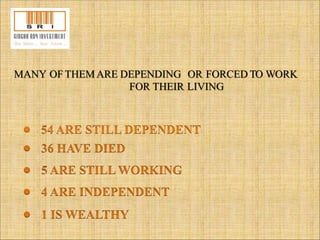

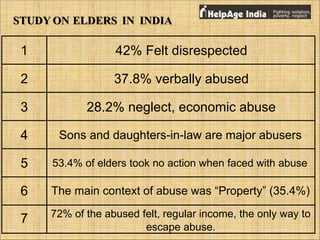

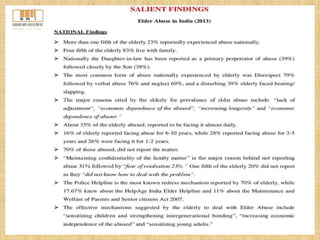

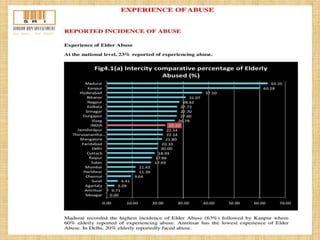

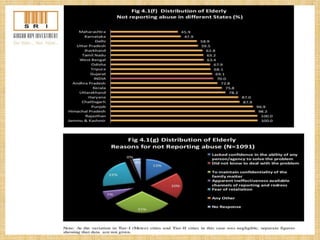

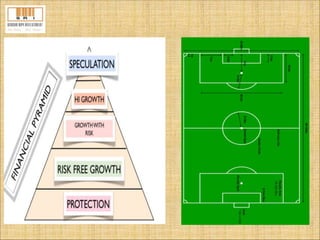

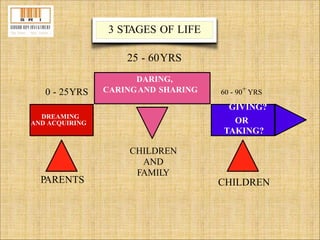

The document discusses abuse and neglect of elders in India. It finds that 42% of elders felt disrespected, 37.8% were verbally abused, and 28.2% experienced neglect or economic abuse. The main abusers were sons and daughters-in-law, and over half of abused elders did not take action. The main context for abuse was related to property. Most elders felt that regular income was the only way to escape abuse. The document also discusses the importance of retirement planning and saving systematically from an early age in order to financially secure one's retirement years.