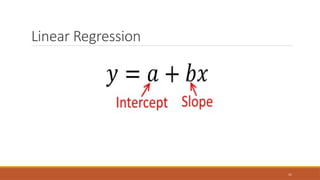

The document provides an extensive overview of forecasting within manufacturing organizations, emphasizing its significance for production, supply chain management, and overall decision-making. It outlines various forecasting methods, their characteristics, and the importance of using accurate past data to predict future demand, while acknowledging that forecasts are often inaccurate and require adaptability. Key forecasting techniques discussed include qualitative and quantitative analysis, moving averages, exponential smoothing, and linear regression.