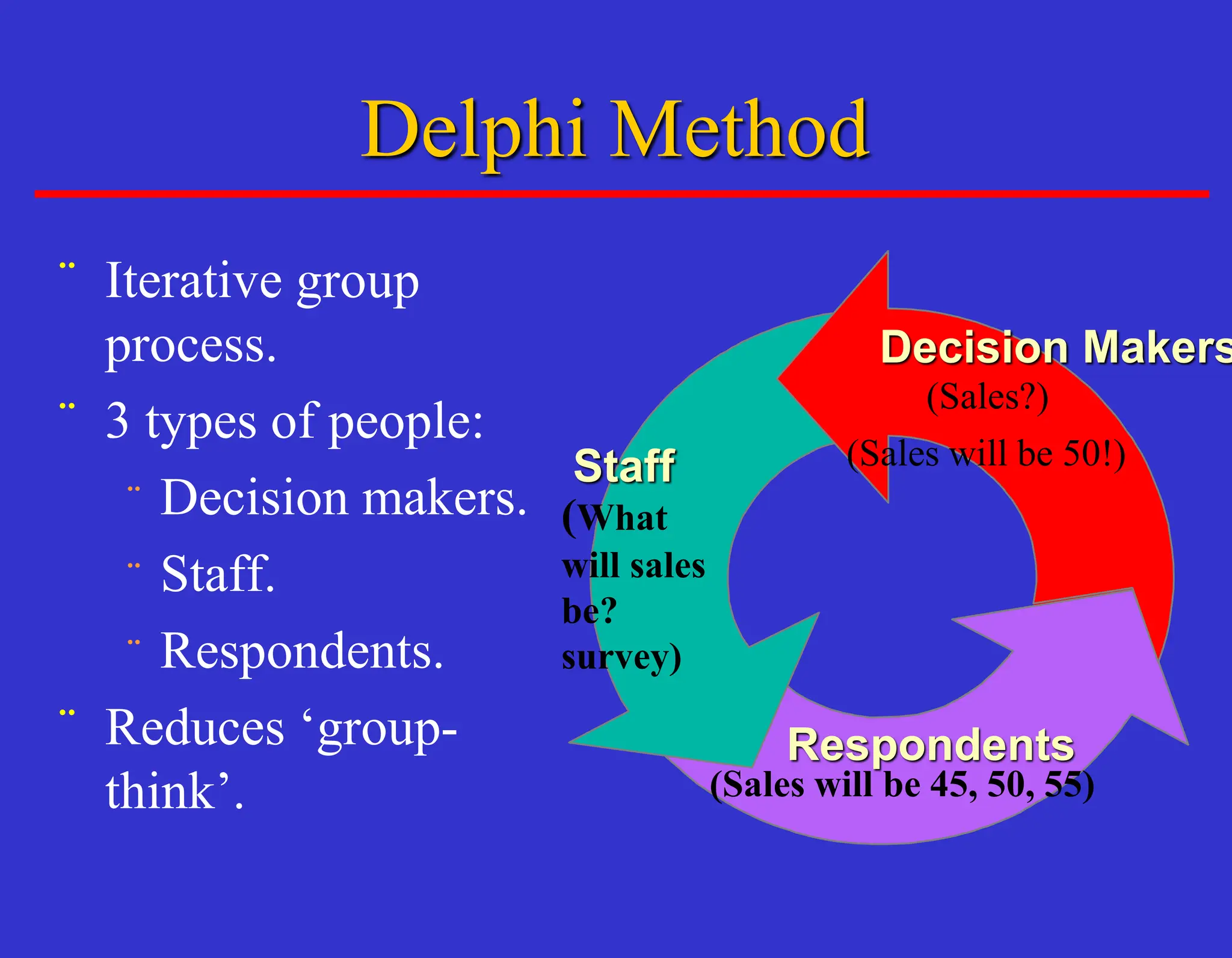

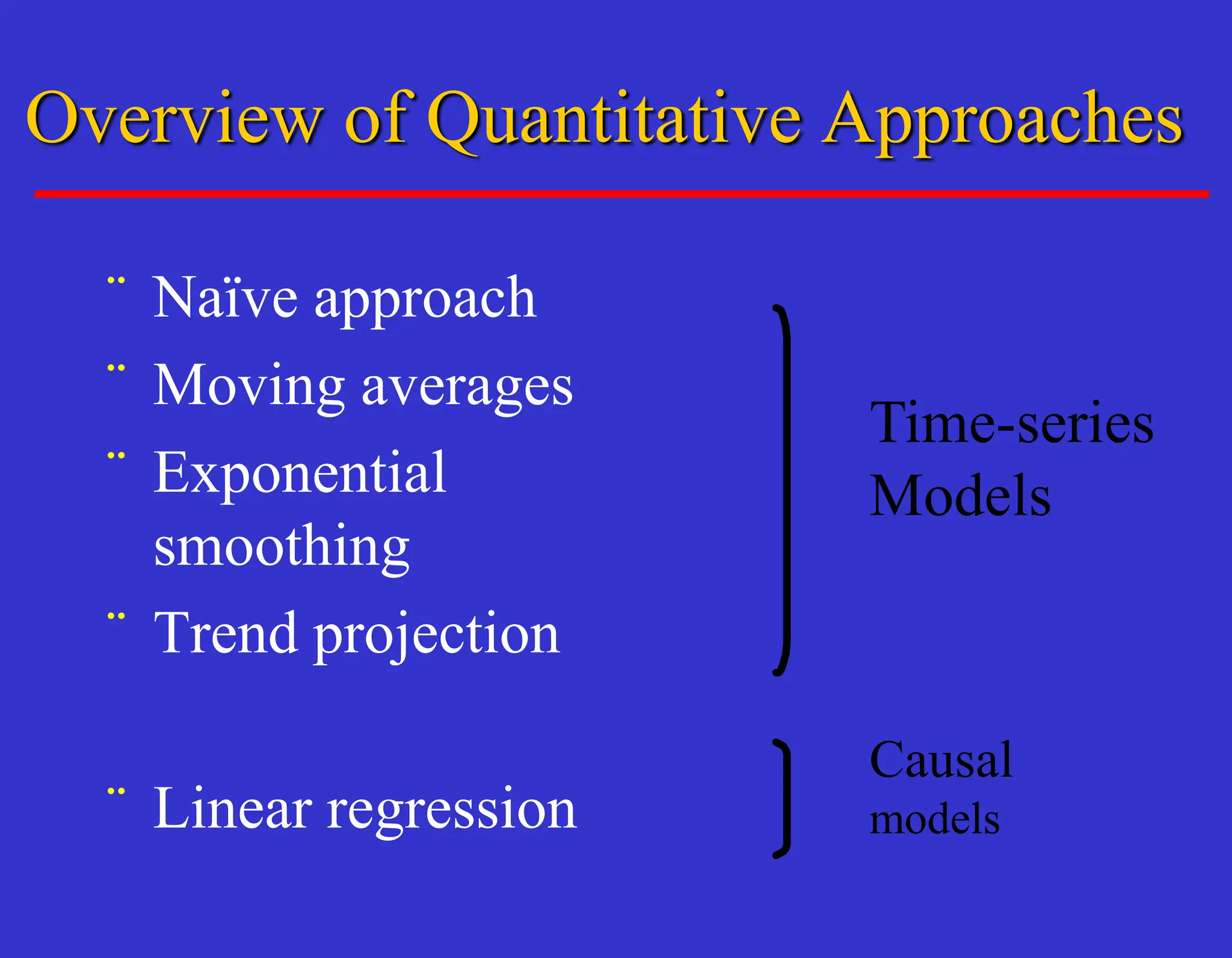

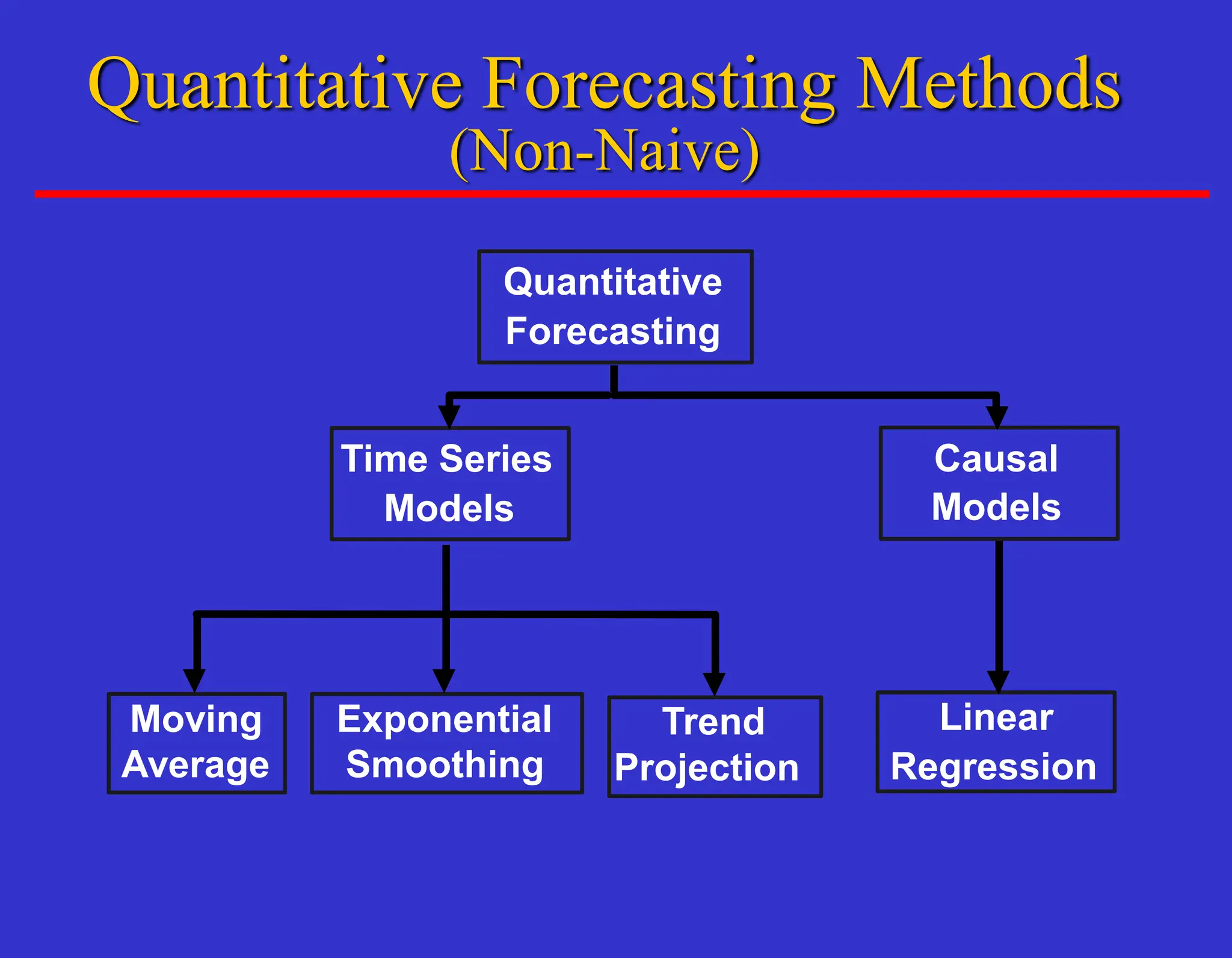

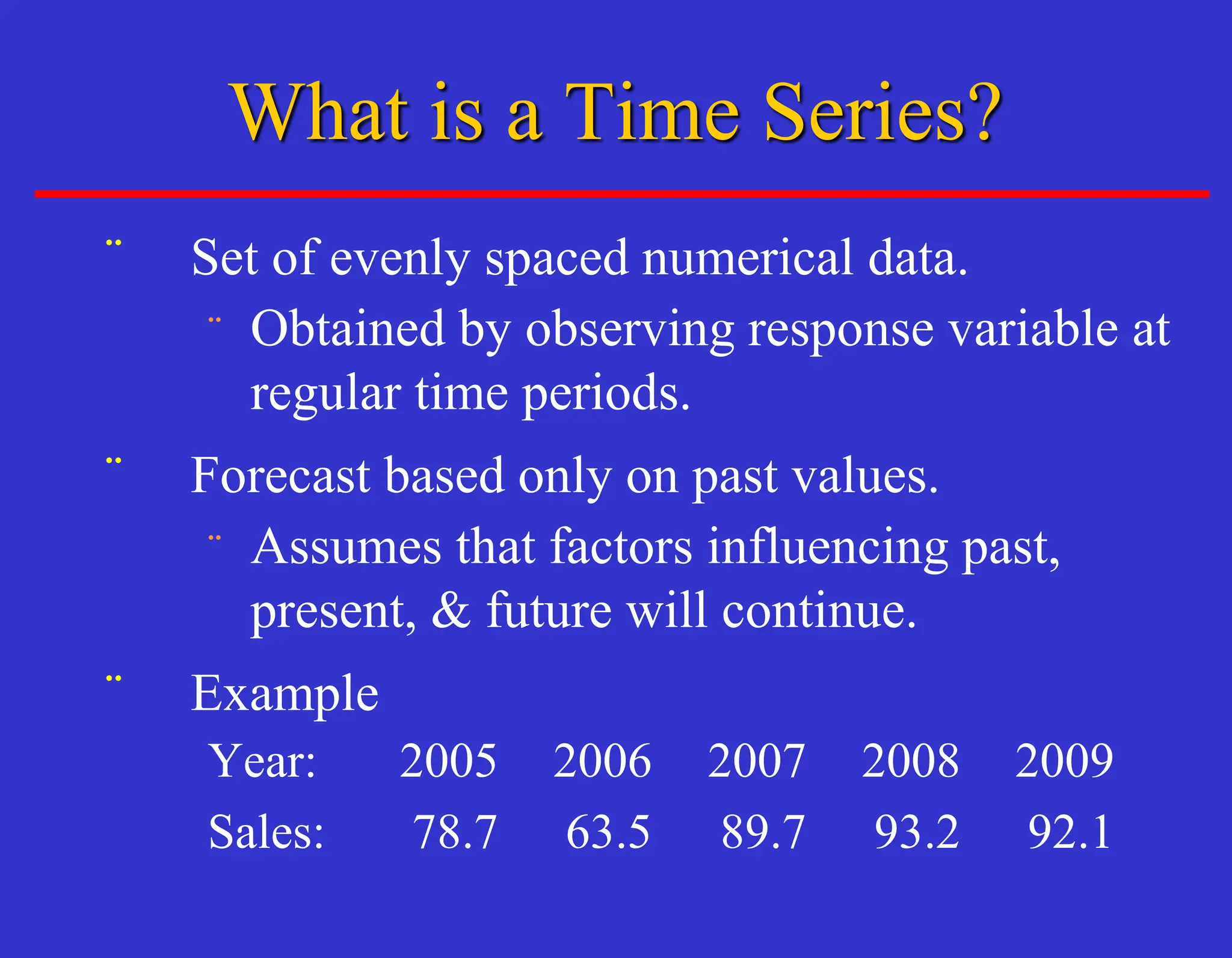

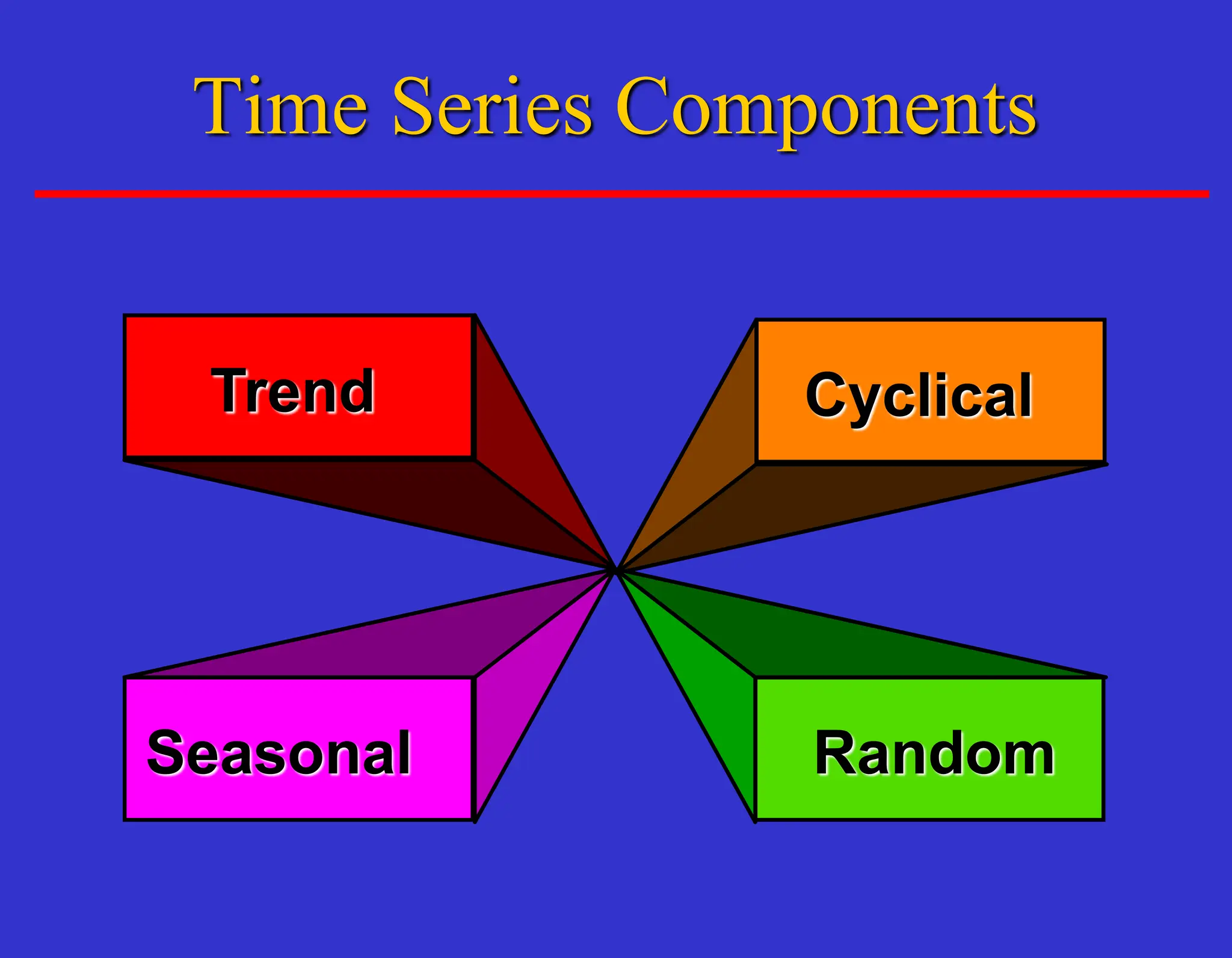

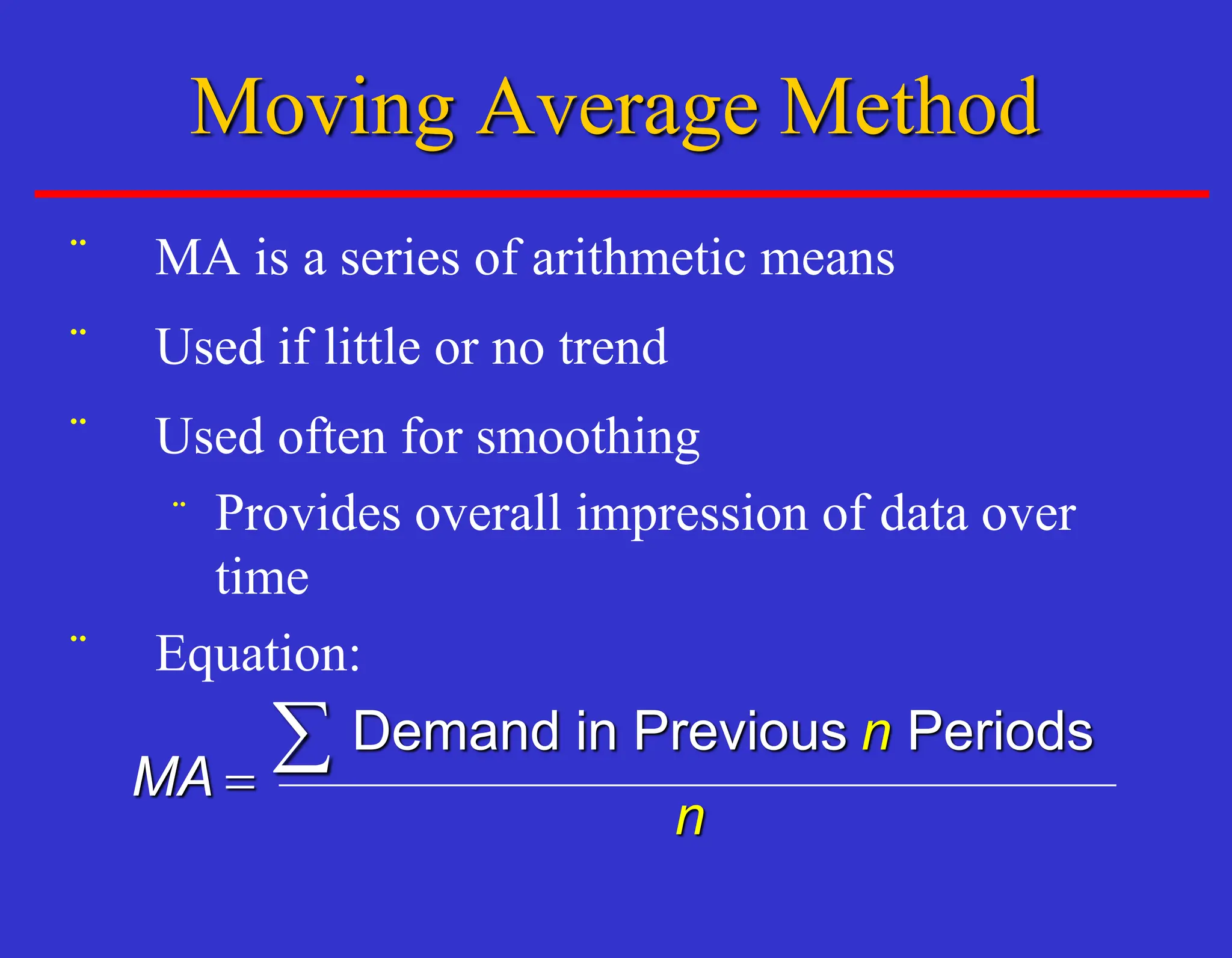

