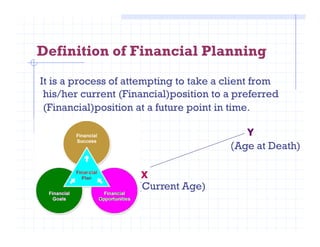

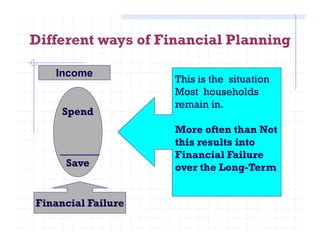

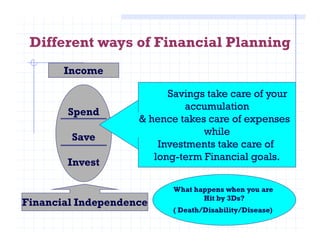

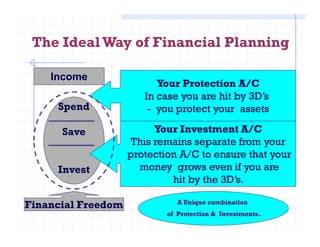

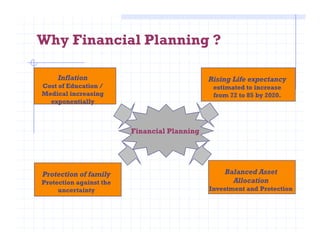

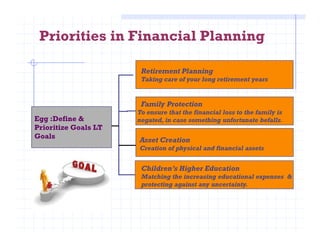

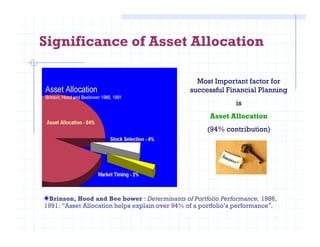

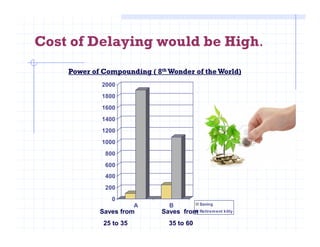

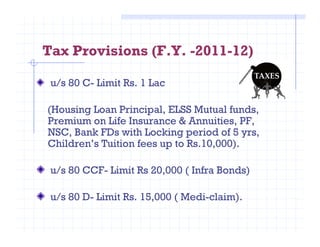

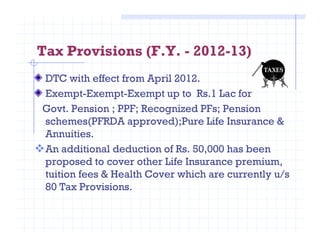

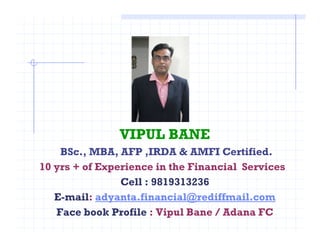

The presentation by Vipul Bane outlines the importance of financial planning, emphasizing goal setting, understanding risk profiles, and making informed investment decisions to secure financial futures. It highlights various strategies for financial planning, including asset allocation and the significance of early investment to achieve long-term financial goals. The document also offers insights on navigating financial challenges or uncertainties, providing a comprehensive overview of available services for personalized financial guidance.