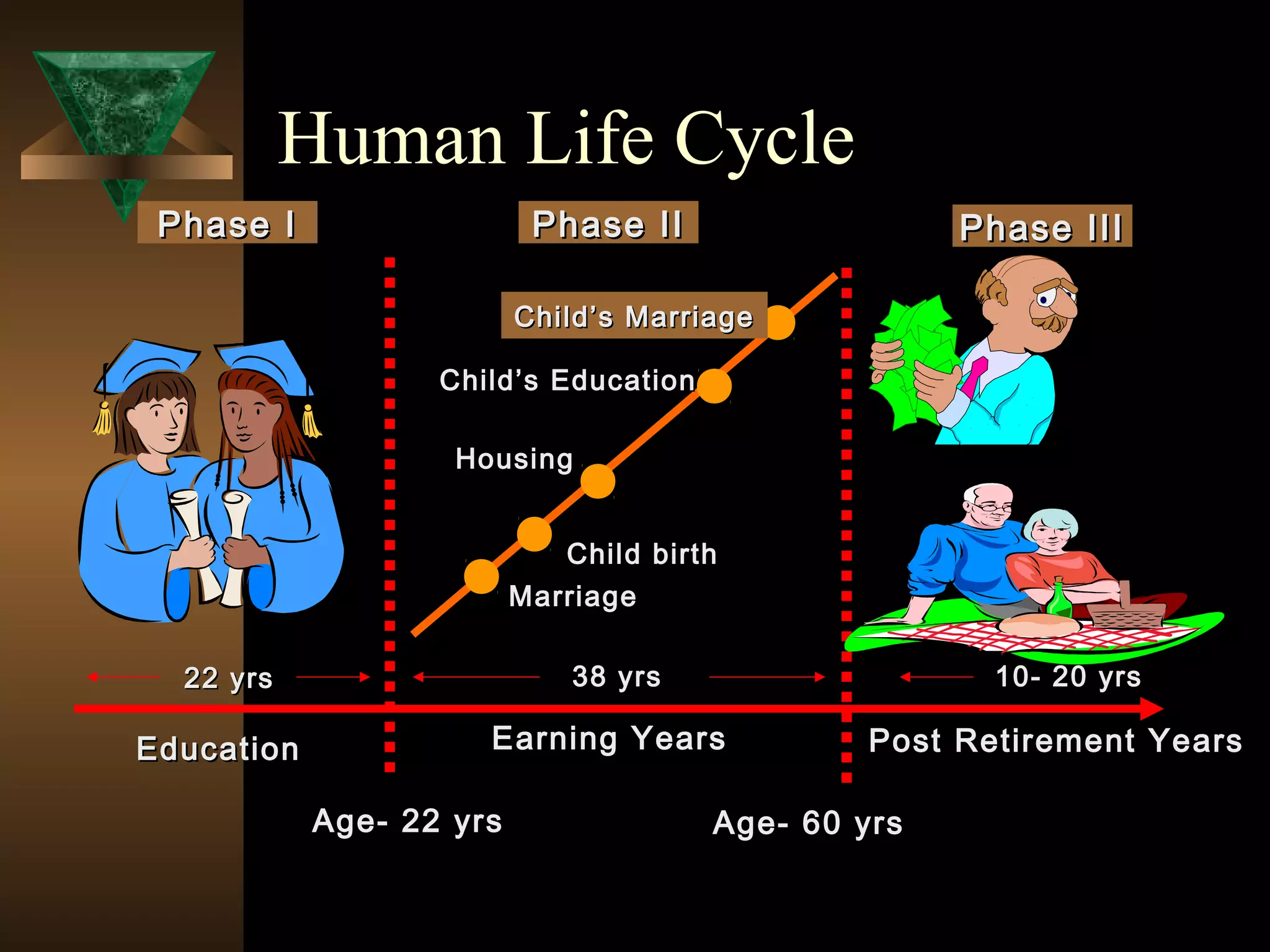

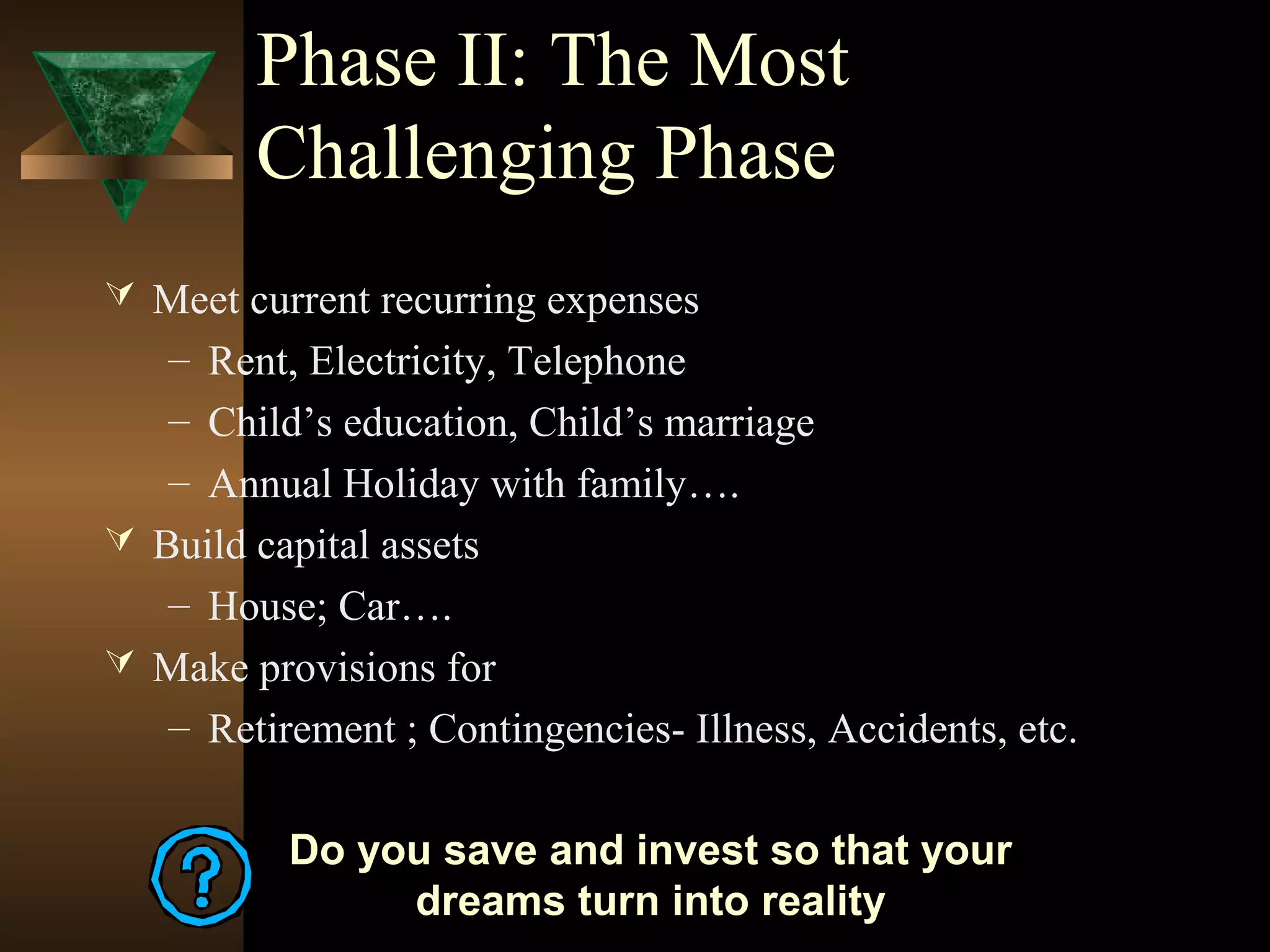

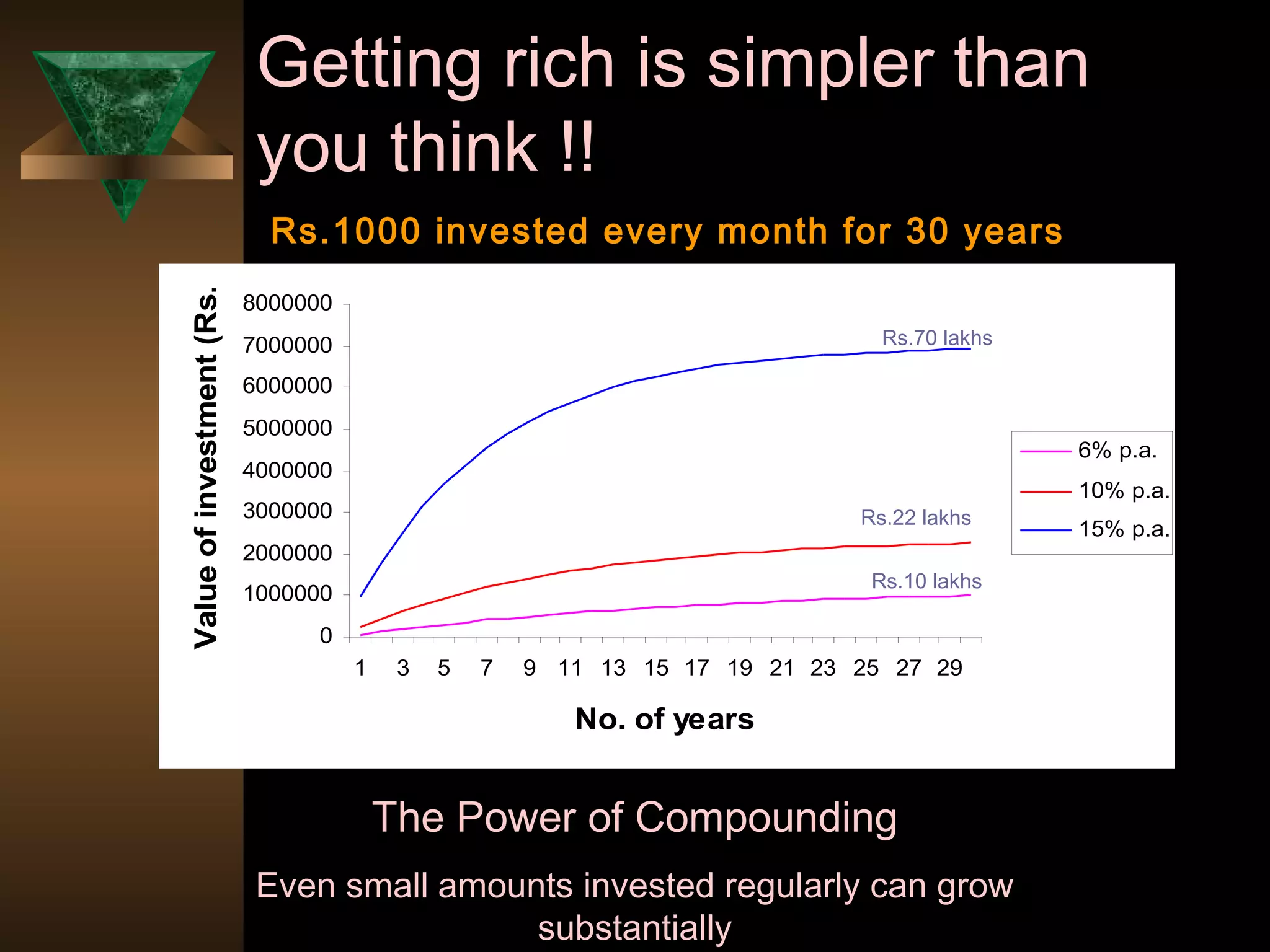

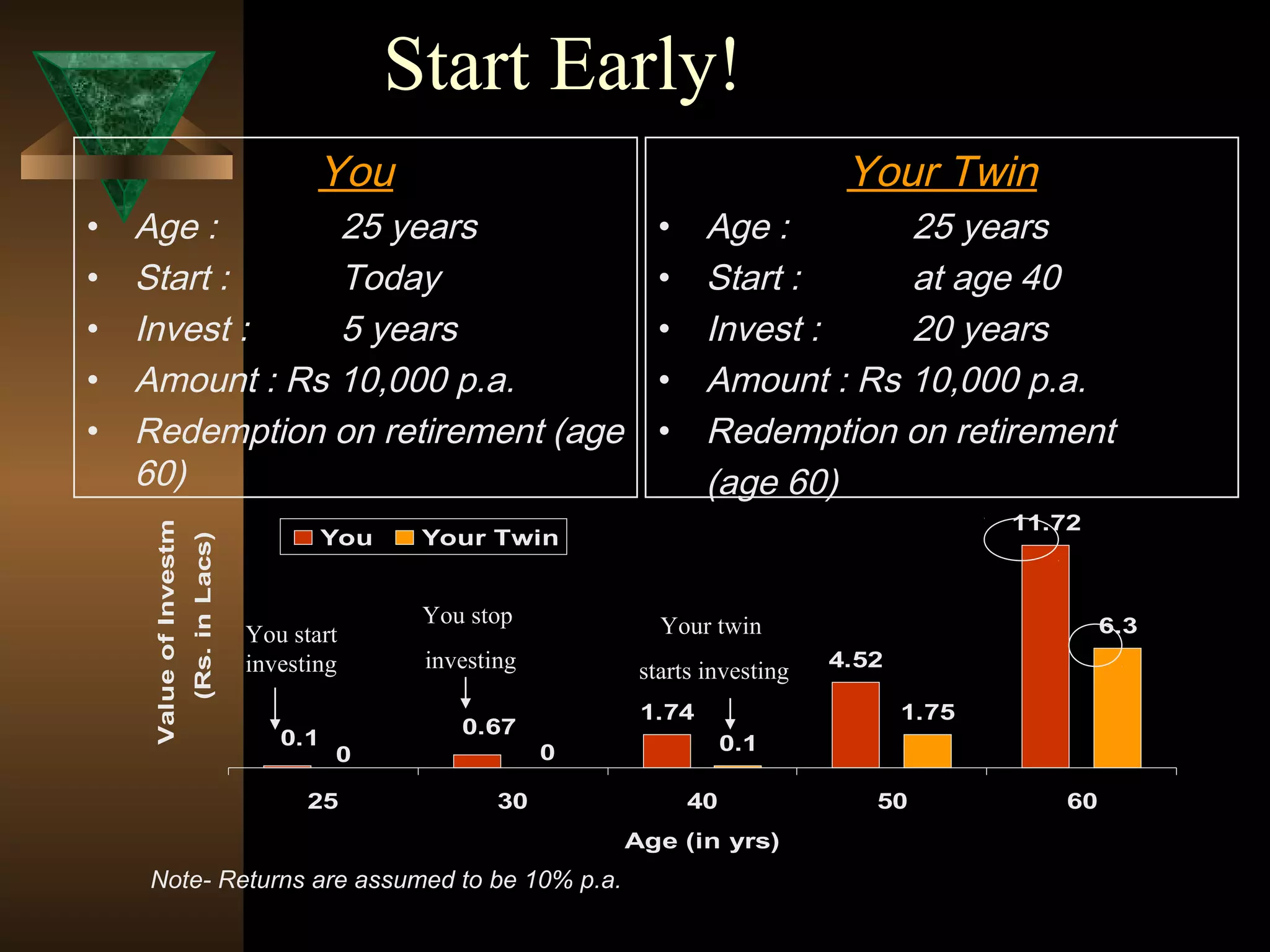

