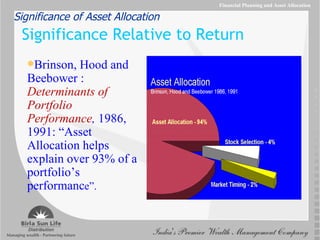

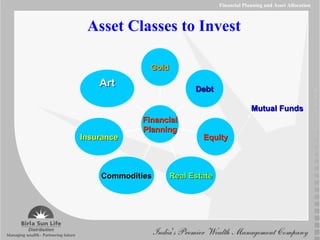

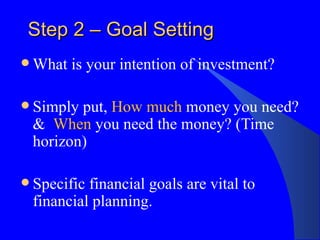

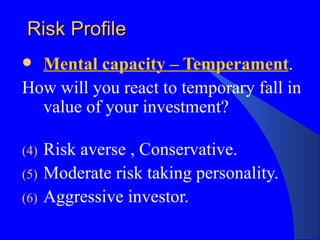

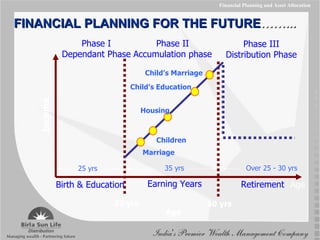

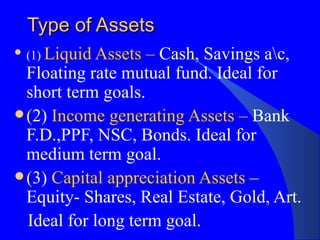

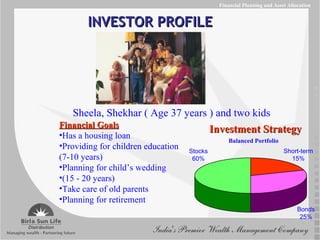

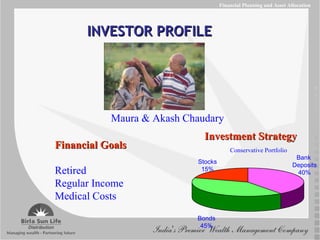

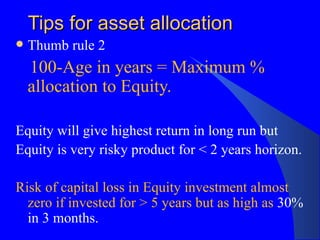

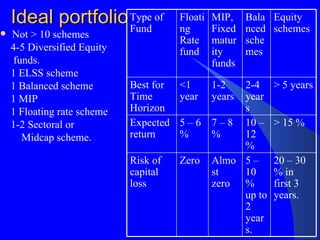

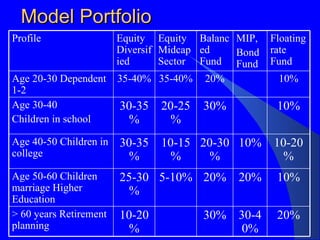

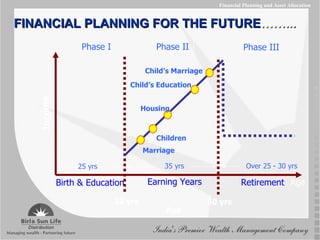

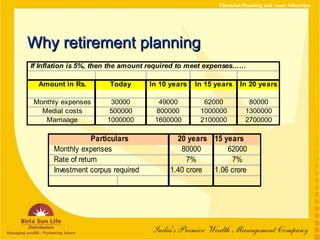

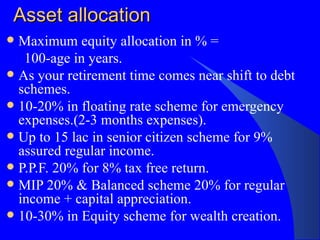

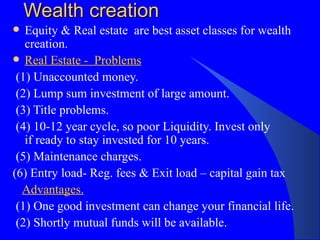

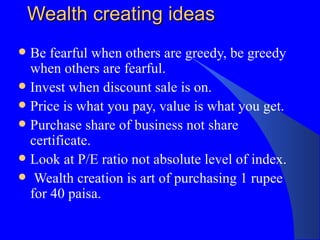

Financial planning involves managing one's finances through proper asset allocation to meet financial goals over time. Asset allocation involves investing a predefined percentage of savings across different asset classes like equity, debt, gold, etc. for diversification and risk management. One should determine their financial goals, risk profile, and current financial situation to develop an appropriate asset allocation strategy tailored to their needs. Regular financial planning and reviews are necessary to achieve financial health and sustainable wealth creation.