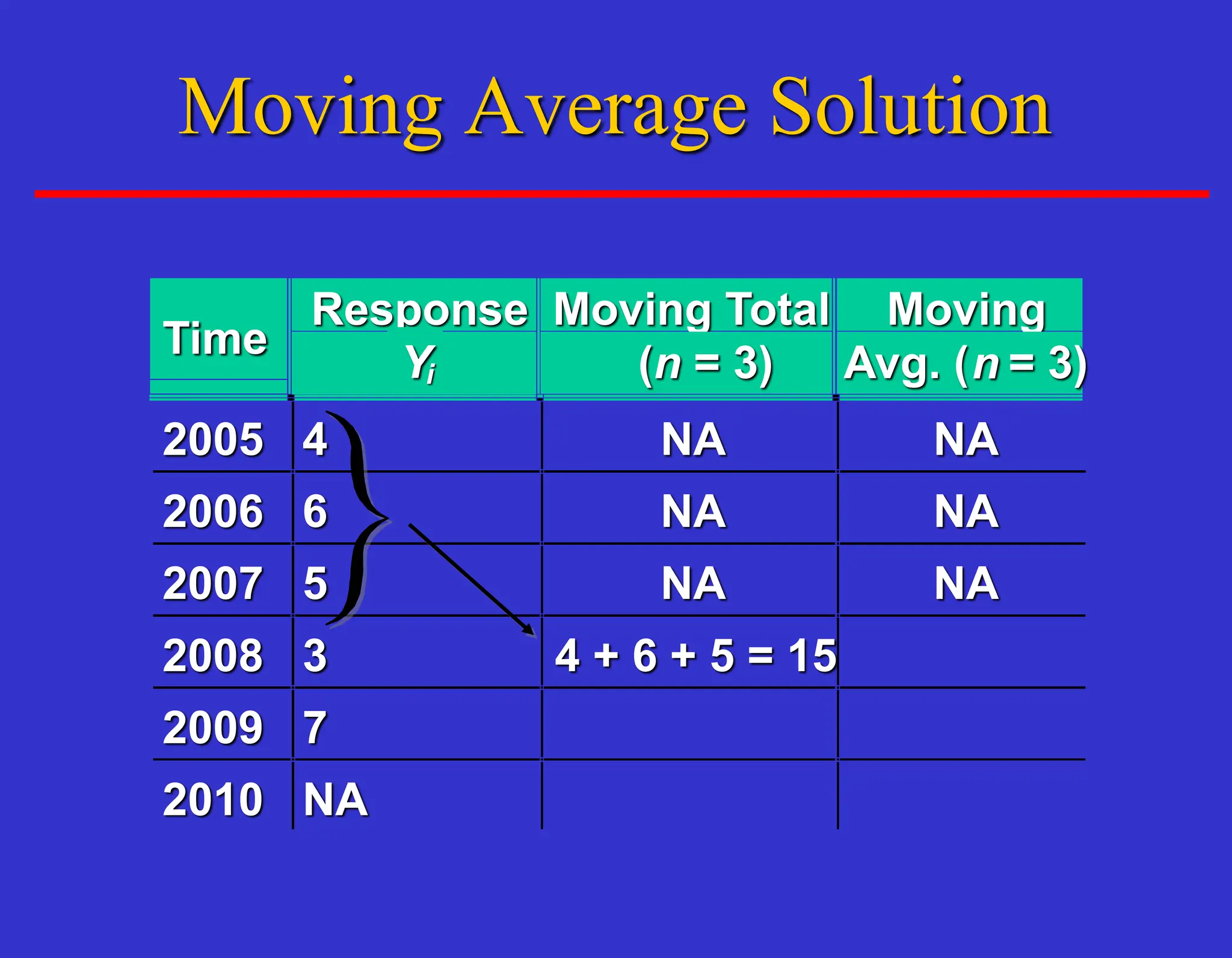

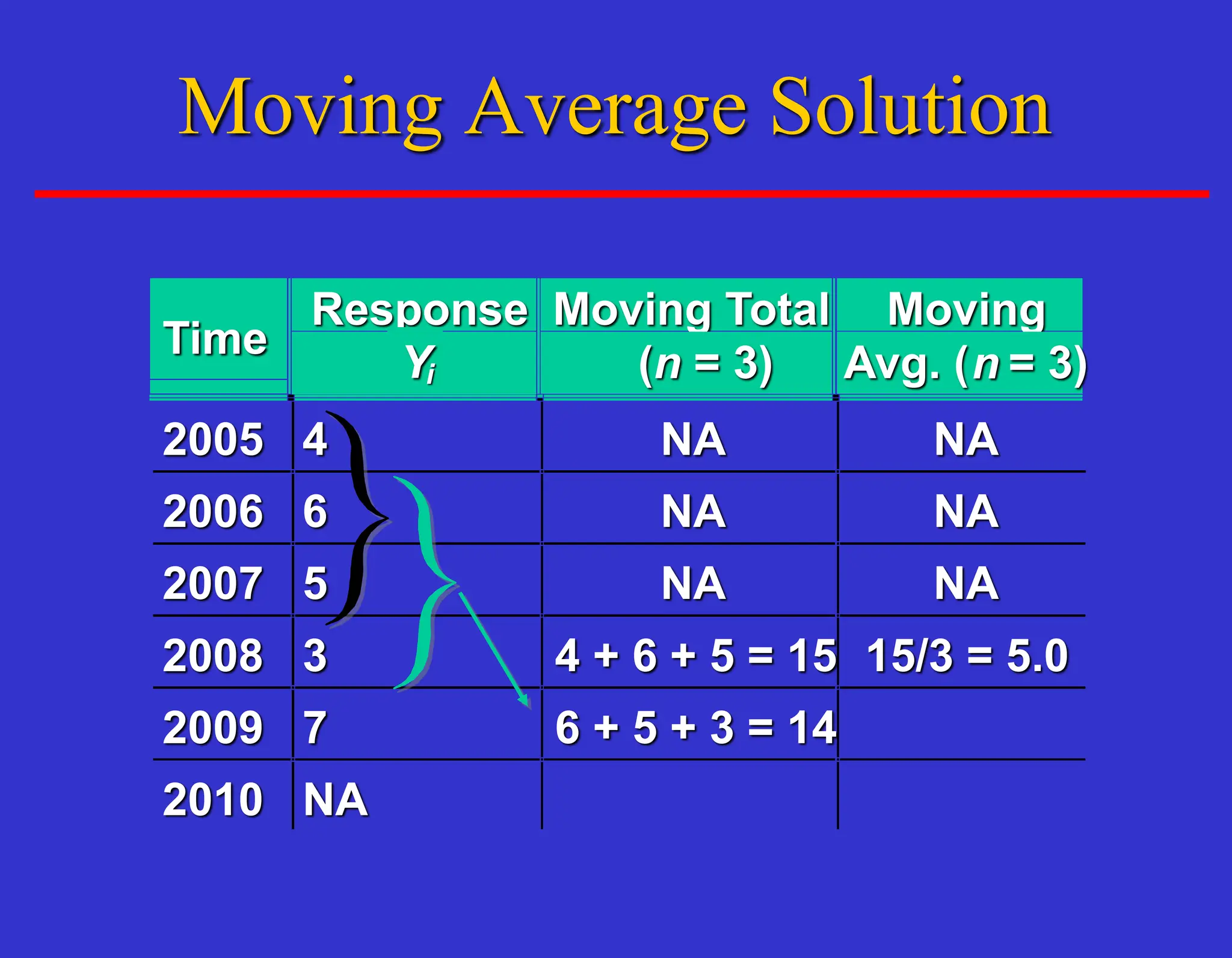

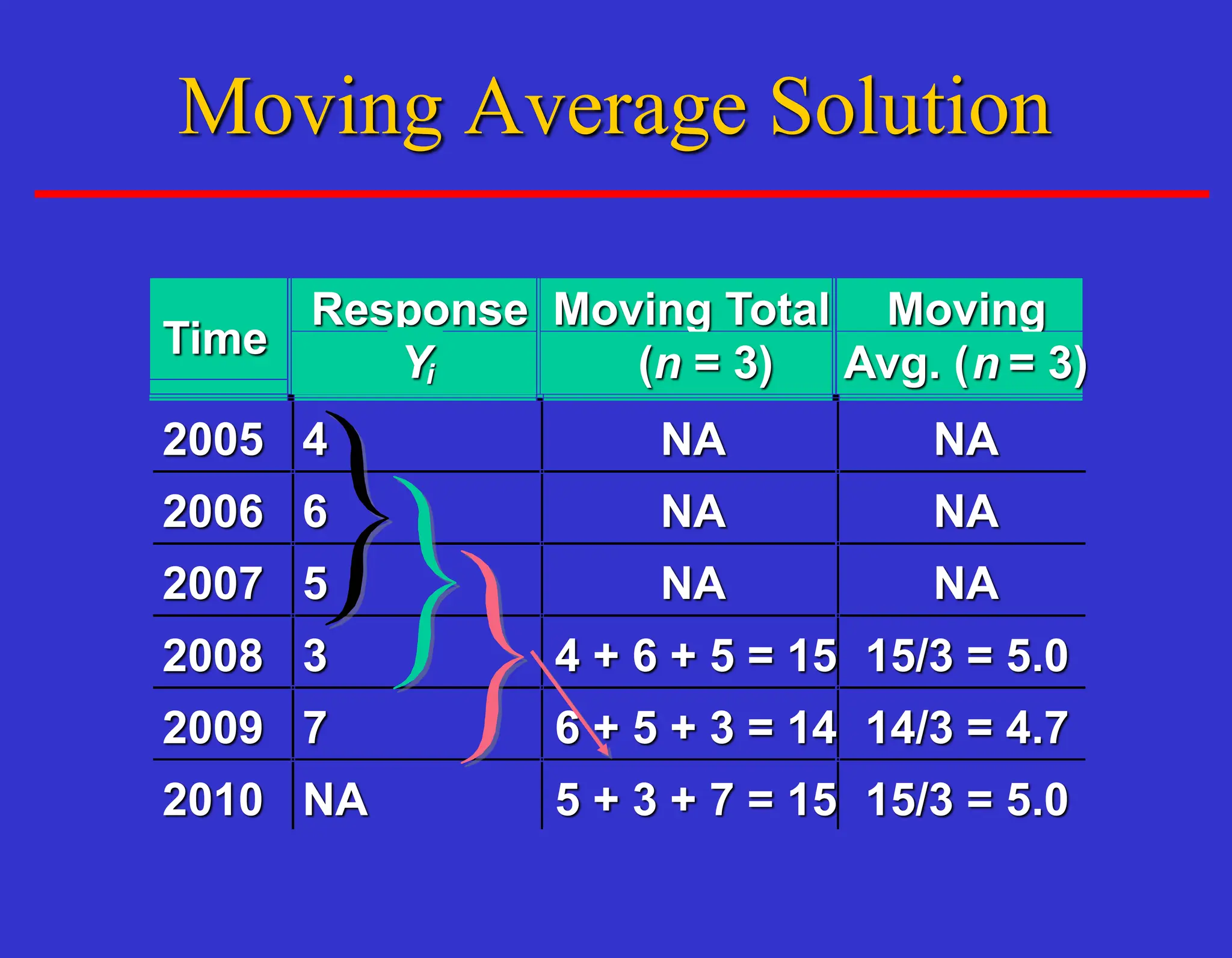

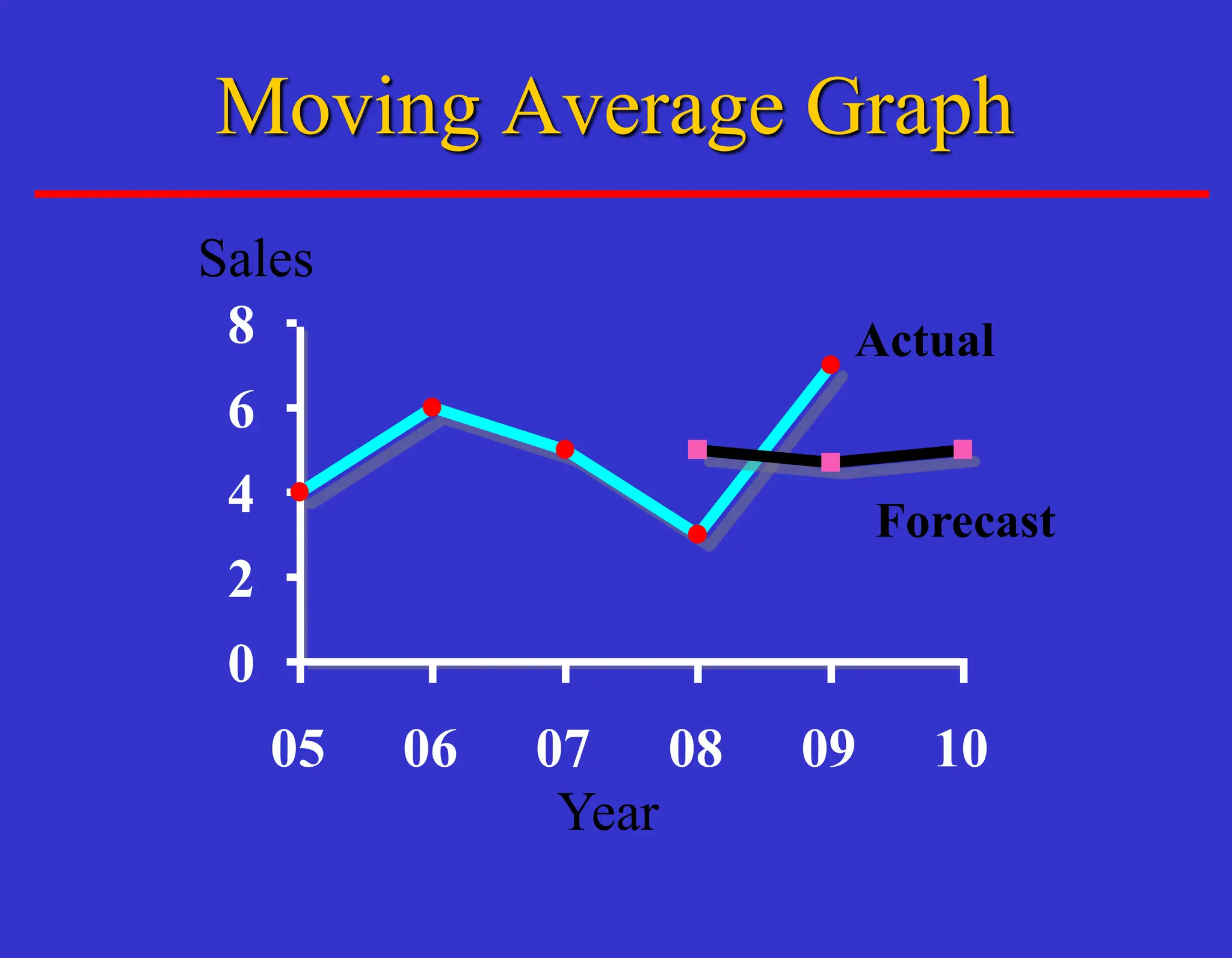

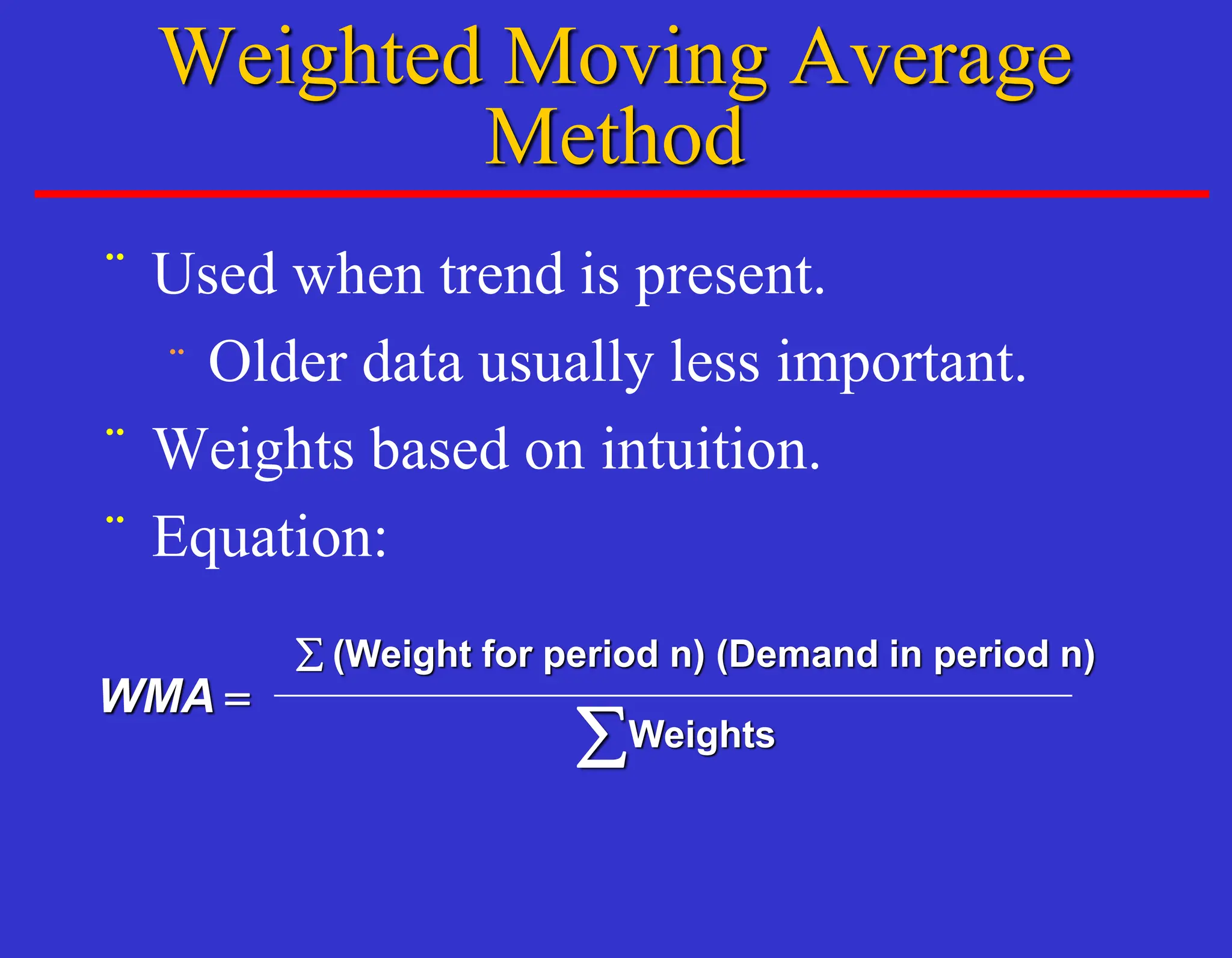

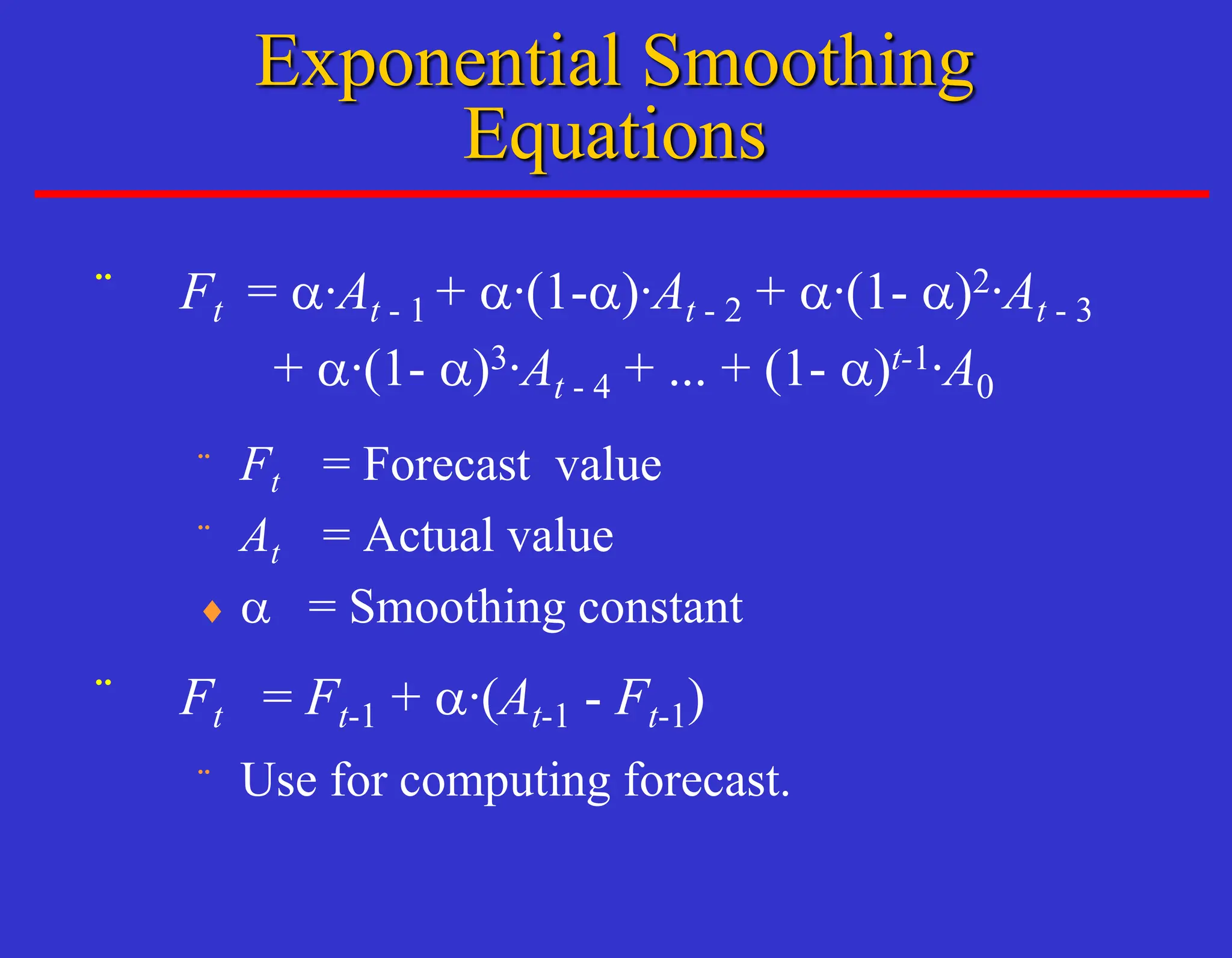

