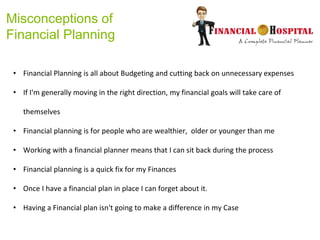

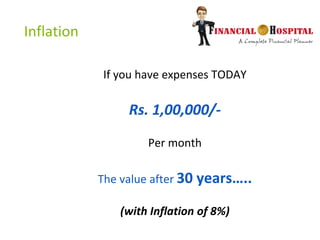

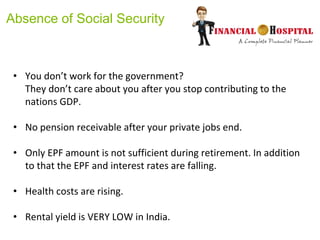

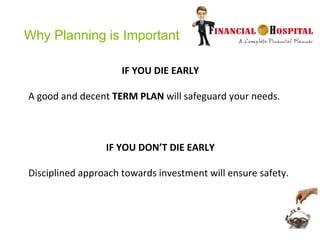

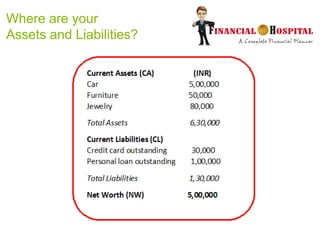

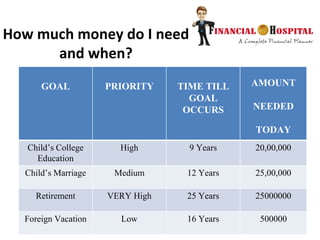

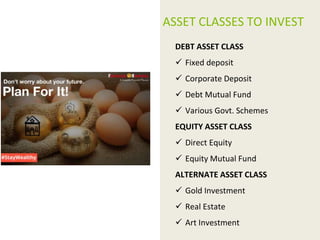

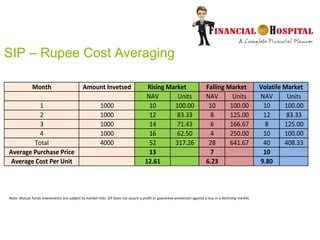

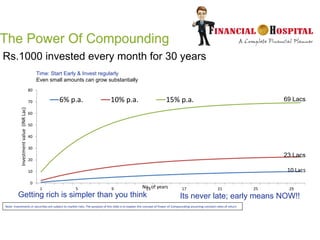

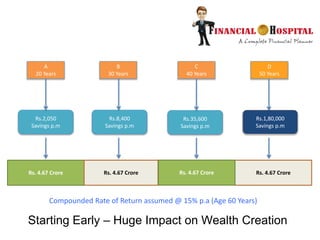

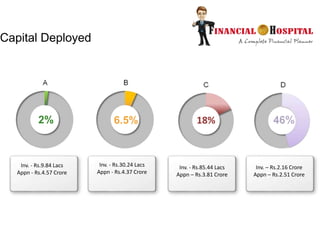

Financial planning is a long-term process of managing one's finances to achieve goals. It provides a roadmap to financial well-being and sustainable wealth creation. Many misconceptions exist, such as that it only involves budgeting or is only for the wealthy. Financial planning is needed due to risks like living too long in retirement, changing lifestyles, inflation, and lack of social security. It involves understanding assets, liabilities, priorities, timelines, and appropriate investment vehicles. Starting financial planning early allows greater benefits of compounding returns. Using systematic investment plans smooths out market volatility for better long-term returns. Financial planners can help develop and implement customized plans.