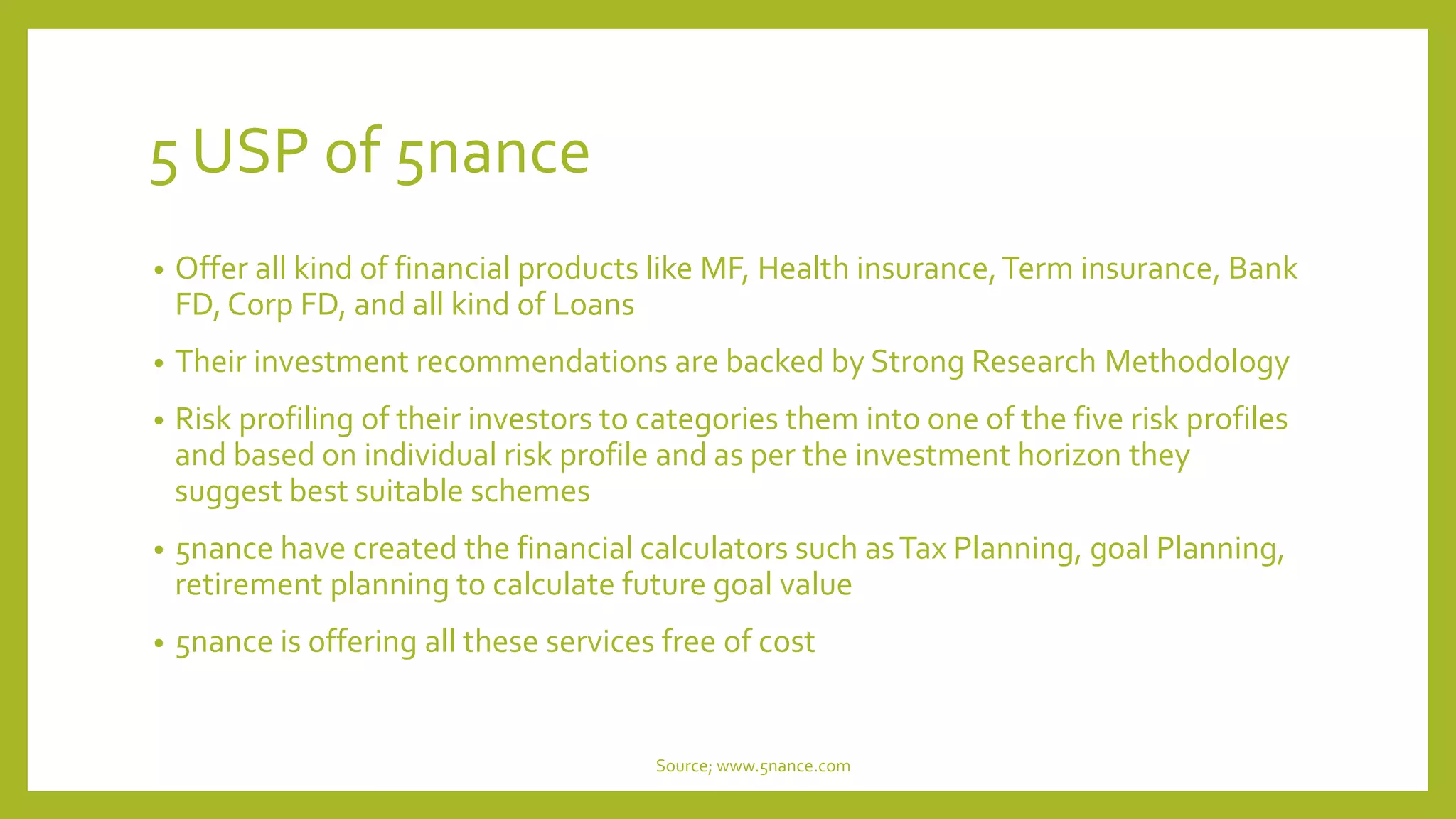

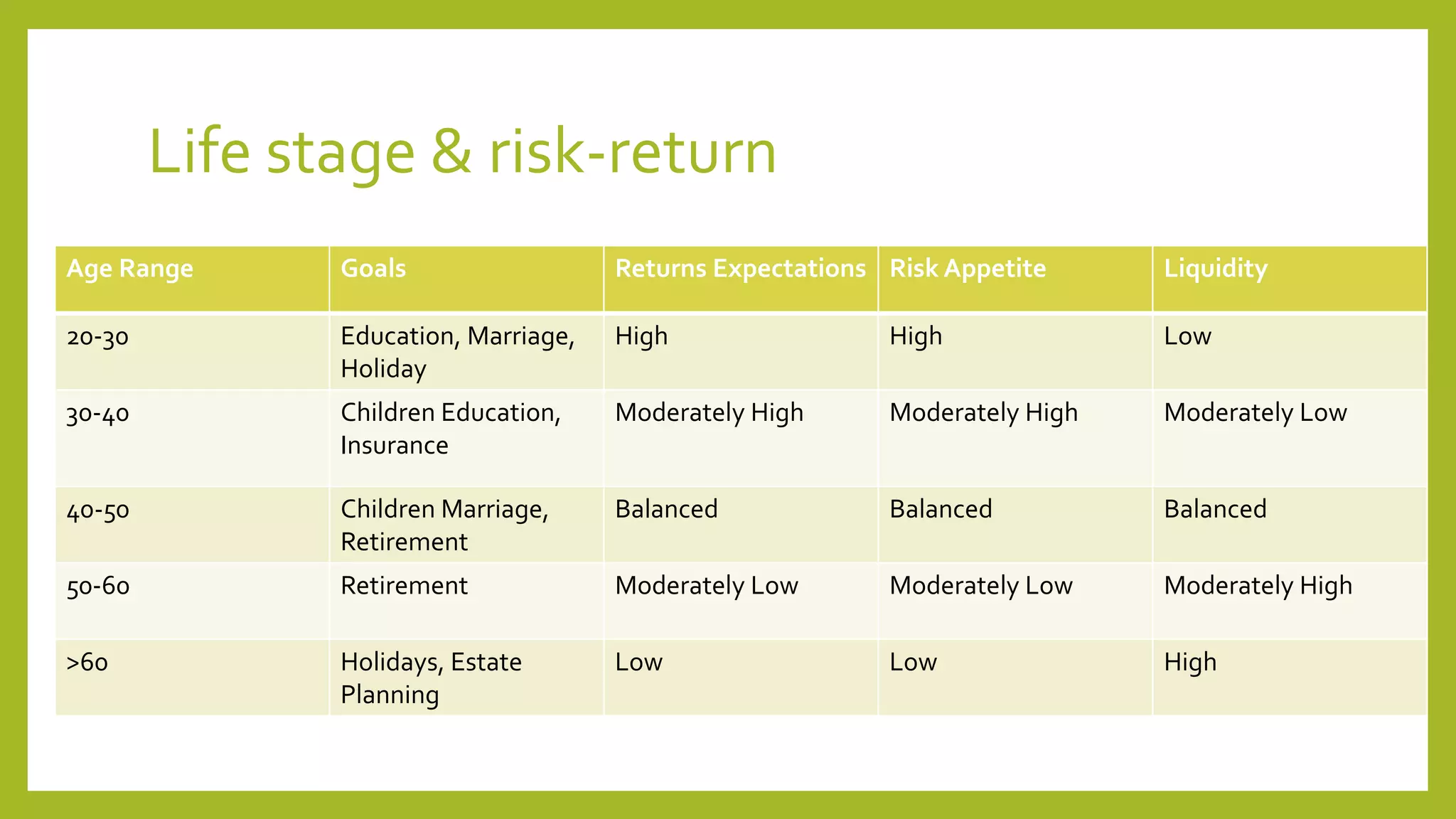

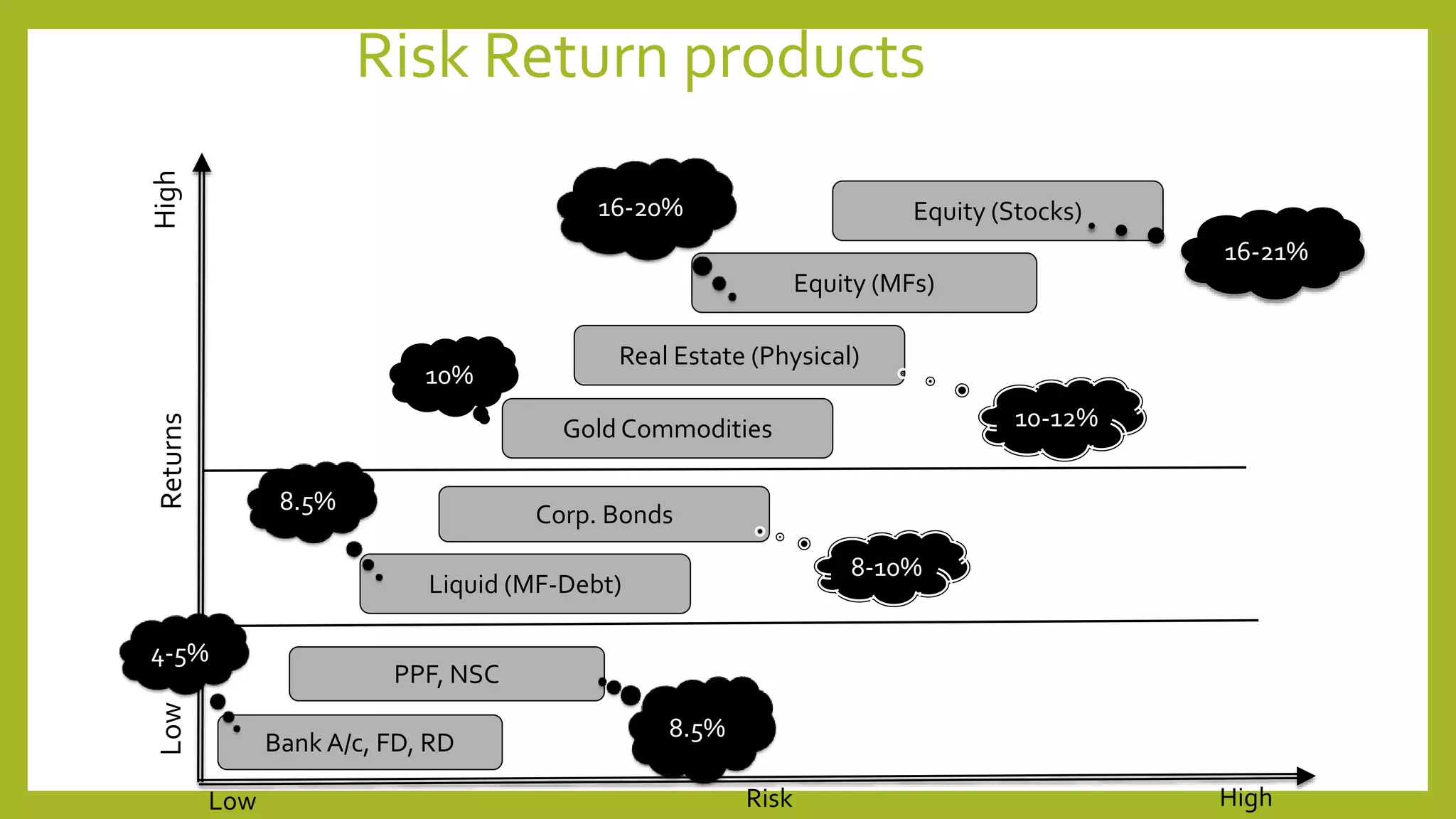

The document discusses personal financial management. It notes that personal finance addresses how individuals obtain, budget, save, and spend monetary resources over time based on their goals, risk appetite, income, expenses, and accumulated wealth. It also discusses assessing an individual's risk profile based on their life stage and matching them with appropriate financial products and investment classes, from low to high risk, to achieve different return expectations. The conclusion emphasizes the importance of financial education, knowing one's risk tolerance, regularly reviewing one's portfolio, diversifying investments, and analyzing risks of different financial products.