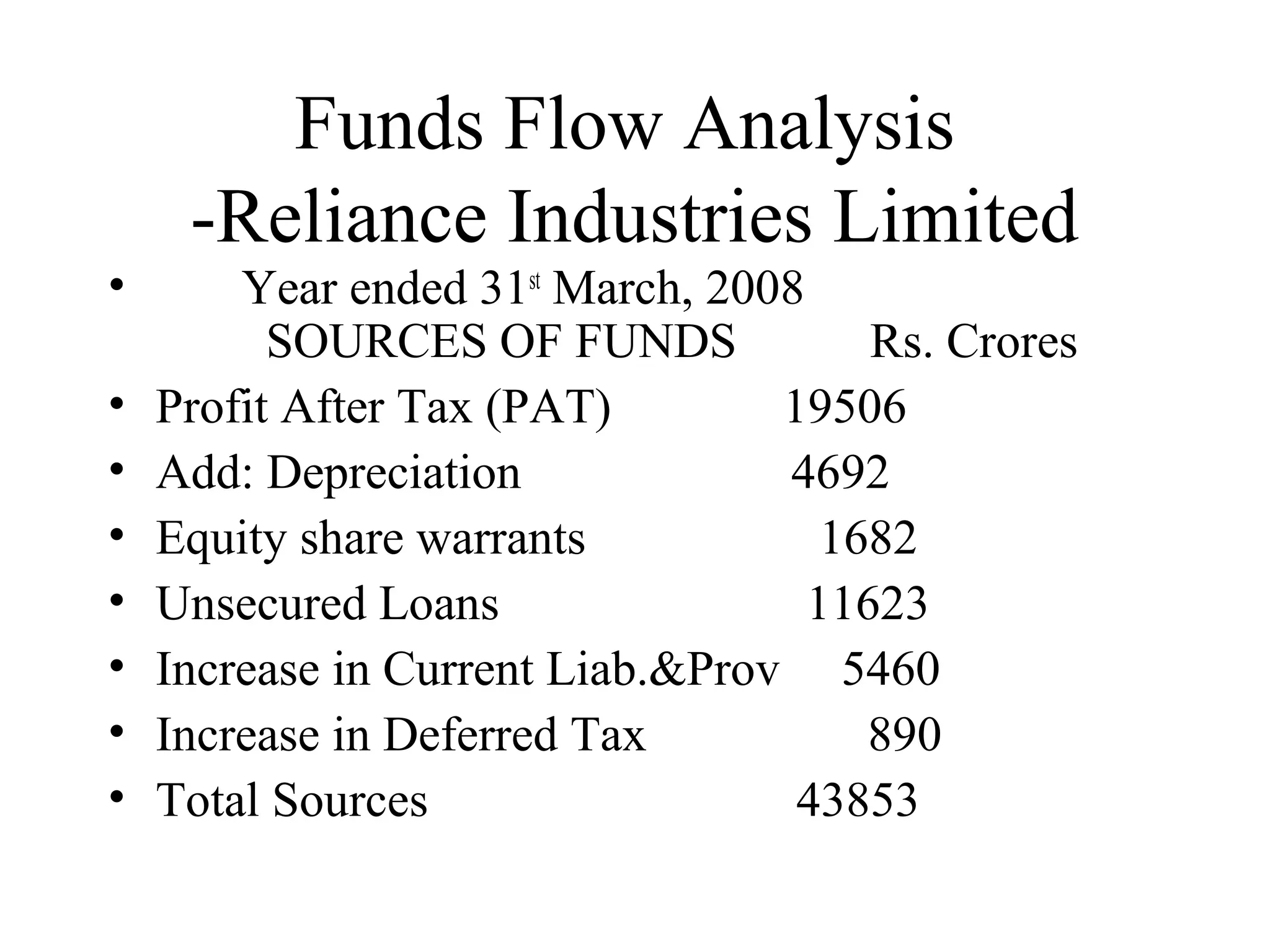

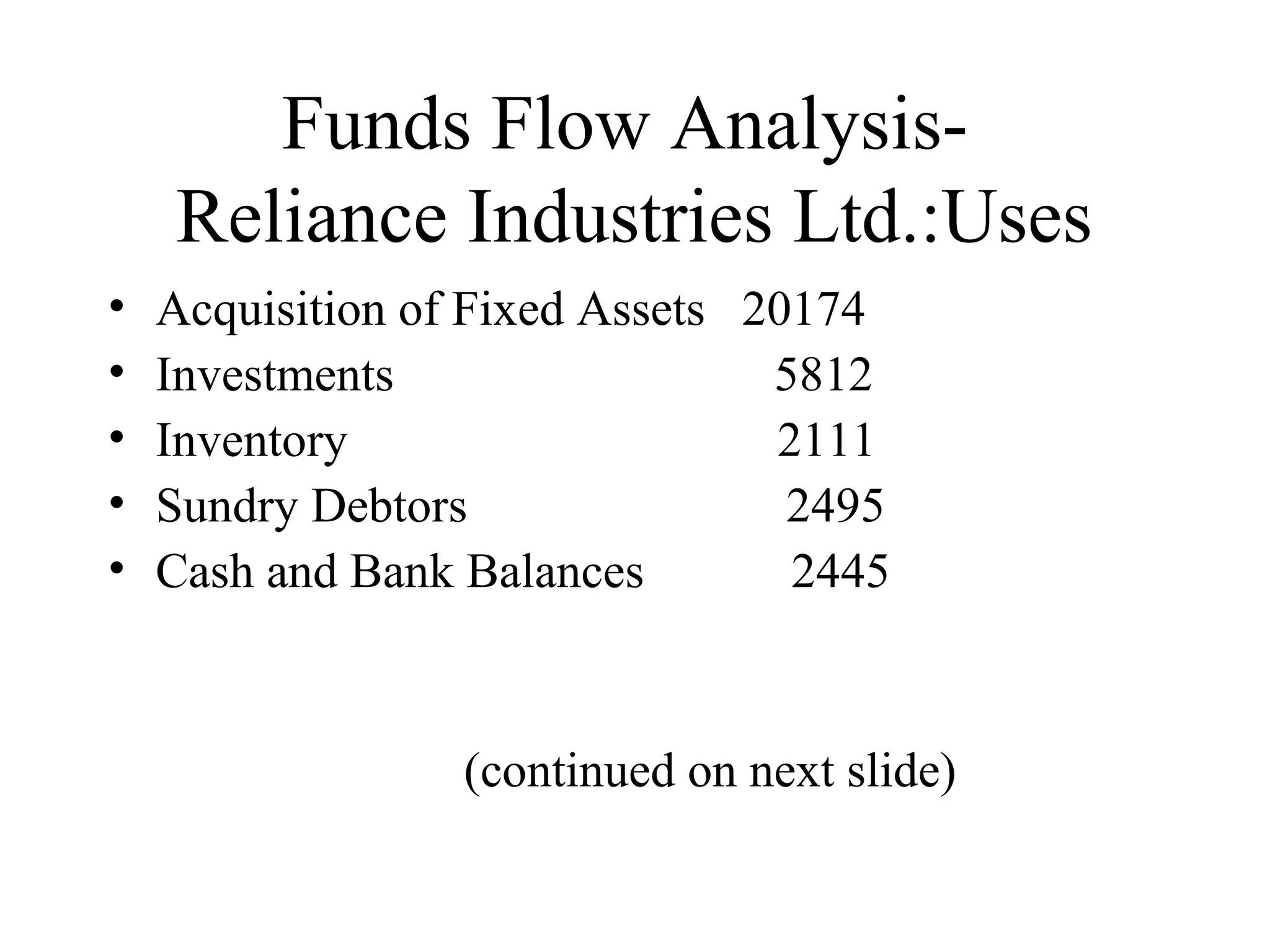

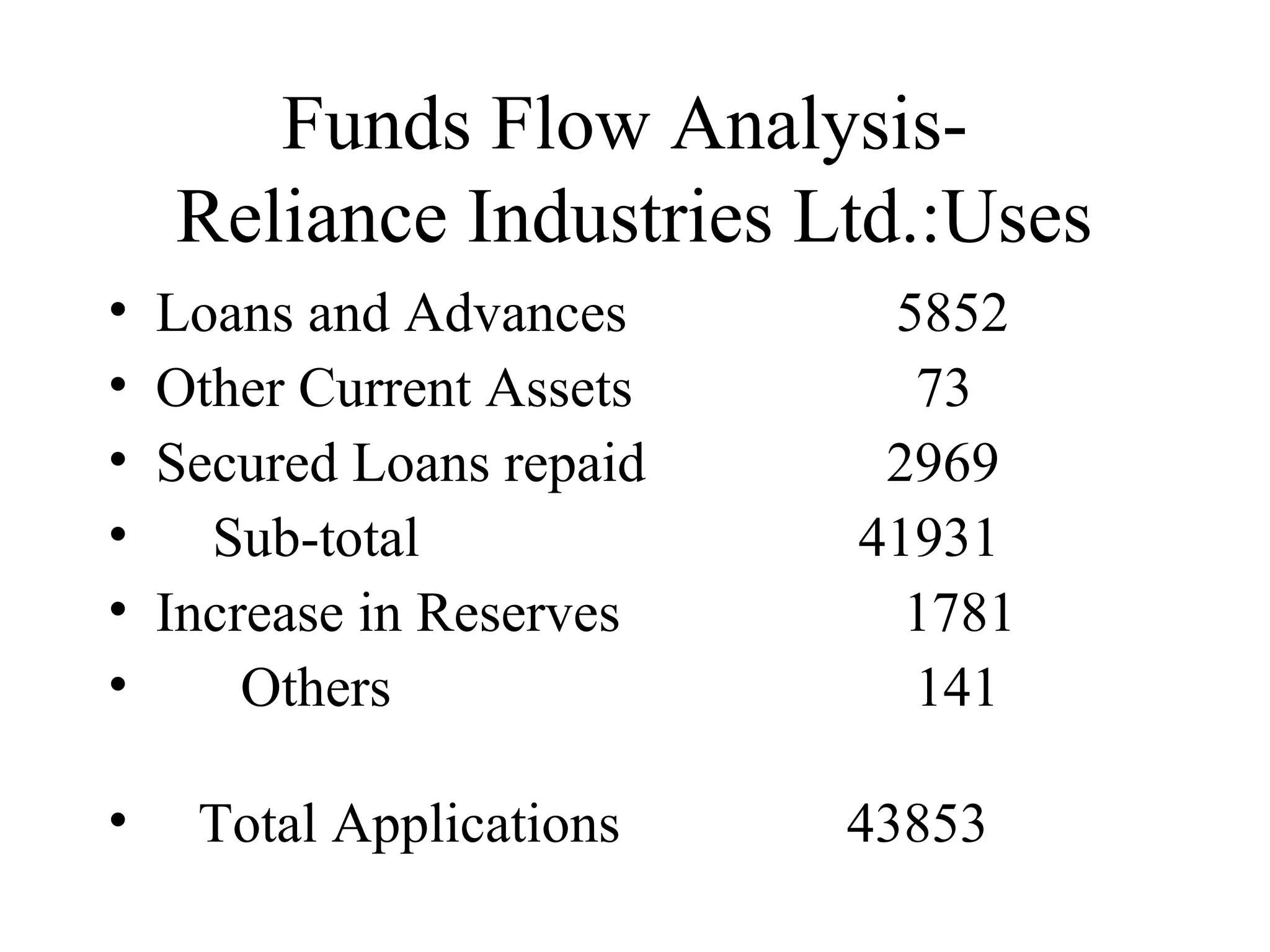

