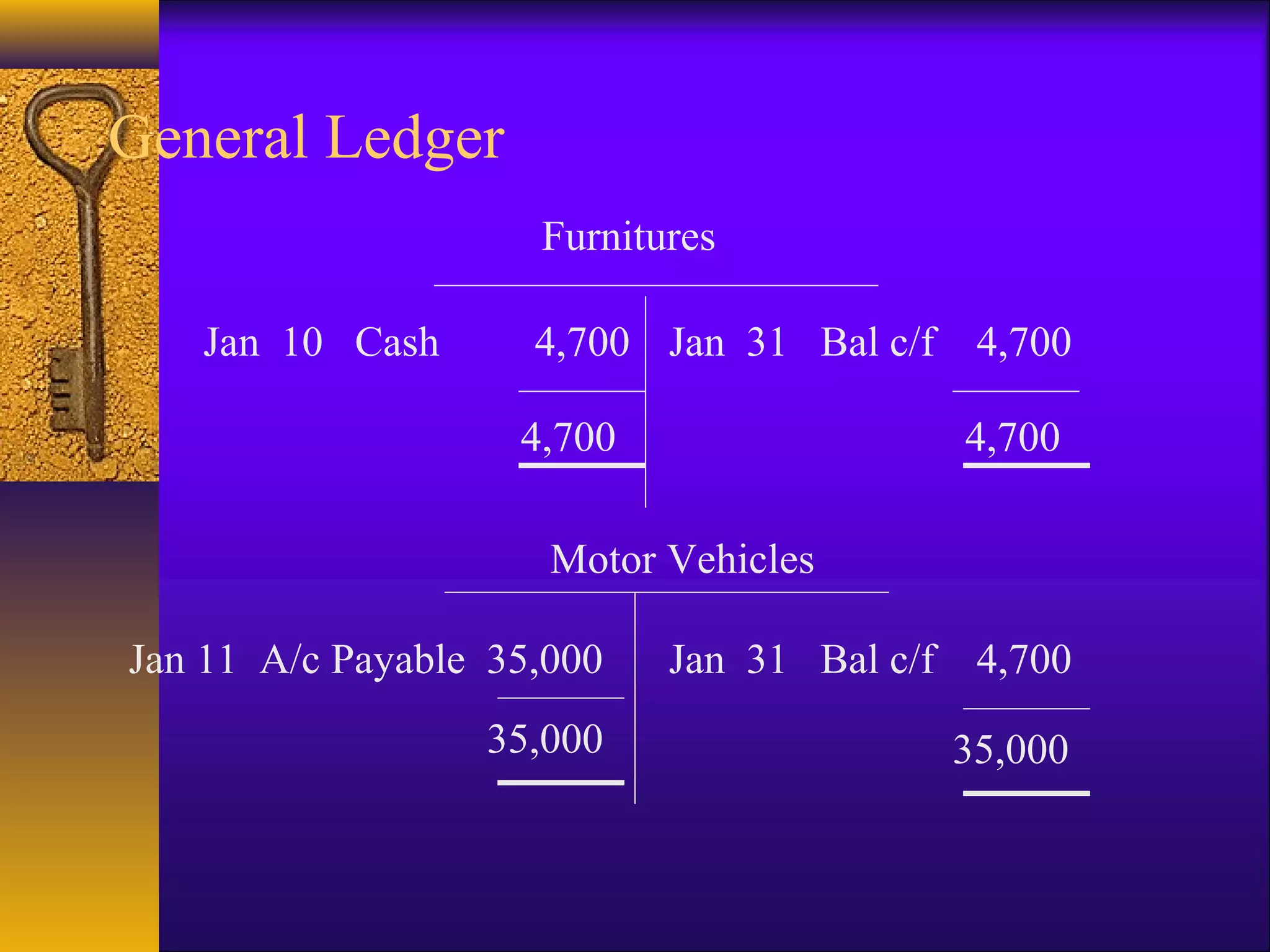

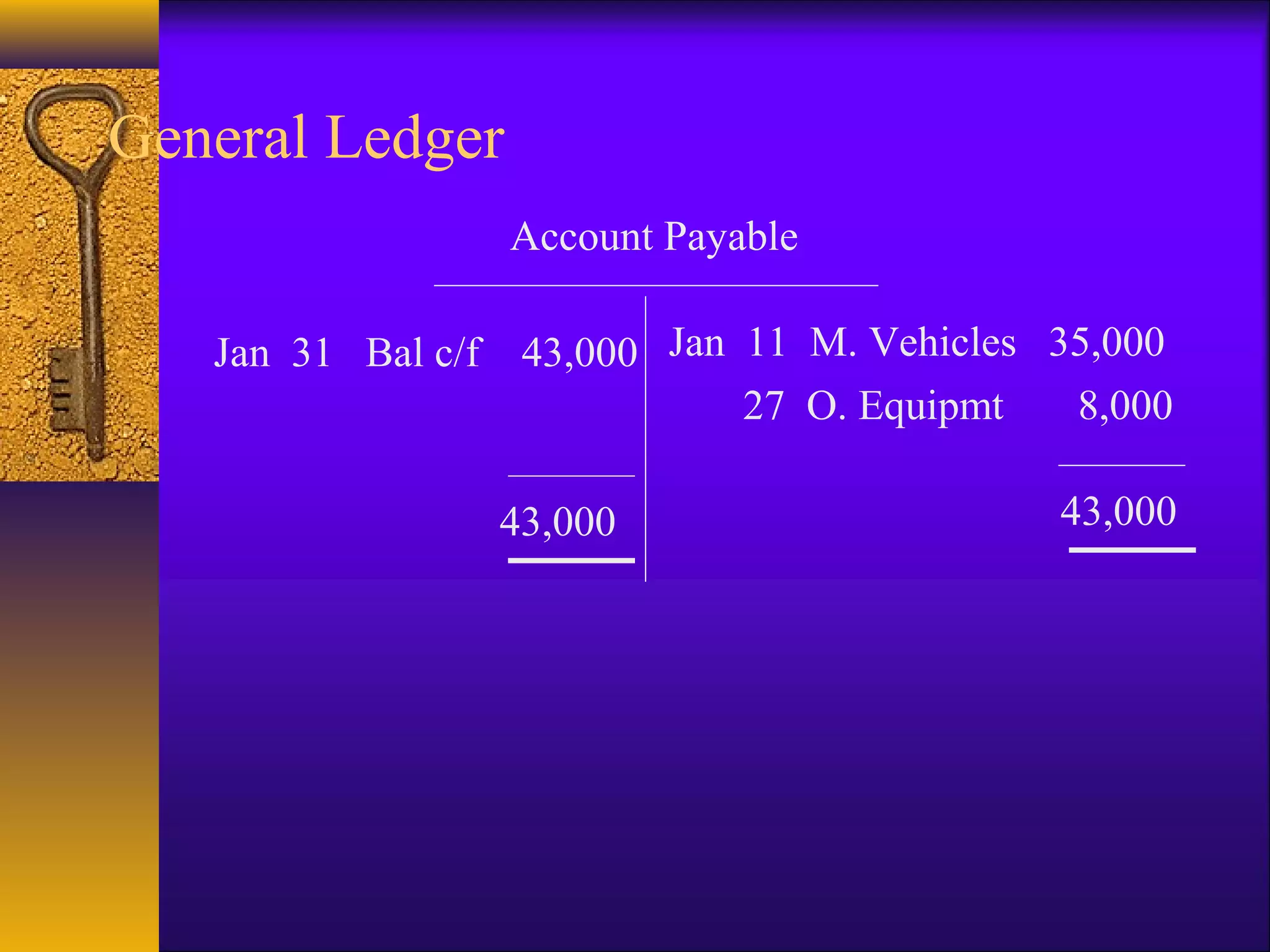

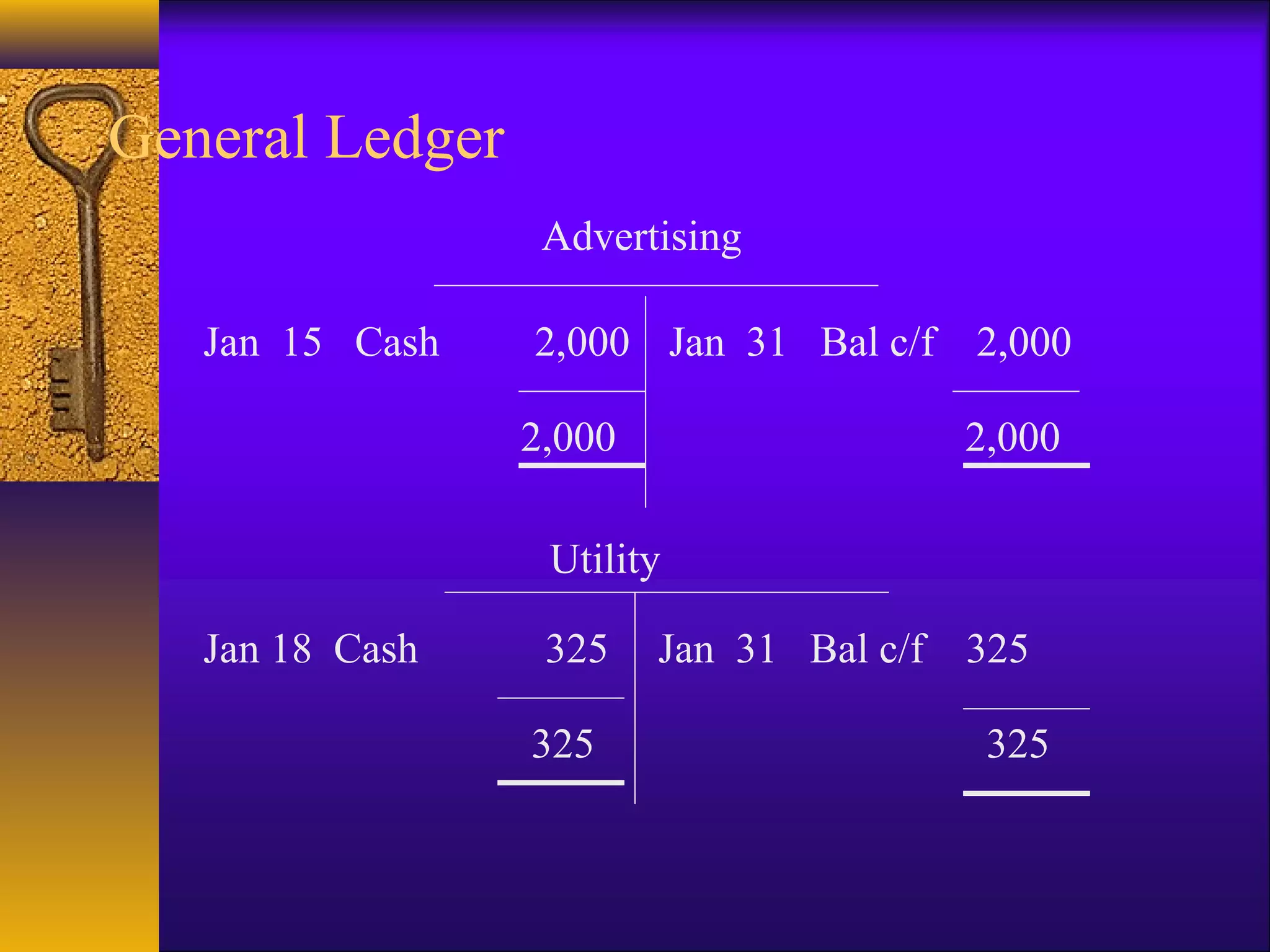

