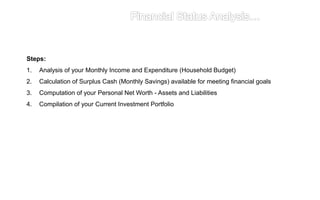

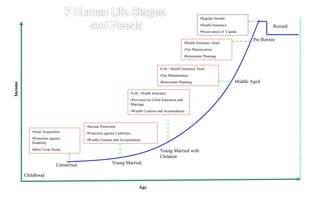

The document provides information on financial planning across different life stages in 4 steps:

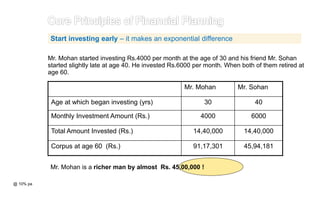

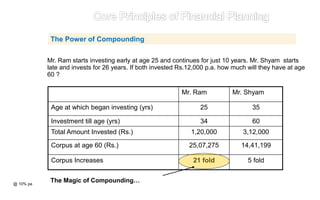

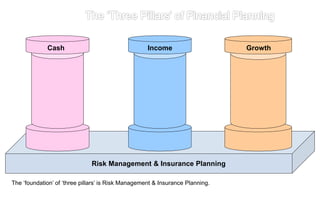

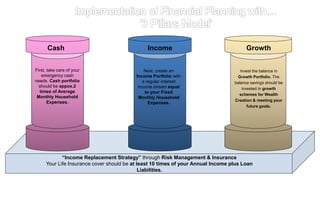

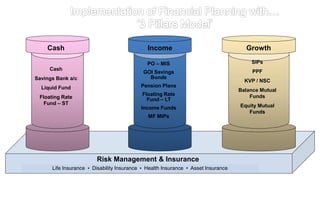

1) Analyzing current financial status, 2) Setting financial goals, 3) Developing a plan to achieve goals, and 4) Regularly reviewing progress. It emphasizes the importance of starting financial planning early to benefit from compounding returns over time. Various strategies are outlined for savings, investment, risk management, taxation, and retirement planning to work towards financial independence.