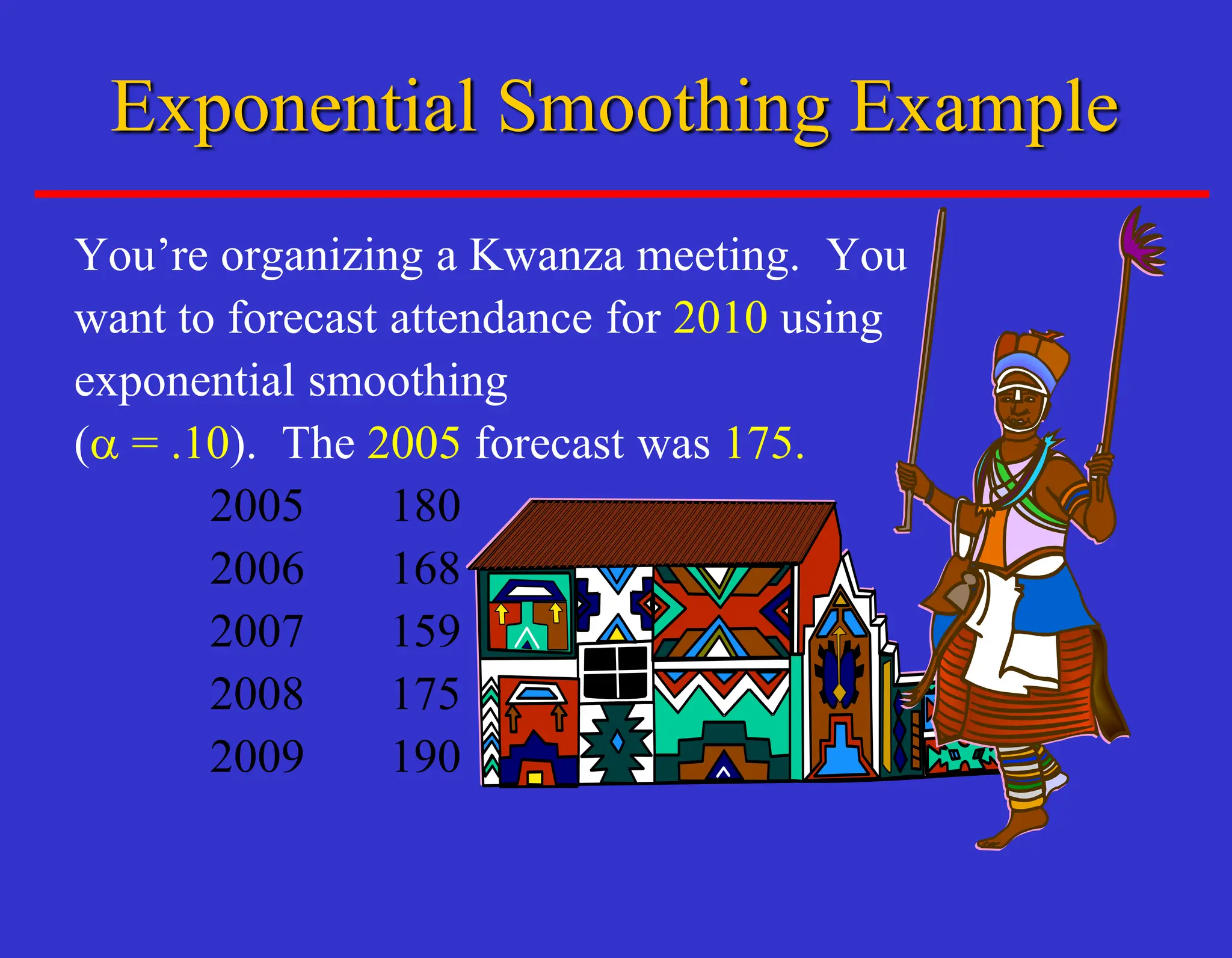

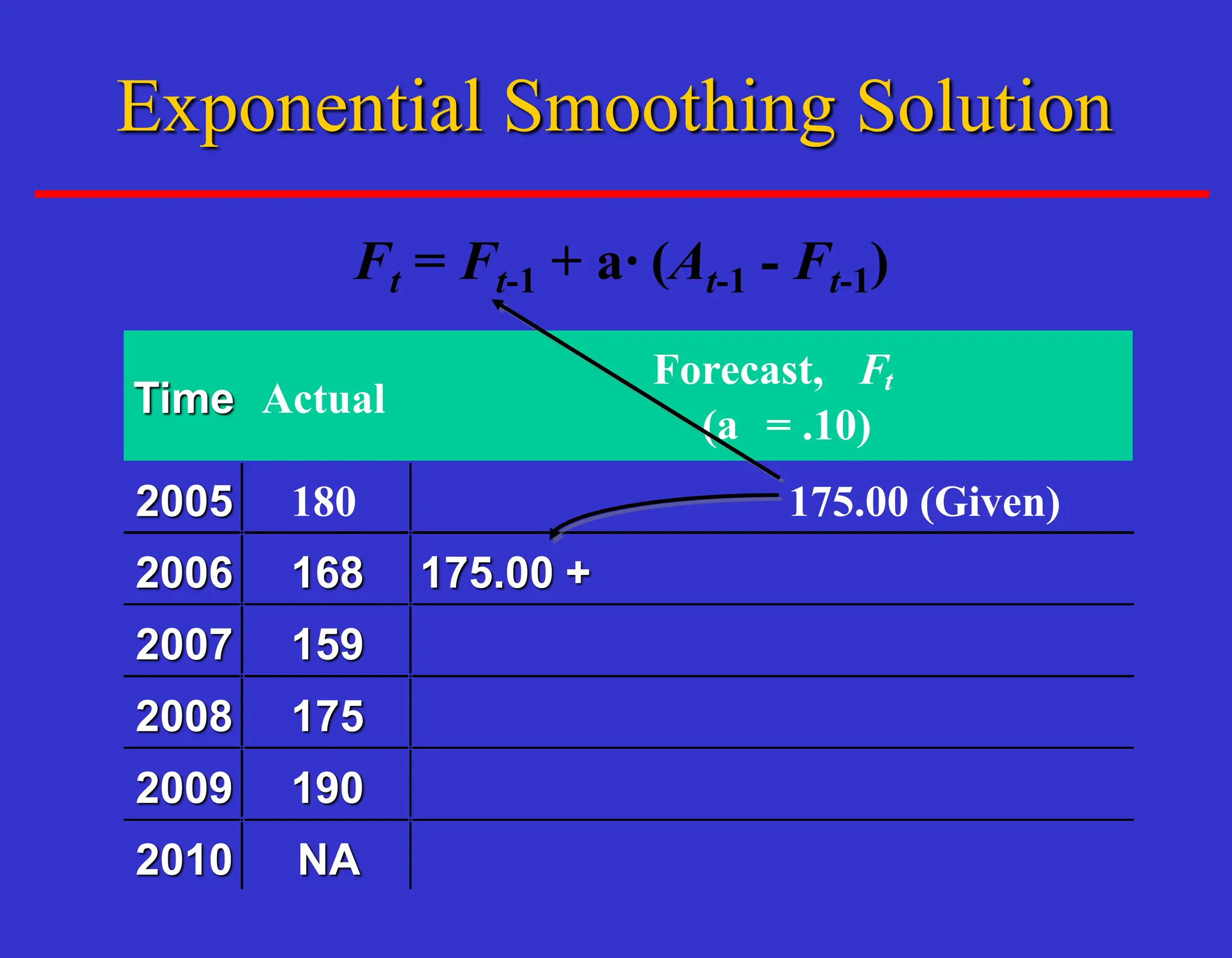

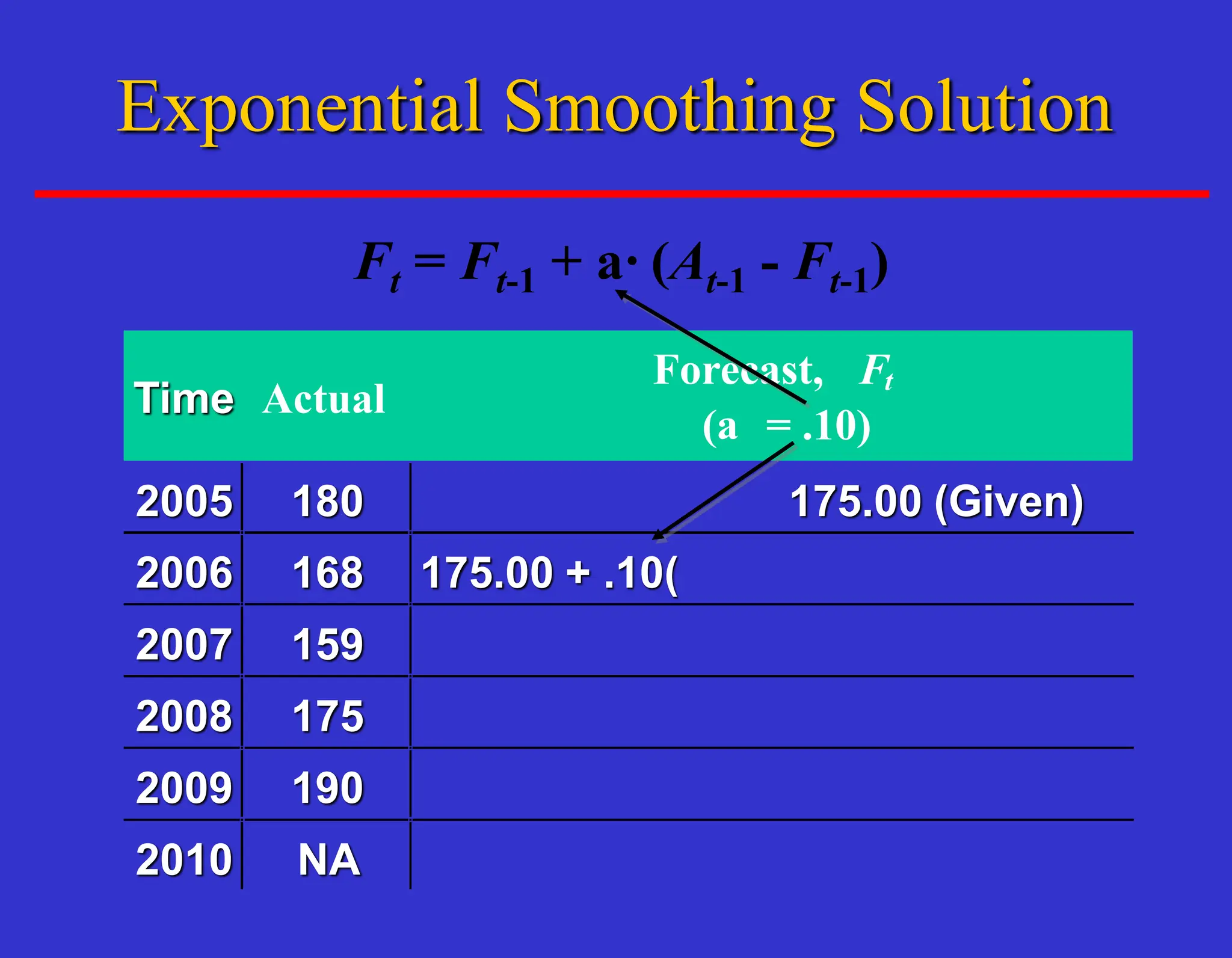

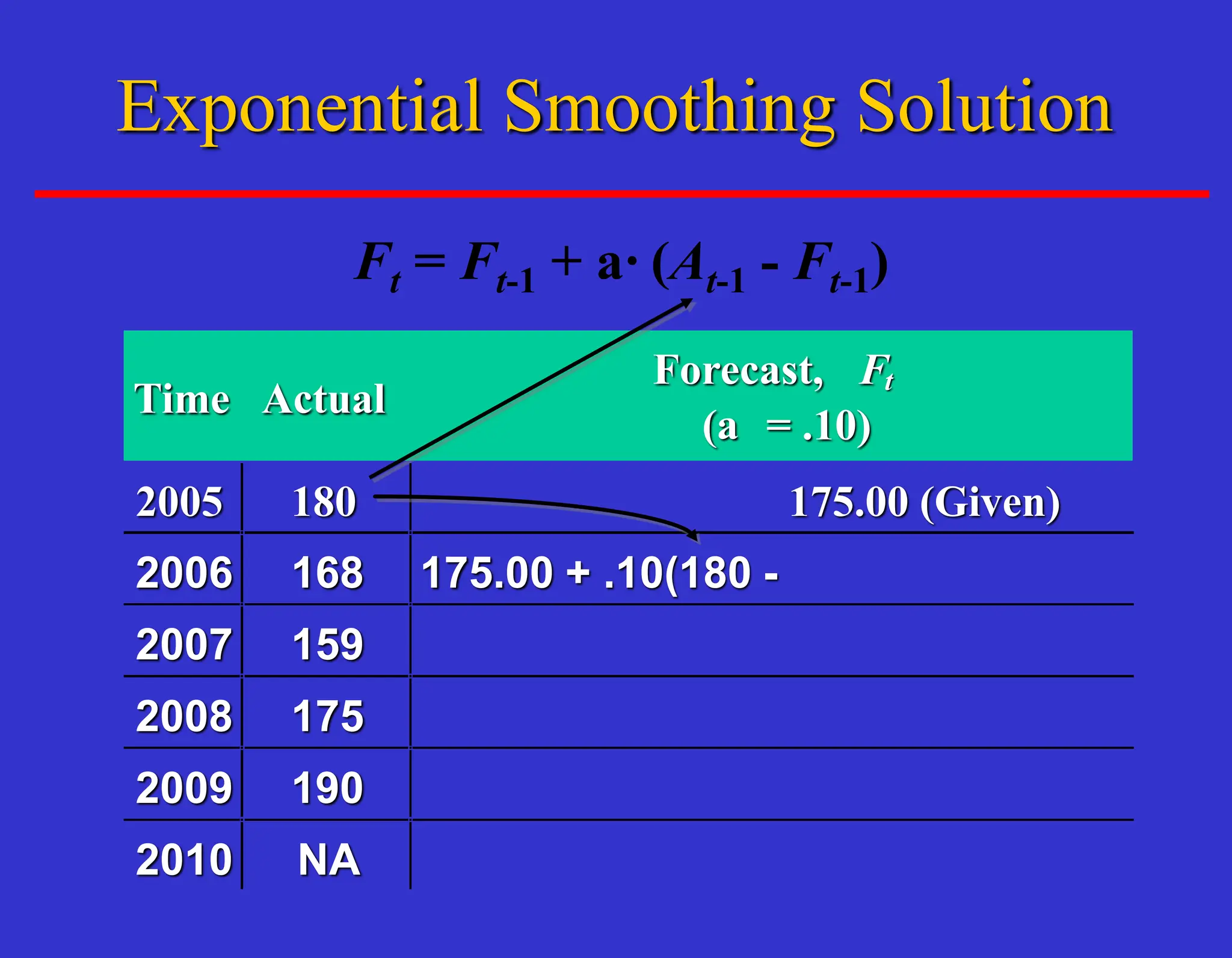

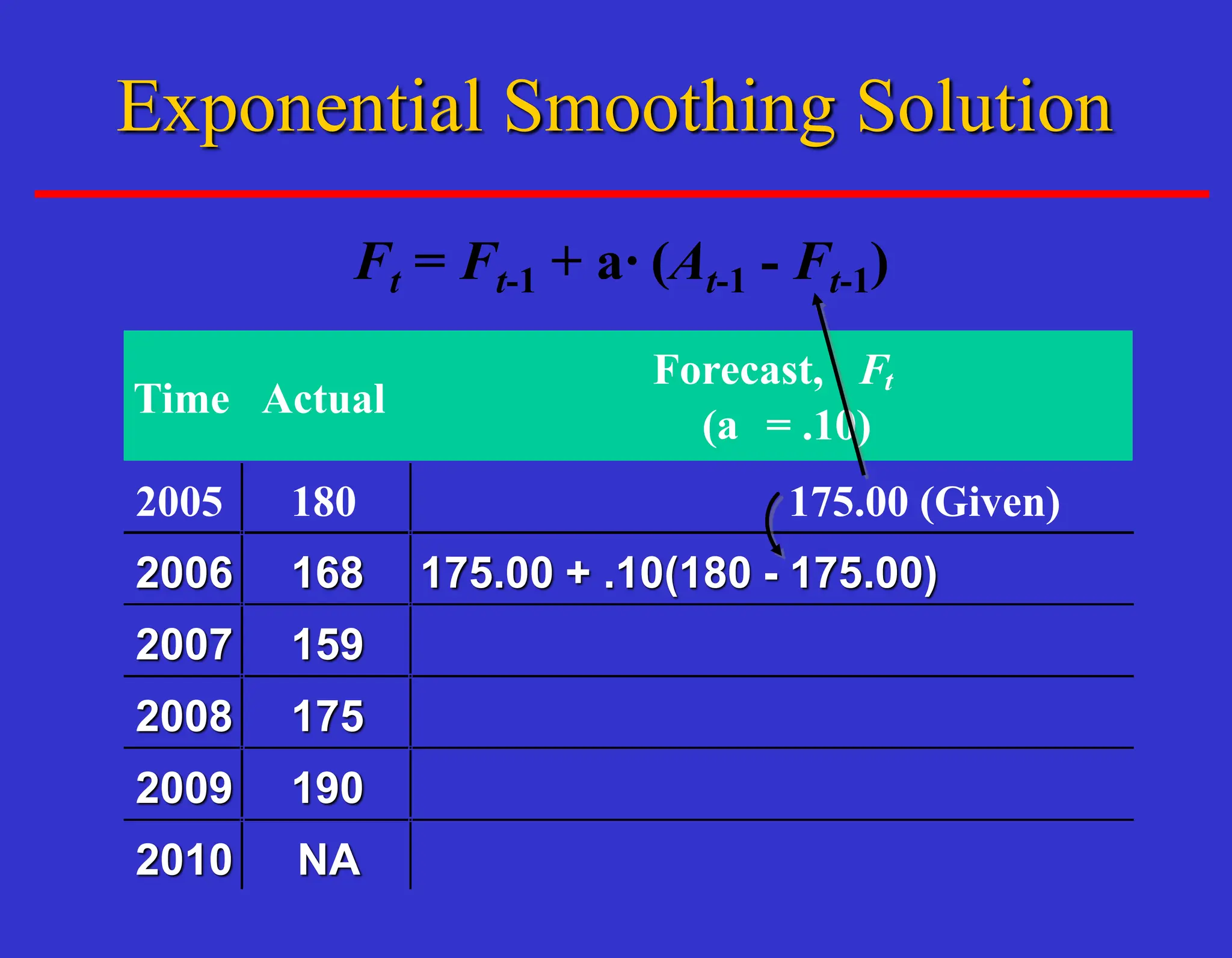

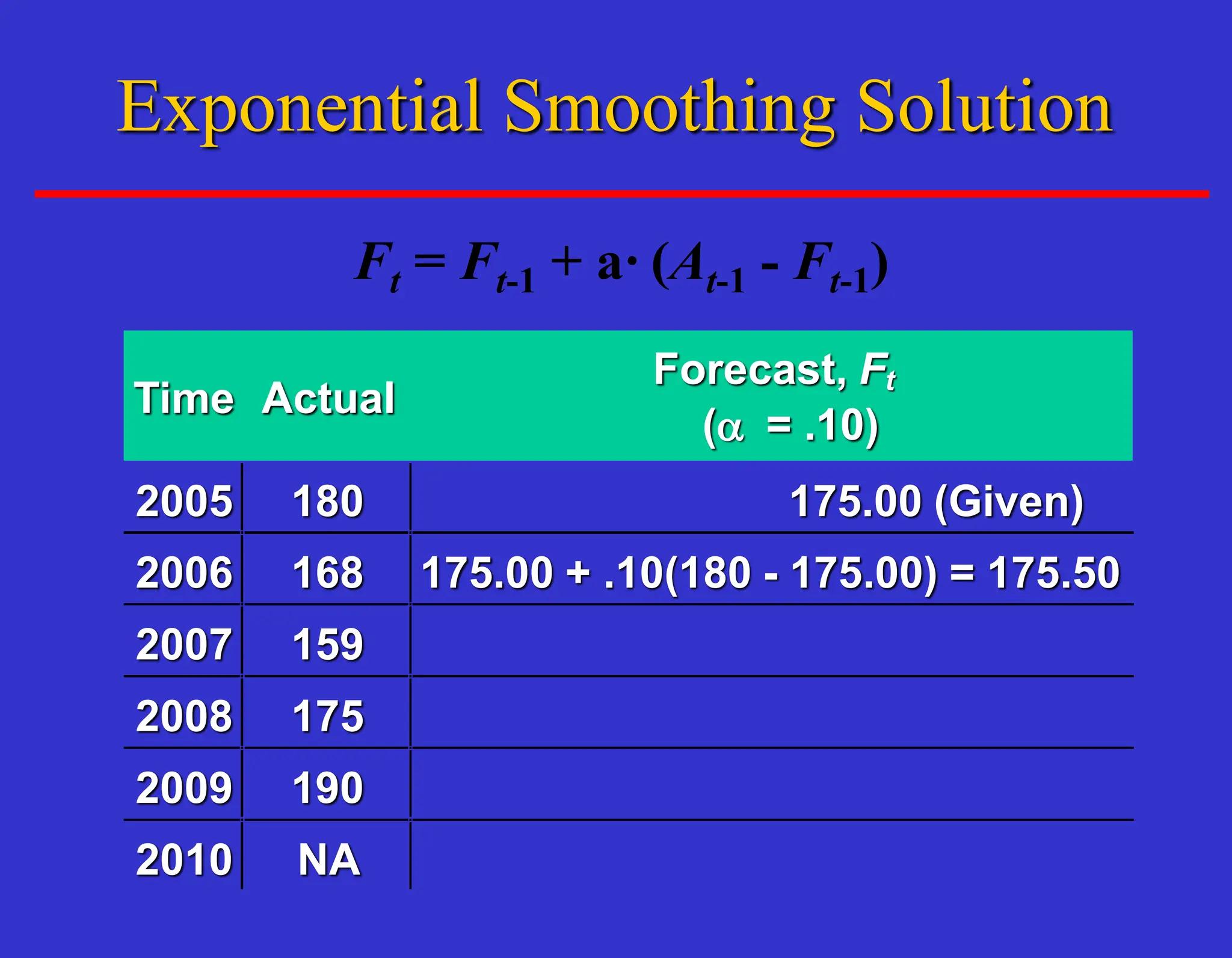

