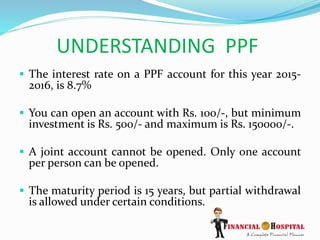

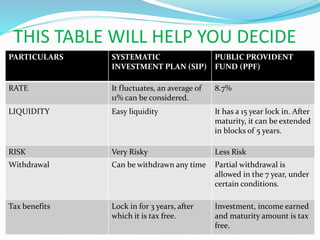

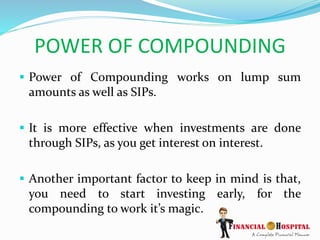

The document discusses systematic investment plans (SIPs), public provident funds (PPFs), and compares the two options. SIPs allow regular small investments in funds and benefit from compounding returns over time. PPFs offer lower but guaranteed returns and have restrictions including a 15-year lock-in period. While both can fund long-term goals, SIPs provide more flexibility and opportunity for higher returns compared to PPFs. The document provides details on investment limits, interest rates, liquidity, and tax benefits of SIPs and PPFs to help decide which may be a better fit depending on an individual's needs and goals.