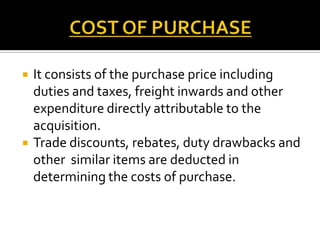

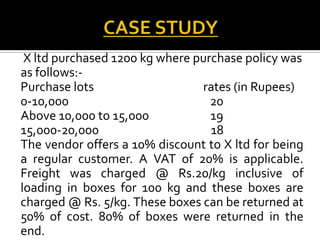

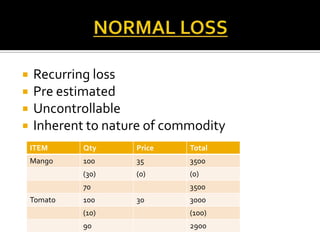

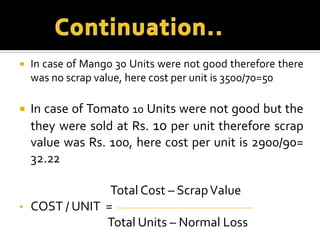

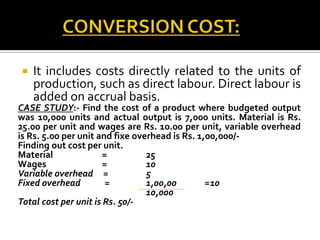

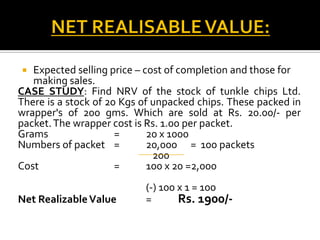

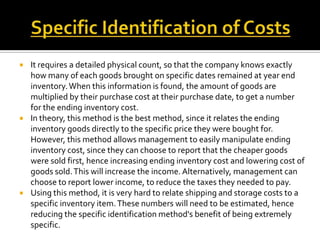

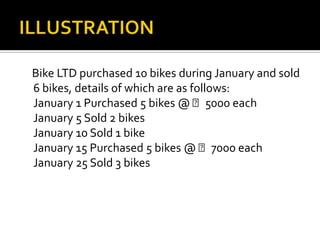

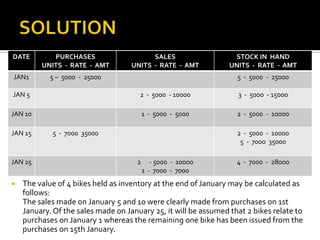

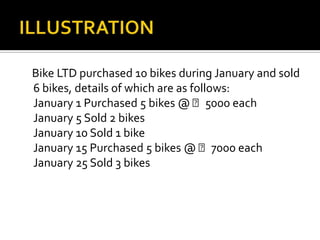

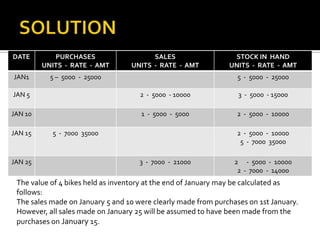

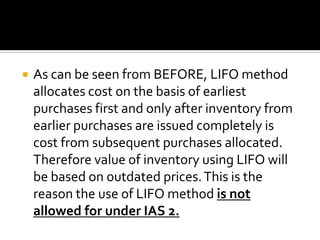

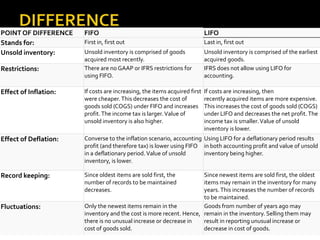

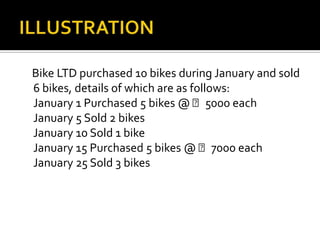

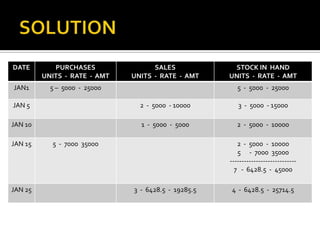

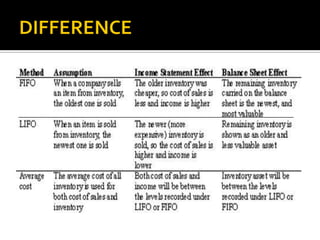

The document discusses inventory valuation and different methods used for valuing inventories. It defines inventories as assets held for sale, in production for sale, or materials/supplies used in production or rendering services. Inventories arise due to time lags in purchase and sale or processing. They must be valued at the lower of cost or net realizable value. Cost includes all purchase, conversion and other costs to bring inventory to its present condition/location excluding abnormal costs. Common costing methods are FIFO, LIFO and weighted average.