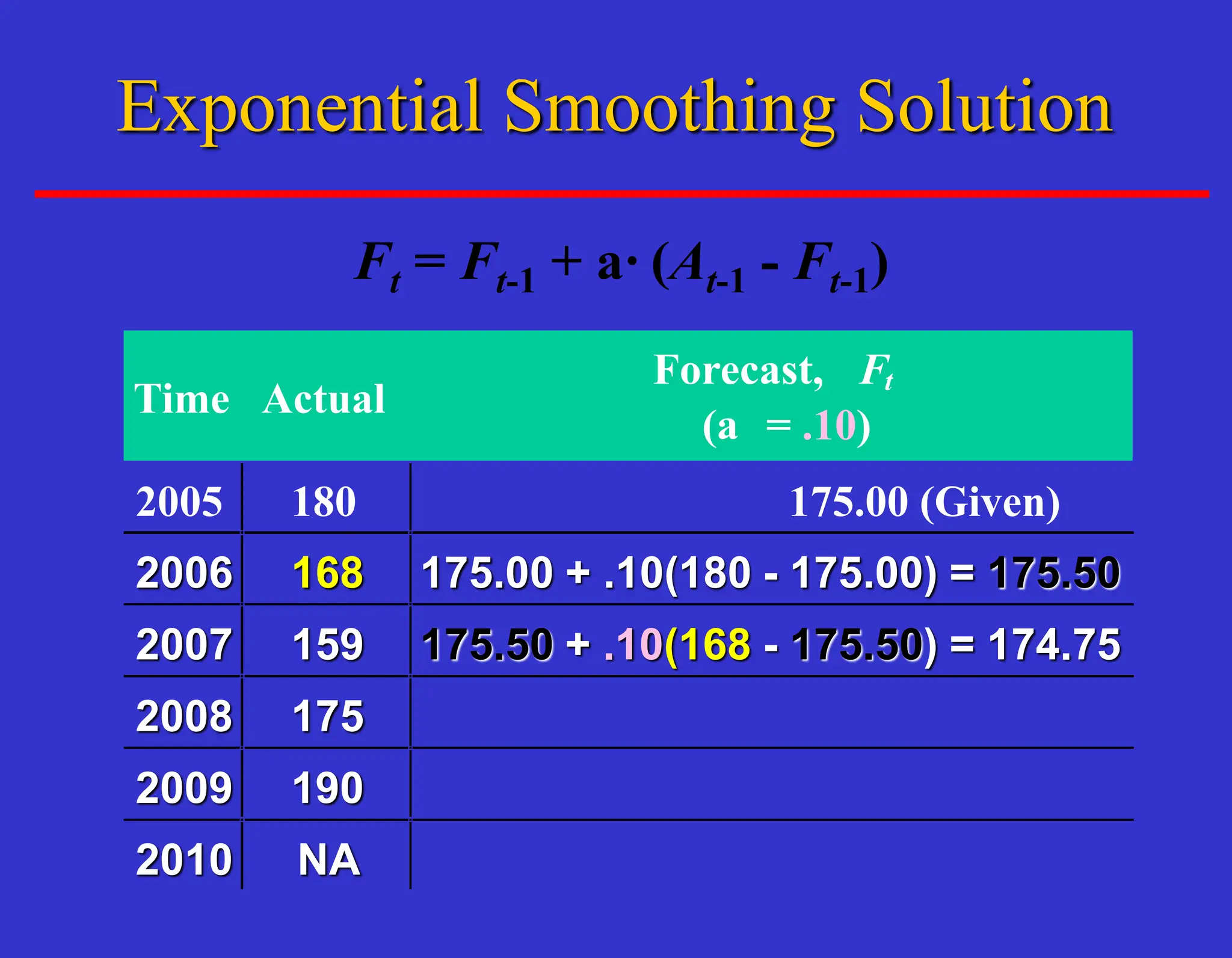

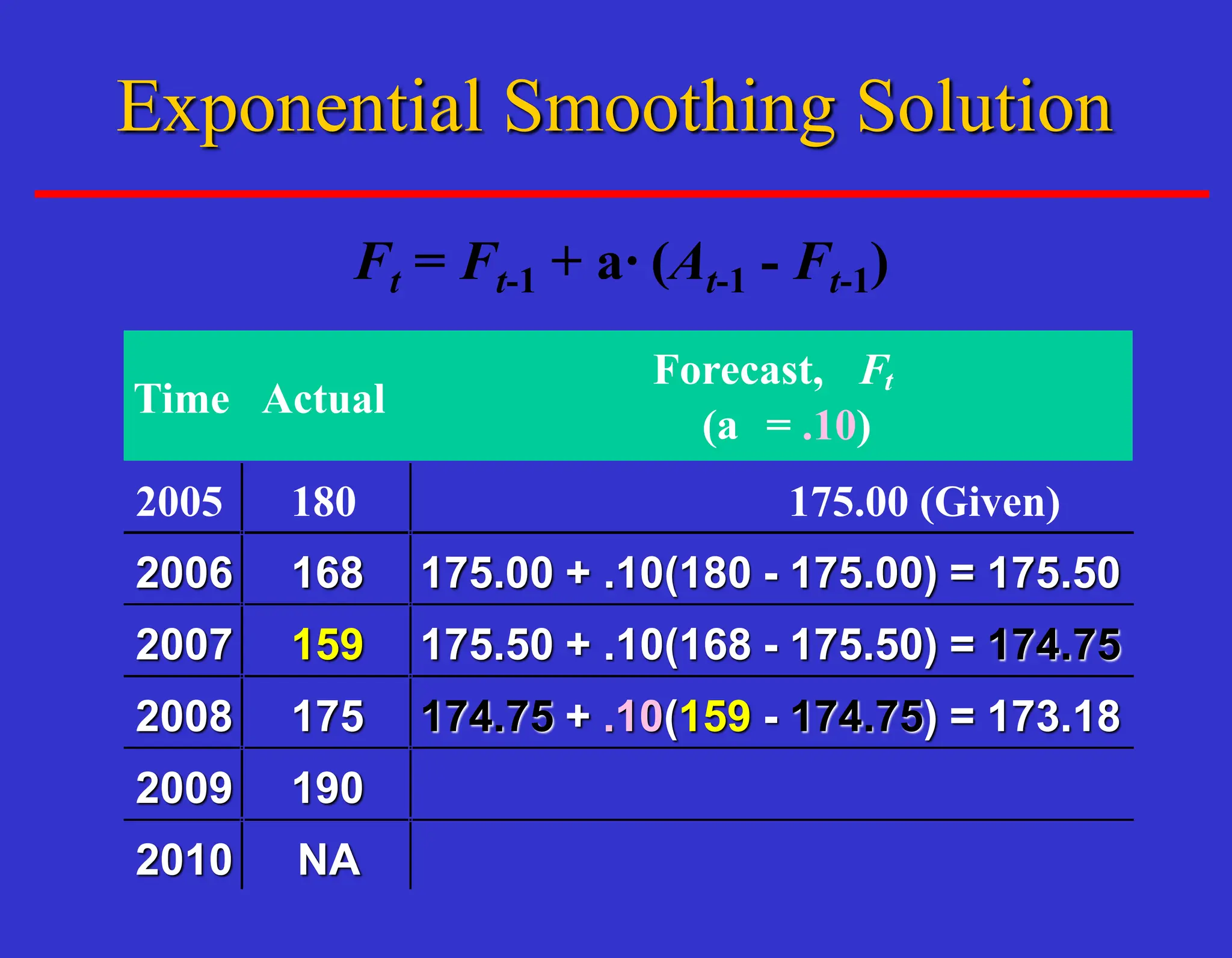

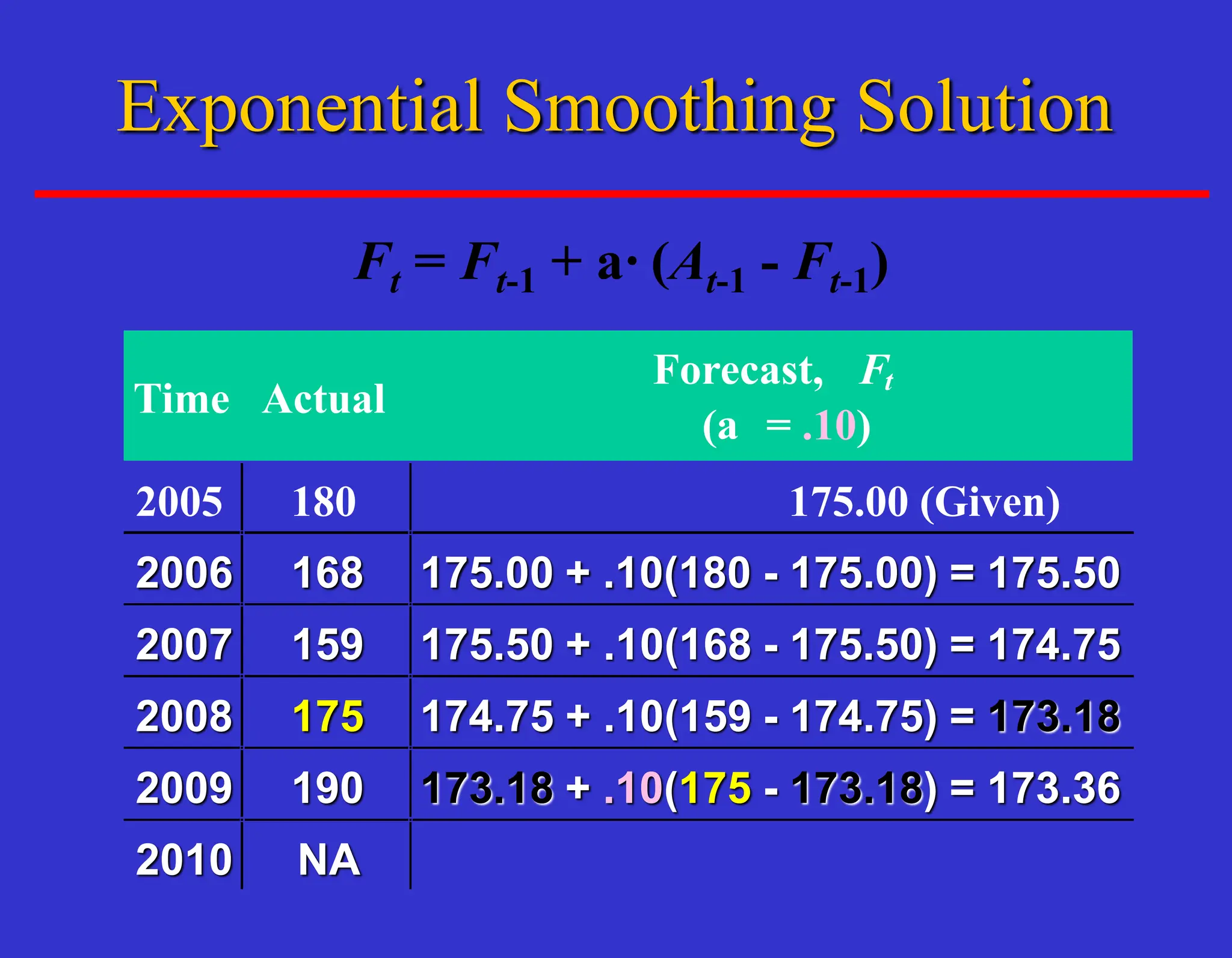

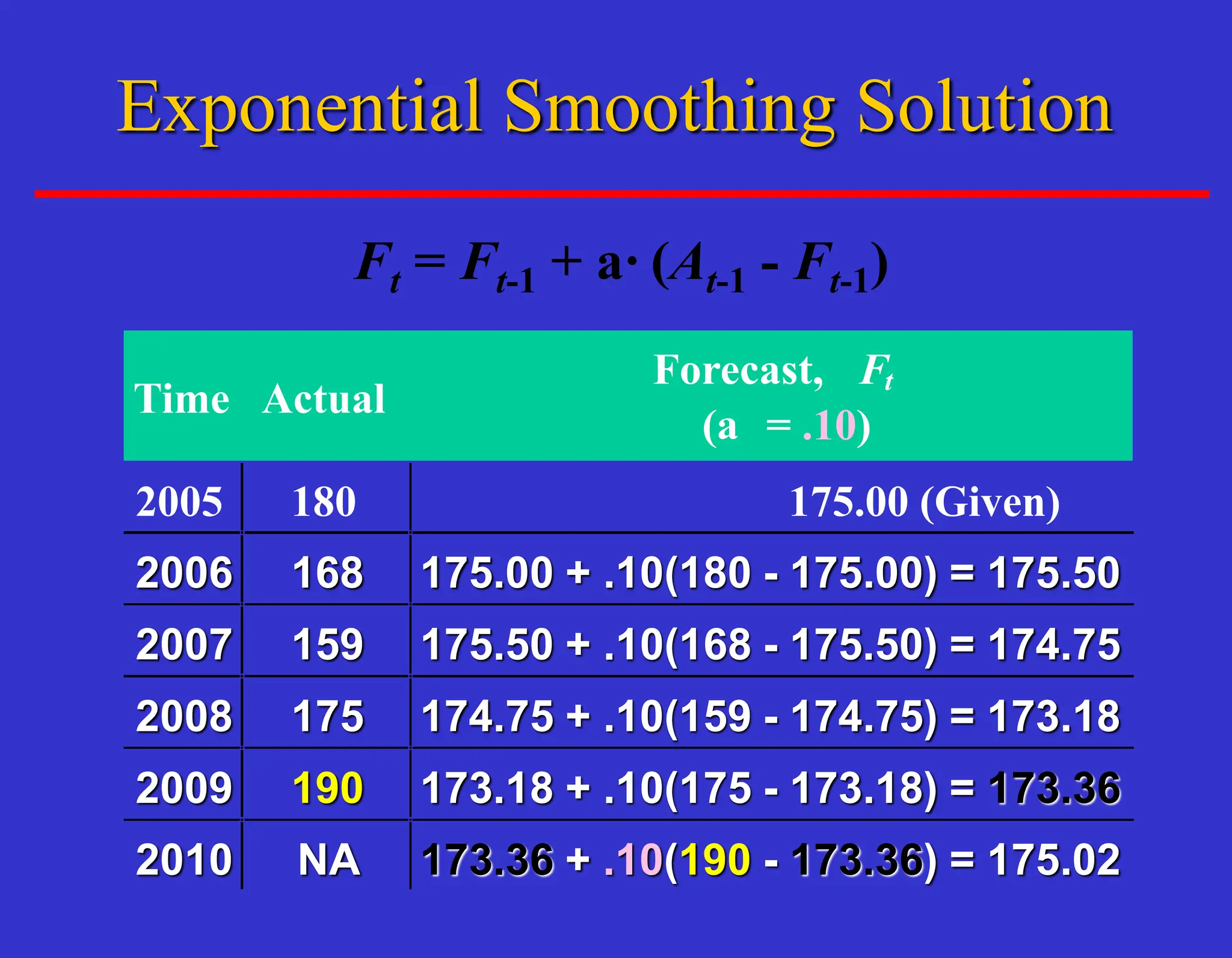

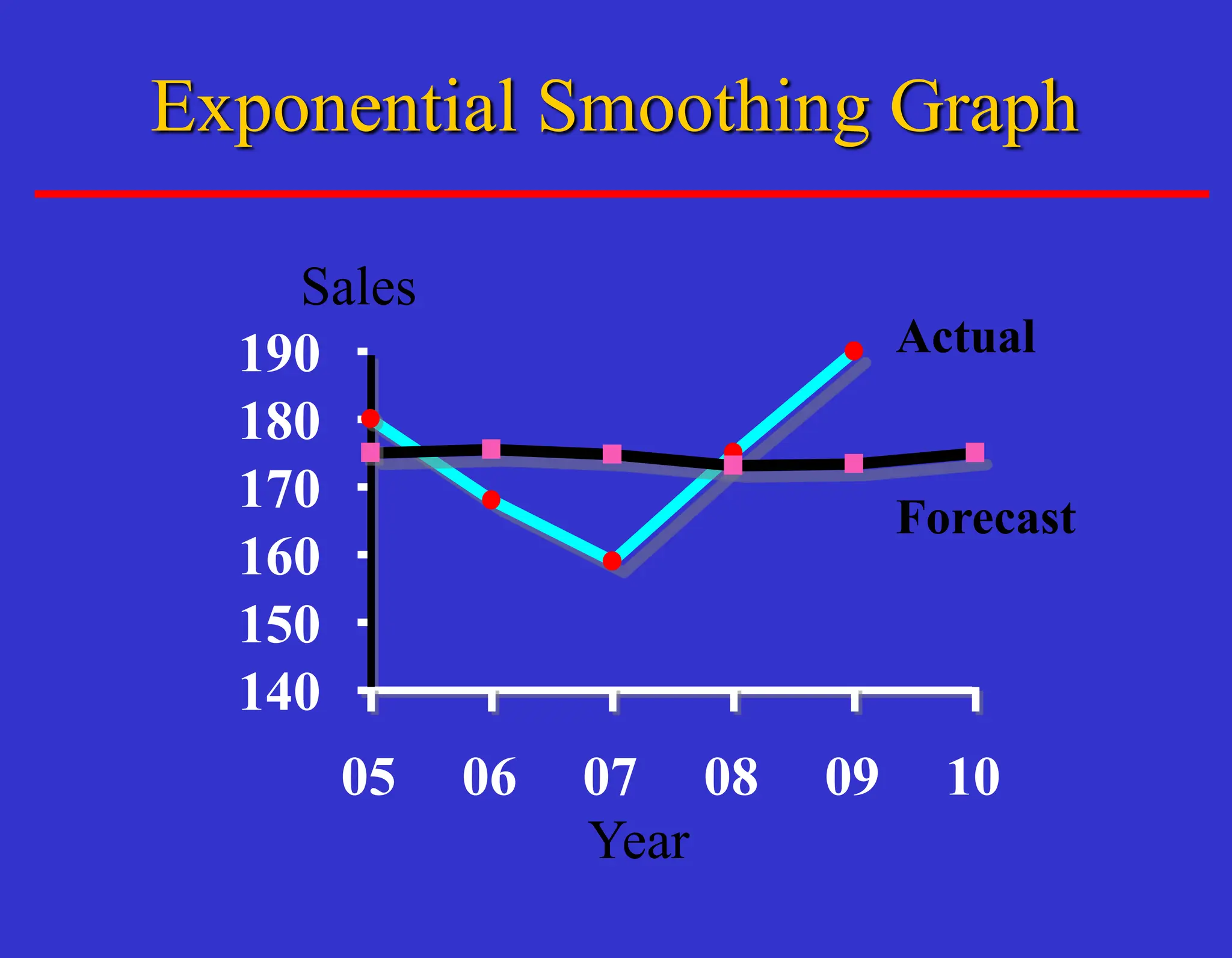

