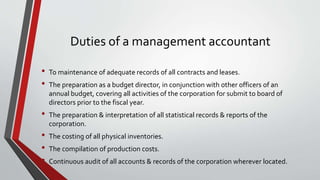

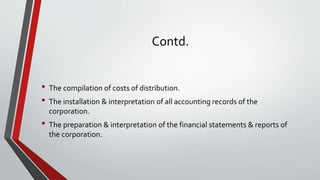

The document discusses management accounting, including its definition, objectives, functions, scope, and limitations. It defines management accounting as the presentation of accounting information to assist management in policymaking and day-to-day operations. The objectives include promoting efficiency, interpreting financial statements, and allocating responsibility. The functions of management accounting include forecasting, organizing, controlling, analysis, and communication. A management accountant assists management by preparing budgets and reports, interpreting financial data, and ensuring compliance.