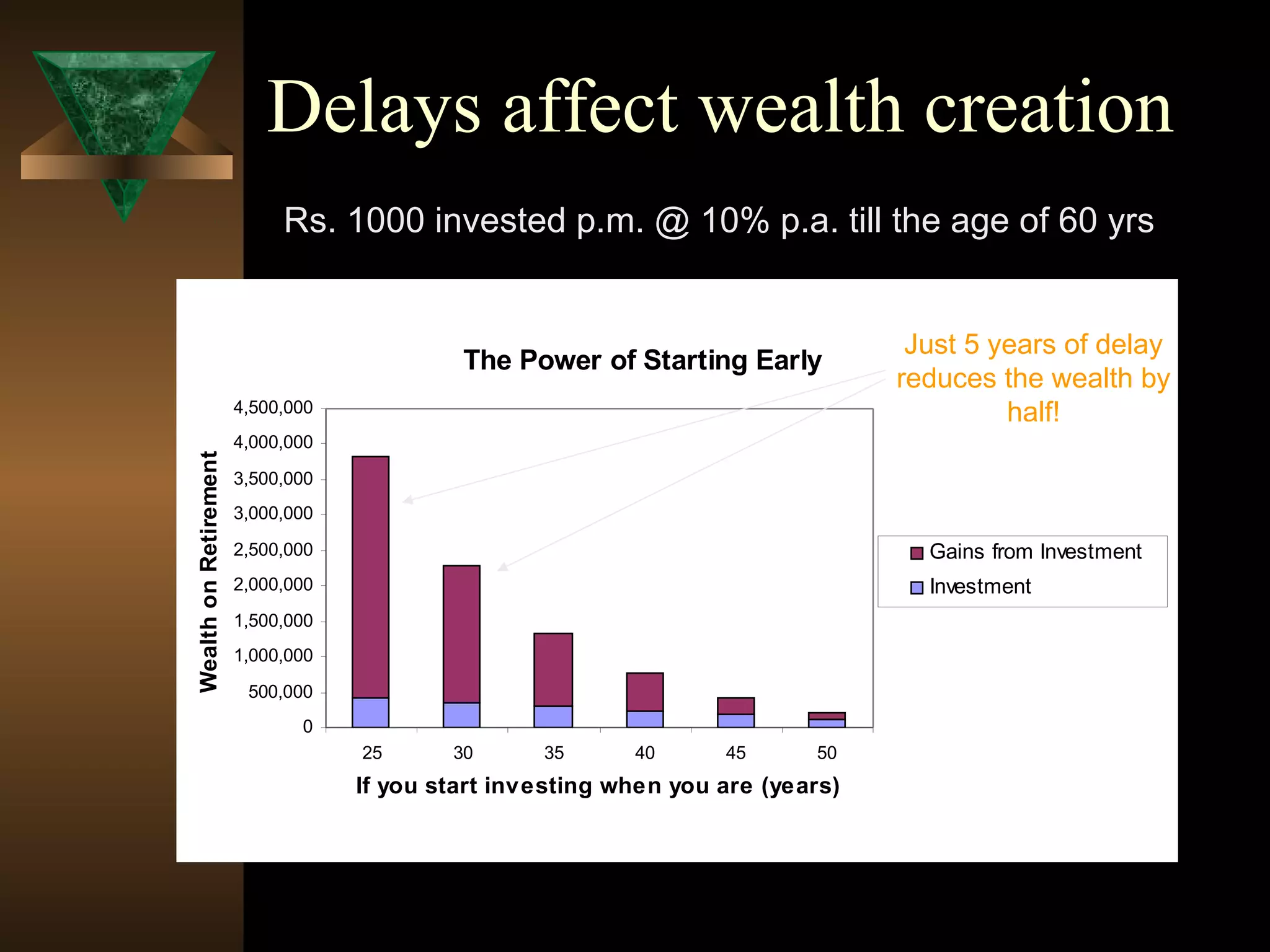

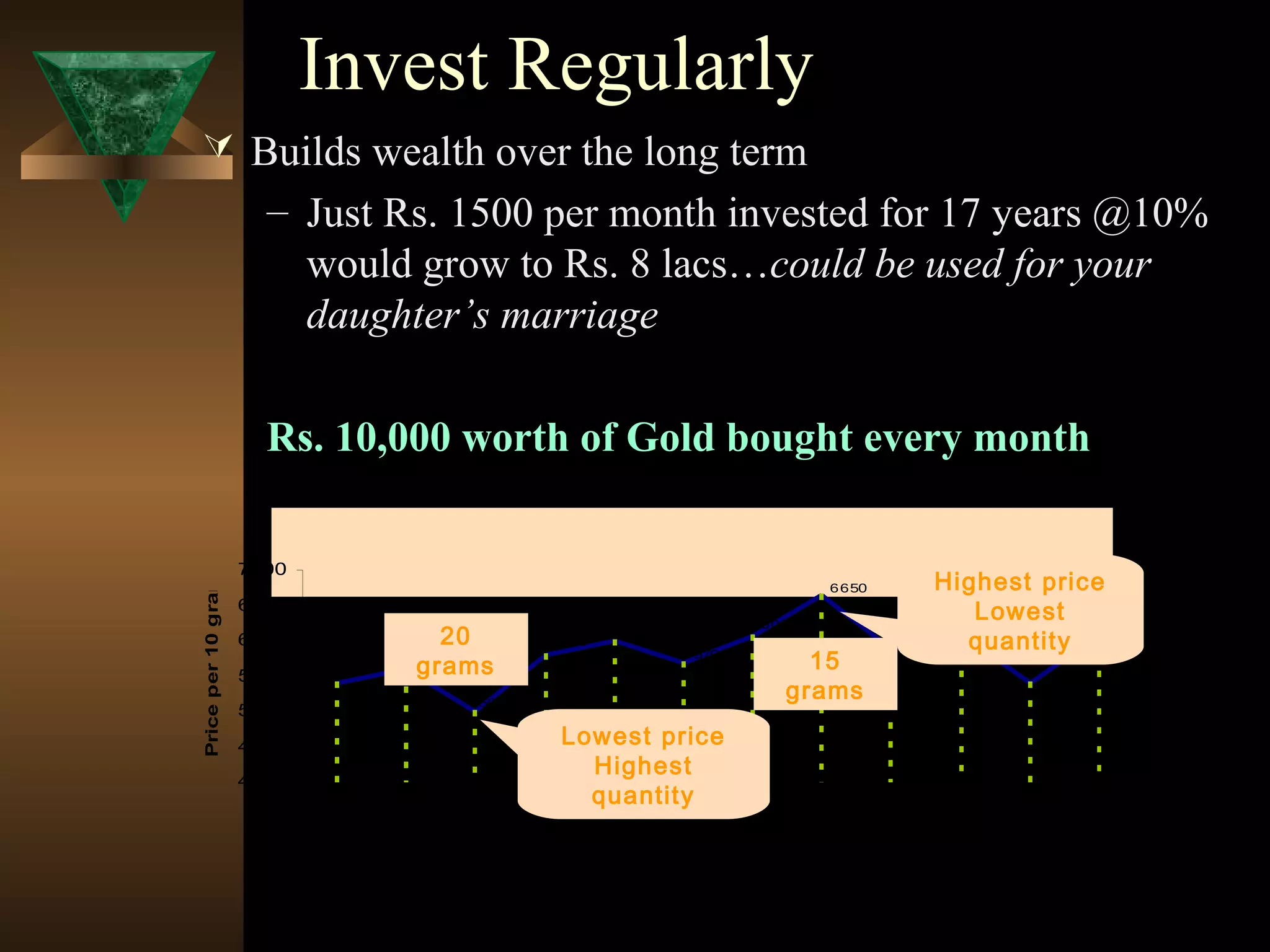

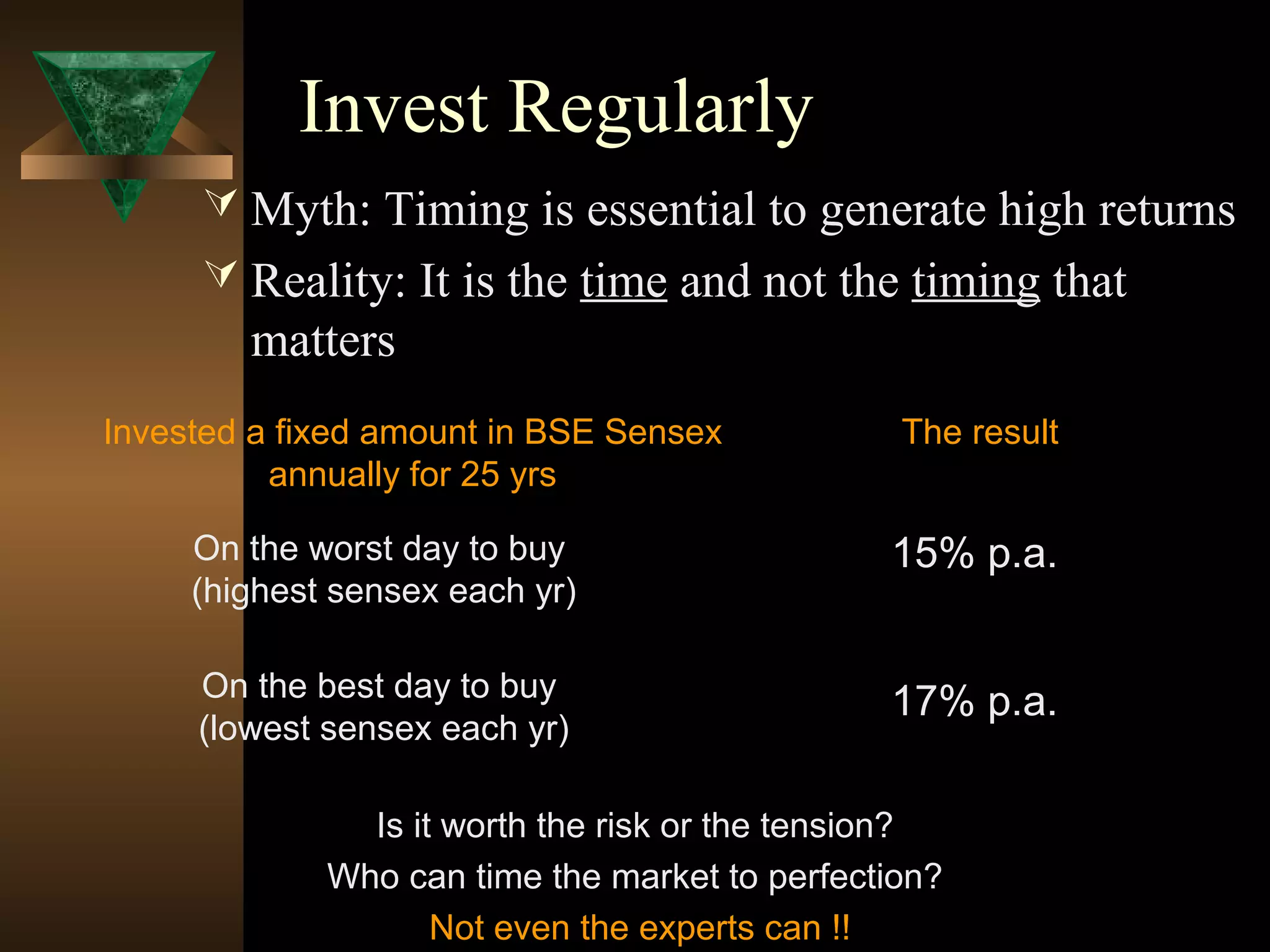

