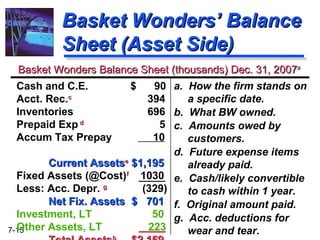

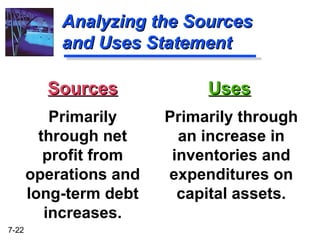

The document discusses cash flow statements and funds flow statements. It provides explanations of key components of the statements, including cash flows from operating, investing and financing activities. It also includes an example cash flow statement and funds flow statement for a company called Basket Wonders.