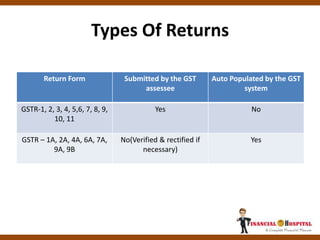

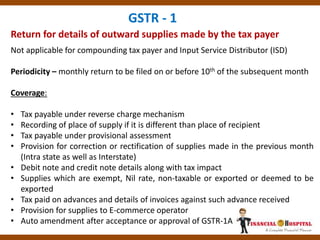

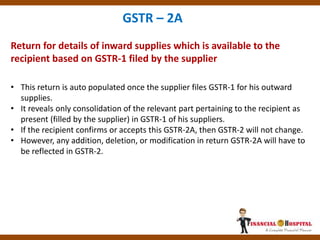

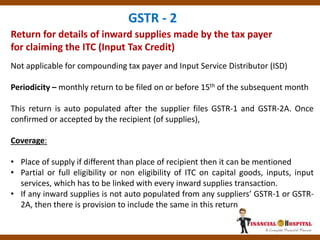

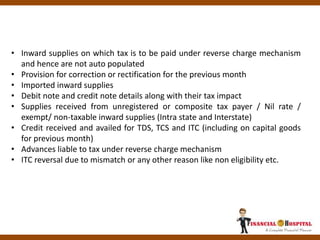

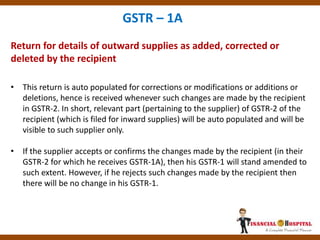

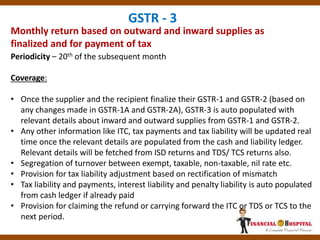

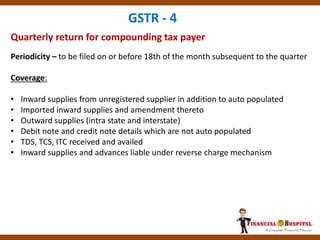

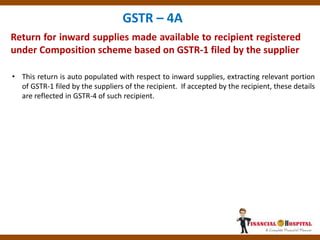

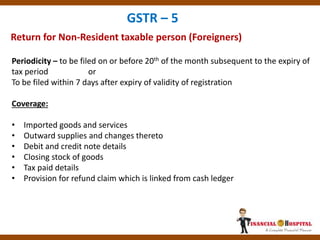

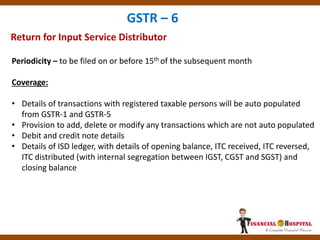

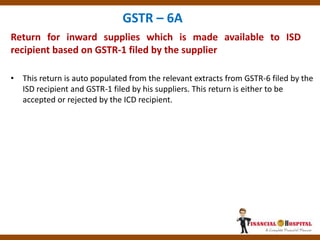

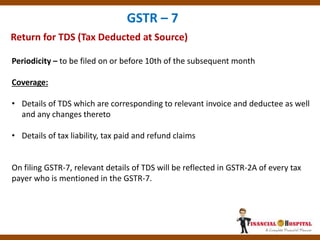

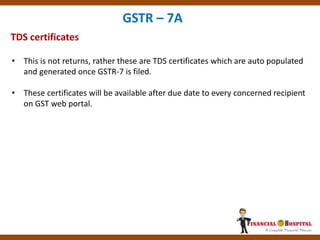

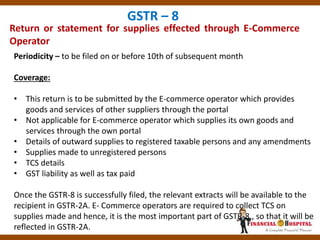

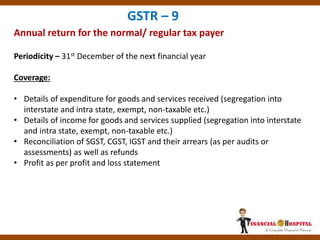

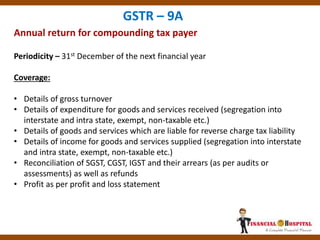

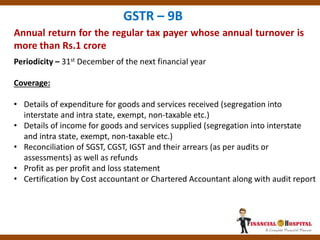

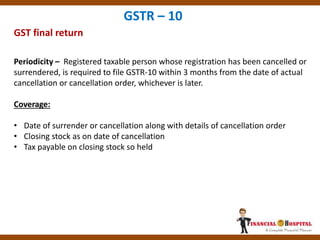

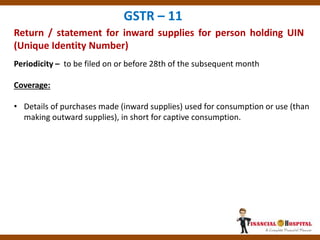

The document summarizes the various types of returns required to be filed under the Goods and Services Tax (GST) regime in India. It discusses 18 different return forms including monthly, quarterly, annual returns to be filed by regular taxpayers, compounding taxpayers, Input Service Distributors, e-commerce operators, non-resident taxpayers, and others. The returns require reporting of outward and inward supplies, input tax credit claimed, tax payable, payments made, and other details. The returns are largely auto-populated based on information filed in other returns, and allow for modifications and corrections.