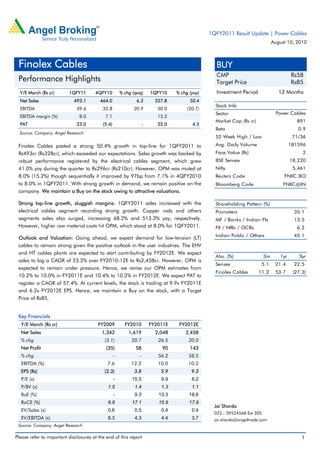

1) Finolex Cables reported a 50.4% year-over-year increase in net sales to Rs. 493.1 crore for the first quarter of FY2011, driven by strong growth in the electrical cables segment.

2) Operating margins declined to 8% from 15.2% in the prior year quarter due to higher raw material costs, though margins improved sequentially.

3) Net profit increased 4.5% year-over-year to Rs. 23 crore for the quarter despite margin pressure, with sales growth offsetting higher costs.