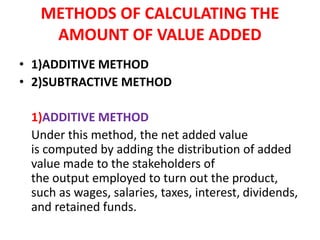

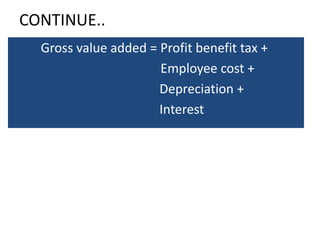

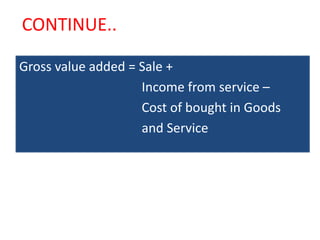

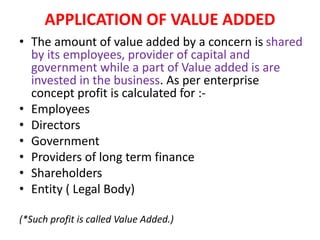

This document discusses the value added statement, which is a modified version of the profit and loss account that reveals a company's operating performance. It summarizes how value added is calculated as the difference between the value of a firm's outputs and purchased inputs. The value added statement shows how the wealth created by a business over time is distributed among stakeholders like employees, capital providers, and the government. It has advantages like improving employee attitudes and linking a company's accounts to national income reporting. The document also describes subtractive and additive methods for calculating value added and applications like using it to determine employee profit-sharing amounts.