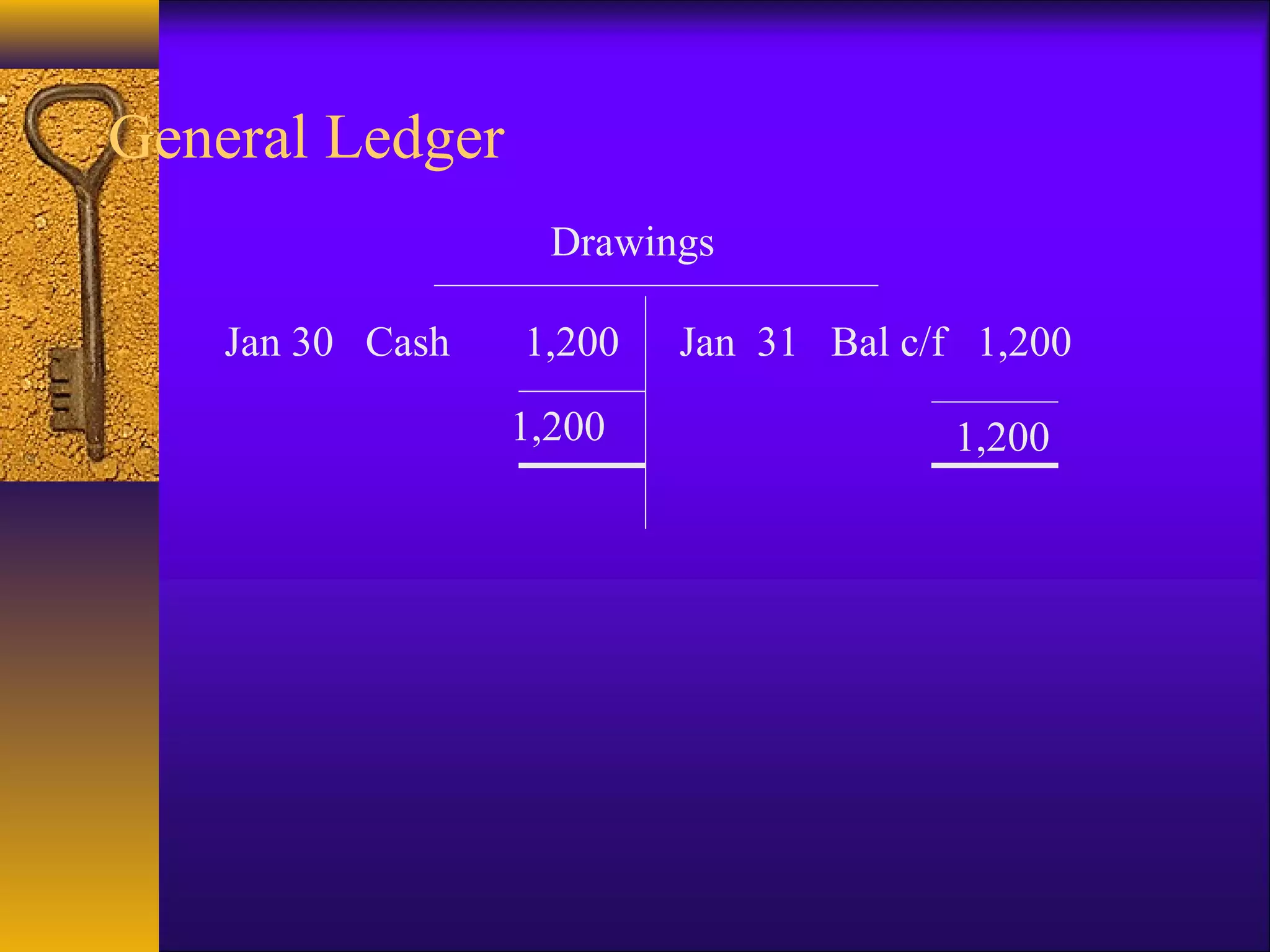

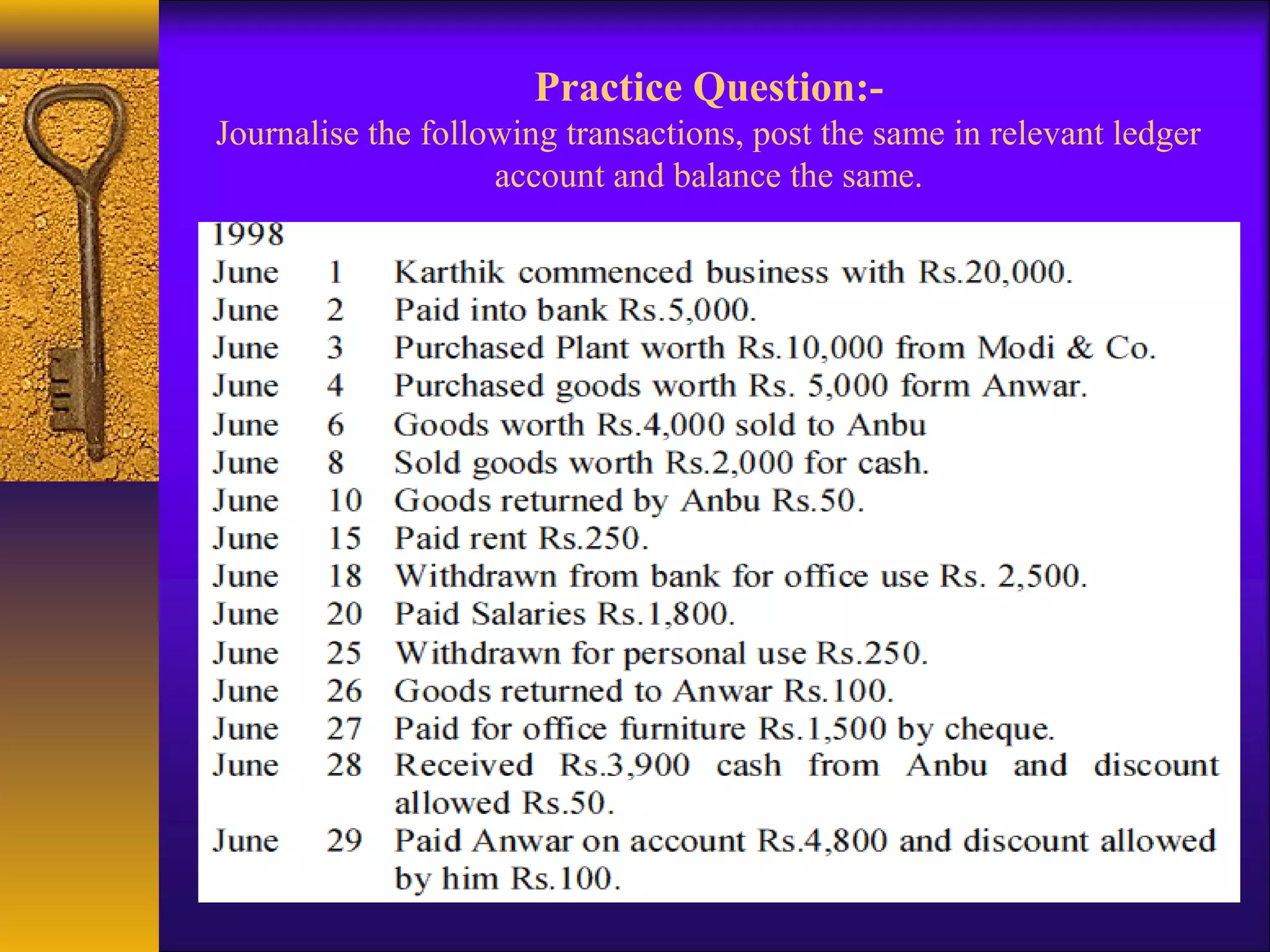

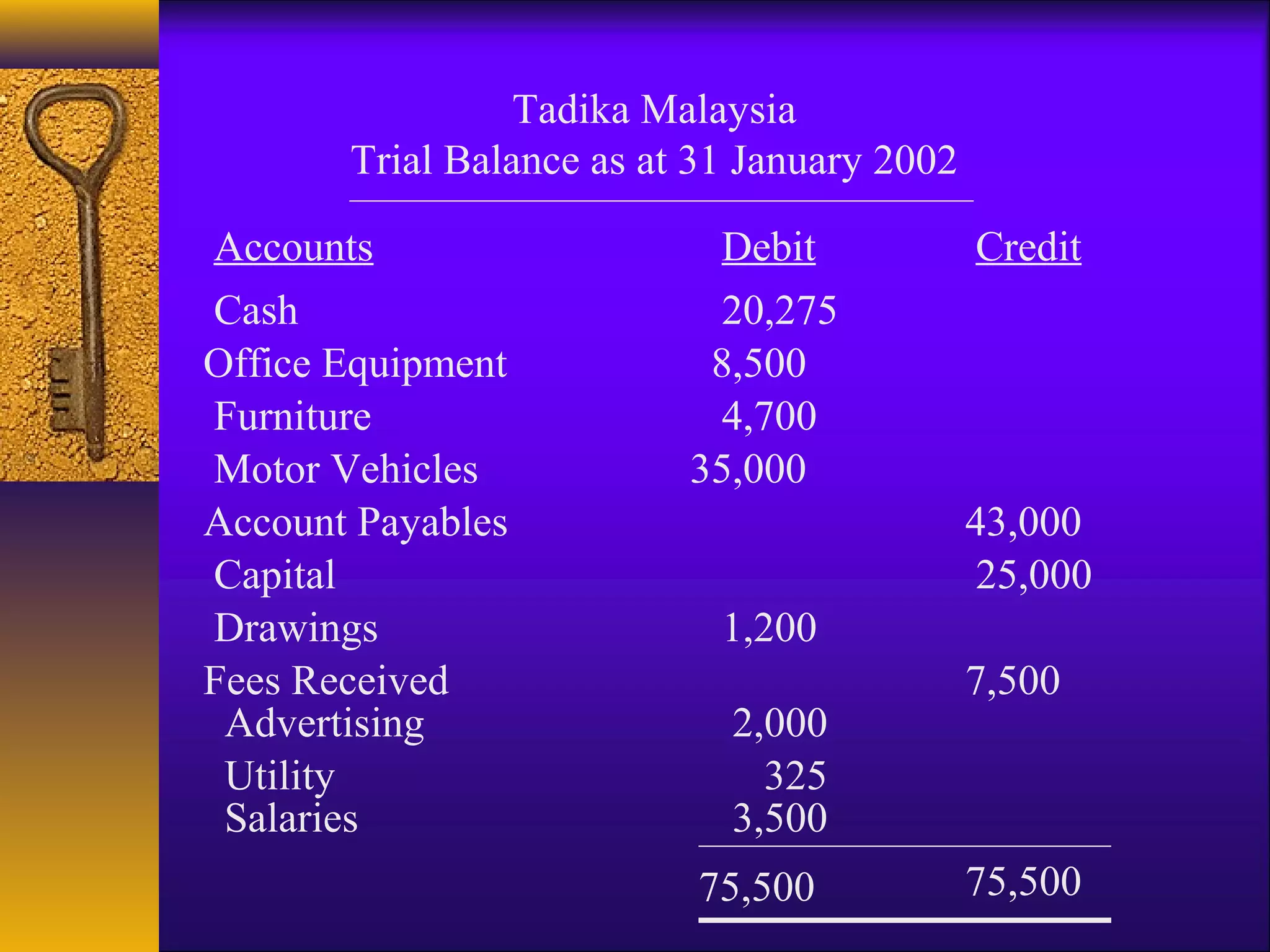

