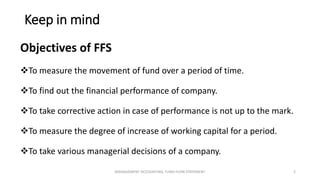

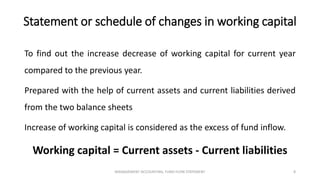

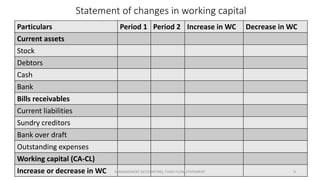

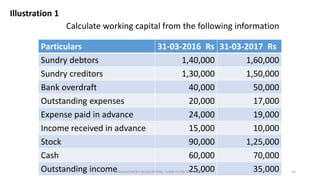

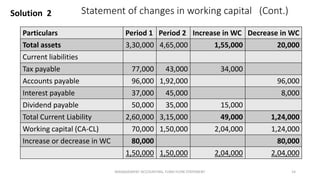

The document outlines the procedure for preparing a funds flow statement and a statement of changes in working capital, highlighting their objectives and importance in assessing a company's financial performance. It details the factors affecting working capital, categorizing assets and liabilities into current and fixed items, and explains how to prepare these statements for managerial decision-making. Additionally, it includes illustrations and calculations to demonstrate working capital changes over specified periods.