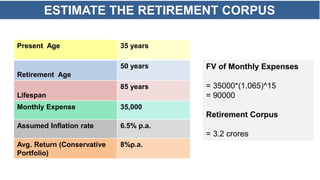

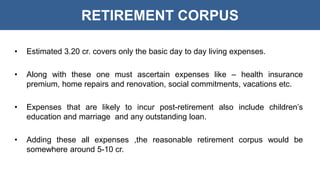

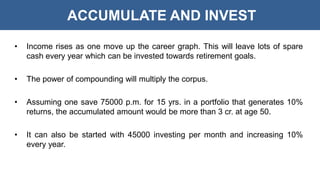

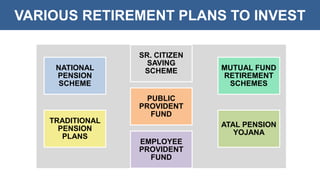

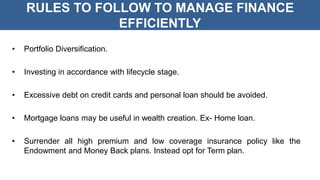

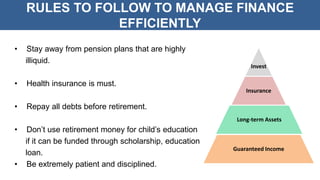

Retirement planning involves determining the amount of money needed for a comfortable life after work, aiming for financial independence by preparing for a post-retirement duration of 25 to 35 years. Key considerations include inflation, medical expenses, and the need for a diversified investment portfolio, estimating that an average retirement corpus could range from 5-10 crores depending on various factors. Strategies for efficient management include regular investments, avoiding high debt, and ensuring adequate health insurance.