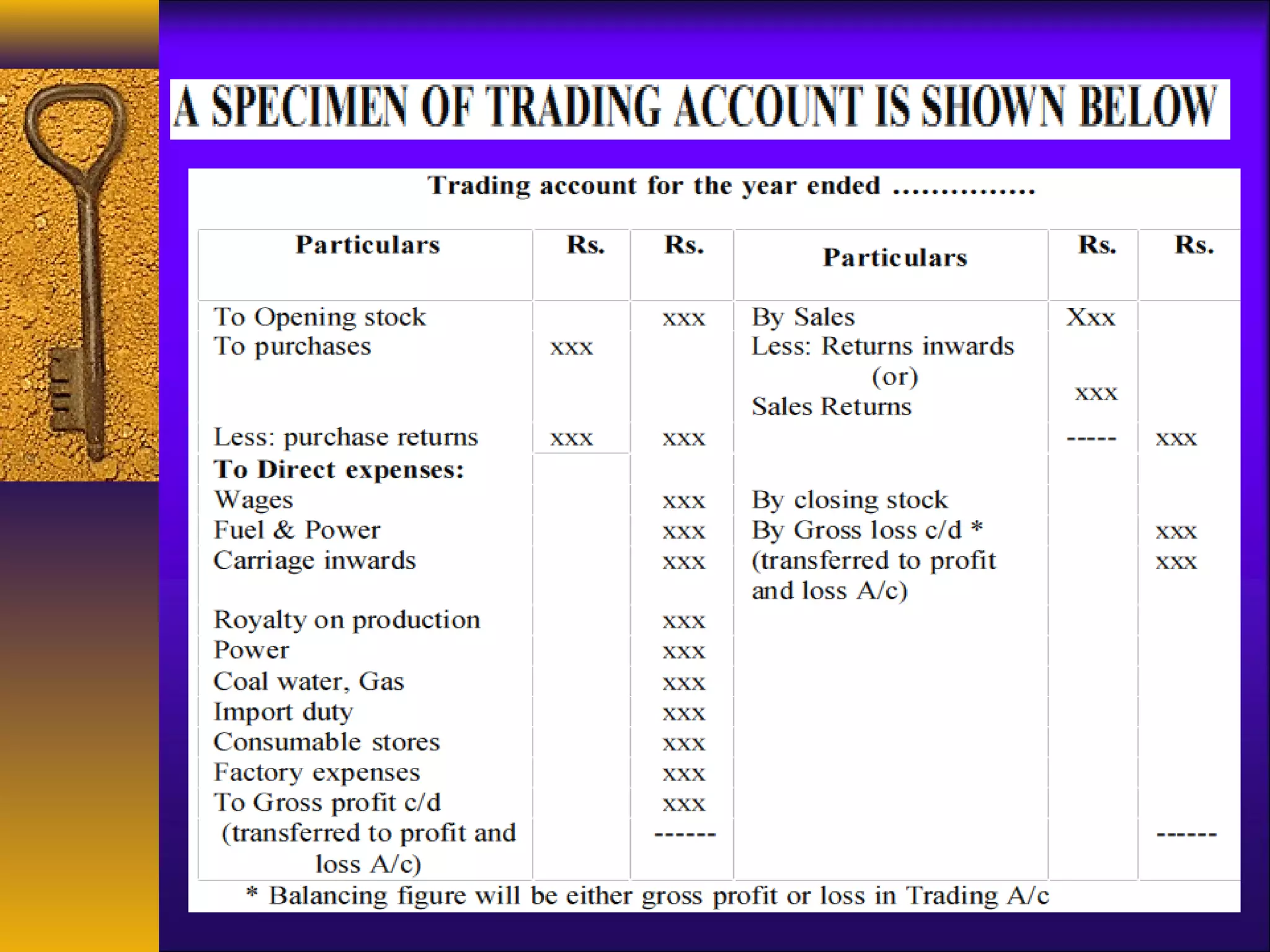

The document discusses key accounting concepts including bookkeeping, accounting, double-entry accounting, and the accounting cycle. It defines bookkeeping as the routine recording of financial transactions and accounting as the analysis of a company's financial performance. The accounting cycle includes recording transactions in a journal, posting to ledger accounts, and preparing a trial balance to check the arithmetic accuracy of the ledger. Key accounts include assets, liabilities, equity, revenues and expenses.