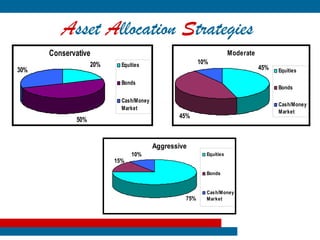

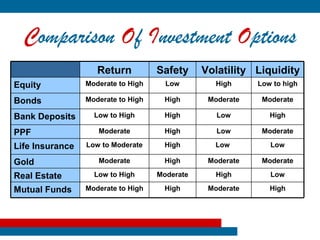

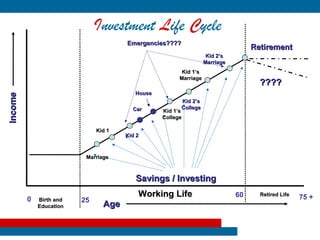

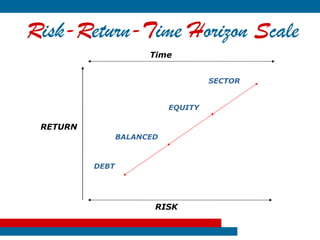

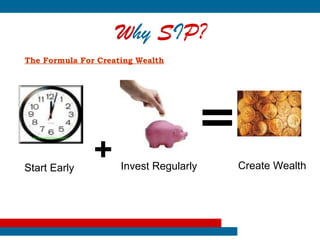

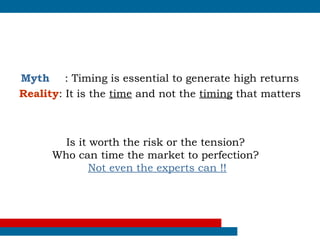

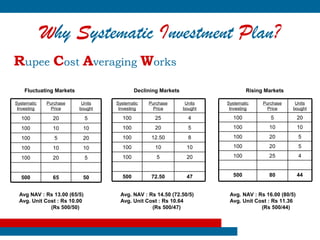

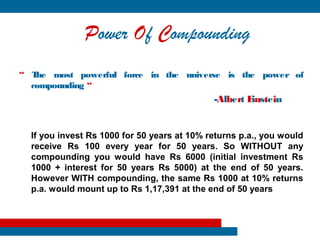

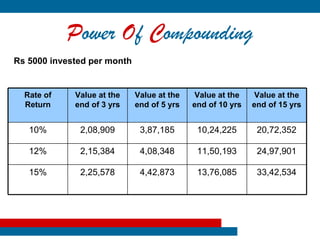

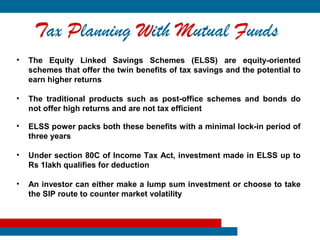

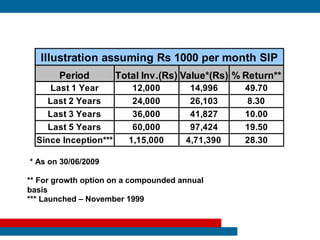

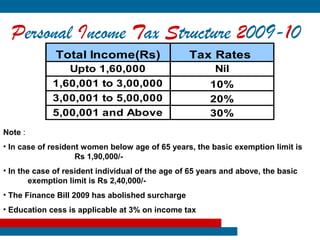

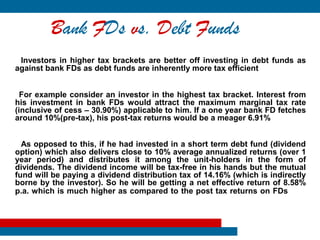

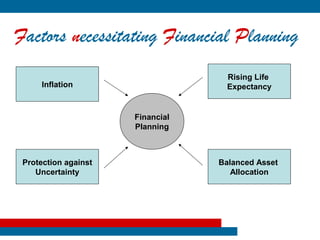

Financial planning involves identifying an individual's financial needs and goals over time and developing a strategy to meet those needs and goals. The key objectives of financial planning are to identify monetary requirements, prioritize financial needs, assess one's current financial position, plan savings and investments to achieve goals, and optimize returns through diversification. Systematic investment plans (SIPs) allow regular investing of small amounts in mutual funds and are an effective way to benefit from rupee cost averaging and the power of compounding returns over the long term. Insurance provides protection from life's uncertainties and ensures one's dependents are provided for in times of need.