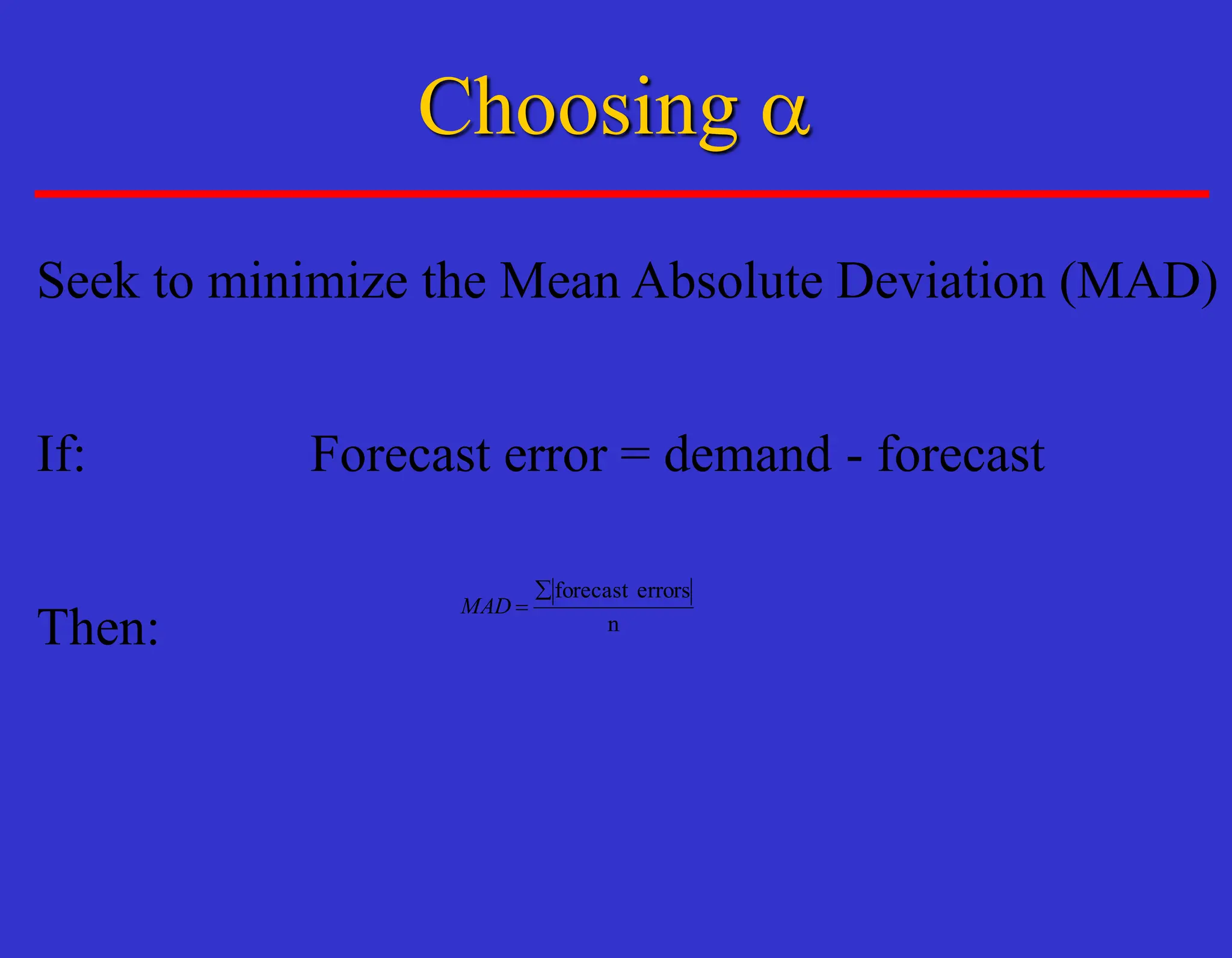

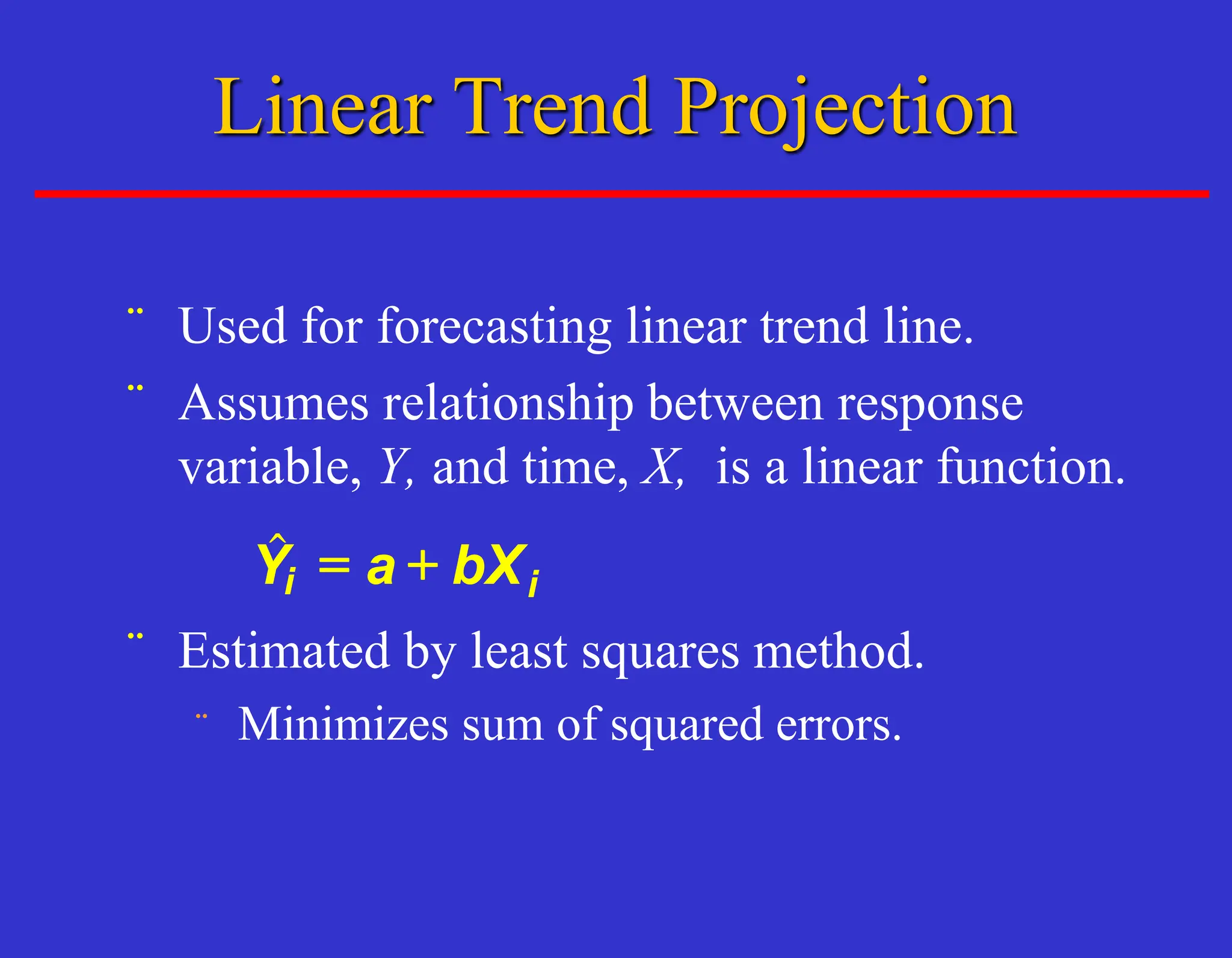

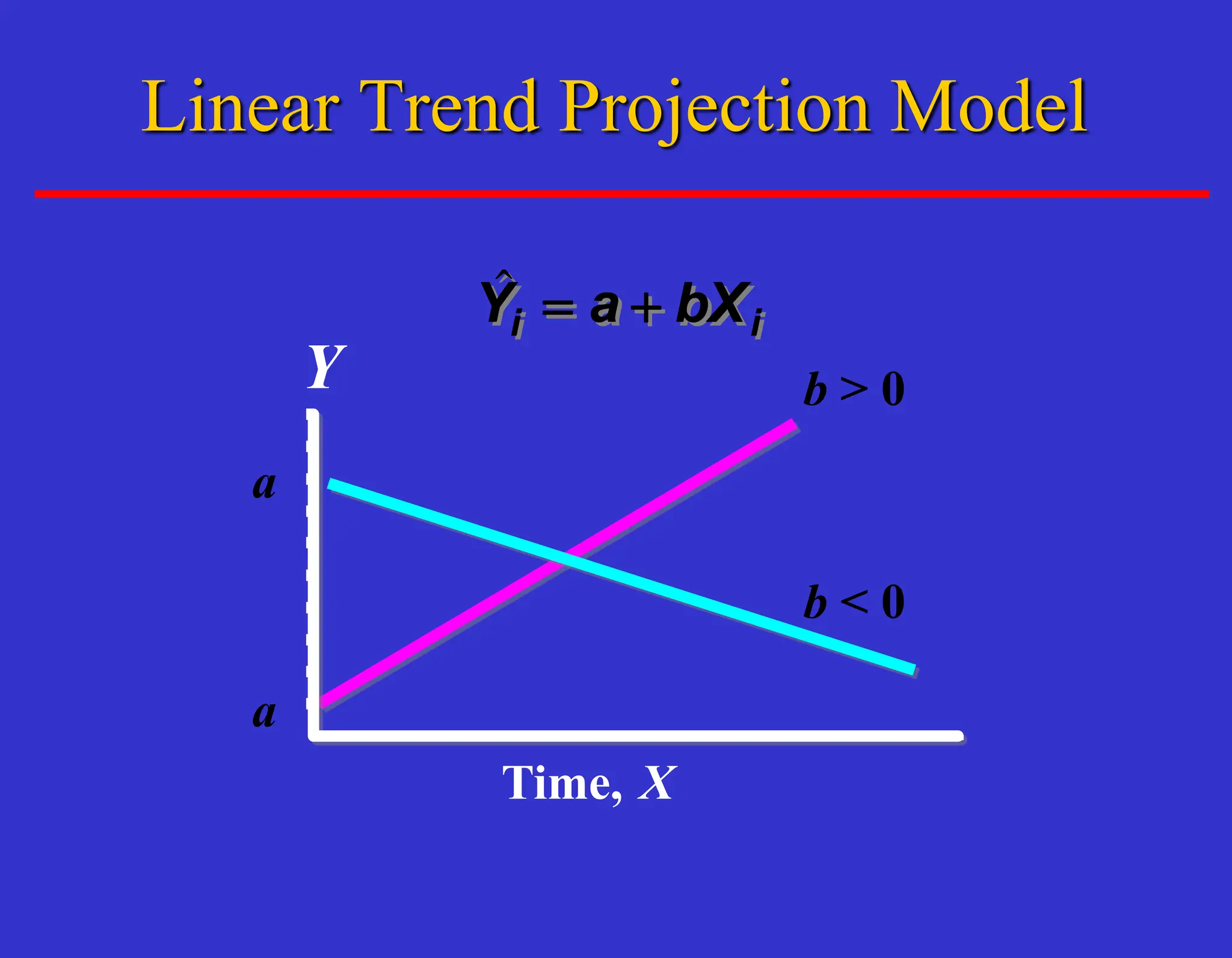

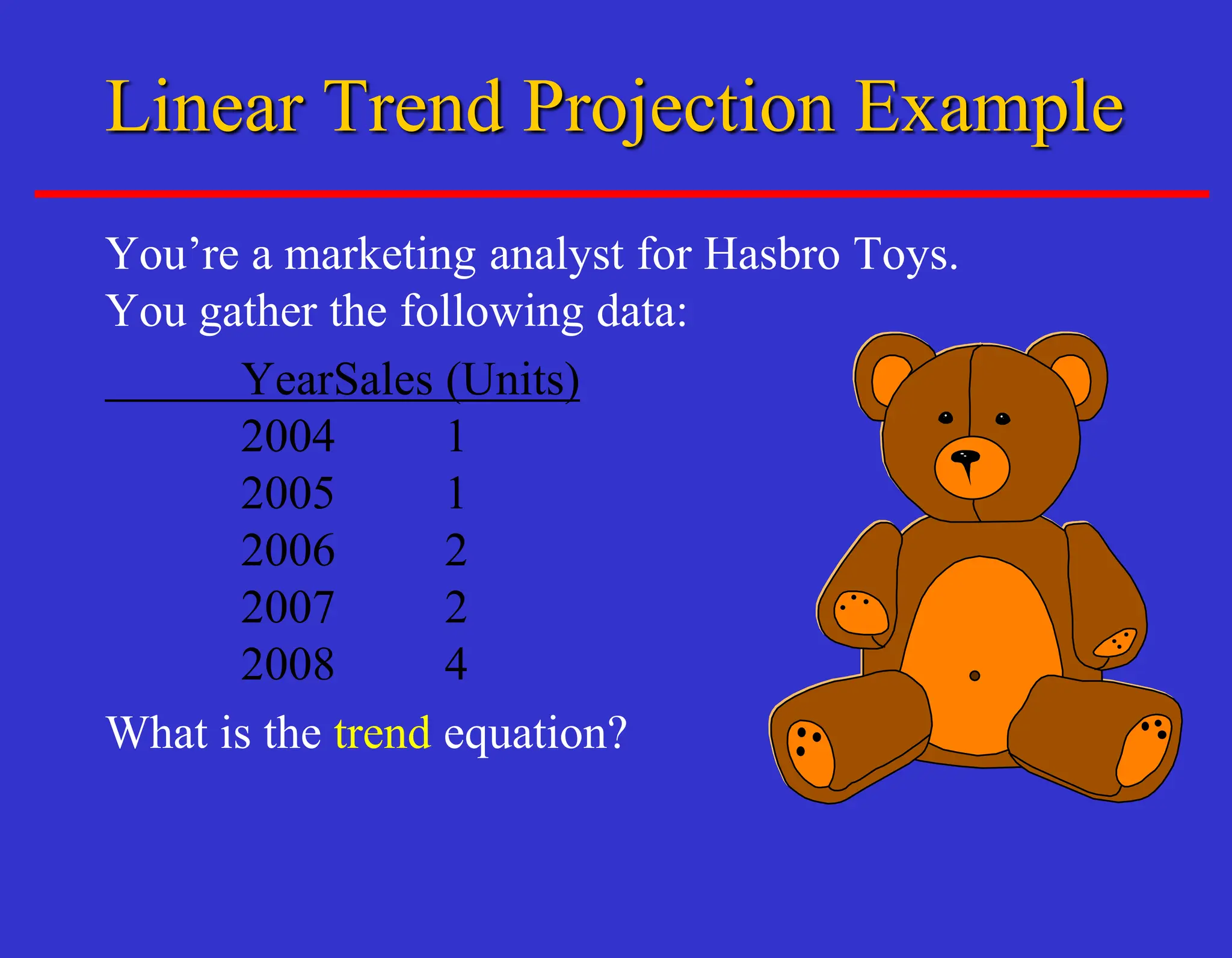

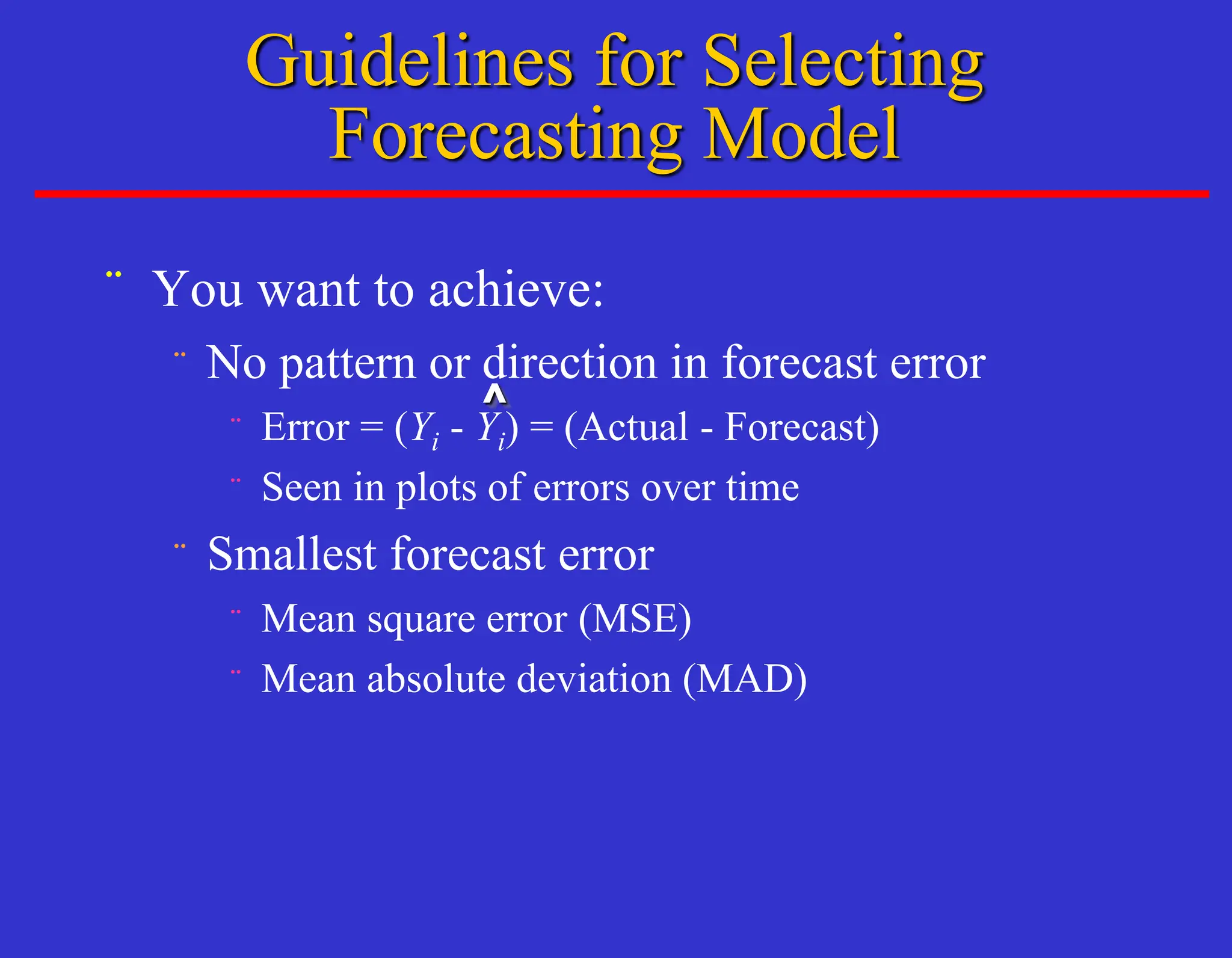

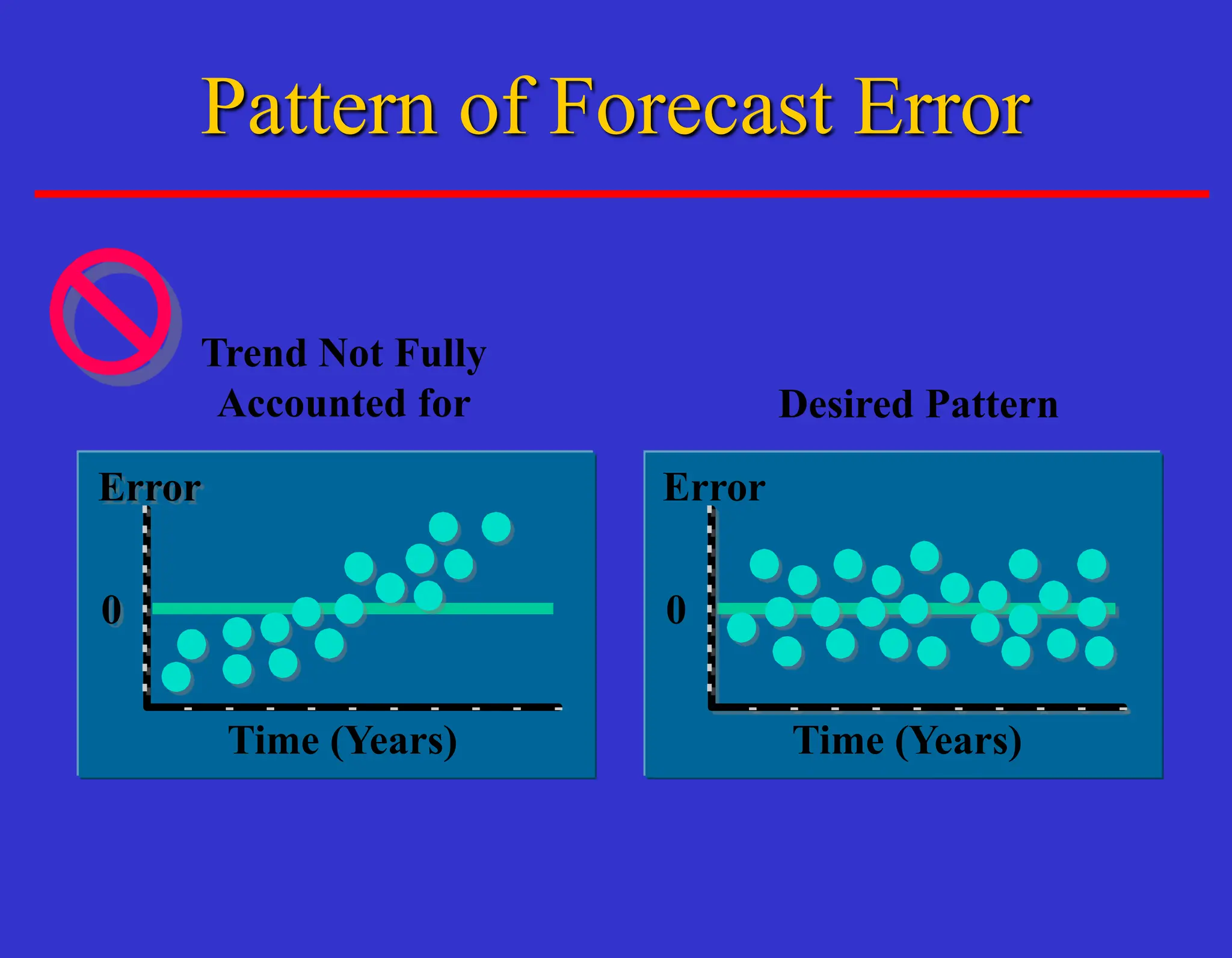