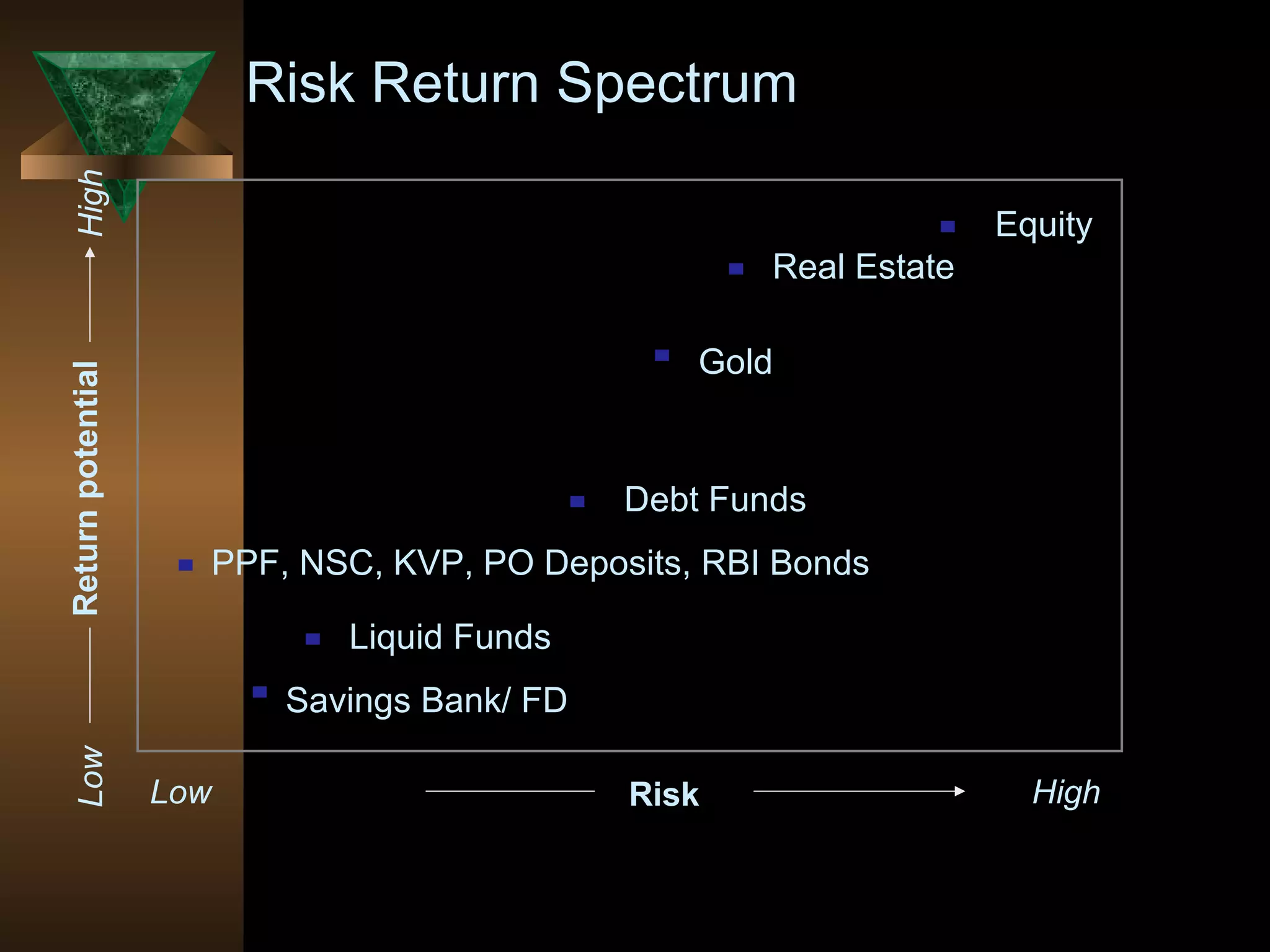

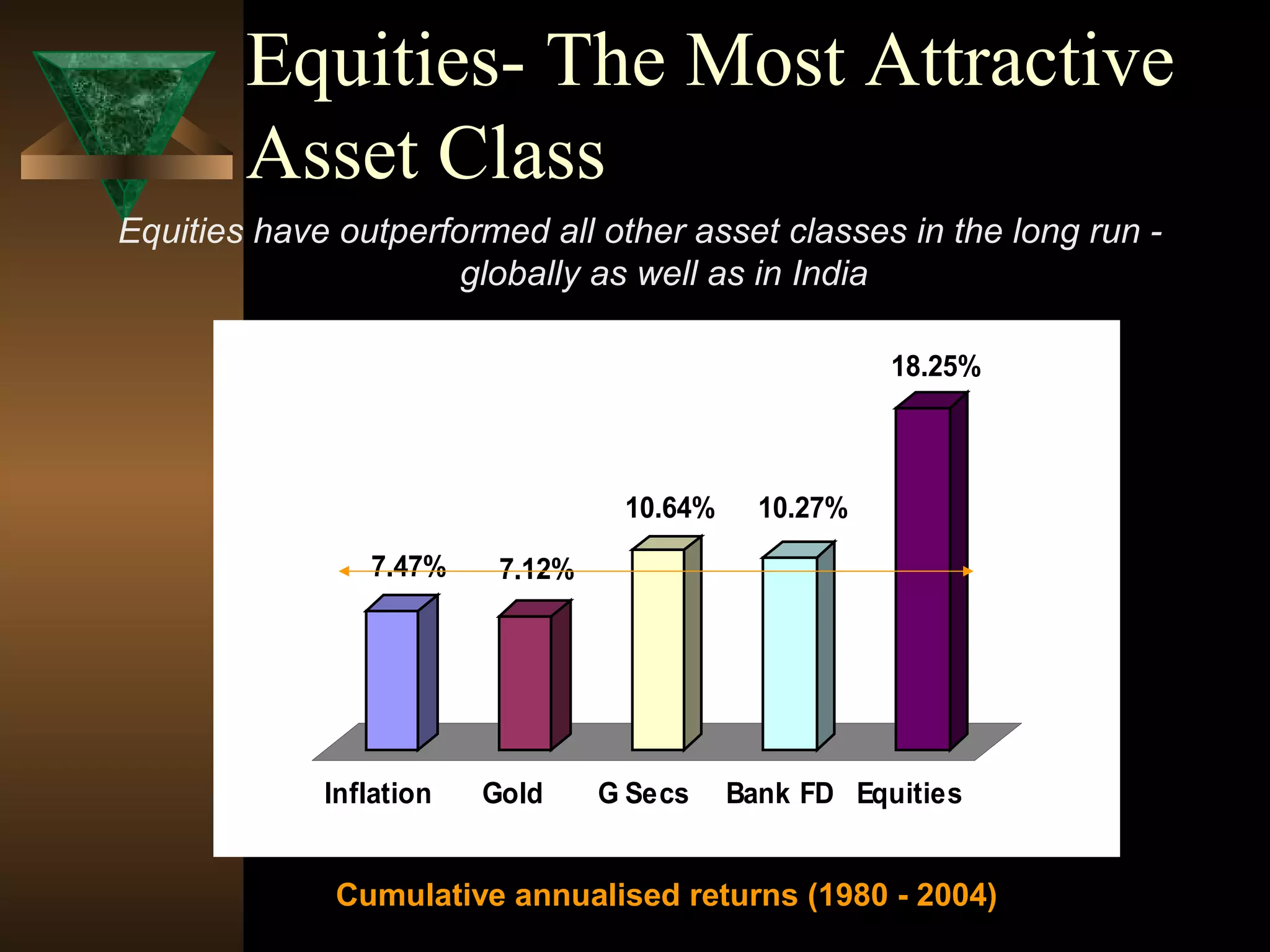

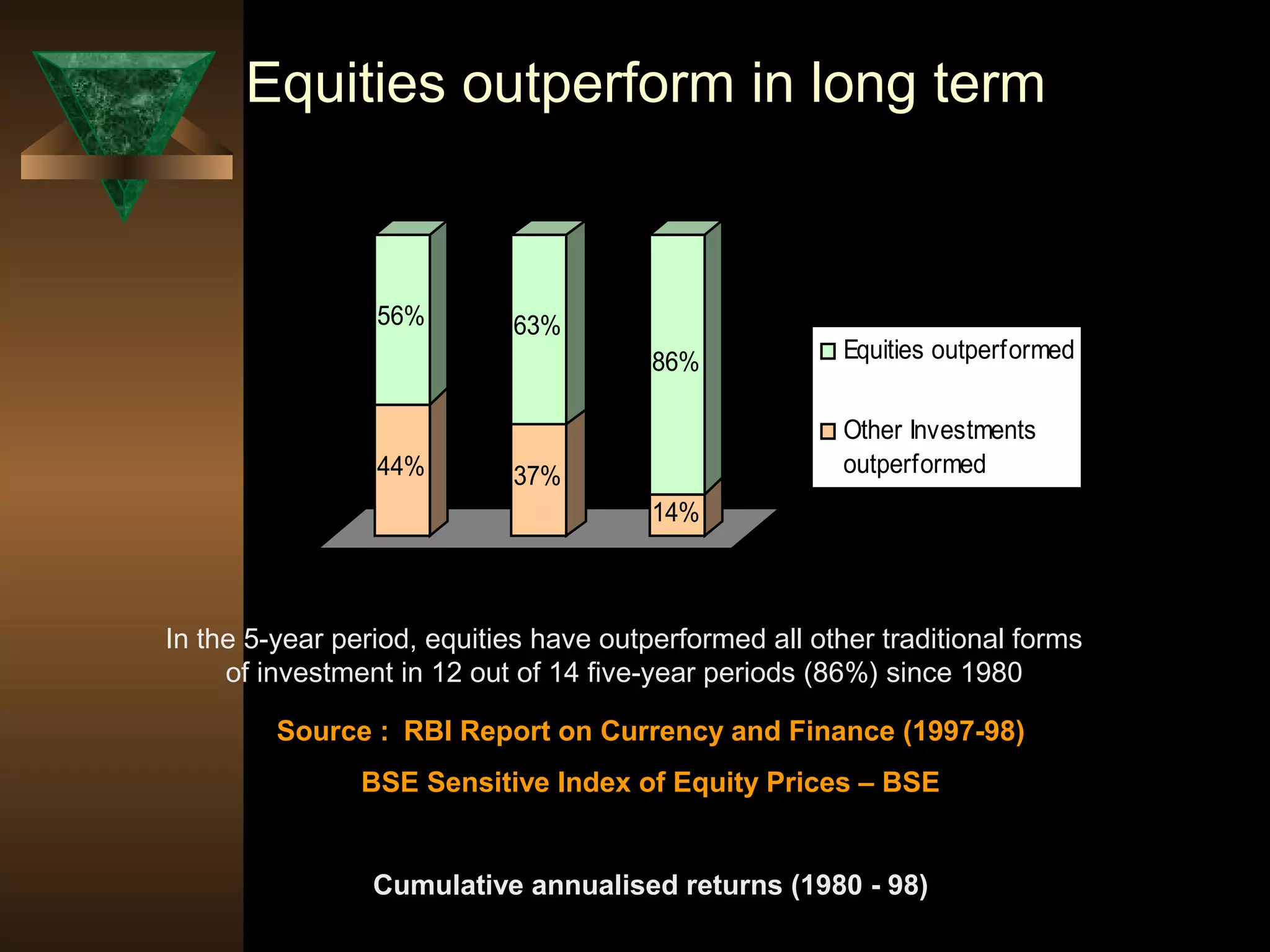

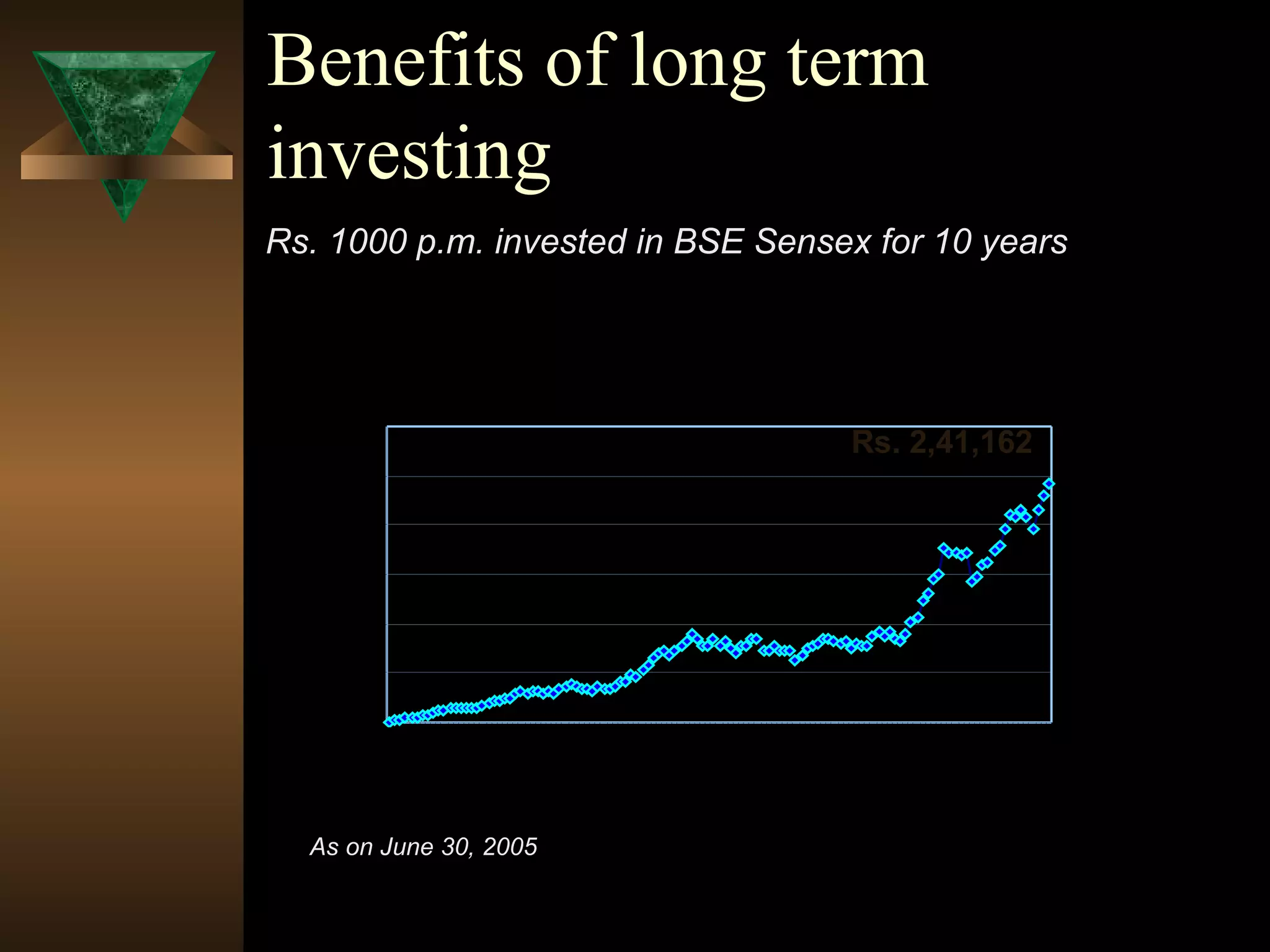

