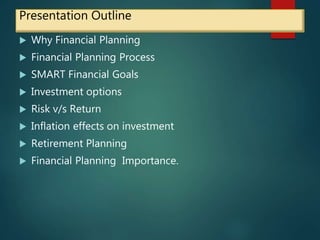

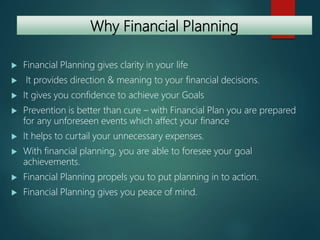

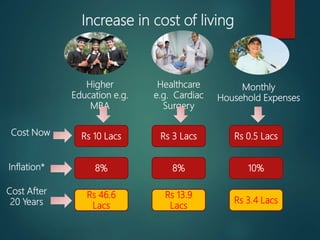

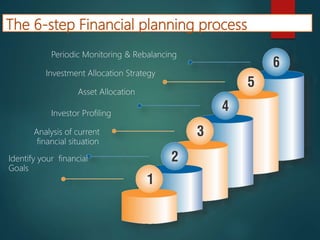

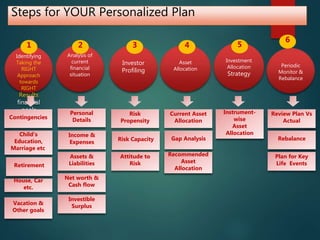

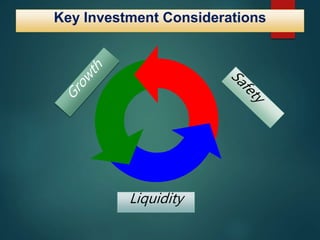

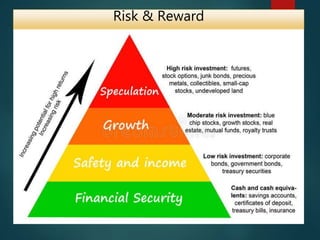

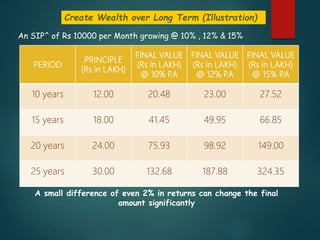

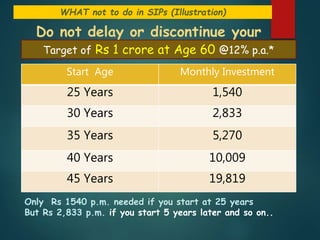

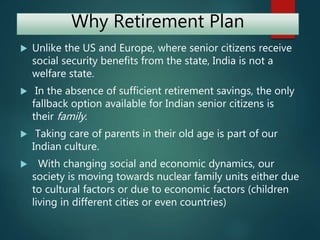

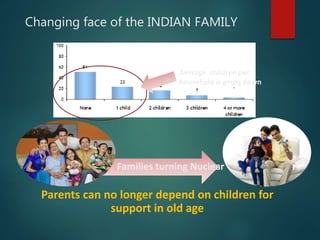

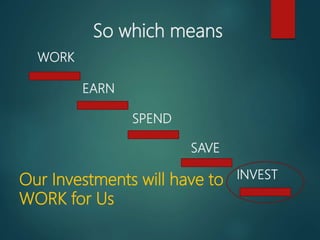

The document outlines the importance of financial planning, emphasizing its role in helping individuals achieve their life goals through effective management of finances. It discusses the financial planning process, including goal-setting, investment strategies, and risk management, while highlighting the necessity of preparing for unforeseen events. Additionally, it stresses the significance of retirement planning in the context of changing family dynamics and the need for personal financial security.