This document outlines the course plan for a Financial Management course offered at Mekelle University. The 2-credit hour course aims to familiarize students with basic concepts of financial management and techniques for optimal investment and financing decisions. It will cover topics such as financial statement analysis, capital budgeting, capital structure, and working capital management. The course will be taught through lectures, assignments, presentations and include a final exam. Student assessment will be based on assignments, presentations, quizzes, and a final exam.

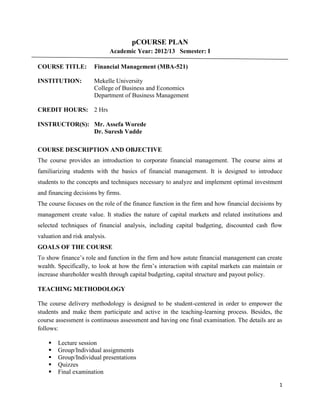

![ASSESSMENT

Group/Individual Assignment ……………………………… 10%

Group/Individual Presentations …………………………….. 10%

Quizzes ……………………………….…………………….. 30%

Final Examination ………………………………………….. 50%

Total ………………………………………… 100%

SCALE

A [85–100] C [50 – 60]

B+ [75 – 84] D+ [40 – 49]

B [65 – 74] D [30 – 39]

C+ [61 – 64] F [0 – 30]

COURSE POLICY

According to the MU legislation, you must attend at least 80% of the 32 hours (i.e., at

least 26 hours) and score at least 50% result from the continuous assessment; otherwise

you can’t sit for the final examination.

You must submit group assignments at least within a given dead line.

You must attend group assignments and group presentations regularly.

SUGGESTED READINGS:

Brigham, E.F., and Ehrhardt, M.C., 2003, “Financial Management: Theory and Practice”,

South Western Publishing, USA, 12th Ed.

I.M. Pandy, 2005, “Financial Management”, Vikas Publishing House Pvt. Ltd., New

Delhi, 9th Ed.

Myers, S.C., and Brealey, R.A., 2003, “Principles of Corporate Finance”, McGraw-

Hill/Irwin, USA, 7th Ed.

M Y Khan and P K Jain, 2004, “Financial Management Text, Problems and Cases”, Tata

McGraw Hill.

Prasanna Chandra, 2001, “Financial Management – Theory and Practice”, Tata McGraw

Hill, 2nd ed.

Preethi Singh, 2009, “Fundamentals of Financial Management”, Ane Books Pvt. Ltd.,

New Delhi, 2nd Ed.

Any Book, journal, or article on Financial Management or Corporate Finance.

4](https://image.slidesharecdn.com/fm-mbacourseplan-121109000922-phpapp01/85/Fm-mba-course-plan-4-320.jpg)