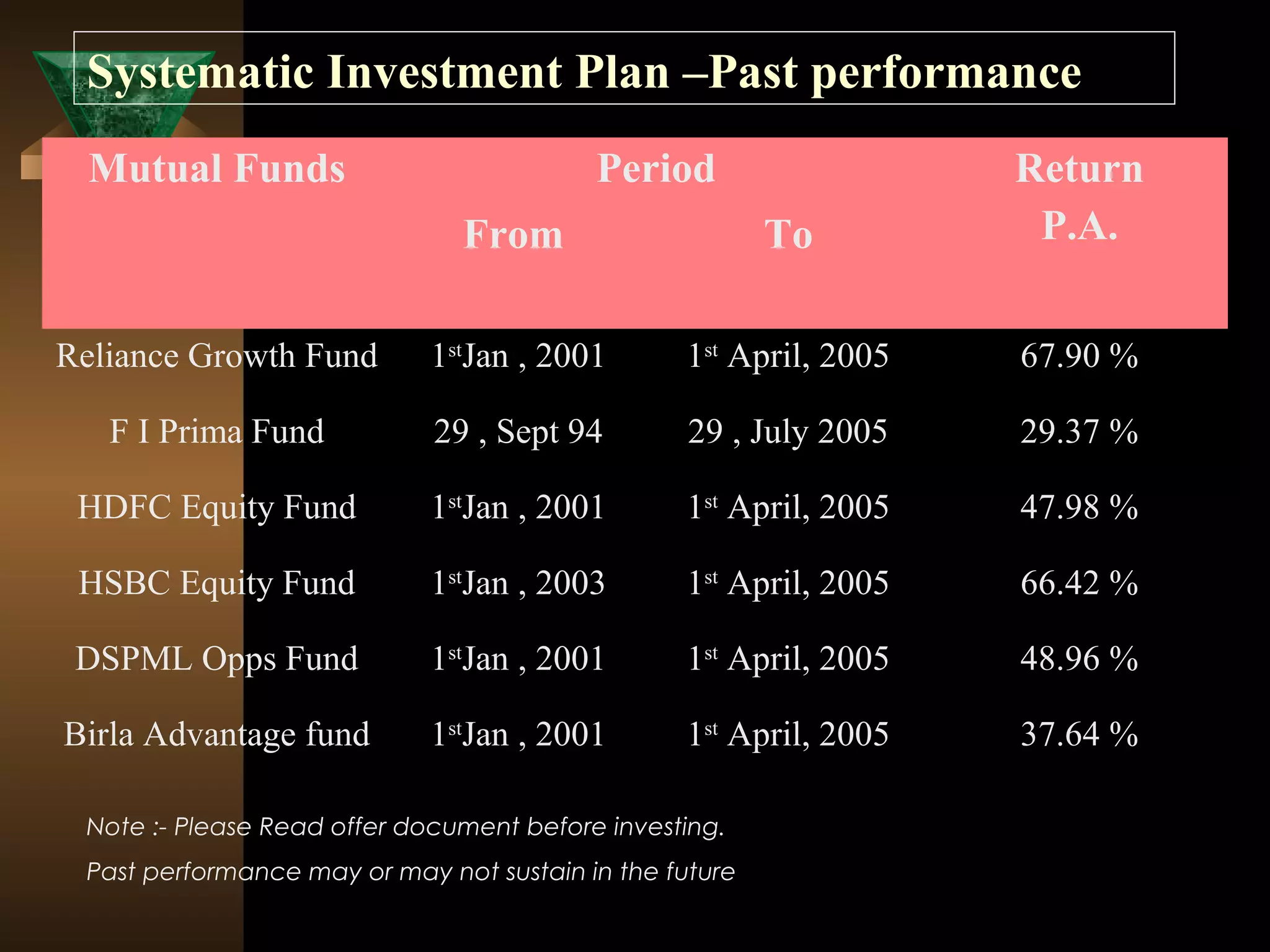

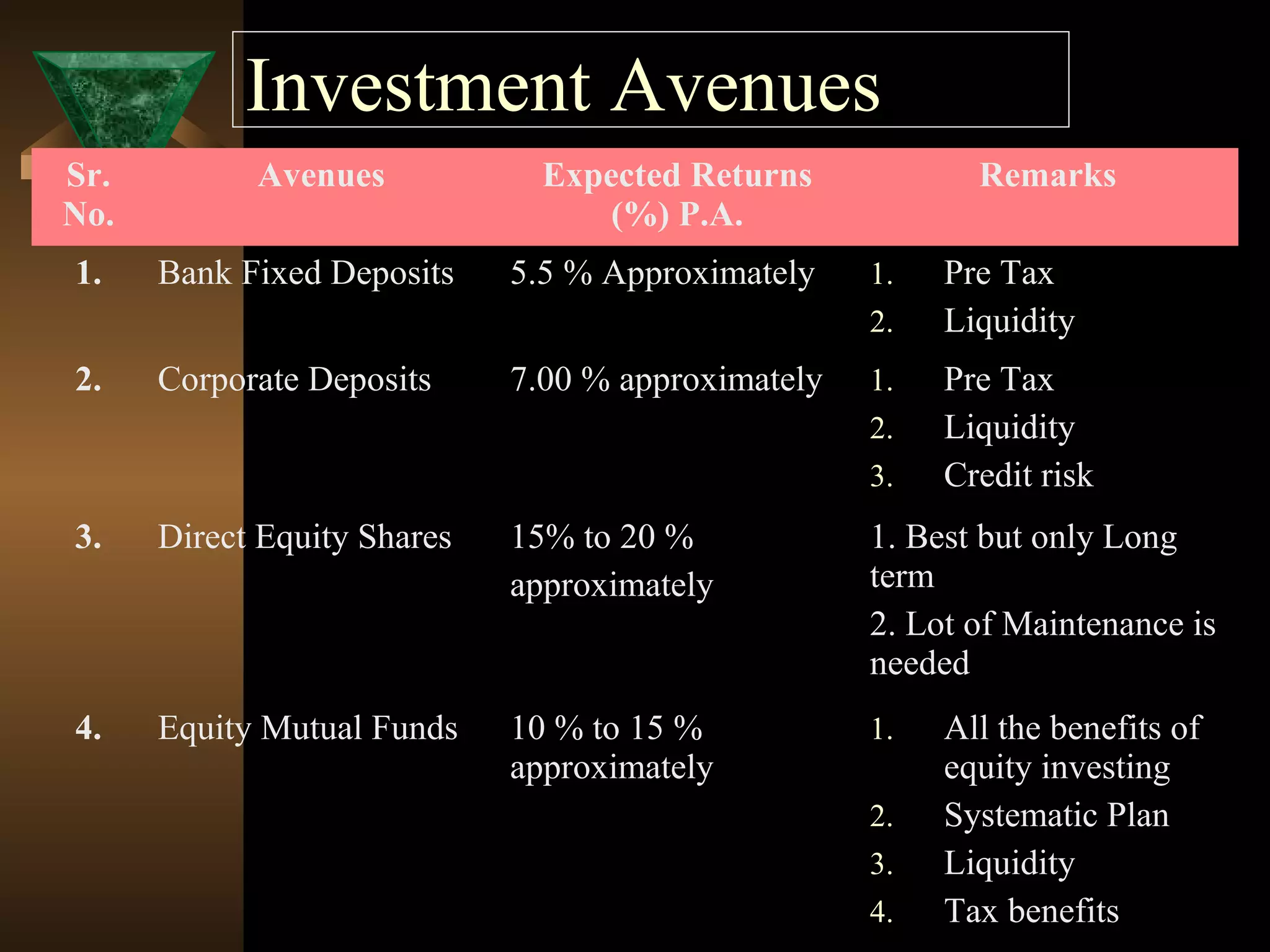

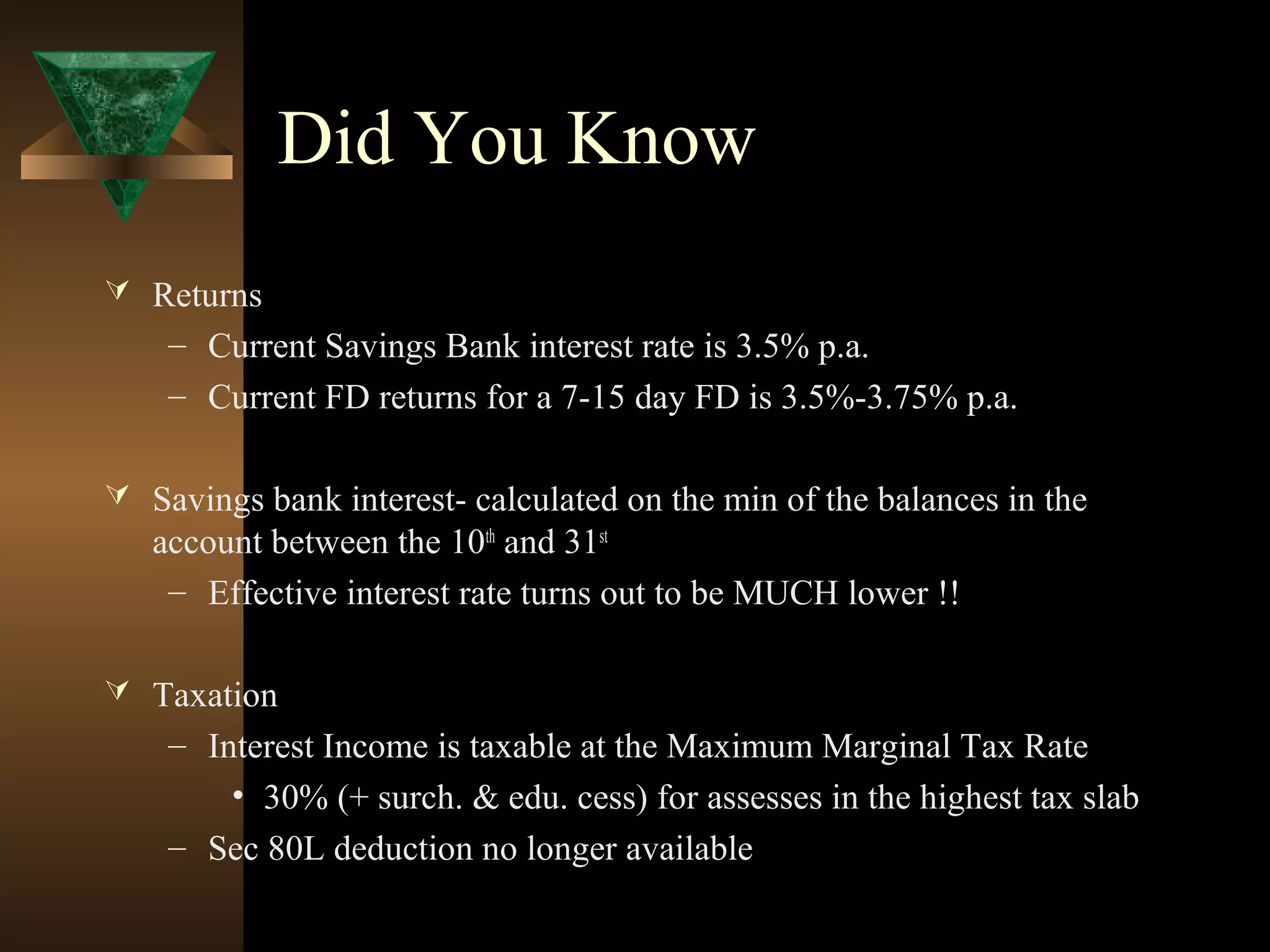

The document discusses the importance of systematic investment plans (SIPs) as a method for individuals to accumulate wealth over their lifetime, particularly emphasizing the impact of starting early and investing consistently. It highlights common misconceptions about investing, including the belief that market timing is essential, and stresses the advantages of equities and mutual funds as investment options. The document provides statistical evidence on returns from various investment instruments and encourages readers to develop a disciplined savings approach to enhance their financial stability.