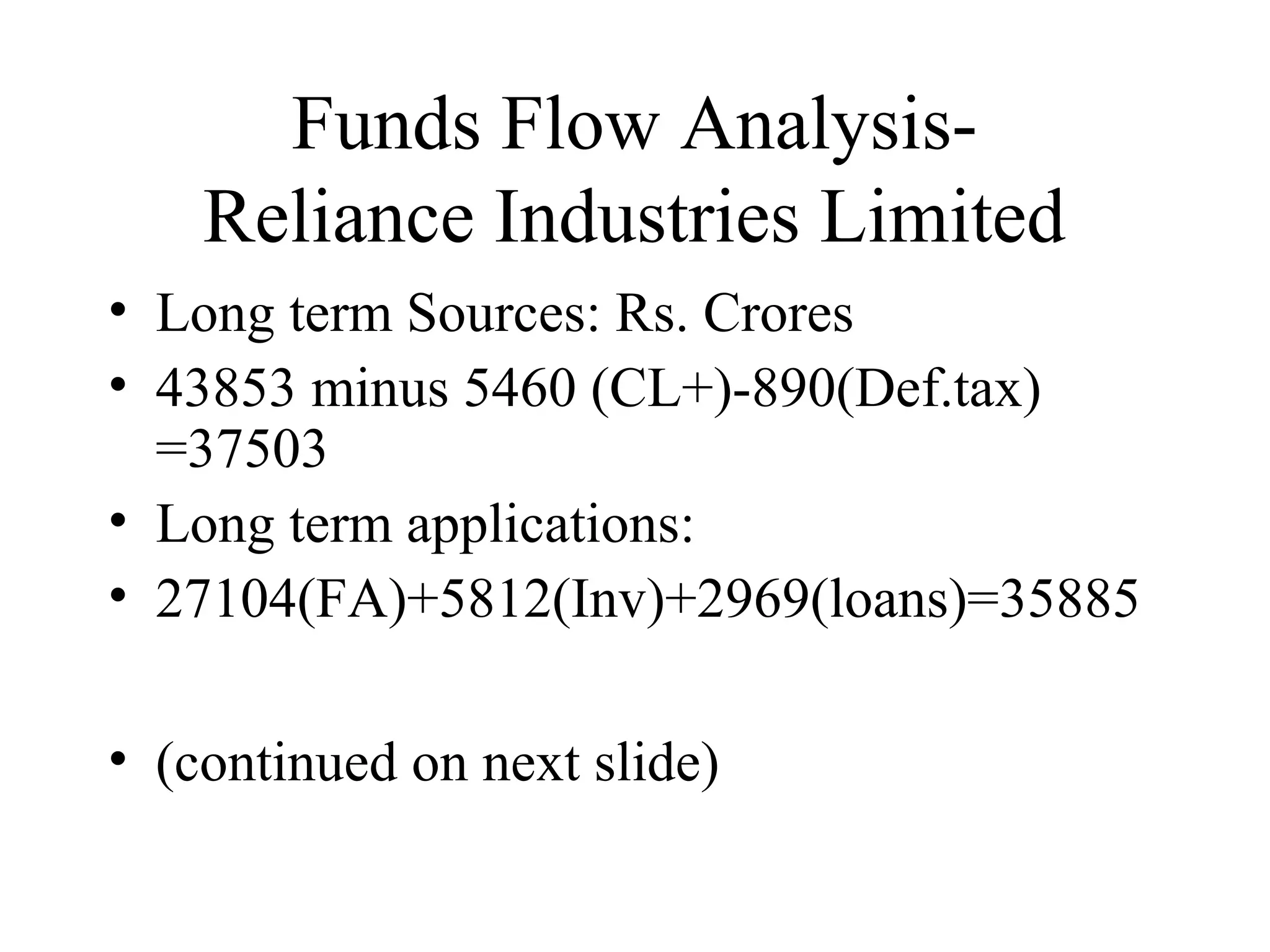

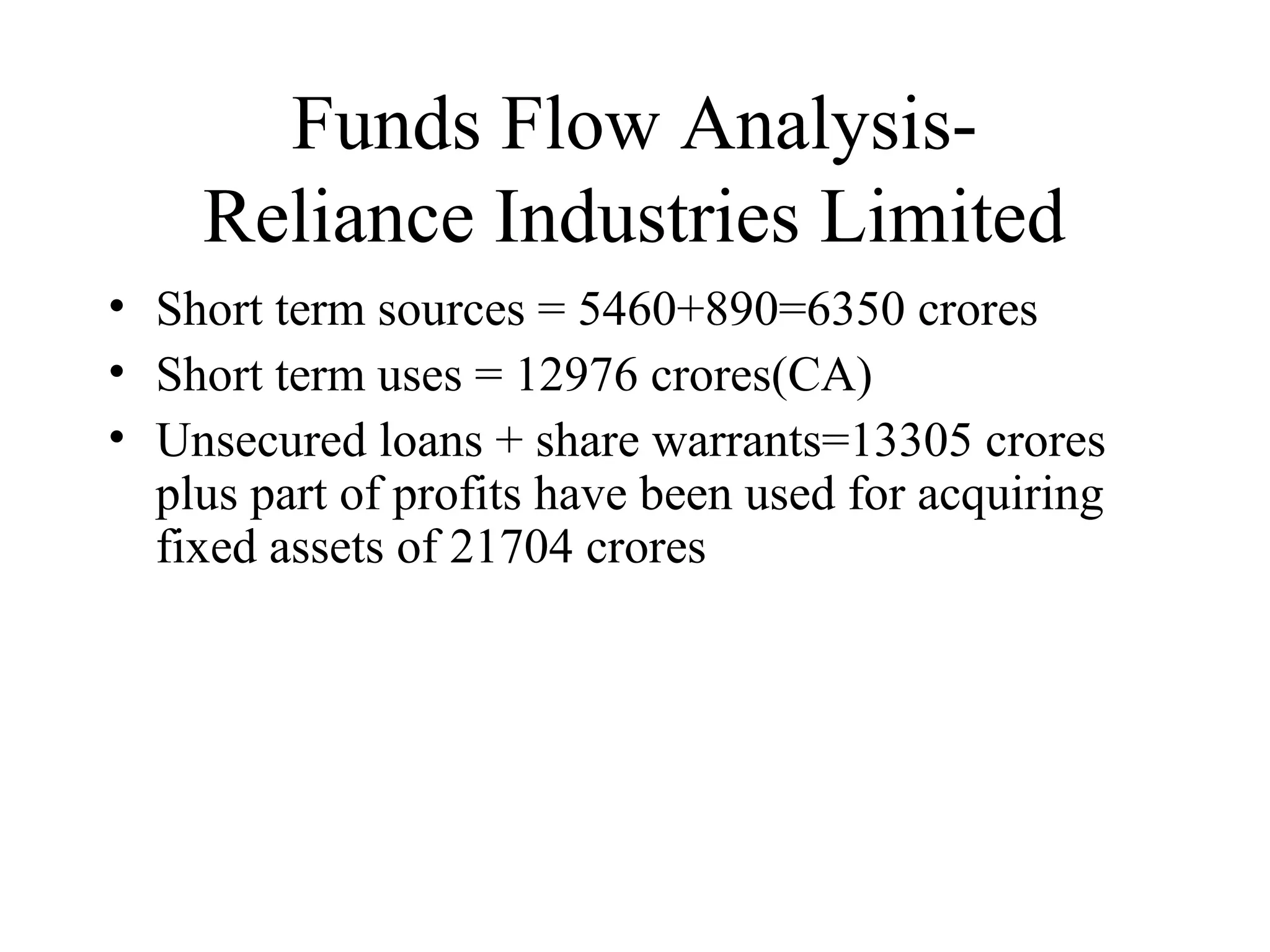

The document provides information on funds flow statement (FFS) including its concept, preparation on total resource basis and cash basis, significance and interpretation. It discusses the learning objectives of FFS, introduction and concept of FFS, how it is prepared from the balance sheet and profit and loss account, and the importance of FFS in analyzing sources and uses of funds in a business.