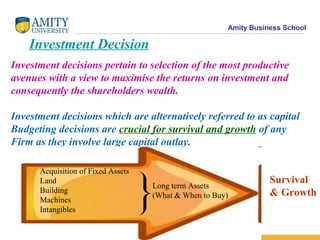

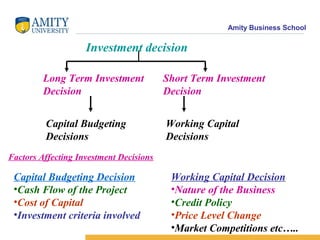

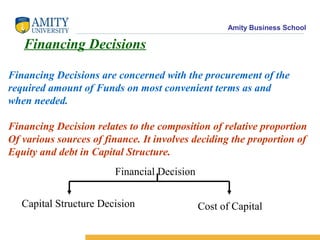

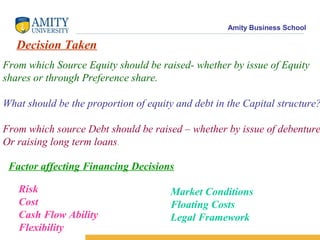

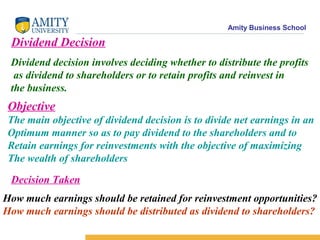

The document provides an overview of financial management. It defines financial management as planning and controlling a firm's financial resources, including procuring funds in an economic manner and employing funds optimally to maximize returns. It then outlines the evolution of financial management from the traditional to modern phase. Key aspects of financial management are investment, financing, and dividend decisions. Investment decisions involve selecting profitable investment avenues. Financing decisions relate to determining the optimal capital structure and sources of finance. Dividend decisions balance paying dividends to shareholders versus retaining profits for reinvestment.