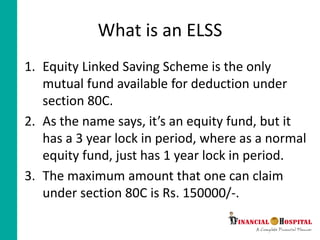

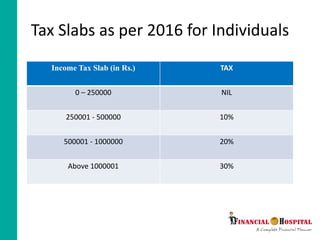

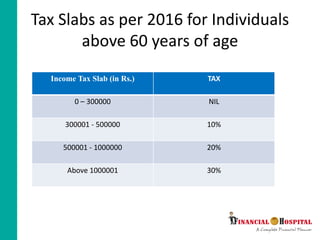

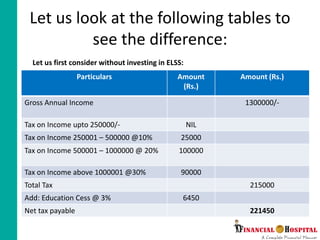

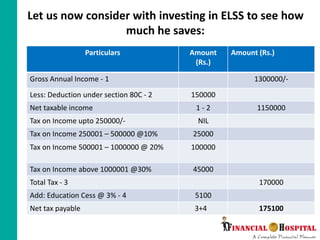

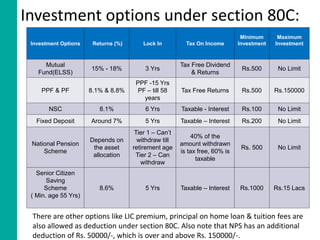

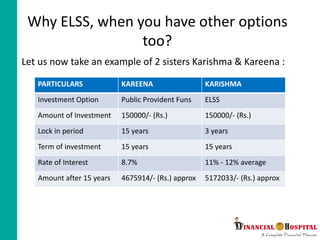

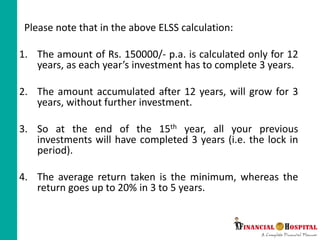

The document explains the Equity Linked Saving Scheme (ELSS) as a mutual fund offering tax deductions under Section 80C, emphasizing its 3-year lock-in period. It provides a comparison of tax savings for individuals investing in ELSS versus other options, highlighting the benefits of tax-free returns. Ultimately, ELSS is portrayed as a flexible and lucrative investment option, particularly suitable for tax savings and long-term financial goals.