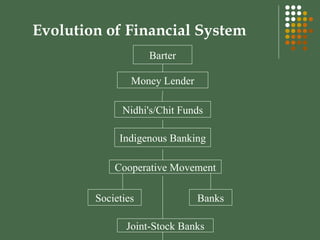

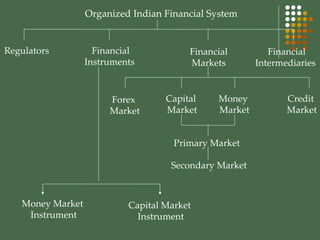

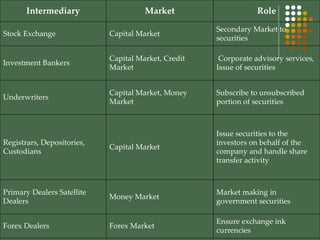

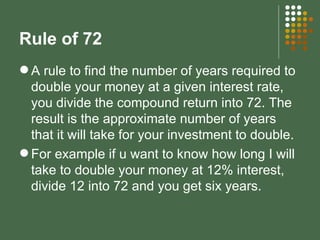

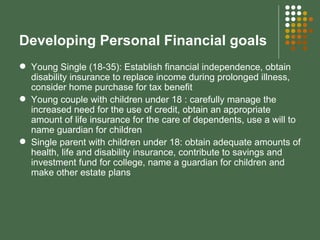

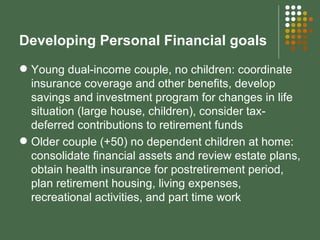

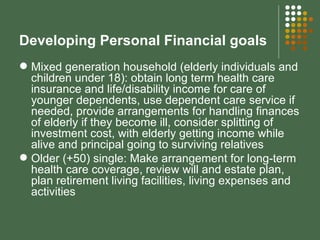

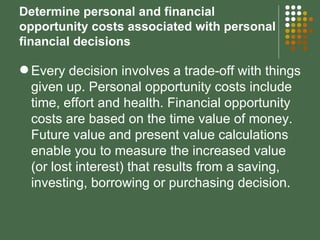

The document discusses personal financial planning and the Indian financial system. It provides an overview of various financial instruments and markets in India including money markets, debt markets, equity markets, and derivatives markets. It also discusses various financial intermediaries, regulators, and the relationship between the financial system and the broader economy. Various investment approaches and options available to different income categories are presented along with a case study on financial planning for a high-income individual.

![Personal Financial Planning (PFP) [email_address] Facebook Study Group: http://www.facebook.com/group.php?gid=143970885148](https://image.slidesharecdn.com/financialplanning-new-090903091353-phpapp01/85/Personal-Financial-Planning-Guide-1-320.jpg)