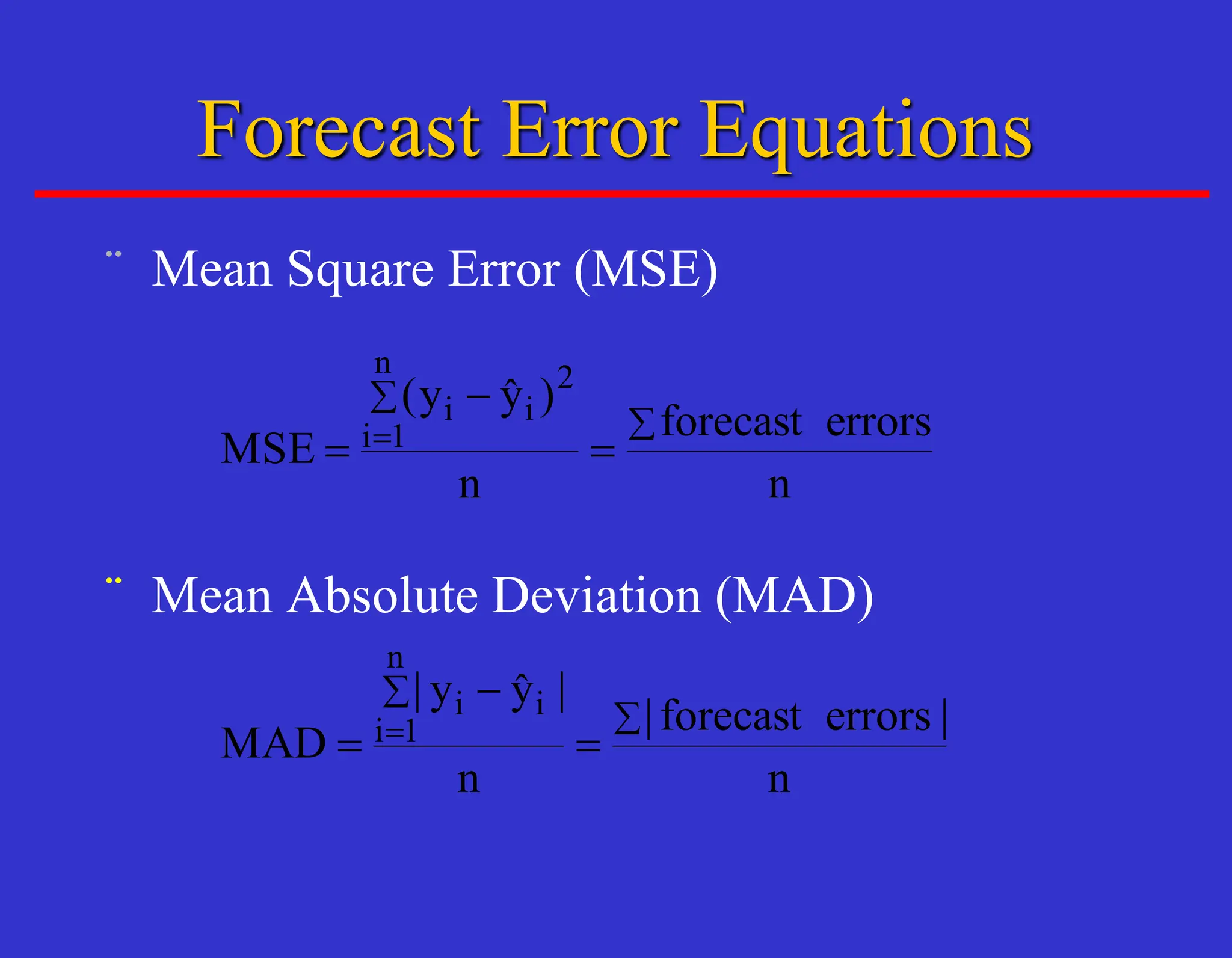

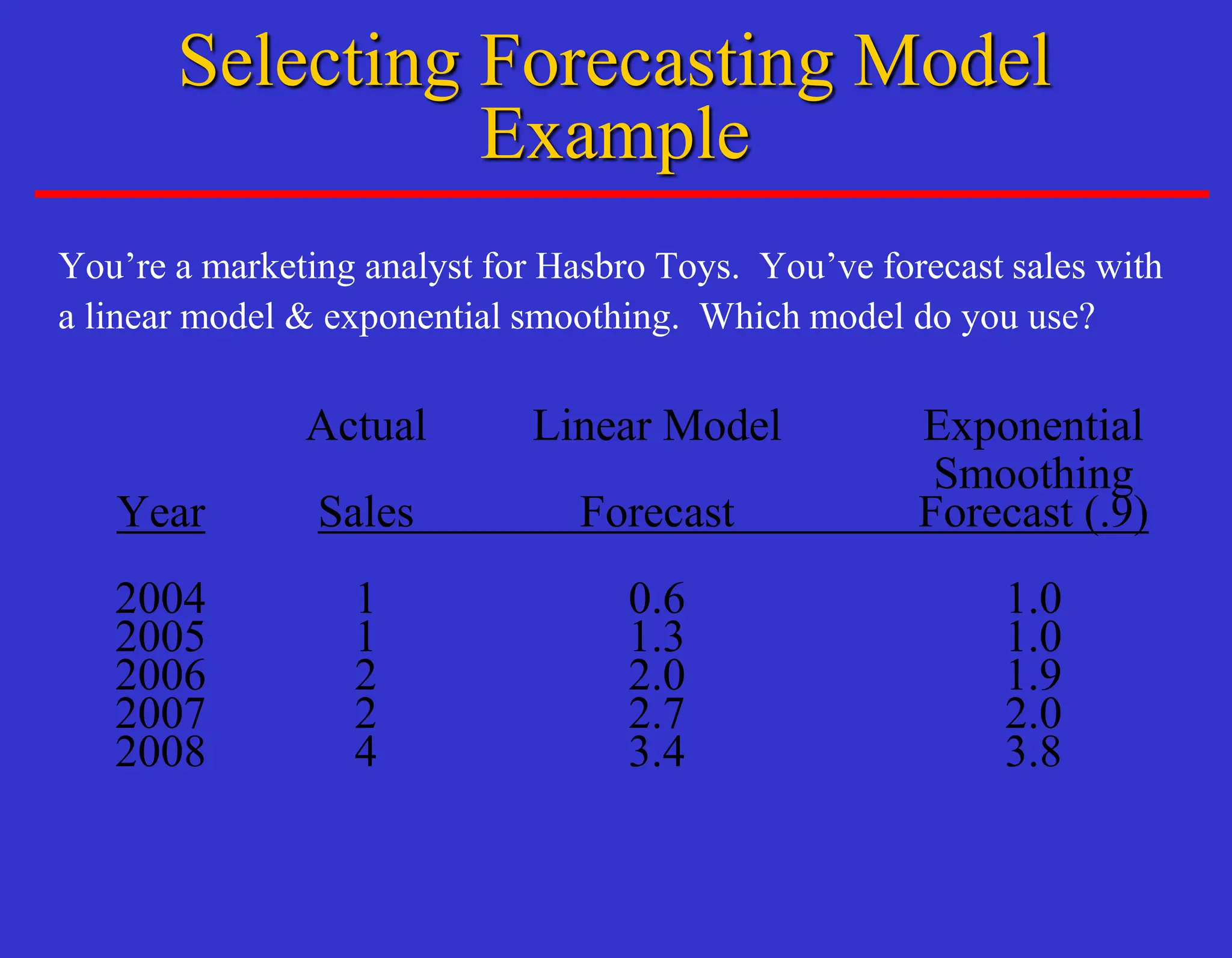

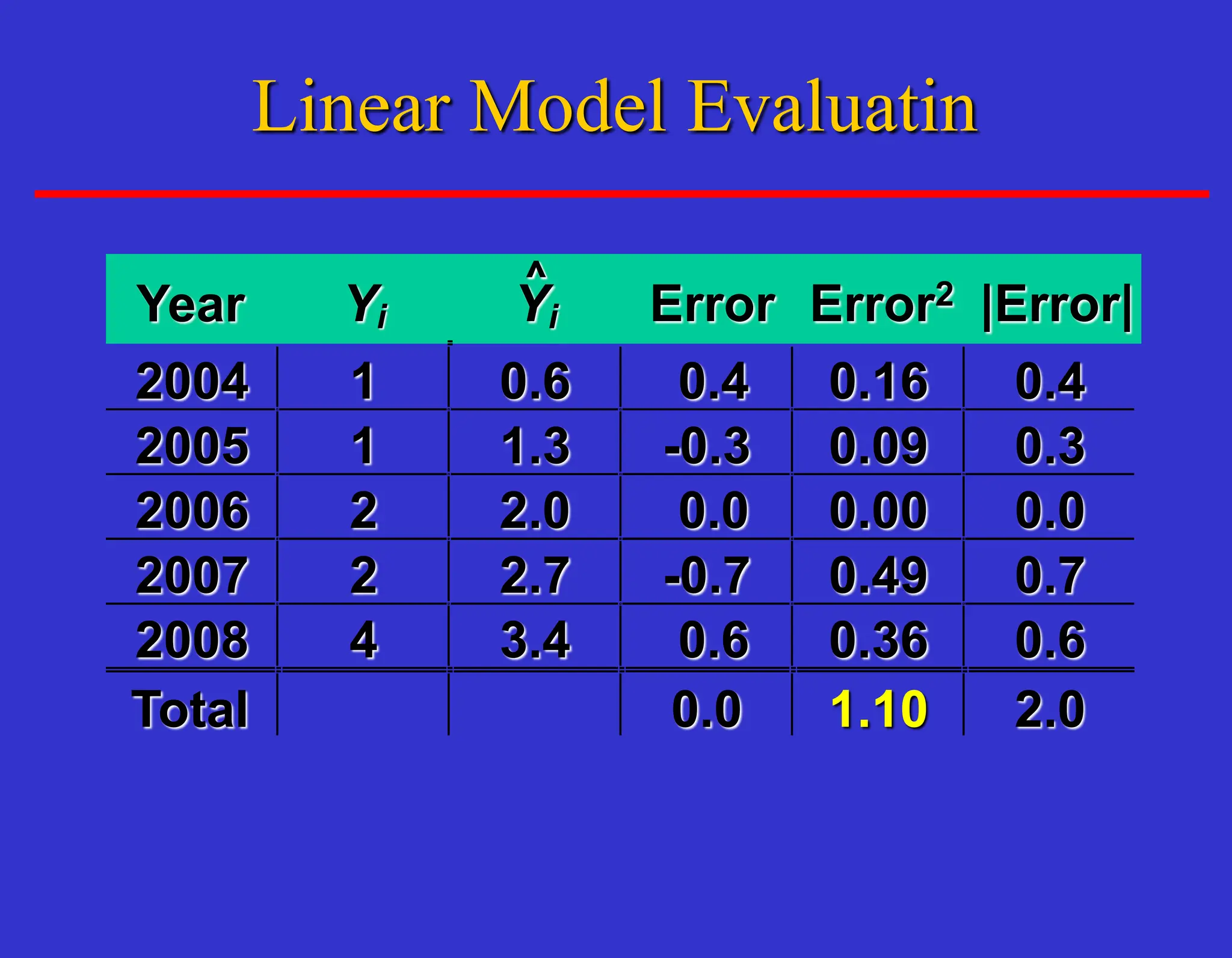

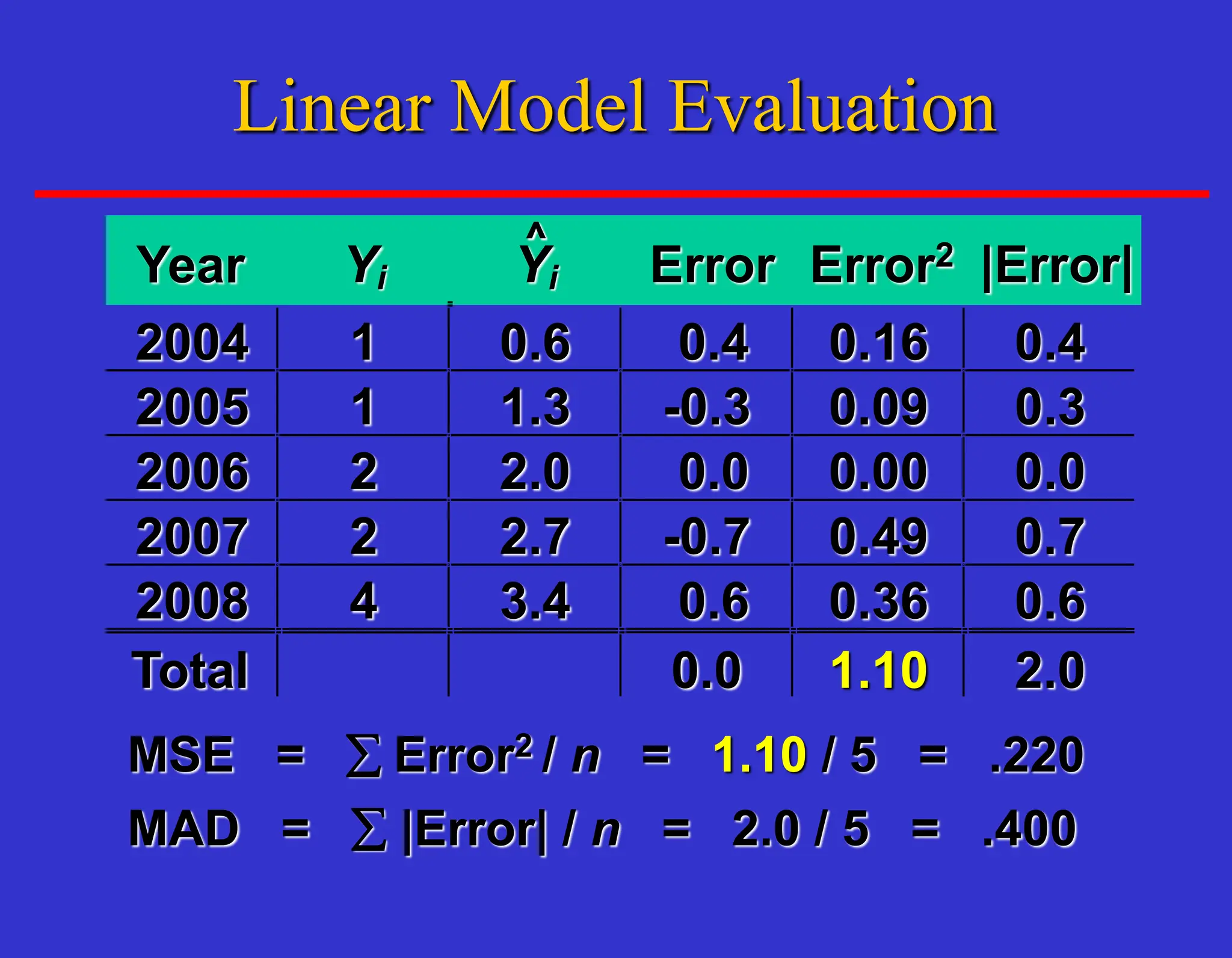

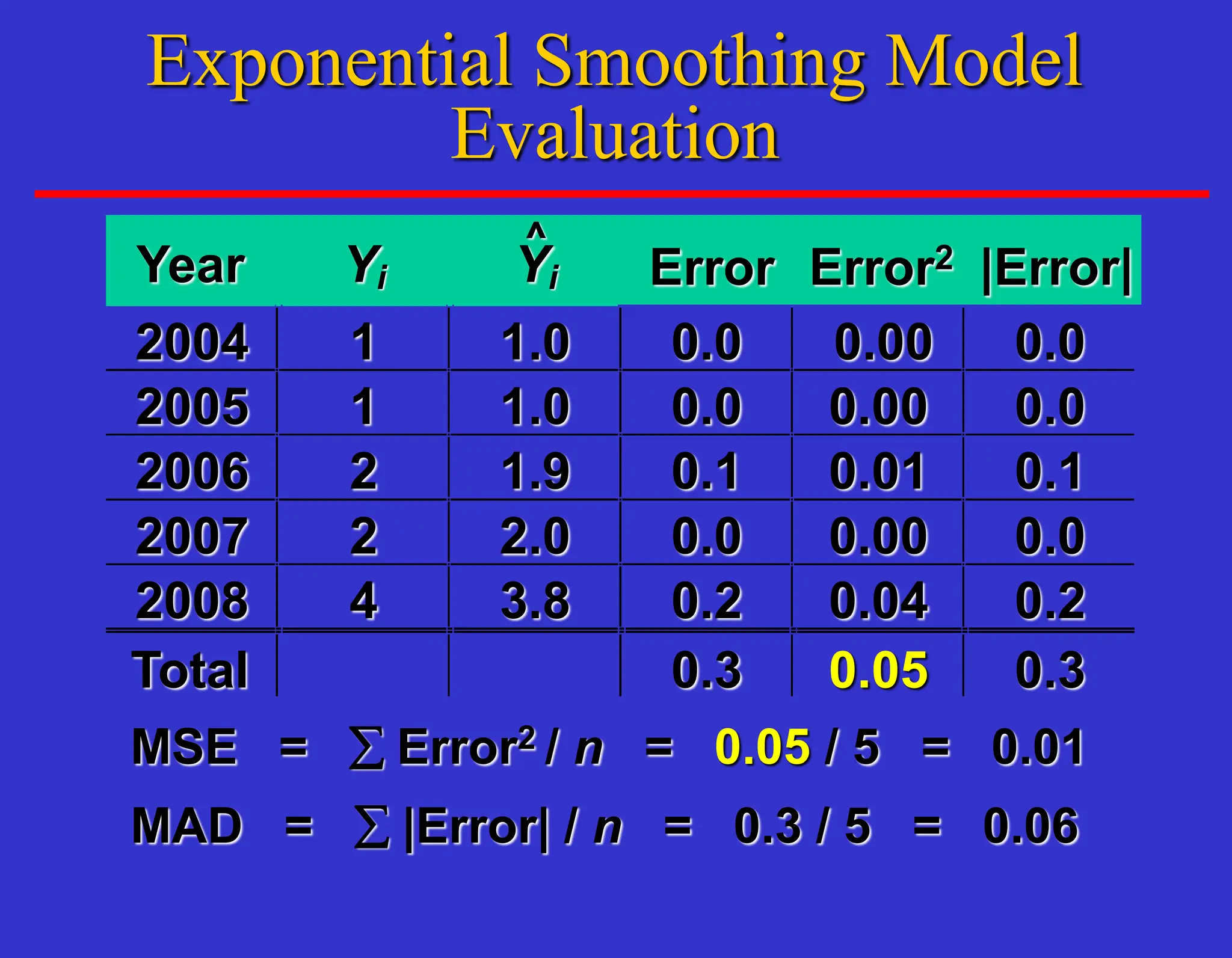

The document outlines forecasting methods in operations management used by Tupperware, detailing various types of forecasts (short, medium, long-range) and their relevance to business decisions such as sales, production, and staffing. It discusses different forecasting methodologies including qualitative methods like the jury of executive opinion and quantitative approaches such as moving averages and exponential smoothing. The importance of understanding product life cycles and the limitations of forecasting accuracy are also highlighted.